It is said that the stock market is risky and investment should be cautious. But what we see is that no matter whether the stock market is in a big upswing or a big downturn, there are crowds of people, and there is simply no less. So many are very puzzled; the stock market is just up and down; how does no one go? For those who do not understand, it is very difficult to understand, but those who really understand the investment of people understand it very well. In fact, this involves the concept of short.

What does Bearish?

What does Bearish?

Its English name, Bearish, which means bearish, refers to those investors who expect the market or the price of a particular asset to fall. It's when a person or an investment organization expects an imminent fall in the price of an asset and so takes a short position, i.e., by selling assets that they don't already own in the expectation of buying them back in the future at a lower price. It is a market sentiment that indicates a bearish overall market.

In finance, it usually refers to an investment strategy in which an investor anticipates that the price of an asset (e.g., a stock, commodity, or currency) is going to fall and therefore takes a position to sell short-selling contracts. Specifically, taking a short-selling position means that the investor buys an asset (usually a stock) by borrowing it and selling it immediately, and then repurchases the asset at some point in the future to return it to the lender. If the price of the asset falls at the time of the future repurchase, the investor can buy the asset back at a lower price and make a profit.

Short selling is an investment strategy as opposed to a traditional buy-long position. The investor expects the market to fall and therefore profits from the fall by selling short. This is the opposite of a long buy position, where an investor buys an asset with the expectation that the price will rise.

When a large number of investors take bearish positions, the market may come under pressure to sell short. This can lead to more investors taking bearish positions, creating a cyclical effect that ultimately drives asset prices down. As with buying long positions, short-selling investors also face the risk of losses. If the market moves against their expectations and asset prices rise, short-buying investors will buy back assets at higher prices when they repurchase them, resulting in losses.

A market can be said to be in a short-selling market when the overall market is generally falling and investors are generally adopting a short-selling strategy. This is often referred to as a bear market because the bears are pawing downward, kind of like the stock market is being pushed downward. On the other hand, when the stock price rises, it is called a bull market because the bull's horns are up.

Bearish and bullish

| Distinctions |

Bearish |

Bullish |

| Definition |

Investor selling in anticipation of price drop. |

Investors anticipating rising prices. |

| Characteristics |

Bearish investor using short selling strategy. |

Optimism, bullish market |

| Measures |

Borrow, sell, expect lower repurchase in short selling. |

Buy assets expecting higher future selling price. |

| Impact |

Strong short selling can trigger a downtrend. |

Strong long positions may lead to an uptrend. |

| Profitability |

Profits from falling prices, with unlimited risk. |

Profits from rising prices, but limited potential losses. |

What does a stock short mean?

It is when an investor sells a stock short by borrowing it and selling it in the market. This is the opposite of the traditional strategy of buying stocks. The investor believes that the price of the stock will go down and is thus able to buy back the shorted stock at a lower price and make a profit on the difference.

In order to short-sell a stock, the investor needs to borrow the appropriate number of shares from a broker or other lender and then sell those shares. At some point in the future, the short-selling investor needs to buy back the same number of shares and return them to the lender so that the transaction is completely closed. If the price of the stock is lower at the time of the repurchase than it was at the time of the short sale, the short-selling investor makes a profit.

Bearish strategies are often used when the market is falling or moving sideways because, in these market conditions, the short-selling investor is expected to profit from the decline in the stock price. Selling stocks short is a high-risk investment strategy because stock prices could theoretically rise without limit, resulting in potential losses for bearish investors that could also be uncapped.

In the case of GameStation GME, for example, Zhang San borrows 100 shares from fund a to sell short, and the 100 shares sold by Zhang San are bought by fund b. At this point, Li Si wants to sell GME, so he borrows 100 shares from Fund B. The 100 shares sold by Li Si were in turn bought by Fund C. Then Wang Wu borrows GME from Fund C and sells it again, and so on. Theoretically, its number is up to n times the number of shares outstanding, i.e., there is no upper limit.

And because the U.S. regulatory system allows stock brokers to conduct internal hedging, that is, to hedge internally between their different clients' mandates for the same stock in opposite directions and in equal quantities, without having to enter the exchange, So at a given time, it is almost impossible to pinpoint the exact amount.

short position

| Characteristics |

Description |

| Definition |

selling an asset to profit from a future price drop. |

| Risk |

Investors may face losses if prices rise rather than fall. |

| Leverage |

Leverage amplifies gains and losses with asset price changes. |

| Market Environment |

Used in anticipation of market or asset decline, ideal for downtrends or bear markets. |

| Hedging Strategies |

Used to hedge against overall market decline, reducing portfolio risk. |

| Trading Instruments |

Investors hedge against market declines through short selling and derivatives. |

Short Alignment

It usually refers to a relatively strong bearish force in the market, as evidenced by multiple assets, Securities, or market indices showing a downward trend. This type of alignment may suggest pessimism in the market, where investors generally expect prices to continue to fall.

Prices of most stocks are showing a downtrend and may be market-wide or sector-specific. Some major market indices, such as stock indices and futures indices, show an overall downward trend. Some technical indicators, such as the Relative Strength Index (RSI), the Stochastic Index (kdj), etc., show that the market or asset is oversold.

Short-term averages are crossing the long-term averages downward, forming a "death cross," which may imply the strengthening of bearish forces. Some reversal patterns, such as head and shoulders, may be formed at this time. Along with a downtrend, trading volume may increase, indicating pessimism among market participants.

It may be a reference factor for investors when conducting market analyses, especially when formulating short-selling strategies. However, investors need to be aware that market sentiment and trends are dynamic and may be affected by various factors.

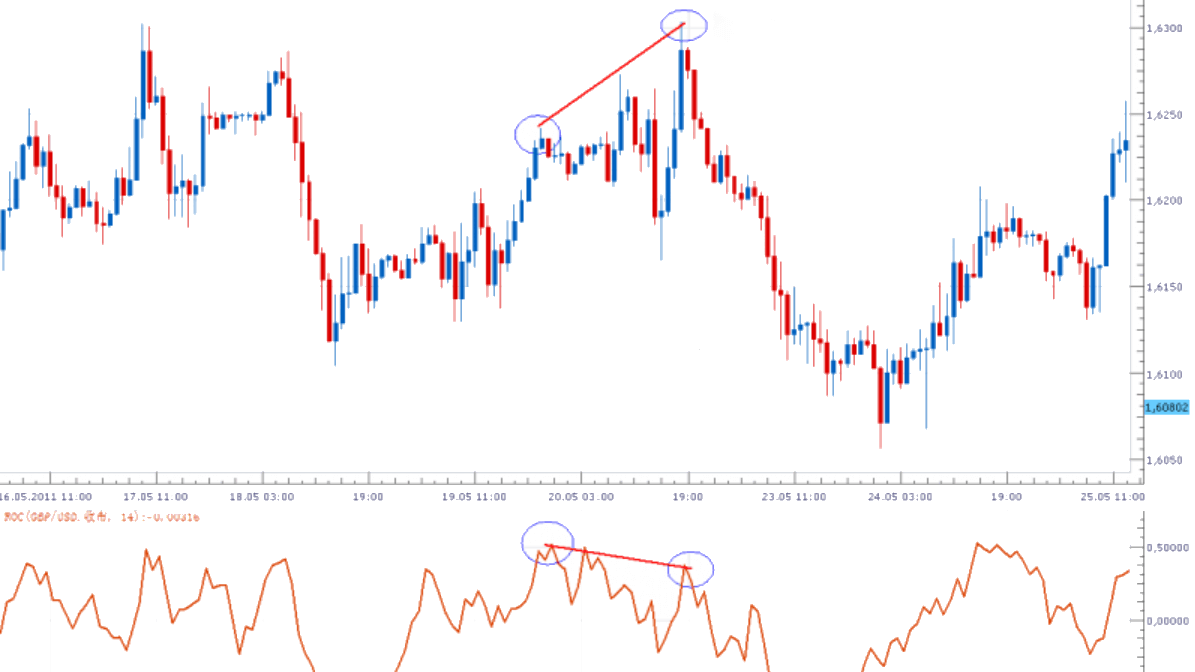

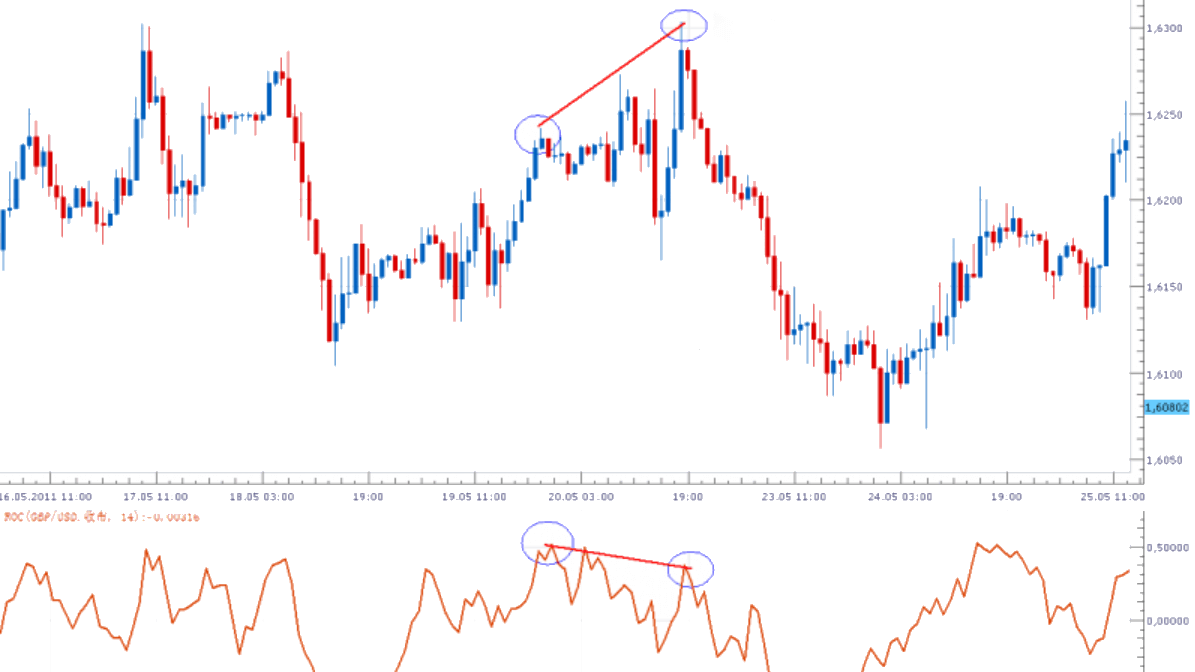

Divergence and flag shape

Short divergence is a pattern in technical analysis that refers to a situation where market prices make new highs, but the corresponding technical indicators or market trends show relatively weak signals suggesting a possible price reversal. It is a reversal signal that suggests that the strength of the market's uptrend may be weakening and that a downward price trend may be occurring.

This is demonstrated by market prices forming new highs on the chart, i.e., prices making new highs. In contrast to the formation of new highs, the underlying technical indicators or other market trends show signs of weakening. This may be in the form of falling technical indicators, negative trend lines, etc.

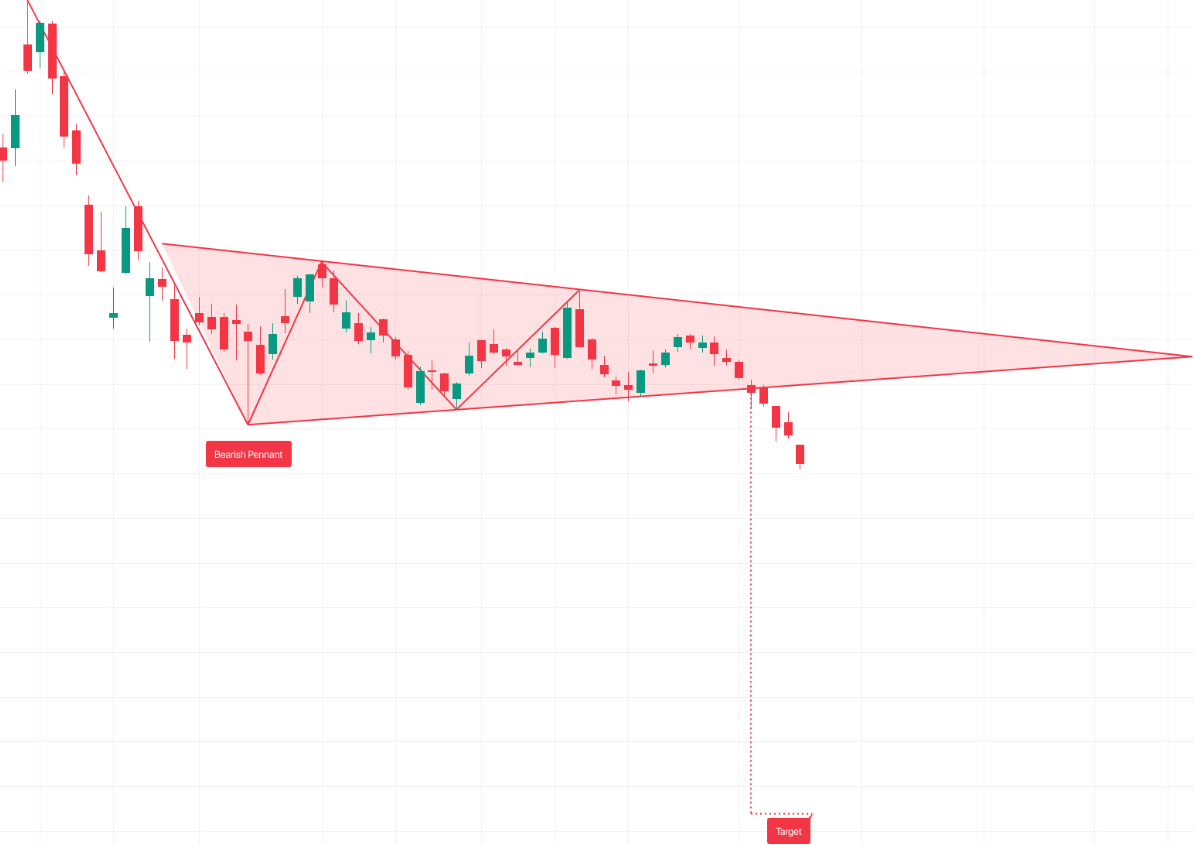

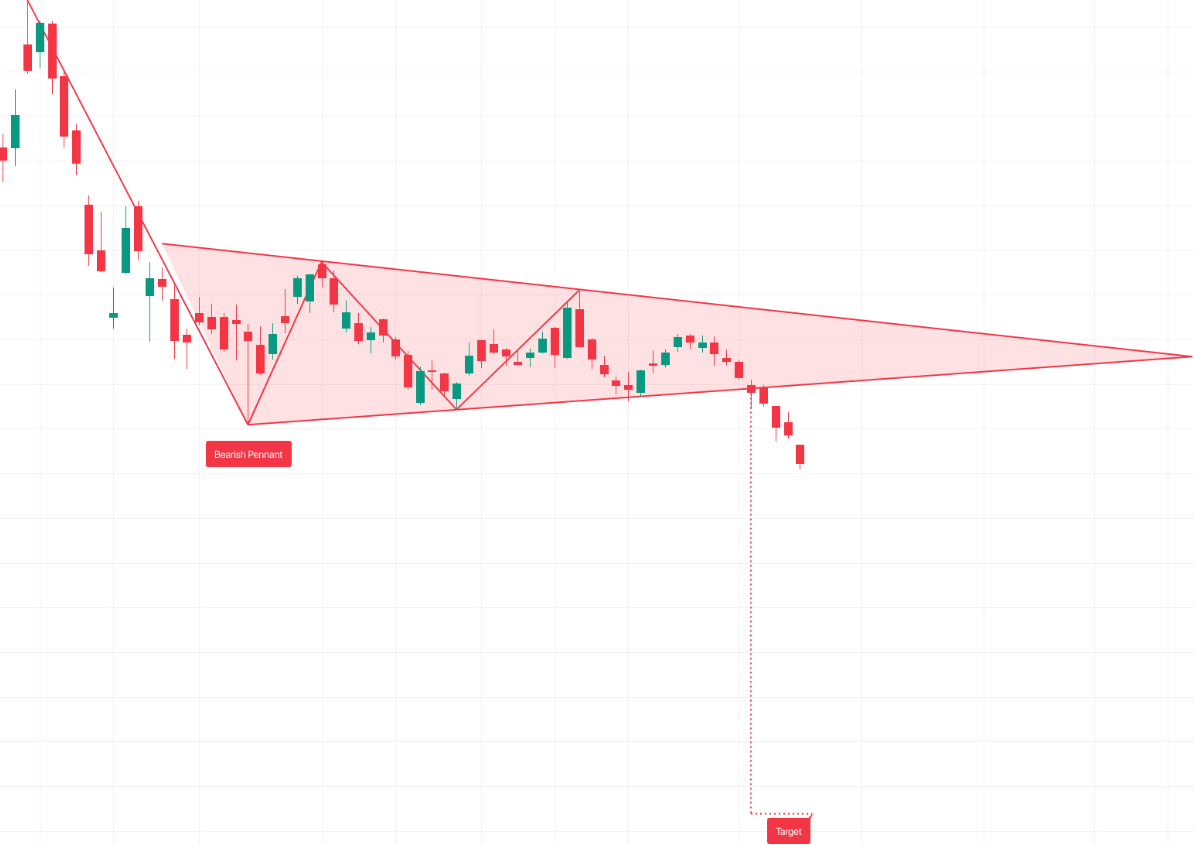

The short flag is also a technical analysis graphic pattern that is often used to determine possible price trends in the market. It is a reversal pattern that suggests that the current uptrend may reverse into a downtrend.

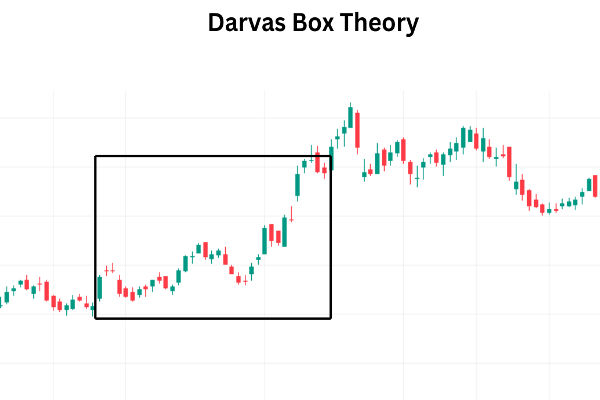

Prior to the formation of a flag pattern, the market usually goes through a period of uptrend where the price of a stock or market index continues to rise. After the uptrend, a short period of sideways consolidation occurs, forming a flagpole. This consolidation may be characterized by relatively stable prices with low volatility, forming a flagpole that slopes downward.

During the formation of a flagpole, volume usually decreases gradually. This is because trading activity by market participants is relatively low during a consolidation.

The final confirmation of a flag formation is when the price breaks downwards through the support line of the flag. This is a signal that suggests the market may be entering a downtrend. It is seen as a reversal pattern that signals a possible reversal of the current uptrend into a downtrend, and investors will consider a short-selling strategy after observing this pattern.

Bounce and backfill

A short rally is a situation where prices experience a short-term rise in a downtrend in a market or specific asset. This upturn may be temporary and simply result from weakening seller power or a change in market sentiment. It does not imply a fundamental change in the market trend, but rather a brief rise in a downtrend.

In a downtrend, there is a short-term period of rising market prices that creates a rally. Volume may be relatively low at this time, which may indicate reduced interest from market participants. The reason for the rally is a change in market sentiment, such as favorable news or a change in market expectations.

Some technical indicators may signal a rally, such as the Relative Strength Index (RSI) or the Stochastic Index (KDJ), showing that the market is oversold. However, the support of these technical indicators does not necessarily indicate that the trend has changed.

Short covering, also known as short closing, is when an investor closes a position in the market by purchasing the same number of positions, thereby covering the position previously sold short. This usually leads to an increase in market prices as investors buying assets increase demand, which drives prices up. And when market prices start to rise, more investors who originally sold short may feel the increased risk and choose to cover (buy) their previously sold short positions in order to avoid losses.

In the event of positive news or changes in the market, investors feel a change in market sentiment and choose to cover their positions in order to avoid further losses. When market sentiment changes from pessimistic to optimistic, investors may choose to cover their positions to avoid further losses. Or when some technical indicators, such as the relative strength index (RSI) or stochastic index (KDJ), show that the market is in an oversold state, investors may expect prices to rise and choose to cover the position.

The specific stEPS are that the investor first sells a certain amount of assets short, i.e., borrows and sells. When the investor believes the right time has come, they purchase the same amount of the position they bought short to close the position they previously sold short. When the position is closed, the investor will either gain or lose the difference in the price movement of the asset. The previously borrowed asset is then restored by purchasing the asset, and the transaction is completely closed.

This usually occurs after an investor expects the price of an asset to fall, and then the market or the price of a particular asset begins to rise and the investor feels the need to close the position to avoid further losses. It is a common strategy for managing risk and realizing gains.

It is important to note that it does not always result in profits. This is because the price of the asset may be higher at the time of closing the position than it was at the time of the short sale, causing the investor to suffer a loss. Investors need to be cautious and fully aware of the market risks when engaging in this closing operation.

The act of covering can exacerbate market rallies, creating a so-called "squeeze" as investors are forced to buy assets in a rising market, driving prices even higher. This phenomenon, also known as a "short squeeze," occurs when an investor is forced to buy assets to close out a position, thus fueling the market rally.

Short reversal pattern

| Reversal Patterns |

Characteristics |

Significance |

| Double Bottom |

Two lows, second lower, "U" bottom. |

Downtrend ended, ushering uptrend. |

| Head and Shoulders Bottom |

Three lows, lower central low, head and shoulders. |

Short trend ending, shifting to uptrend. |

| Peak-to-bottom transition |

Arc bottom |

Market will reverse into an uptrend |

| Double Top |

Two highs, second lower, "M" top. |

End of uptrend, downtrend |

| Head and Shoulders |

Three highs, lower head high, head & shoulders. |

Long trend ended, will turn downtrend |

| Peak Turnaround |

Arc Top |

Market will reverse into a downtrend |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

What does Bearish?

What does Bearish?