In today's society, weight loss is a common goal for many. But have you ever considered that selling diet pills could propel a company into the global top 10? This remarkable achievement is a reality for Eli Lilly. As a leader in the pharmaceutical industry, Eli Lilly has garnered significant attention from investors, especially amid the recent global economic slowdown. Let's delve into Eli Lilly's market capitalization growth and explore its stock investment potentials.

Eli Lilly's Company Profile

Eli Lilly, headquartered in Indianapolis, Indiana, is a globally recognized multinational pharmaceutical company. The company specializes in the biomedical and pharmaceutical business and is committed to developing and marketing innovative medicines across multiple therapeutic areas such as diabetes, cancer, and neurological disorders.

It was founded in 1876 by Eli Lilly, an American chemist and pharmacist, on the basis of his military experience and qualification as a pharmacist, with the aim of filling a gap in the quality and stability of the supply of medicines on the market at that time. Since its inception, the company has focused on the development and production of high-quality medicines, covers a wide range of therapeutic areas such as diabetes, cancer, and neurological disorders, and has established an extensive distribution network worldwide.

The company has not only continued the mission of its founder, Eli Lilly, to consistently introduce innovative drugs but has also established a strong reputation and leadership position in the industry. Through its broad product line and globalization strategy, Eli Lilly has become a trusted and significant force in the pharmaceutical field by providing effective solutions to medical needs around the world. It occupies an important position in the global pharmaceutical industry and has contributed greatly to the advancement of medical technology and the improvement of patients' quality of life.

Currently, Eli Lilly and Company's main business focuses on biopharmaceuticals and pharmaceuticals, and its product lines cover the therapeutic needs of a wide range of clinically important diseases, including diabetes, oncology, immunology, neuroscience, and pain management, among others. In the field of diabetes treatment, the company is known for its insulin and analogs; it also produces medicines for a number of areas such as cancer treatment (e.g., Alimta), psychiatric disorders (e.g., Zyprexa), neuroscience (e.g., Cymbalta), and osteoporosis.

Moreover, the company excels in R&D and innovation. Every year, the company invests a significant amount of money in R&D, which in 2023 alone will account for more than 20% of its total revenues, demonstrating its high level of commitment and dedication to innovation. It has achieved significant innovations in a wide range of disease areas, with a broad portfolio of patented and breakthrough medicines, particularly in diabetes and cancer treatment, which provide important therapeutic options for patients around the world.

At the same time, Lilly continues to focus on launching innovative medicines, including Donanemab, a new drug targeted for the treatment of Alzheimer's disease, which has been granted Priority Review status by the U.S. Food and Drug Administration (FDA), a recognition that demonstrates its leadership and commitment to the treatment of neurodegenerative diseases.

With the development of this innovative drug, the company has demonstrated its scientific and technological leadership in the treatment of neurodegenerative diseases and its responsiveness to patient needs. It also further strengthens the company's reputation and market position in the global pharmaceutical industry, laying a solid foundation for continued research, development, and innovation in the future.

Today, Eli Lilly and Company operates extensively worldwide, with a presence in more than 120 countries and more than 35.000 employees. In addition, the company is actively expanding its markets, particularly in Asia and Latin America. This strategy aims to meet diversified healthcare needs worldwide, strengthen its market share and presence in emerging markets, and further consolidate its leadership position in the global pharmaceutical business.

In Asia, particularly in fast-growing markets such as China and India, the company is gradually expanding its business footprint through increased market investments, partnerships, and the promotion of its advanced therapeutic solutions. These markets not only have high demand for medicines but also have the potential for sustained growth, providing the company with vast opportunities for growth.

Meanwhile, Lilly is also stepping up its market expansion efforts in Latin America, increasing its market penetration and brand awareness in the region by establishing strategic partnerships, promoting health education, and expanding its sales network. These initiatives will help the company better serve local patients and strengthen cooperation with healthcare organizations and governments to promote health improvement and medical innovation.

The evolution of Lilly's market capitalization

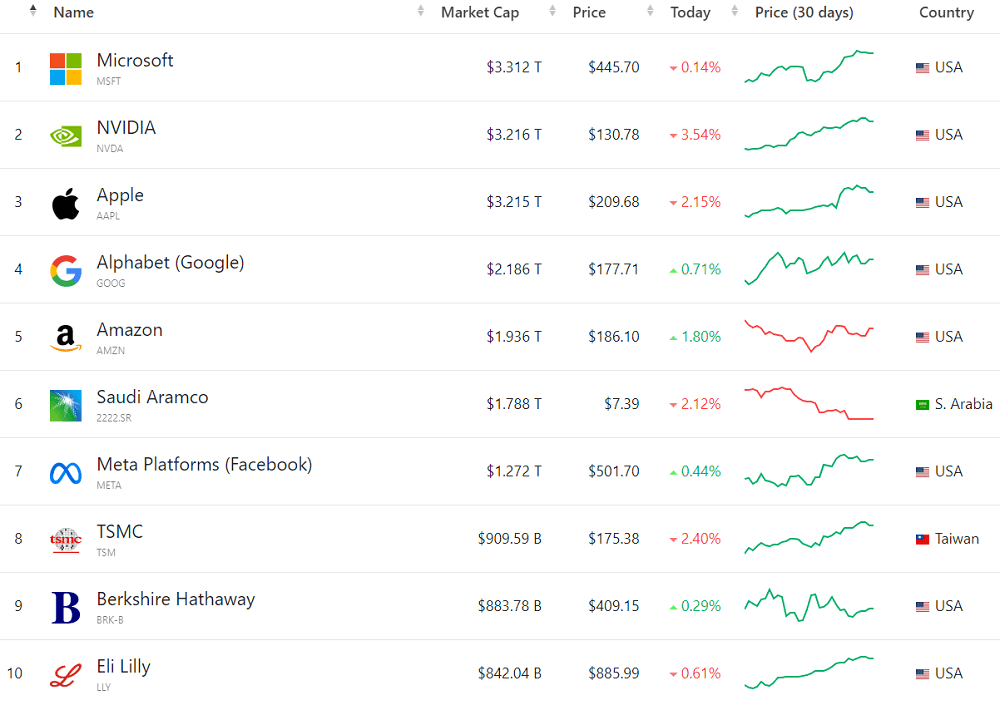

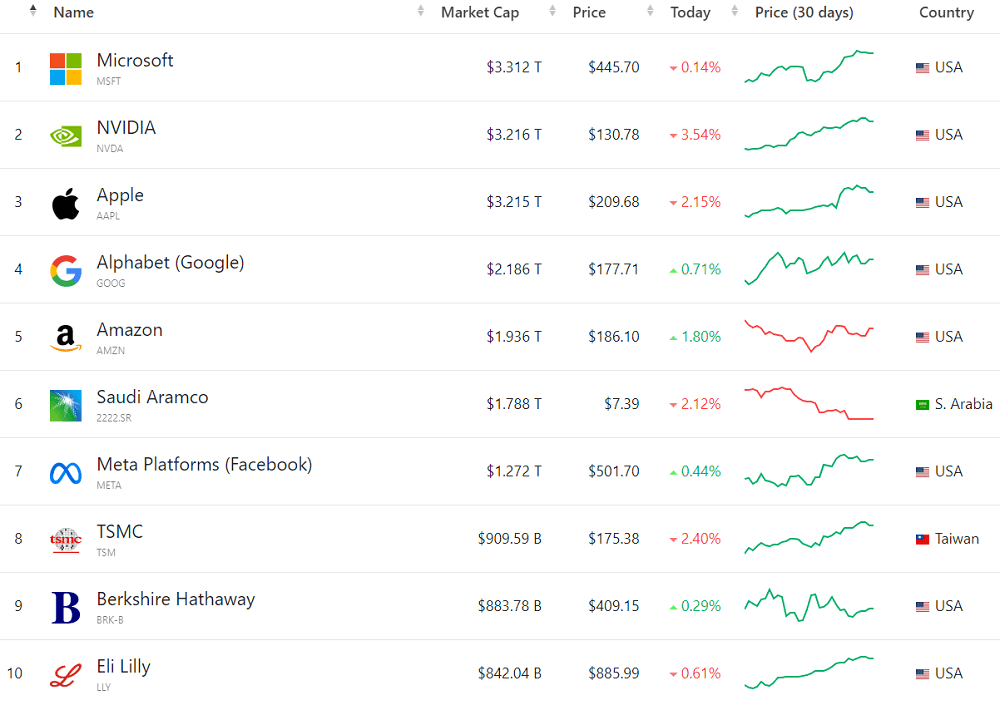

As a key leader in the pharmaceutical industry, Lilly has long maintained a market capitalization within the top 10 globally. In 2023. the company's market capitalization even surpassed that of TSMC to reach the eighth spot on the U.S. stock market capitalization list. As of June 2024. the company's market capitalization was approximately $865.7 billion, making it the 10th largest company in the world by market capitalization.

The company has quickly established itself as a leader in the pharmaceutical industry through the successful development and marketing of key drugs such as insulin since the early 1900s. These drugs have not only played an important role in the treatment of diseases such as diabetes but have also laid a solid market foundation for the company to expand and diversify its business globally. Over time, the company has gradually expanded its product line to encompass a variety of therapeutic areas, including antibiotics and mental health medicines, to continue its innovation and market leadership.

In the mid-20th century, Eli Lilly and Company rapidly expanded its product pipeline across multiple therapeutic areas through an aggressive R&D and M&A strategy. The company not only entered the field of antibiotics but also developed drugs for the treatment of psychiatric disorders. This period of expansion allowed the company to further increase its market share in the pharmaceutical industry, strengthening its global reach and competitive advantage.

At the end of the 20th century, Eli Lilly and Company gained a significant foothold in the global pharmaceutical market with the successful launch of new drugs such as the antidepressant Prozac, a revolutionary antidepressant that significantly boosted the company's market performance and financial growth, making it one of the major leaders in the pharmaceutical industry at the time.

The company then launched a series of new drugs as it continued its path of innovation, including the diabetes drug Cialis and a variety of insulin products. The successful launch of these drugs not only strengthened the company's market position in diabetes and other therapeutic areas but also further contributed to the company's market capitalization growth. With the market acceptance and sales growth of these innovative products, the company continues to expand its presence in the global pharmaceutical market and consolidate its position as an industry leader.

Through continued R&D investments and global market expansion, the company's product pipeline has grown to encompass a number of key therapeutic areas, including cancer, neuroscience, and immunology. These initiatives have not only strengthened the company's market position in each of these areas but have also steadily contributed to the growth of its market capitalization. With its innovative products and broad market coverage, the company continues to play a significant role in the global pharmaceutical industry, demonstrating the potential for continued growth and leadership.

Lilly performed well during the New Crown outbreak, and its development of antibody therapies gained widespread acceptance and adoption. These antibody therapies played an important role in treating patients with COVID-19. effectively helping patients cope with the viral infection. This initiative not only demonstrated the company's technological prowess and agility in responding to public health crises but also drove a significant rise in its market capitalization. By innovating and responding to rapidly changing market needs, the company has further strengthened its position as a leader in the global pharmaceutical industry, offering investors the potential for stable, long-term growth.

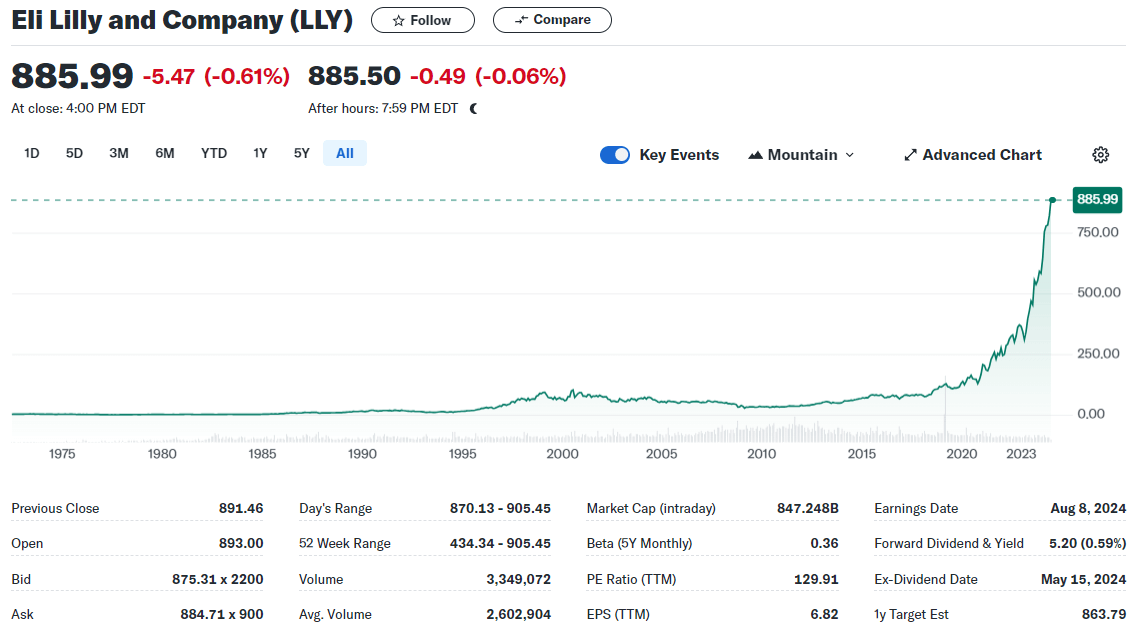

In recent years, Lilly has made significant breakthroughs in the treatment of diabetes and obesity, particularly through the development and marketing of tirzepatide (tirzepatide), which has fueled rapid growth in its share price and market capitalization. Tirzepatide, a GLP-1 receptor agonist, is regarded as a highly effective therapeutic agent that has not only shown promising results in the treatment of diabetes but has also demonstrated potential in the treatment of obesity.

The successful launch of this innovative drug, coupled with the market's optimistic expectations about its efficacy and commercial prospects, has significantly boosted investors' confidence in the company's future growth potential. As a result, the company's share price has recently continued to reach new all-time highs, and its market capitalization has grown progressively, nearly doubling in the past year. This reflects not only the market's confidence in its products but also shows that the company's continued investment in research, development, and innovation is paying off handsomely.

Lilly's success in its market capitalization journey not only confirms its leadership position in the pharmaceutical industry but also highlights its long-term growth potential. The company's success in launching a number of high-impact drugs through continued innovation and market expansion, with notable advances in diabetes and cancer therapies in particular, has significantly boosted its market capitalization and is highly sought after by investors.

Eli Lilly Stock Investment Analysis

Eli Lilly Stock Investment Analysis

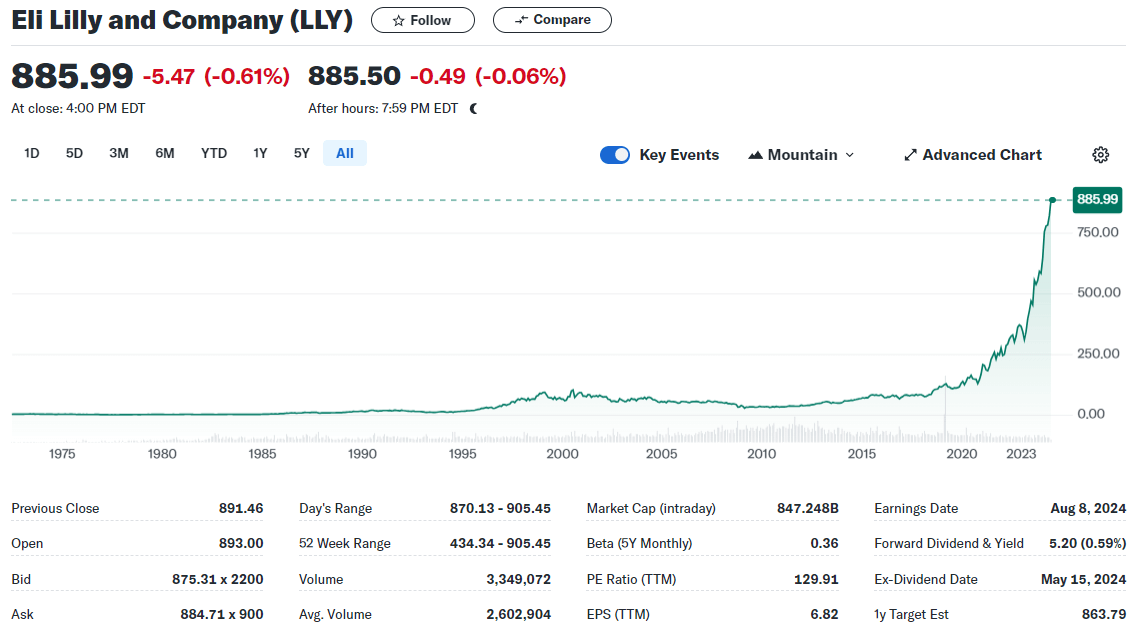

The company's ticker symbol, LLY, has been on an uptrend based on the overall trend, especially since the beginning of 2023. As of June 20. 2024. Eli Lilly and Company's stock closed at $885.99. The stock price had reached a high of $905.45 on that day, showing a continuous growth trend.

This performance reflects the market's optimistic view of the company's future growth potential, particularly in relation to its innovative products and progress in global market expansion. Investors expressed confidence in the company's continued strong market performance and efficient R&D investment in the biomedical and pharmaceutical sectors, which together drove the share price up.

The main reason for the rise in the share price lies in the strong market performance and financial soundness that the company has demonstrated in recent years. Despite its relatively conservative revenue growth rates, the company is a major player in the pharmaceutical industry, with products across a number of therapeutic areas, including diabetes, cancer, neuroscience, and immunology, which not only enjoy a strong reputation in the marketplace but also generate a steady stream of revenue for the company.

Lilly's financial performance has indeed been very strong, particularly its return on equity (ROE) of 50.75%, a metric that reflects a company's ability to efficiently utilize shareholders' funds to generate profits, which is an important measure for investors. A high ROE generally indicates that a company is efficient and superior in managing its capital and operations to create value for shareholders on a sustainable basis.

In addition, the company's earnings per share exceeded market expectations, demonstrating its superior performance in cost management and operational efficiency. This outstanding operational performance not only enhances the company's financial health but also strengthens investor confidence in Lilly's long-term growth potential.

But the continued rise in the stock price has left many investors both surprised and skeptical, beginning to wonder if Lilly stock is overpriced and still has value. Despite the company's strong performance, its high price-to-earnings ratio of 130.48 also suggests that its stock may be overvalued relative to its industry peers.

This high P/E ratio suggests that investors have high expectations for the company's future growth potential. However, a high price-to-earnings ratio could mean increased risk for investors. This is because the high growth expected by the market may not materialize, or the company's future earnings may not grow at a rate that supports the current stock price.

Moreover, the company's debt-to-equity ratio of 1.35 shows that it has a high debt-to-equity ratio in its capital structure, which may raise investors' concerns about its financial leverage management. It is important to realize that a high debt-to-equity ratio indicates that the company is relatively dependent on borrowing debt to support its operations, expansion, and other investment activities. While debt can help a company expand and make investments, high debt levels also pose certain financial risks.

High levels of debt mean that a company has to pay more interest charges, which may have an impact on its profitability and cash flow. In addition, high levels of debt make a company more vulnerable in times of economic downturn or rising interest rates. The market may question the efficiency and sustainability of the company's financial leverage management, especially during volatile economic cycles or increased competition in the industry.

The market is also divided by the stock rating of Eli Lilly and Company. Some analysts have assigned a "hold" rating, suggesting that the current share price may already reflect some of the expected growth or that there are potential risks to be concerned about. They recommend that investors evaluate the risks and rewards before making a decision, rather than adjusting positions immediately.

On the other hand, more analysts gave it a "buy" rating based on its strong business foundation and broad product pipeline, its leadership position in the global pharmaceutical market, and its continued ability to innovate. They are optimistic about the company's long-term growth potential in key therapeutic areas such as diabetes, cancer, and neuroscience, which they expect to drive the stock price even higher and provide investors with a stable, long-term return on their investment.

So as you can see, Eli Lilly stock does show potential to be a long-term holding. Not only because of its significant position in the pharmaceutical industry and its broad product line, which provides a stable revenue base. In addition, the company's demonstrated financial soundness and high return on equity further enhance its long-term investment appeal.

The company also offers a quarterly dividend of $1.30 per share, which translates to a potential dividend payment of $4.69 per year and a yield of 0.58% considering the current share price. This dividend policy shows its commitment to shareholder returns and offers a potential investment alternative for investors looking for steady income.

Overall, the potential for Lilly stock to continue to demonstrate strong performance in the future makes it a worthwhile watch and hold for long-term investors. The company's significant position in the pharmaceutical industry, broad product pipeline, solid financial performance, and high return on equity further enhance its long-term investment appeal.

Eli Lilly Stock Investment Analysis

| Investment Analysis |

Content. |

| market cap performance |

Eli Lilly peaked at $905.45 in June 2024 and capped over $865.7B in 2023. |

| Financial Health |

ROE (50.75%) exceeds EPS expectations, showing strong financial management. |

| P/E Ratio Assessment |

A high P/E (130.48) reflects growth expectations; note investment risk. |

| Debt Management |

Debt-to-equity ratio: 1.35: high debt; consider economic cycle impact. |

| Analyst Recommendations |

Upgrade from "Hold" to "Buy" due to strong innovation and growth potential. |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

Eli Lilly Stock Investment Analysis

Eli Lilly Stock Investment Analysis