When it comes to technical trading strategies, the Darvas Box stands out as a method that has withstood the test of time. Developed in the 1950s by Nicolas Darvas, a professional dancer turned self-taught investor, this approach blends momentum trading with disciplined rules to identify breakout opportunities in the stock market.

Despite its age, the Darvas Box remains a favourite among traders for its simplicity, structure, and focus on price action. So, what exactly is the Darvas Box strategy, and why is it still relevant in today’s fast-moving markets?

What Is the Darvas Box Strategy?

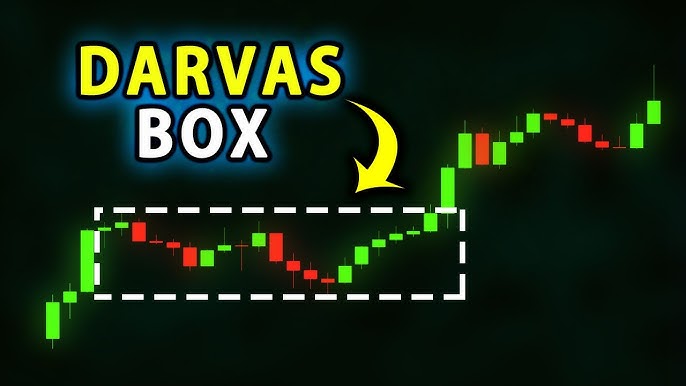

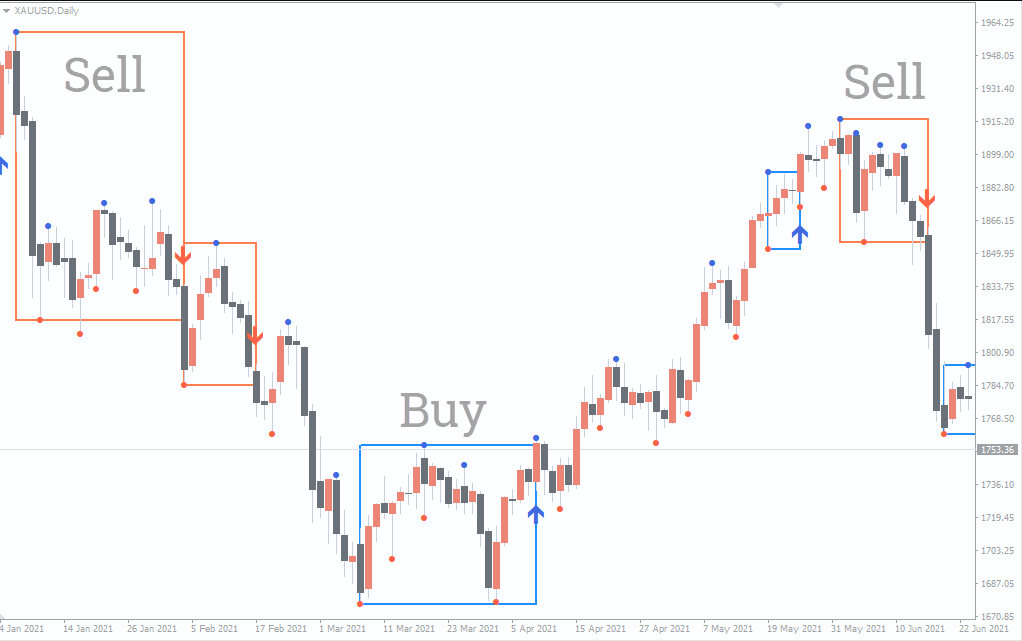

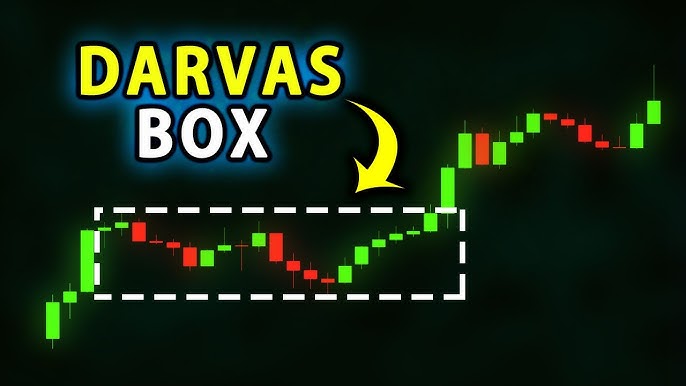

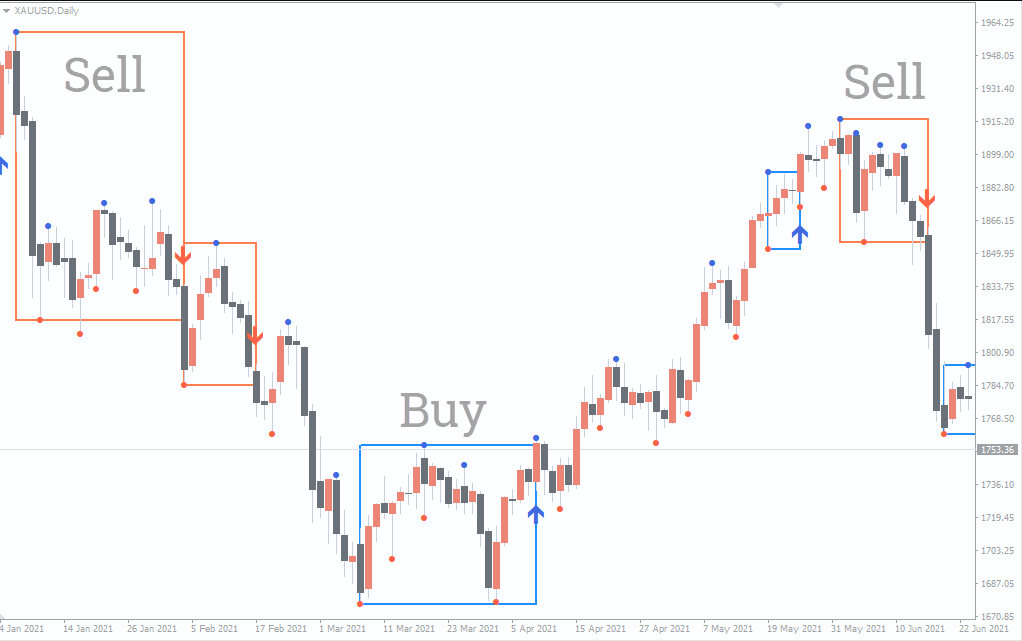

The Darvas Box is a trend-following method based on identifying stocks that are trading within a defined range, or “box”. Once the stock breaks out above the upper boundary of the box with increased volume, it signals a potential buying opportunity. The lower boundary acts as a stop-loss, providing a clear exit point if the trade turns against the trader.

Darvas came up with the idea while on tour as a dancer, using telegrams to communicate with his broker. He developed a method that allowed him to trade without constantly monitoring the market, relying solely on price movements and volume to make his decisions. His system focused on companies hitting new highs, assuming that strong price trends often continue.

How the Darvas Box Works

To build a Darvas Box, a trader looks for a stock that has made a significant upward move and then begins to consolidate. During this consolidation, the price moves within a high and low range. This range forms the “box”. The top of the box is the recent resistance level, while the bottom is the support level.

Here is a simplified process to apply the Darvas Box strategy:

Identify a candidate stock showing strong upward momentum.

Wait for the price to consolidate and form a clear trading range.

Draw the box using the recent high as the upper boundary and the recent low as the lower boundary.

Enter a trade when the price breaks out above the box on higher volume.

Set a stop-loss just below the lower boundary to manage risk.

Adjust the box if the stock forms a new range during the trend.

The simplicity of the rules makes the Darvas Box accessible to traders of all experience levels.

Advantages of the Darvas Box

One of the key benefits of the Darvas Box strategy is its ability to keep emotions in check. With clear entry and exit points, traders are less likely to make impulsive decisions. This structure also helps traders avoid false signals, since breakouts must occur on higher volume to be valid.

Other advantages include:

Trend identification: The method naturally aligns with the trend, helping traders ride strong momentum.

Risk management: The lower boundary of the box serves as a predefined stop-loss, protecting capital.

Clarity and consistency: The rules are straightforward, reducing subjectivity in decision-making.

Time-saving: Ideal for those who cannot monitor charts constantly.

The Darvas Box is especially effective in trending markets, where momentum plays a key role in price movement.

Limitations of the Darvas Box Strategy

Despite its strengths, the Darvas Box is not without limitations. Like any technical approach, it can generate false breakouts, especially in choppy or sideways markets. Traders must be disciplined and stick to volume confirmation to reduce the risk of entering too early.

Additionally, the strategy may underperform during market corrections or in low-volatility environments. Since the Darvas Box relies heavily on price movement and momentum, flat markets can lead to fewer high-quality setups.

Some traders also argue that the Darvas Box is too simplistic for today’s complex market conditions. However, others maintain that its simplicity is what makes it powerful.

How to Use the Darvas Box in Modern Trading

Modern traders often adapt the Darvas Box by incorporating additional technical indicators, such as moving averages or RSI, to increase the strategy’s accuracy. Some may combine it with Volume Profile tools or trend filters to validate breakouts.

The method is also compatible with Automated Trading systems. The clear rules make it ideal for algorithmic implementation, allowing traders to backtest and refine the strategy based on historical data.

With many online platforms now offering box-drawing tools, it is easier than ever to apply the Darvas Box visually. Traders can set alerts for breakouts and manage trades directly from their charts.

Darvas Box in Forex and Crypto Markets

Although originally designed for stocks, the Darvas Box can also be applied to forex and cryptocurrency markets. In these volatile environments, clear breakout patterns and momentum-driven trades are often effective.

The key is to adjust the box size based on the asset's volatility. For example, a cryptocurrency with large price swings may require wider boxes and looser stops, while a currency pair with steady movement may work with tighter ranges.

Volume can be trickier to interpret in these markets, especially in decentralised exchanges. In such cases, traders might rely more on price action and candle structure to confirm breakouts.

Conclusion

Whether you are a beginner looking for a structured entry method or an experienced trader searching for clean breakout opportunities, the Darvas Box strategy offers a reliable framework. It is not a holy grail, but it encourages discipline, clear thinking, and methodical trade execution.

Like any trading strategy, success with the Darvas Box comes from practice, backtesting, and consistent application. Understanding market context is also essential. Not every box breakout will lead to a major trend, so filtering trades and managing risk remains critical.

By studying historical patterns and aligning with strong market momentum, traders can use the Darvas Box to capture meaningful moves while avoiding emotional decision-making.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.