Silver has had monetary value since ancient times, and it is more commonplace than gold, which is highly prized for its preciousness. Therefore, in the field of investment, people are more inclined toward gold. But as the god of the stock market, Warren Buffett believed that silver had more investment value and invested about 1 billion dollars in it. So nowadays, people pay more and more attention to silver investment, especially silver futures as an investment tool, attracting more and more investors to pay attention to and participate. Now let's discuss the overview and trading rules of silver futures as a widely used investment method.

What are silver futures?

It is a trading contract with silver as the underlying that allows investors to buy or sell silver at a predetermined price on an agreed-upon date in the future. It is an agreement between the investor and a futures exchange that stipulates the price at which a certain amount of silver will be bought or sold, the time and place of delivery, and other terms.

The amount of silver represented by each contract is usually 5.000 ounces, and investors are required to pay a margin to participate in the transaction. With the option of physical delivery or cash settlement at contract expiration, this market instrument allows investors to manage risk and pursue investment returns in the face of future price fluctuations.

The silver futures market conducts price discovery through the purchase and sale of contracts, which means that supply and demand in the marketplace directly determine the price at which contracts are traded. Investors trade contracts to express their expectations of future silver price movements, and the buying and selling activity in the market reflects the views and expectations of all parties regarding the future supply and demand for silver.

Investors in this market have the option to buy (long position) or sell (short position) futures contracts to earn a profit on rising or falling prices. A long position means that an investor expects the price of silver to rise, and they buy a contract with a view to selling it at a profit when the future price is higher than the current price. Conversely, a short position indicates that the price is expected to fall, and the investor sells the contract with the hope of buying it back in the future when the price is lower than the current price, thus realizing a profit.

Trading silver futures involves a high level of risk, so investors should adopt effective risk management strategies to protect their capital. Stop-loss orders are a commonly used strategy to limit losses by automatically executing trades when the market price reaches a set stop-loss point. In addition, position control is also crucial. Investors should set the appropriate position size according to their risk tolerance and avoid investing too much money in one transaction.

Futures trading utilizes a leverage effect that allows investors to control larger-value contracts with less capital, thus magnifying the potential for return on investment. For example, if a contract is valued at $10.000. an investor may only need to pay a small percentage of that amount as a margin, such as $1.000. which is leverage.

This mechanism allows the investor to make larger profits during market volatility but also carries risks, as market reversals can lead to rapidly magnified losses. Therefore, when trading futures with leverage, investors must manage their risks carefully, for example, by placing stop-loss orders and controlling their positions wisely to avoid excessive losses.

Most futures traders choose to close out their positions before the expiration of a contract rather than actually delivering it. Closing a position means that an investor closes their position by making a reverse trade. For example, if one holds a long position (anticipating a price increase), one would close the position by selling the contract; if one holds a short position (anticipating a price decrease), one would close the position by buying the contract.

Physical delivery usually occurs in the silver futures market only under certain circumstances, which require the investor to be ready to receive or deliver physical silver. At the expiration of a futures contract, if an investor has an open position and chooses not to close it, they may be required to take or deliver the appropriate amount of silver as specified in the contract.

This typically occurs for commercial users or physical demanders, such as metal fabricators or precious metals dealers, who need to physically use or deliver silver. For most investors, their primary objective when trading futures is to profit from price fluctuations, so they prefer to settle their positions by closing out their positions prior to contract expiration rather than taking actual physical delivery.

Participants in the futures market include speculators, hedgers, and market makers. Speculators take advantage of price fluctuations to earn profits, while hedgers stabilize profits or costs by hedging price risk in the spot market. Market makers provide liquidity and manage the risk of price fluctuations in the supply chain, ensuring stable production costs or selling prices. Investors also use futures as part of a diversified portfolio, aiming to increase earnings potential or manage risk. Together, these participants contribute to the liquidity of the market and the price discovery process.

Overall, silver futures are for speculation and risk management based on the price fluctuations of the underlying silver. It is usually conducted on exchanges, and investors can use these contracts to speculate or hedge their risk. And it provides a trading platform for a variety of participants, facilitating market liquidity and the price discovery process.

Advantages of investing in silver futures

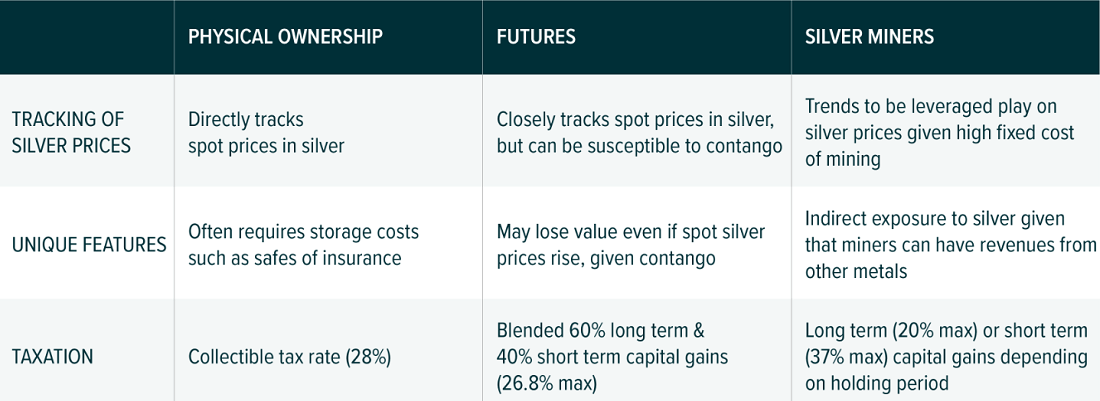

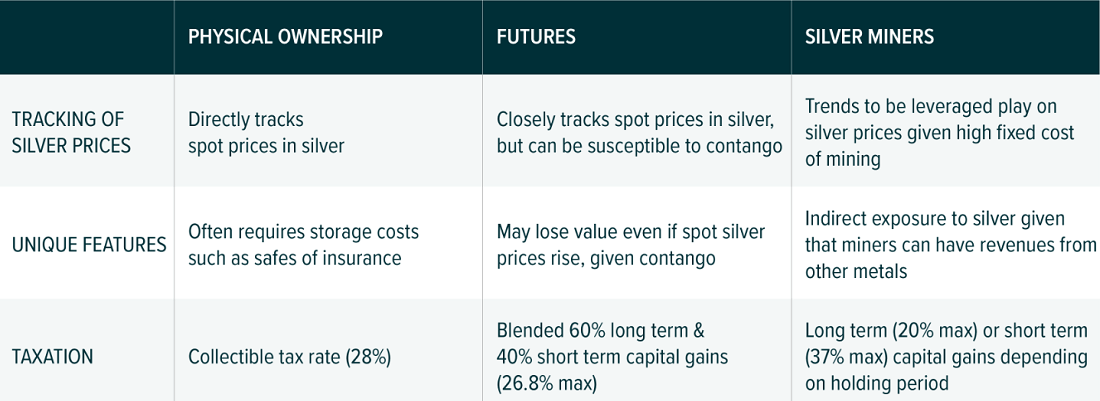

In addition to futures, there are also spot and silver mining stocks. All have the same opportunity to capitalize on market fluctuations, but in comparison, the advantages of silver futures investment lie in leverage, high liquidity, hedging, price discovery and transparency, and global market participation.

Because futures trading allows investors to control a larger-value contract by paying a portion of the margin, there is a high degree of leverage. This allows investors greater opportunities for profit during market volatility but also increases risk. With leverage, an investor can control a larger position by paying only a small percentage of the contract's value as a margin. This allows investors to take greater profits during market fluctuations but may also expose them to greater risk of loss, especially if the market moves against their expectations.

The silver futures market is a highly liquid market with a high volume of buying and selling activity on a daily basis. This high level of liquidity allows investors to buy or sell contracts at market prices at any time, thereby enhancing the efficiency of the market and the ease of trading. Investors can move in and out of the market quickly to take advantage of market volatility, as well as be able to find counterparties to execute their trading strategies more easily. This liquidity also helps reduce transaction costs and improves the price discovery process in the market, making it more competitive and transparent.

Such futures contracts can also be used to hedge against the risk of volatility in the price of physical silver. For example, producers and consumers can use futures contracts to lock in the future price of silver in order to protect themselves against market price fluctuations. Producers can use futures contracts to protect their profits, while consumers can hedge against increased costs associated with higher prices. This tool allows them to better plan and budget to ensure the stability and sustainability of their business operations.

Prices in the silver futures market reflect market participants' expectations of future silver supply, demand, and price movements. By buying and selling futures contracts, participants decide to buy or sell based on their analysis and expectations of the market, thereby directly affecting the market price. This price discovery mechanism provides market participants with a reference price level that enhances market transparency and efficiency and helps them make more accurate investment decisions.

This price discovery mechanism makes the silver futures market an important tool for investors and producers in price risk management and capital appreciation. Investors can use futures contracts to lock in the future price of silver, thereby protecting themselves from market fluctuations while also being able to speculate on the profits from market price fluctuations. Producers, on the other hand, can use the futures market to hedge the risk of raw material prices and ensure stable production costs and sales revenues. This market mechanism promotes communication and cooperation among economic agents, contributes to more effective allocation of market resources, and improves economic efficiency.

The silver futures market attracts the participation of investors and traders on a global scale, which not only increases the depth and liquidity of the market but also expands the diversity of traders. Investors around the globe can utilize the market for speculation, risk management, and portfolio diversification, resulting in a wider range of trading opportunities and choices. This global participation promotes more effective discovery of market prices and more efficient allocation of market resources, providing investors with more trading flexibility and opportunities for profit.

Silver Futures Trading Rules

Despite the many advantages, it is important to note that there are strict rules and procedures that need to be followed when trading silver futures, which are designed to ensure the fairness and effectiveness of the market. These rules cover the execution of trades, price fluctuation limits, Margin Requirements, delivery rules, and market monitoring and regulation. Through these rules, exchanges and relevant regulatory bodies are able to effectively monitor the behavior of market participants, prevent market manipulation and misconduct, and protect the interests of investors and the stability of market order.

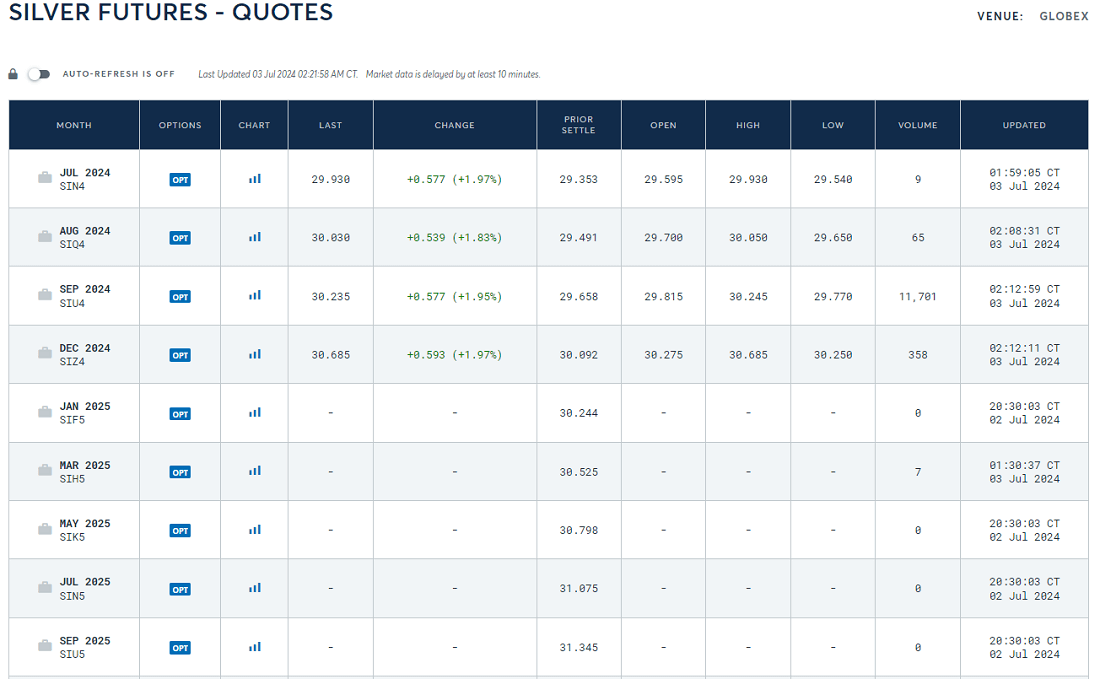

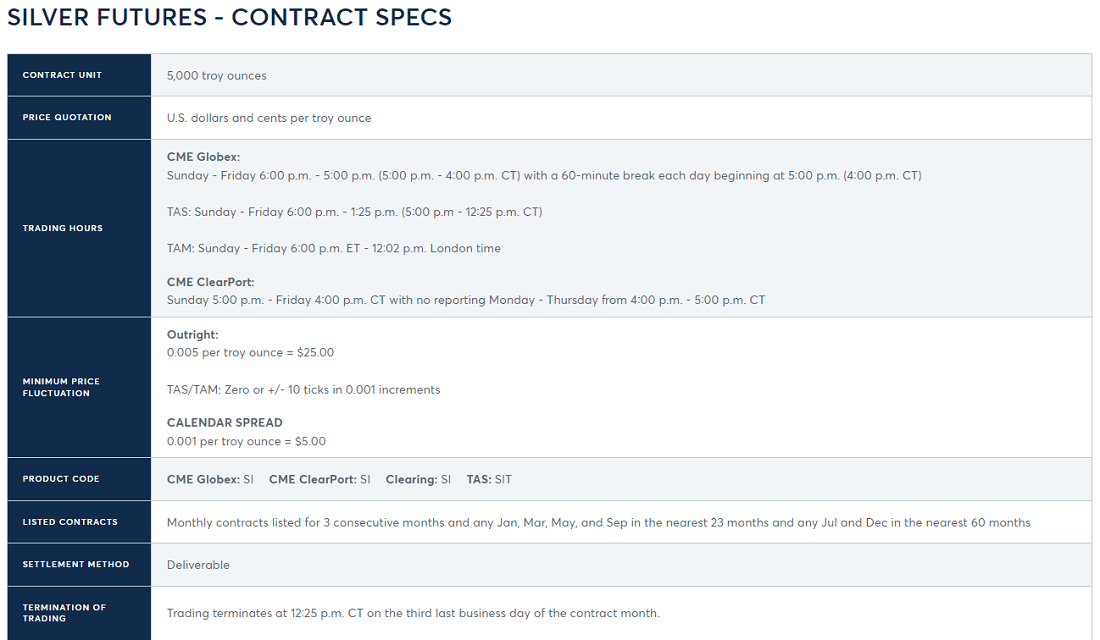

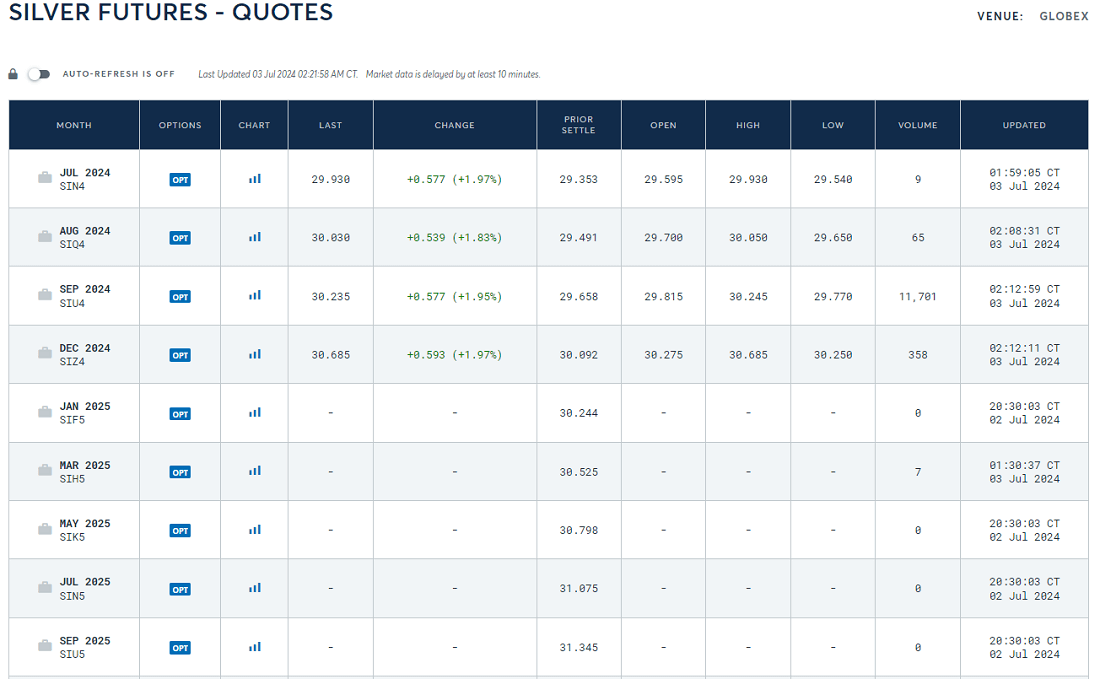

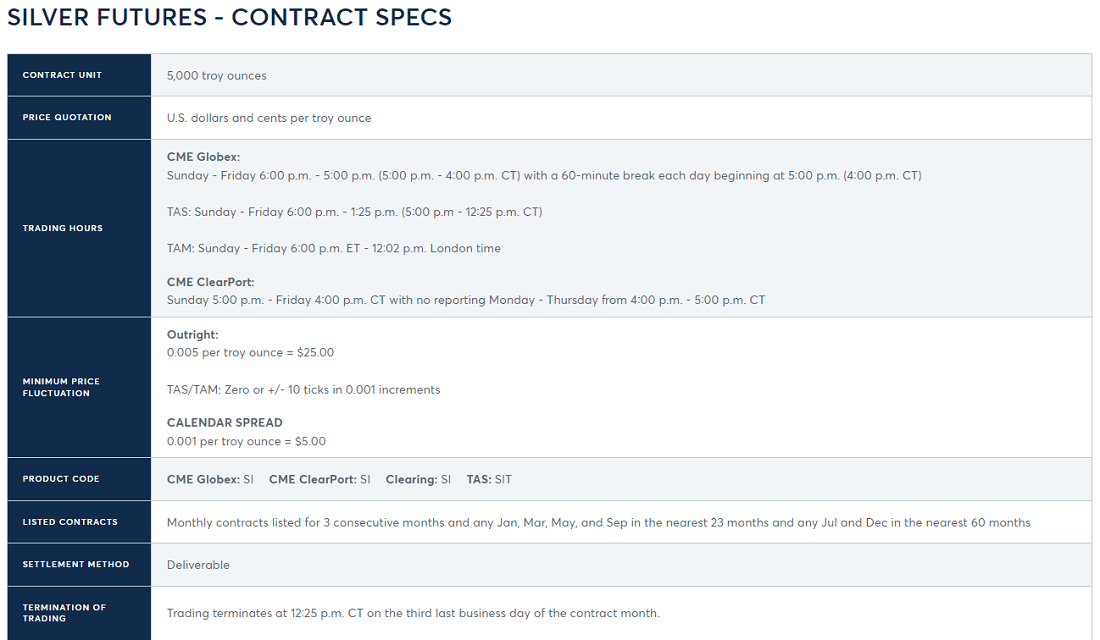

Generally speaking, various exchanges have silver futures products trading, of which the Chicago Mercantile Exchange (CME) is more famous. Each futures contract usually includes a contract size (e.g., each contract represents 5.000 ounces of silver), a delivery location (usually a designated warehouse), and a delivery month (usually several months in the future). These contract specifications are crucial for investors as they determine the exact characteristics of the contract and the conditions under which it will be traded.

Also, when trading futures, one needs to be aware of the associated fees and commission policies, which usually include trade execution fees, clearing fees, and market data fees. Investors should carefully compare these fees when selecting brokers and exchanges to ensure that they are in line with their trading strategies and budgets.

The exact amount of handling fees varies by exchange and futures company. For example, the Shanghai Futures Exchange (SHFE) handling fee is usually 0.5% (five thousandths) of the transaction amount. For example, assuming a silver futures contract price of 4.000 yuan per kilogram and a contract for 15 kilograms, there are a lot of handling fees for about 4.000 yuan × 15 kg × 0.0005 = 30 yuan. The Chicago Mercantile Exchange (CME), on the other hand, typically charges a commission of between $2.50 and $5.

Silver futures trading is usually carried out during the working day, with a specific trading time according to the exchange, usually including day trading and night trading. Day trading is usually from 9:00-11:30 and 13:30-15:00. Monday through Friday, while night trading is from 21:00 to 2:30. Monday through Friday.

Exchanges set specific opening and closing times as well as intermediate trading sessions. This extended schedule allows global investors to participate in futures market trading activities by choosing the right time to trade based on their time zone and market dynamics.

Exchanges often set price fluctuation limits, also known as price limits or price fluctuation limiting mechanisms, to control market volatility and maintain market stability and liquidity. These limits are set based on the price and time movements of silver futures contracts, and once the futures price reaches the level of the set limit, the exchanges will suspend trading or take specific market actions to prevent excessive volatility or abnormalities in the market. Such measures are designed to protect investors from extreme market volatility while ensuring that the market operates efficiently and fairly.

At the same time, trading silver futures requires investors to pay a percentage of the margin as collateral for the transaction, usually a small percentage of the contract value. This margin payment allows the investor to control a larger value of the contract through leverage, thereby enhancing the return on investment.

The use of leverage in futures trading can increase potential returns, but it also comes with a higher level of risk. Therefore, investors need effective risk management strategies, such as setting stop-loss orders and controlling positions appropriately, to ensure that they are able to limit their losses in a timely manner during market volatility and to keep their investment portfolios sound.

In general, futures contracts are usually set with a specified delivery month, and investors can choose to close out their positions or opt for actual delivery before the expiration of the contract. If an investor decides to take delivery, he or she must comply with delivery rules and procedures, including defined delivery locations and silver quality standards.

Although most futures traders choose to close their positions rather than take physical delivery, if an investor chooses to hold a futures contract to maturity and take physical delivery, he or she must be prepared to receive or deliver a certain amount of silver. Physical delivery usually takes place between companies or investors who require physical silver, and the place and manner of delivery will vary depending on the provisions of the futures contract.

In addition, the silver futures market is strictly regulated and monitored by the exchanges and the relevant regulatory bodies to ensure that the market operates fairly, transparently, and efficiently. The regulators are responsible for monitoring the behavior of market participants and preventing manipulation and market rigging. These regulatory measures include overseeing the implementation of exchange rules, scrutinizing the trading activities of market participants, and implementing necessary regulatory measures to safeguard market order and investor interests.

To summarize, silver futures trading rules cover a number of important aspects, including exchange specifications, trading hours, price fluctuation limits, margin requirements, delivery rules, regulatory oversight, and risk management strategies. Investors participating in trading should understand and comply with these rules in detail to ensure that trading is conducted under reasonable risk control. At the same time, this regulated trading environment and high degree of transparency make this market a favored choice for investors, providing participants with a safe and fair trading platform.

Silver Futures Overview and Trading Rules

| OVERVIEW Content |

Rules |

| Enables buying and selling future silver at set prices. |

5,000 oz per lot, priced in USD/oz. |

| Provide speculative and hedging opportunities. |

0.005 USD/oz, equivalent to 25 USD/lot |

| Set stop-loss points to limit losses. |

0.001 USD per ounce, equivalent to 5 USD |

| Set appropriate position sizes based on risk tolerance. |

Monday to Friday, 9:00–11:30 and 13:30–15:00 |

| Use a partial margin to magnify investment returns. |

Monday to Friday, 21:00–2:30 next day |

| Close positions before the contract ends to avoid delivery. |

Usually 5%–18% varies with market risk. |

| Physical delivery is possible post-expiration if positions are open. |

Price limits stabilize markets. |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.