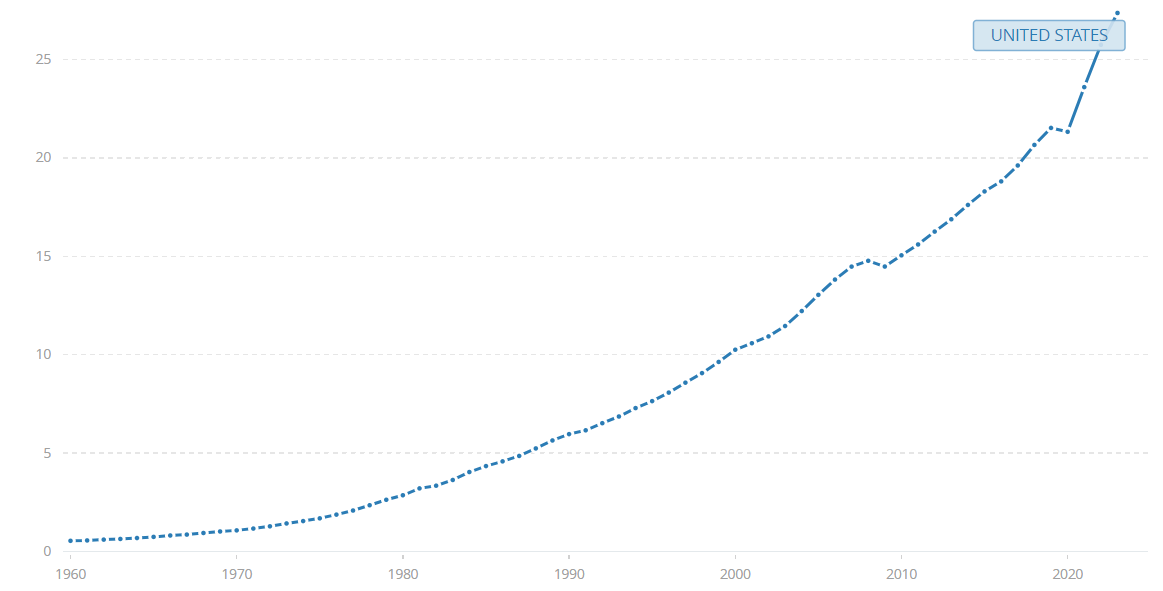

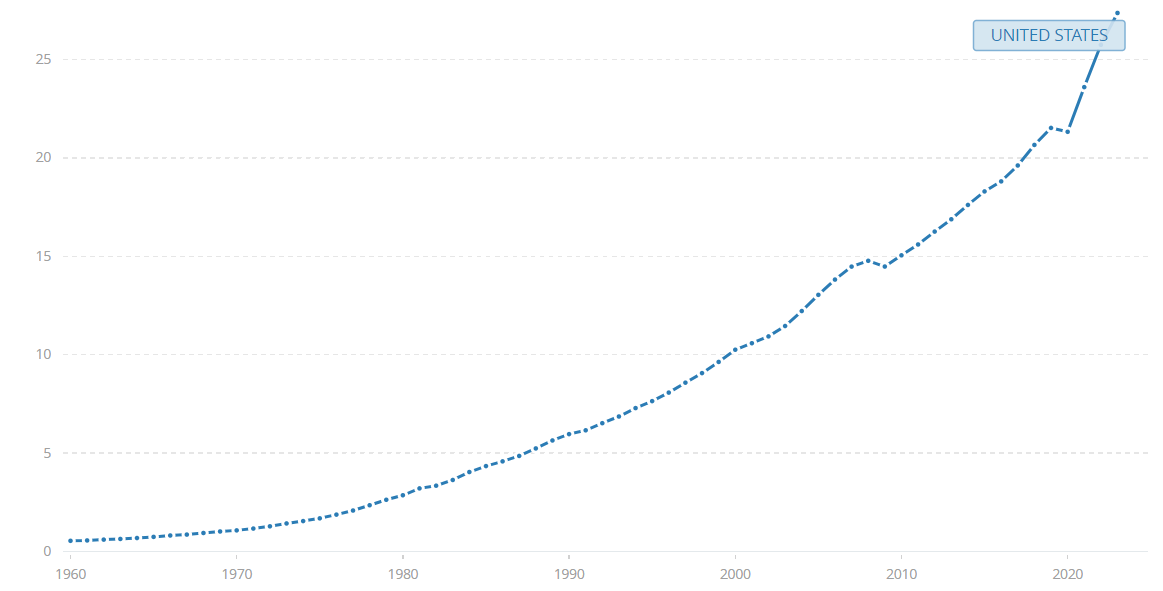

The current performance of the US economy is remarkable, especially its 26% of global GDP, a nearly 20-year high. The US dollar, as the world's major currency, controls the monetary rules, and despite the implementation of monetary tightening policies, the economic growth rate is still higher than the outside world's expectations, reflecting the strength of its economy and the dominance of the US dollar in the global monetary rules. However, behind the strong performance, there are still challenges and uncertainties. Next, we will delve into the historical background and current status of the US economy.

Historical Background of the U.S. Economy

Historical Background of the U.S. Economy

In 1783. the United States successfully won the War of Independence, completely breaking away from British colonial rule and beginning a new era of independent development. Although the economy of the United States was still in its infancy in the early period just after independence, the country quickly entered the track of rapid economic growth by virtue of its rich natural resources and expanding markets. During this period, the United States, taking advantage of its vast land area and rich mineral resources, gradually built up an economy full of potential.

Entering the mid-19th century, especially after the end of the Civil War in 1865. the U.S. economy underwent a remarkable transformation. The post-Civil War Reconstruction period marked the transition from a predominantly agrarian economic model to one centered on industrialization in the United States. The rapid rise of factories and railways gave a great impetus to the development of industrial productivity and also accelerated the process of urbanization, enabling the United States to gradually form a modernized economy dominated by industry and cities.

In 1913. the U.S. financial system ushered in an important milestone—the establishment of the Federal Reserve Bank. This event marked the formal maturity of the U.S. financial system. The establishment of the Federal Reserve System (Fed) not only provided a stable monetary policy for the financial market but also enhanced the ability of financial regulation and the ability to respond to economic fluctuations. The establishment of this system laid a solid foundation for the economic growth and financial stability of the United States, allowing it to occupy an important position on the subsequent global economic stage.

Although the early 20th century predicted that Britain, Russia, the United States, and Germany would dominate the global power landscape, the world wars and the wave of globalization changed this prediction. The two world wars and the changes they brought about led to the rapid rise of the United States, which transformed itself from a major industrial nation to the center of the global economy. With its strong economic power, scientific and technological innovation, and financial base, the United States quickly became the leader of the global economic and financial system, with far-reaching effects on the global economic and political landscape.

When World War I broke out in 1914. the United States remained neutral in the early stages and did not formally enter the war until 1917. After the end of the war, the United States chose an isolationist policy that limited international intervention and participation, resulting in the proportion of international trade to GDP falling to a record low. This policy reflected the United States' preoccupation with domestic issues and relative detachment from international affairs at the time. However, this isolationism did not last, and changes in the global situation and the outbreak of the Second World War forced the United States to recalibrate its international strategy.

The Second World War radically altered the global economic and political landscape. During the war, the U.S. demonstrated amazing manufacturing capabilities and became a key supporter of the Allies. After the war, the US quickly replaced Britain as the global hegemon, and the US dollar replaced the British pound as the major international currency. This period marked the establishment of US dominance in the global economic system and reshaped the international financial system.

In 1944. the Bretton Woods system was established, with the US dollar pegged to gold as the major international currency and other currencies pegged to the US dollar. This arrangement placed the dollar at the center of the global economy and supported the economic recovery of the United States. Although the system came to an end in the 1970s due to economic pressures, the US dollar retained its status as a major global currency and continued to play a key role in international financial markets.

In the 21st century, the accelerating process of globalization has brought international economic and financial markets closer together. The entry and rise of China further consolidated the dominant position of the United States in the global economy. China's economic development not only drove the growth of global trade and investment but also strengthened the ties between the United States and other major economies and increased the influence of the US dollar in the global economic system. This phase of globalization and the rise of China has allowed the United States to continue to maintain its significant position in the international financial and economic arena, while at the same time presenting new challenges and opportunities.

In short, the early United States rose rapidly to become the world's leading superpower thanks to the war dividend, monetary policy, and globalization. Successful industrial transformation and massive capital accumulation further consolidated its global leadership. However, the fallout from the nation's fiscal and monetary expansion, the current soft landing issue, and the public's lack of confidence in the economic outlook have added uncertainty to the future of the U.S. economy.

What Dominates the U.S. Economy

In 2023. the U.S. economy showed unexpectedly strong stability, thanks in large part to a boost in consumer spending. Despite the challenge of rising interest rates, consumer spending by U.S. consumers has remained strong, thus supporting economic growth. Strong consumer spending not only boosted economic activity but also helped stabilize the overall performance of the economy, ensuring continued expansion.

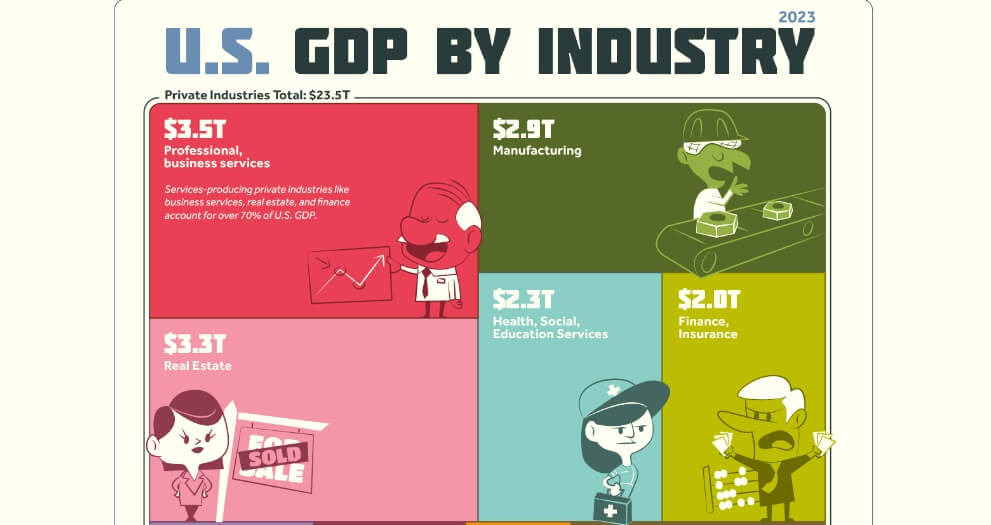

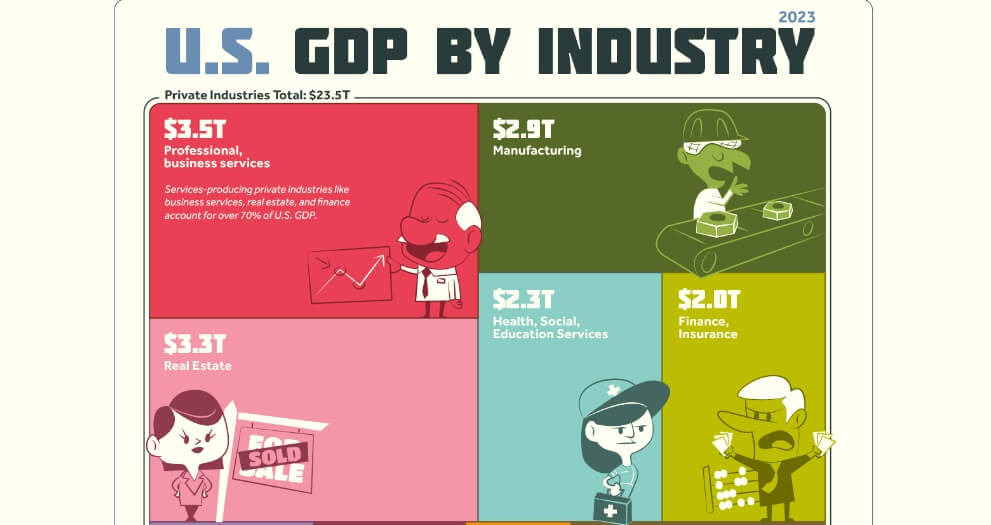

With the world's largest consumer market, the US is a major driver of economic growth. The service sector is at the heart of the U.S. economy, accounting for more than 80 percent of gross domestic product (GDP). The services sector encompasses financial services, healthcare, education, retail, information technology, and entertainment, which play a key role in the economy.

The financial services and technology sectors are particularly prominent and have a global reach. The United States is not only a global center for financial and technological innovation but also home to many world-leading companies, such as Apple, Google, and Goldman Sachs, which occupy a pivotal position in the global market.

The economic structure of the United States is highly dependent on the free market, the financial system, and the technology industry. The federal government dominates taxation and sectoral spending, while the Federal Reserve System is independently responsible for the money supply. However, this arrangement also brings with it complex relationships in terms of policy. For example, the recent Federal Reserve interest rate policy has been linked externally to the upcoming presidential election, generating a great deal of discussion.

The United States has been at the forefront of technological innovation in the world, particularly in the areas of information technology, biotechnology, and clean energy. Silicon Valley is globally recognized as a center of technological innovation, attracting large amounts of investment and talent. The United States is a global leader in technology and innovation, especially in the fields of information technology, biotechnology, and artificial intelligence. The technology sector not only drives economic growth but also attracts significant investment.

While the service sector dominates the U.S. economy, manufacturing remains important. The U.S. manufacturing sector encompasses a wide range of sectors, including aerospace, automotive, machinery, electronic equipment, and chemicals. Although the overall economic weight of manufacturing has declined, it still plays a key role in technological innovation and the production of high value-added products.

The United States manufacturing sector is dominated by high-technology, high-value-added products, with notable competitiveness in aerospace, high-tech electronic equipment, and automobiles in particular. These areas not only drive technological progress but also have a significant impact on the structure and global competitiveness of the United States economy. Despite the dominance of the service sector in the economy, innovation and high-end products in manufacturing remain critical to the long-term growth and international competitiveness of the U.S. economy.

The United States is one of the world's largest agricultural producers, and agricultural exports are important in the global marketplace. Major agricultural products include corn, soybeans, wheat, beef, and pork. Although agriculture is a small percentage of GDP, it is important to US export trade and the rural economy.

As one of the world's largest energy producers, the U.S. is particularly strong in the oil and gas sector. Revolutionary technologies in shale oil and natural gas have transformed the U.S. from a traditional energy importer to a net exporter of energy, a transformation that has had far-reaching implications for global energy markets. U.S. energy production capacity not only meets domestic demand but also occupies a significant position in the global marketplace, driving international energy price movements and enhancing the U.S. strategic position in the global energy supply chain.

Overall, the U.S. economy is highly diversified and dominated by the services sector, with strong competitiveness in manufacturing, agriculture, energy, and science, technology, and innovation. The main drivers are services and consumer spending, while manufacturing and STI play a key role in structural upgrading and long-term economic growth.

Current Status and Trends of the U.S. Economy

As the U.S. presidential election approaches, the atmosphere of electioneering is becoming more and more tense, with the confrontation between the two parties intensifying. However, the performance of the U.S. economy is unsatisfactory, which is extremely unfavorable to the ruling Democratic Party. Currently, the overall economic indicators of the United States, including leading and synchronized indicators, are not performing as well as the market expects, and some of the indicators have even issued warning signs of recession.

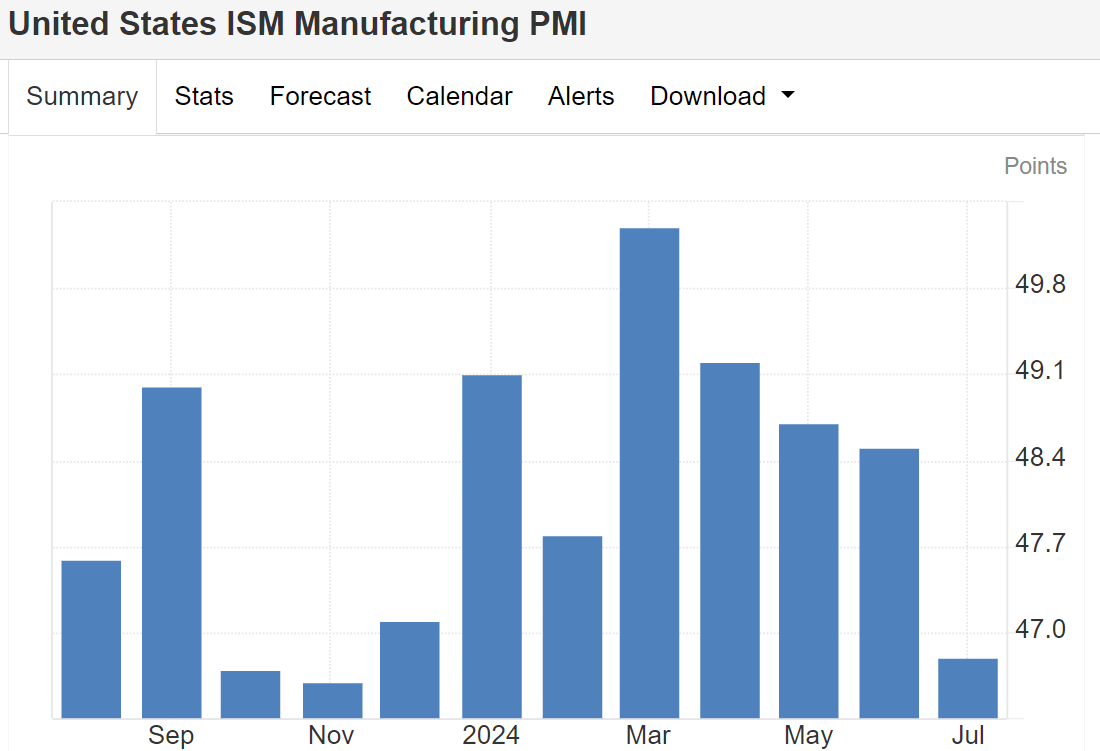

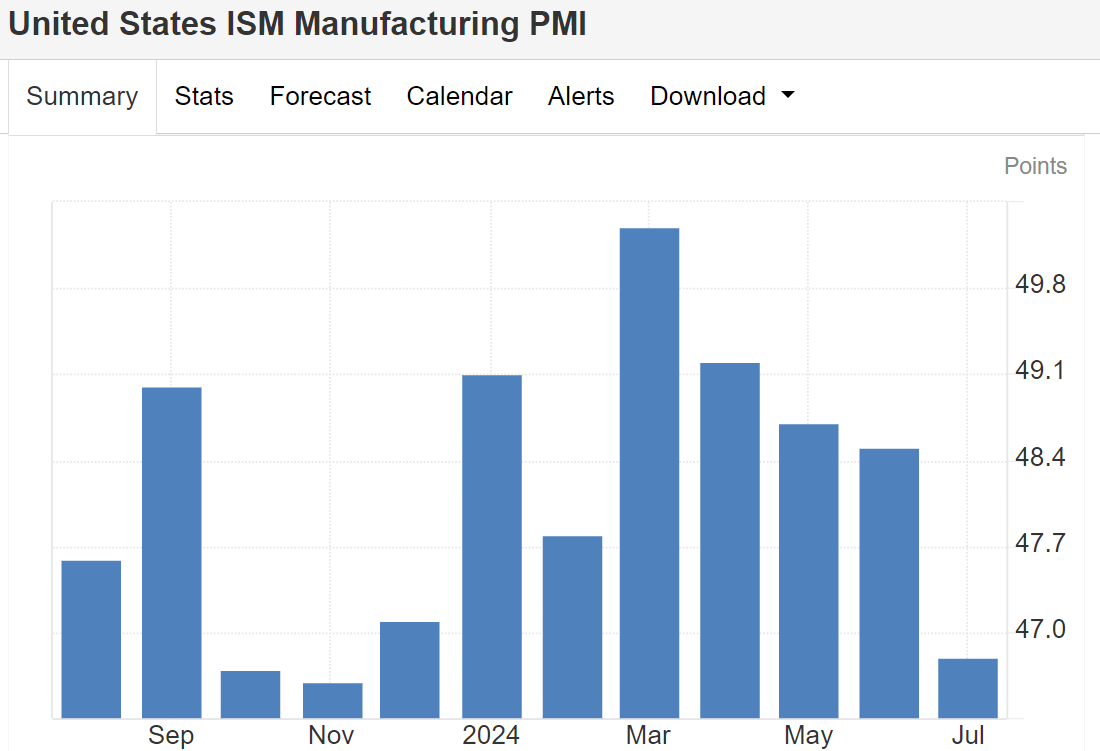

As a market-recognized important leading economic indicator, the Purchasing Managers' Index (PMI) has sent worrying warning signals in recent years. For example, the Institute for Supply Management's (ISM) manufacturing purchasing managers' index (PMI) has declined for three consecutive months and fell below the 50 cut-off.

This situation usually signals that the U.S. manufacturing sector may be experiencing a recession, because PMI below 50 usually indicates that manufacturing activity is contracting rather than expanding. In addition, the core services PMI also performed poorly and also fell below the 50 cut-off line, which indicates that another important pillar of the U.S. economy—the service sector—also appeared from the boom to signs of recession.

The decline in these PMI indicators reflects the slowing trend of economic growth, which is a warning sign for market participants and policymakers to pay high attention to. The deterioration in the performance of the manufacturing and service sectors, which are major components of the economy, could have far-reaching implications for the overall economy. Investors and analysts need to closely track changes in these indicators in order to make strategic adjustments to the current economic environment and prepare for future economic trends.

On the inflation front, the U.S. Consumer Price Index (CPI) has fallen significantly from its mid-2022 high of 9% but has never fallen below 3% over the past year. Although the CPI has recently fallen back to around 3 percent, suggesting some easing of inflation, it still falls short of the 2 percent target set by the Federal Reserve Board. This reflects the fact that the fall in inflation, while significant, has failed to meet the expected reduction, suggesting that the inflation issue remains challenging.

The easing of inflation is closely linked to the slowdown in economic growth, suggesting that the US economy may have entered a slowdown phase. However, the failure of CPI to fall to the target level set by the Federal Reserve Board continues to put pressure on the conduct of monetary policy. One of the major challenges faced by the Fed is how to effectively control inflation to meet its inflation target while ensuring stable economic growth. This dilemma requires the Fed to fully weigh the balance between economic growth and inflation control in formulating monetary policy.

The Federal Reserve Board is increasingly concerned about the U.S. job market. Currently, the U.S. unemployment rate has exceeded 4%, and the continuing upward trend has triggered widespread concern about the health of the economy. According to the Sahm Rule study, when the difference between the three-month average of the unemployment rate and the previous year's low reaches 0.5 percentage points, the risk of recession increases significantly. Currently, the Sahm Rule data is close to this warning line, indicating that the risk of recession in the United States is rising.

A rising unemployment rate not only reflects weakness in the job market but also hints at weakening economic activity. The early warning signs of Sahm Rule have fuelled concerns about the future course of the economy. If the unemployment rate continues to climb and breaks through the key thresholds, it may have a negative impact on consumer spending and economic growth, which makes it more challenging for the Federal Reserve Board to formulate monetary policy. In such an economic environment, how to balance inflation control and employment promotion has become a key issue for the Federal Reserve Board to address.

Despite economic indicators showing the risk of recession, the Federal Reserve Board has not yet taken measures to cut interest rates, triggering widespread skepticism among economists. Many experts believe that the current economic situation requires looser monetary policy to stimulate growth and mitigate the risks associated with high interest rates. The market is looking forward to the announcement of a rate cut by the Board at its September meeting and expects that its policy adjustments will have a significant impact on the direction of the economy.

Historical experience has shown that US stocks tend to decline to some extent a month before the announcement of a rate cut decision, which explains the recent high-grade market jitters. Investors' anticipation of an impending recession and a cycle of interest rate cuts may have prompted them to adjust their investment strategies to hedge against potential risks at a time of heightened market volatility. Such adjustments not only reflect a sensitive reaction to the policy moves of the Fed but also demonstrate the market's uncertainty and caution about the future direction of the economy.

In view of the current weakness of the US economy and the potential risk of recession, investors should revisit their asset allocation strategies. It is recommended to reduce exposure to risky assets and instead increase allocation to the bond market. The bond market typically offers relatively stable returns and lower risk in a recessionary and volatile stock market environment. By shifting funds to the bond market, investors can effectively reduce the overall volatility of their portfolios and protect capital in the midst of economic uncertainty.

The onset of a cycle of interest rate cuts may be favorable to the bond market. Interest rate cuts usually lead to a decline in bond yields, which in turn boosts the market value of bonds, and thus bond investments may yield additional returns. The stock market, meanwhile, may be under correction pressure, especially if economic growth slows. By turning to the bond market at this time, investors can not only enjoy the potential benefits of higher bond prices but also keep their portfolios robust in the face of economic headwinds.

The U.S. economy is currently under downward pressure, and although the Federal Reserve Board is maintaining a tight monetary policy, the likelihood of a rate cut is increasing. Investors should pay close attention to changes in economic indicators and adjust their investment strategies in response to potential economic downturns and market volatility. Future economic trends will have a significant impact on investment decisions.

Current Status and Trends of the U.S. Economy

| Current status |

Trends and Challenges |

| 26% of global GDP: strong but facing challenges. |

Slowdown in economic growth and risk of recession |

| Strong consumer spending; services dominate. |

Growth relies on consumer spending and services. |

| Manufacturing is strong; tech leads. |

Tech advances drive growth in manufacturing and tech. |

| CPI above target, rising unemployment |

Inflation control and job market challenges coexist. |

| Tightening policy and rising rates cut expectations. |

Monetary policy adjustments for economic slowdown. |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

Historical Background of the U.S. Economy

Historical Background of the U.S. Economy