In both daily life and the stock market, the adage 'cheap is cheap, and expensive is expensive' holds true. Media reports and popular stock stories often highlight high-priced stocks, which not only reflect their numerical value but also signify market trust in their strength and potential. Investors frequently favor these stocks for their perceived stability and growth prospects. However, this preference for high-priced stocks also poses challenges and risks. This article explores the advantages and strategic considerations of investing in such stocks, providing insights into navigating their complexities effectively.

What is a High-Priced Stock?

What is a High-Priced Stock?

A high-priced stock typically refers to shares trading at significantly higher prices than other stocks in the market. These stocks are associated with companies that boast substantial market capitalization, strong financial health, and a stable business environment. As a result, they earn widespread recognition and trust among investors. The elevated share price not only highlights the company's stature and credibility but also signifies investor confidence in its long-term growth prospects and profitability.

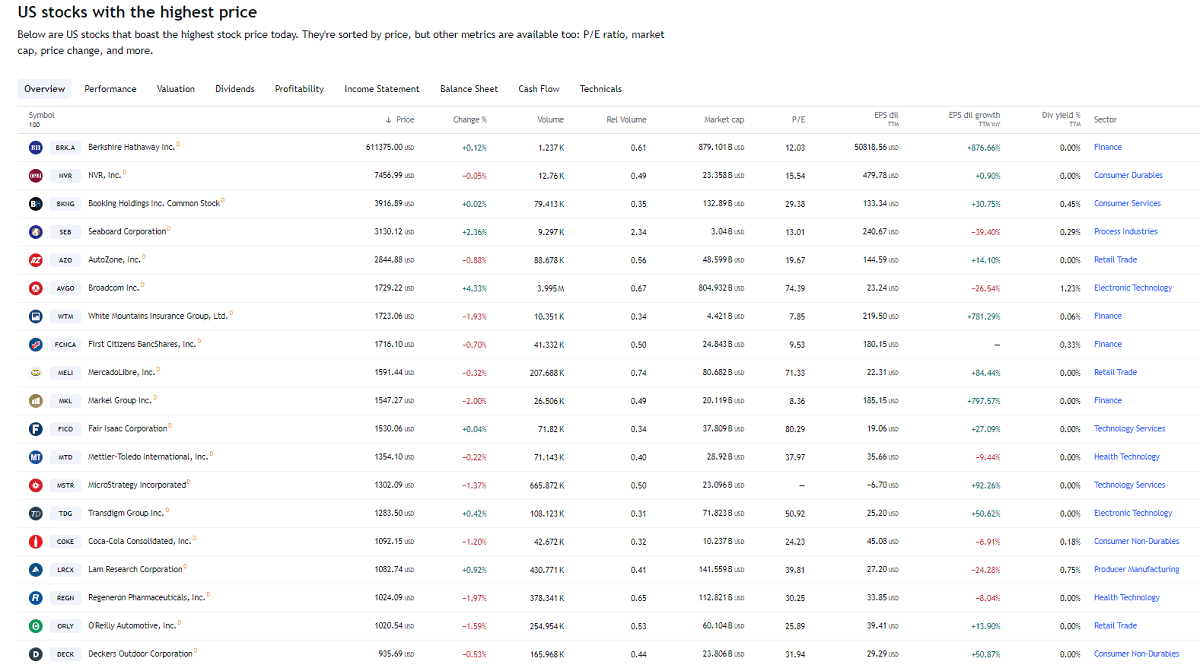

High-priced stocks often belong to large companies that have solidified their position in the market. These companies lead their industries and consistently demonstrate strong financial performance and profitability. Examples include Berkshire Hathaway, Apple, and Amazon, which are renowned for their high share prices that reflect market recognition of their strength and growth potential. Consequently, they attract significant attention and capital from long-term investors.

Investors typically trust these stocks due to their stable financial performance and promising long-term growth outlook. This trust stems from their industry leadership, strong brand presence, and ongoing innovation, which sustain their competitive advantage in a challenging market environment.

Despite their high share prices, these stocks are highly liquid and actively traded, appealing to institutional and large investors. This liquidity allows for relatively easy buying and selling, mitigating the volatility risk associated with substantial trades.

High-priced stocks offer advantages such as stable returns, low investment risk, long-term growth potential, and resilience against inflation, making them attractive to investors seeking stable income and reliable investment returns. Many of these companies also enhance investor returns through regular dividend payouts.

At the same time, high-priced stocks, with their established market recognition and stable business models, are favored by investors looking for stable long-term investments.

Moreover, high-priced stock companies usually have the potential for sustained growth and are able to maintain growth through innovation and market expansion. For example, Amazon has been able to maintain strong growth in the market by continuously expanding its business areas, such as e-commerce and cloud computing, as well as driving technological innovation. This ability makes them an ideal long-term holding for investors, as they demonstrate the ability and potential to stay ahead of the curve in a changing business environment.

In addition, because of their solid business models, companies in this stock category are typically able to maintain profitability in an inflationary environment by raising prices or otherwise passing on cost increases to consumers. This ability makes them more resilient to inflation, and investors are therefore more inclined to hold these stocks for the long term to generate stable returns and protect against the risks associated with fluctuations in the economic cycle.

Of course, while they are usually relatively stable, they are not completely risk-free. The share prices of high-priced stocks may still fluctuate more sharply when the market fluctuates or when a company's performance is not as good as expected. Such volatility may have an impact on investors' assets, especially for those who wish to buy and sell stocks for quick profits in a short period of time and need to assess and manage their risks carefully.

Meanwhile, the valuation of some high-priced stocks may already be quite high, which means that their room for future growth may be limited. Investors considering investing in such stocks need to pay particular attention to assessing whether their valuations are reasonable and sustainable. Excessive valuations may mean that the stocks have been overpriced by the market and may face the risk of adjustment or a return to normal valuations in the future.

Based on these characteristics, it is usually suitable for long-term investors, especially those looking for stable returns and lower risk. These stocks come from companies with strong financials and stable profitability and usually have the potential for sustained growth. Holding these stocks for a long period of time allows investors to enjoy the benefits of stable company performance and growth while reducing the risks and costs that may be associated with frequent trading.

In short, high-priced stocks represent quality companies in the market with stable returns and lower risk for long-term investors. Despite the higher share prices, these stocks tend to offer consistent earnings and growth potential. That's why many investors pick it over low-priced stocks.

Which is More Profitable: High-Priced or Low-Priced Stocks?

Which is More Profitable: High-Priced or Low-Priced Stocks?

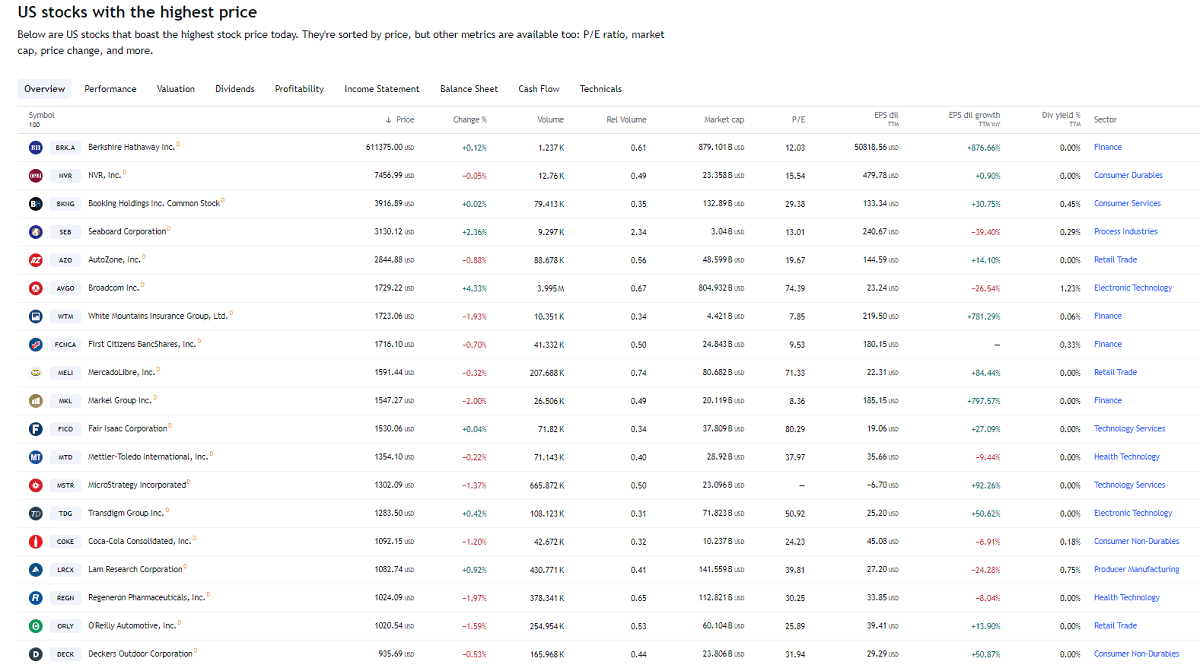

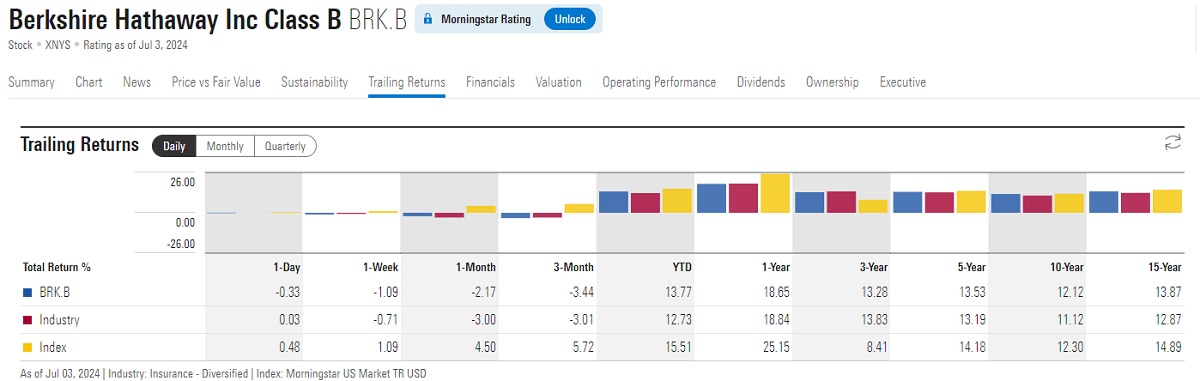

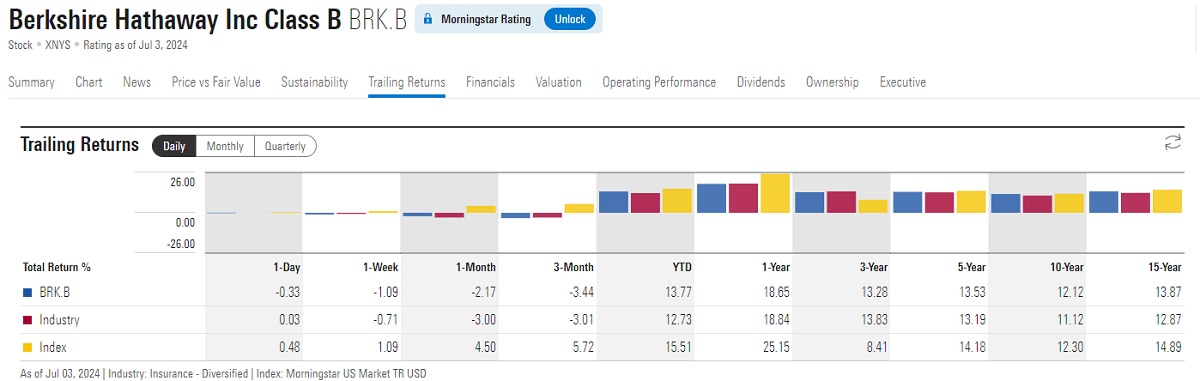

It's important to realize that no one stock class is guaranteed to outperform the other in terms of returns. The return performance of a stock is not solely determined by the high or low price of the stock but depends on a number of factors. In this regard, there are advantages and disadvantages to both high-priced and low-priced stocks, and it all depends on the investor's risk tolerance, investment objectives, and strategy. However, in terms of long-term investment returns, high-priced stocks will stand out more, as shown in the chart above, where Berkshire Hathaway has a better return than the sector and index.

This is due to the fact that high-priced stocks usually come from companies with large market capitalization, solid financials, and stable business models. These companies usually have leading positions and strong market competitiveness and are able to consistently and steadily generate profits and provide high long-term returns. Investors believe that these companies have good growth potential and consistent profitability and are therefore willing to buy their shares at a higher price.

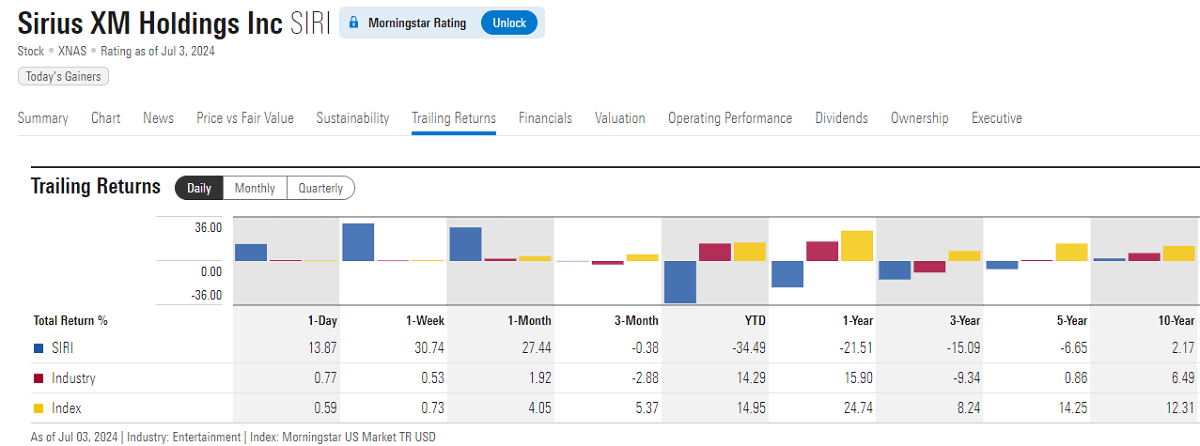

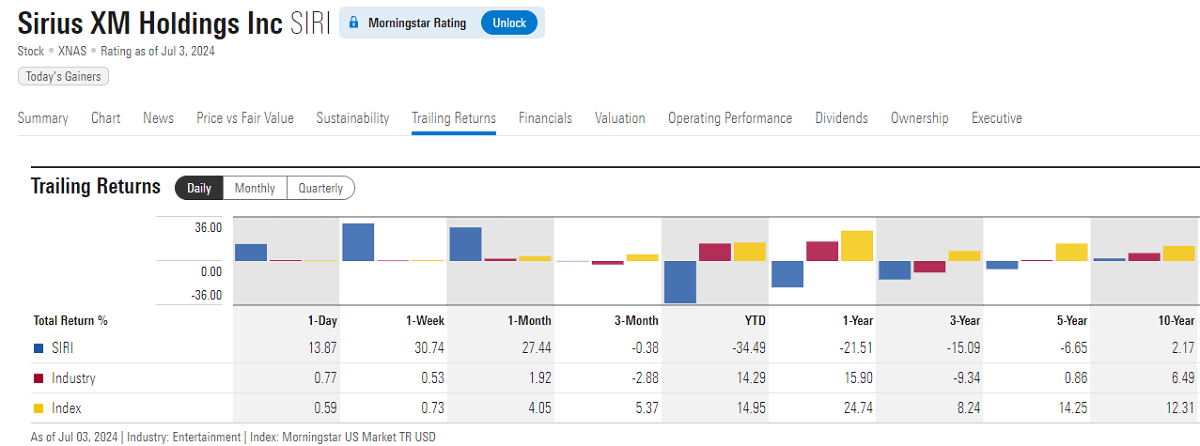

Low-priced stocks, on the other hand, are less expensive, but their investment risk is higher as they may be exposed to factors such as financial instability, business risks, or market speculation. Some low-priced stocks may experience short-term price fluctuations due to market sentiment or specific events, attracting speculators for short-term trading. However, in the long run, only those low-priced stocks with sound financials and solid business models can provide sustainable long-term investment returns.

Therefore, investors' strategies play a crucial role in the stock market. Long-term investors usually prefer to look for high-priced stocks with stable returns, as these stocks usually come from companies with large market capitalization and sound financials that can provide reliable investment returns over the long term.

In contrast, short-term speculators prefer low-priced stocks because of their high volatility and potential for rapid changes, which are suitable for investment strategies that seek short-term gains. Therefore, investors need to formulate strategies based on their own investment objectives, risk appetite, and market expectations when selecting stocks to achieve optimal investment results.

Generally speaking, high-priced stocks usually come from companies with large market capitalization, good financial condition, and stable business, so the investment risk is relatively low. These companies usually have a leading position in their industries, with stable profitability and sustained cash flow. Investors tend to choose these stocks because they represent the market's recognition of a company's long-term growth potential.

Even though its price may fluctuate widely over time, its fundamentals are usually solid, and it is able to perform consistently through market volatility. As a result, high-priced stocks are seen as one of the safer investment choices, especially for investors who emphasize capital preservation and long-term appreciation.

Moreover, these companies usually have strong market positions and competitiveness and are able to provide more stable returns on a sustained basis. They often have leading positions in their industries, with good brand influence and customer bases. Due to their solid market position, these companies are usually able to respond effectively to market competition and economic fluctuations and maintain relatively stable profitability and cash flow.

Therefore, high-priced stocks are often trusted by the market and are considered to be high-quality long-term investment targets. These stocks usually come from companies with a large market capitalization, a solid financial position, stable management, and sustainable growth in performance. Their high share prices not only reflect the market's confidence in their good operations and long-term growth potential but also show investors' recognition of their stability and reliability. Those who invest in these stocks usually believe that these companies can survive in a competitive market environment for a long time and continue to provide stable shareholder returns.

Low-priced stocks, on the other hand, are usually characterized by high price volatility and can rise or fall quickly, which exposes investors to high risk, especially during changes in market sentiment and liquidity. Often coming from companies with small market capitalization, financial instability, or an uncertain outlook, these stocks have particularly high price volatility and require investors to have a strong risk tolerance and patience.

Therefore, investing in low-priced stocks requires a careful assessment of their risk and reward potential, taking into account the financial health of the company, its market outlook, and industry competition. Although low-priced stocks may experience rapid growth in the short term, this is often accompanied by a high degree of market volatility, and investors should avoid making investment decisions based on short-term gains alone.

In addition, short-term explosive growth in low-priced stocks usually reflects market optimism or is driven by specific events, but investors should be aware that such price movements may not reflect the true value of the stock. When engaging in short-term speculation, it is important to maintain a sufficient sense of risk control to avoid potential losses and liquidity problems.

Low-priced stocks, while usually failing to outperform higher-priced stocks in the long run, may deliver higher yields in the short term. Such stocks usually appeal to investors who are willing to take higher risks and are looking for quick returns. These investors look for short-term price fluctuations and market sentiment and expect to make a profit by buying and selling quickly.

However, regardless of the type of stock one invests in, investors should focus on the fundamentals of the company's financial health, the competence of the management team, and the market outlook. It is only through in-depth analysis and comprehensive evaluation that rational investment decisions can be made and long-term investment return goals can be realized.

Investment Strategy for High-Priced Stocks

Investment Strategy for High-Priced Stocks

These stocks are indeed suitable for long-term holding, as they usually come from financially sound and well-performing companies with strong market competitiveness and stable profitability. These companies tend to be able to maintain steady growth and provide substantial investment returns over a longer period of time.

In contrast, short-term blind trading may be subject to market volatility and short-term sentiment, which is risky and volatile. Investors should therefore focus on analyzing and evaluating the long-term growth potential of a company and developing an investment strategy that is suitable for long-term holding in order to achieve the goal of solid long-term investment returns.

It is a wise strategy to avoid concentrating too much money on a few high-priced stocks, as this may increase investment risk. Adopting a diversified investment approach reduces the overall risk of the portfolio. By investing in a diversified range of asset classes and sectors, investors can balance the risks that may arise from price fluctuations in a single stock and better protect against market volatility. This strategy helps to enhance the stability of the overall portfolio, thereby better achieving long-term investment objectives.

At the same time, although such stocks usually reflect the company's excellent performance and market position, investors should still be cautious in assessing their valuation levels when selecting them. Avoid excessive price-to-earnings or price-to-sales ratios and ensure that the investment is priced within a reasonable range, which will better protect the investment and reduce possible future risks.

And it is crucial for investors to keep abreast of changes in the market and the industry, especially the impact of factors such as competitive dynamics, technological advances, and regulatory changes in the industry in which the company operates. Keeping abreast of such information can help investors adjust their investment strategies, make more accurate decisions, and effectively manage investment risks. This information sensitivity and flexibility are particularly important for investors who hold high-priced stocks for a long period of time, helping them to capitalize on market opportunities and avoid potential investment risks.

Regularly reviewing the performance of the portfolio and the market environment is a crucial step in the investment process. Through regular review, investors can assess the overall performance of the portfolio, including the return and volatility of individual assets. Based on changes in the market environment and individual investment objectives, investors can make timely adjustments to their position structure to ensure consistency with their investment objectives and risk appetite. This regular review and adjustment can help investors optimize their portfolio allocation to cope with market uncertainty and volatility, thereby better achieving their long-term investment objectives.

In addition to these strategic plans, investors should also be cautious in their selection of high-priced stocks. In general, one can base their assessment on a few key criteria. For example, one can choose stocks with a share price higher than $50. an increase of more than three times in one year, a company in a leading position in the industry, and outstanding performance. By combining these criteria, investors are able to make a more targeted selection of stocks with good potential and high long-term investment value.

When the stock's unit price is above $50. it reflects the company's well-established and stable position in the market. Second, a significant increase of more than three times in one year shows that the market highly recognizes the company's performance and potential. The company must be in a leading position in its industry, with market share leadership and the ability to innovate. Finally, outstanding performance, including steady earnings growth and healthy financials, is one of the key considerations for investors in selecting high-priced stocks.

On a technical level, investors can then evaluate a stock's long-term growth potential and industry outlook by looking at the monthly K-line chart. Monthly K-plots can provide a broader time horizon, helping investors to capture long-term trends and important price dynamics. Combined with fundamental analysis, such as a company's financial condition, market position, and competitive advantage in the industry, investors can develop a long-term holding strategy in pursuit of stable investment returns and capital appreciation.

In addition, staying calm and rational is key when investing in high-priced stocks. Avoid emotional decision-making and stick to your investment plan and strategy in the face of stock price volatility. It is also necessary to set clear stop-loss points based on technical analysis. Timely stop-loss can effectively control losses and avoid further expansion.

Understanding and adopting the above recommendations can help investors select and manage their investments in high-priced stocks in a more targeted manner, thereby realizing their long-term investment objectives and reducing investment risks. At the same time, these strategies will help investors maintain a sound investment mindset, manage their investment portfolio effectively, and look forward to long-term, stable investment returns.

Advantages and Strategies for Investing in High-Priced Stocks

| Description |

Investment Strategy |

| Stable earnings and long-term growth potential. |

Select industry leaders and high-growth potential stocks. |

| Prominent brand and market share. |

Pick influential companies with a large market share. |

| preferred by institutional and long-term investors. |

Focus on institutional investment and market sentiment. |

| Stable price and dividends. |

Long-term hold with a reinvestment strategy. |

| High market liquidity and trading activity. |

Prioritize stocks with good liquidity. |

| It helps diversify risk and reduce portfolio volatility. |

Carefully select stocks and asset allocation strategies. |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

What is a High-Priced Stock?

What is a High-Priced Stock? Which is More Profitable: High-Priced or Low-Priced Stocks?

Which is More Profitable: High-Priced or Low-Priced Stocks? Investment Strategy for High-Priced Stocks

Investment Strategy for High-Priced Stocks