The yen was volatile Friday after the BOJ conducted so-called rate checks

with traders, reinforcing perceptions that authorities intervened in the market

earlier to prop up the currency.

This followed a surge of as much as four yen in the minutes after a

softer-than-expected reading of US inflation. The spike in volume reinforced

conviction that Tokyo had stepped in.

The yen remained the worst-performing major currencies this year though,

falling as much as roughly 12% against the dollar, as the BOJ trod too

cautiously to narrow the yield spreads.

There was "palpable nervousness in the market" in recent sessions from hedge

funds looking to protect carry trades for that kind of scenarios, said Ruchir

Sharma, global head of FX option trading at Nomura International.

Rate checks typically happen when volatility increases and verbal

intervention appears insufficient to tame currency moves. That was last seen in

Sep 2022 to spark immediate intervention.

The yen was easing towards 150 per dollar back then and the subsequent rally

lasted several months. Still it touched its weakest since 1986 last week due to

an inflation crisis that resulted in eleven Fed rate hikes.

The lately surge was a victory for Japanese authorities, but there will need

to be a forceful follow up for the yen to sustain any gains. Therefore, the next

BOJ meeting will capture intense attention.

Jigsaw

Japan's top currency official continued to keep speculators on edge amid

potential signs of an evolution in Tokyo's yen strategy as he played down a

report that government officials had confirmed intervention.

The BOJ reported Friday that its current account will probably fall ¥3.2

trillion on the next business day. That compares with an average forecast

increase of ¥333 billion among private money brokers

That gap proved accurate in confirming a government push. In further

evidence, Thursday was one of the busiest days for yen spot trading since

November 2016, according to CME Group.

Masato Kanda has tried to maximize the impact of currency policy by

repeatedly leaving doubt in the market over Japan's actions, which helps to

unsettle those aggressive bears.

He is scheduled to step down at the end of July, to be replaced by Atsushi

Mimura, who is currently director general of the finance ministry's international bureau.

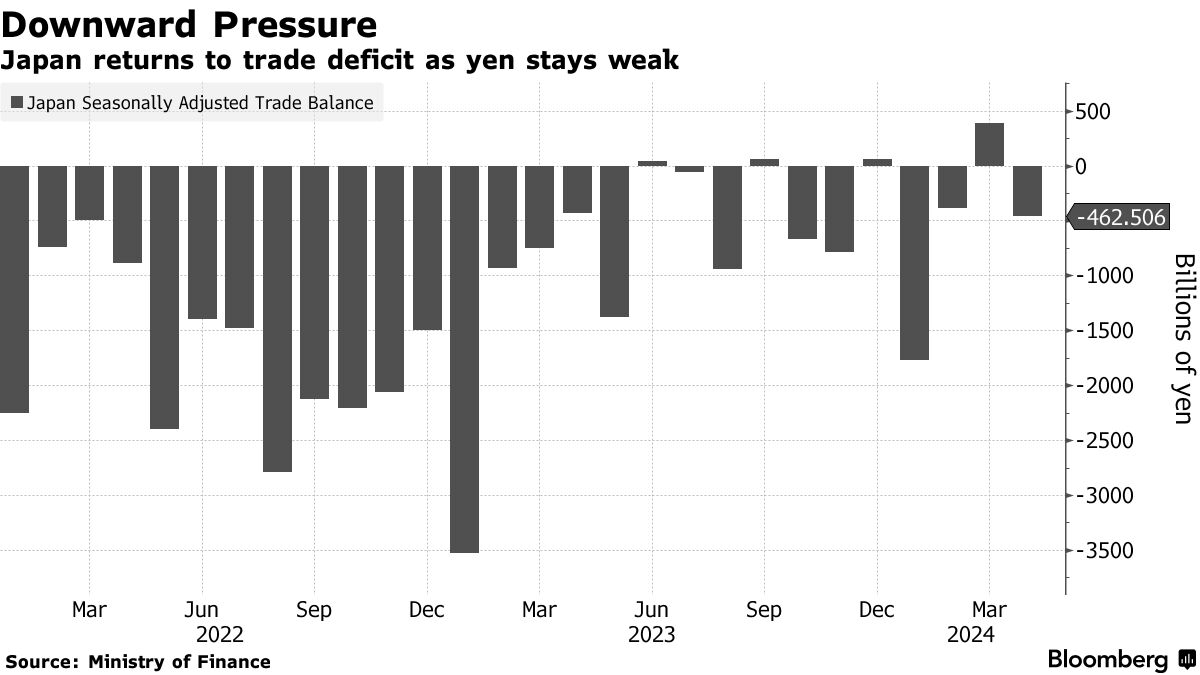

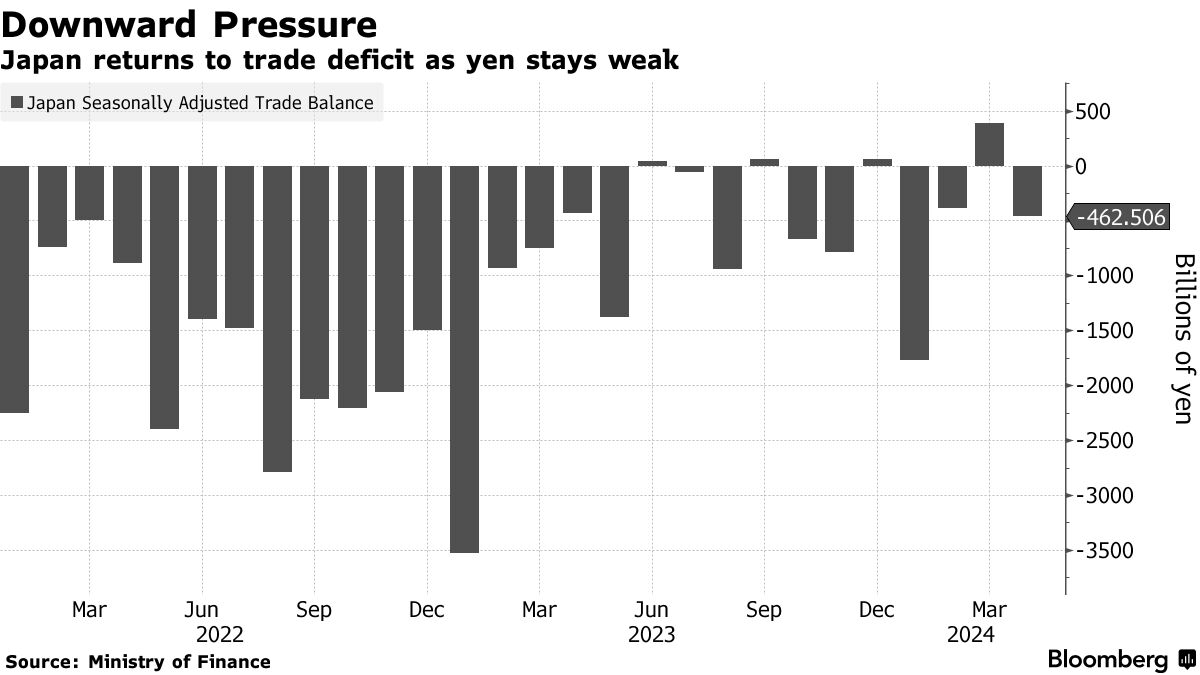

Japan's import prices have recently risen by around 9.5%, of which 9.2% is

down to the weakness of the yen. The weak yen has pushed the nation's trade

balance into deficit again in April.

Some economists say the action in the markets made a rate hike more likely

because following a government response, while others say it made it more

unlikely because pressure on the yen has eased.

Dead End

Yujiro Goto, head of FX strategy at Nomura Securities, said a hike by 15 bps

might lead to a 2-3 yen gain for the currency, but a rate rise alone may not be

sufficient to shift its direction.

"If the yen continues to trade weakly into the July meeting, the bank would

need to consider an early rate hike even as it decides on the pace of Japanese

government bond purchase reductions."

Similarly, Barclays sees only a limited currency impact and forecasts the yen

will end the quarter at 160 per dollar although it predicts the BOJ will raise

its target to 0.25% this month.

"While JPY weakness raises expectations of a BOJ hike this month we think

domestic-overseas yield differentials are too wide for a sustained reversal," said Mitul Kotecha, head of FX for Asia at Barclays.

"If there's no change in rates, then we may well see renewed yen selling," said Ray Attrill, head of FX strategy at National Australia Bank. Swap markets

show the probability is nearly 50%.

Some have suggested if the BOJ hiked in addition to announcing a reduction in

bond purchases, the move could risk being seen as driven by the volatile

currency and not its mandate to stabilise prices.

The BOJ has repeatedly said it does not target the yen. Despite that, Kazuo

Ueda has not ruled out policy changes if the falling currency rate was seen

changing the outlook for inflation.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.