In today's society, peace is indeed the main theme, and forceful conflicts between countries are rare. However, in other areas, there are quite a few bumps and bruises. Especially when trade tensions escalate between two global economic giants, it's not just a problem between two countries but a source of shock to the global economic system. Now let's take a deeper look at the nature and global impact of trade wars.

What is Trade War?

It refers to the economic conflict and possible retaliation between two or more countries that is triggered by the implementation of various trade barrier measures (e.g., tariffs, quotas, subsidies, import and export restrictions, etc.) to protect their economic interests. It usually begins with the adoption of restrictive trade measures by one country against another, leading to retaliatory measures by the other country, thus creating a vicious circle.

Trade wars usually begin as a result of dissatisfaction between participating countries over trade policies and trade balances. For example, one country may perceive that another country's exports are underpriced or that the other country has taken unfair trade subsidies and respond by imposing tariffs or other trade restrictive measures. Such actions often lead to a similar response from the other country, creating a cycle of gradual escalation of trade barriers and trade conflict.

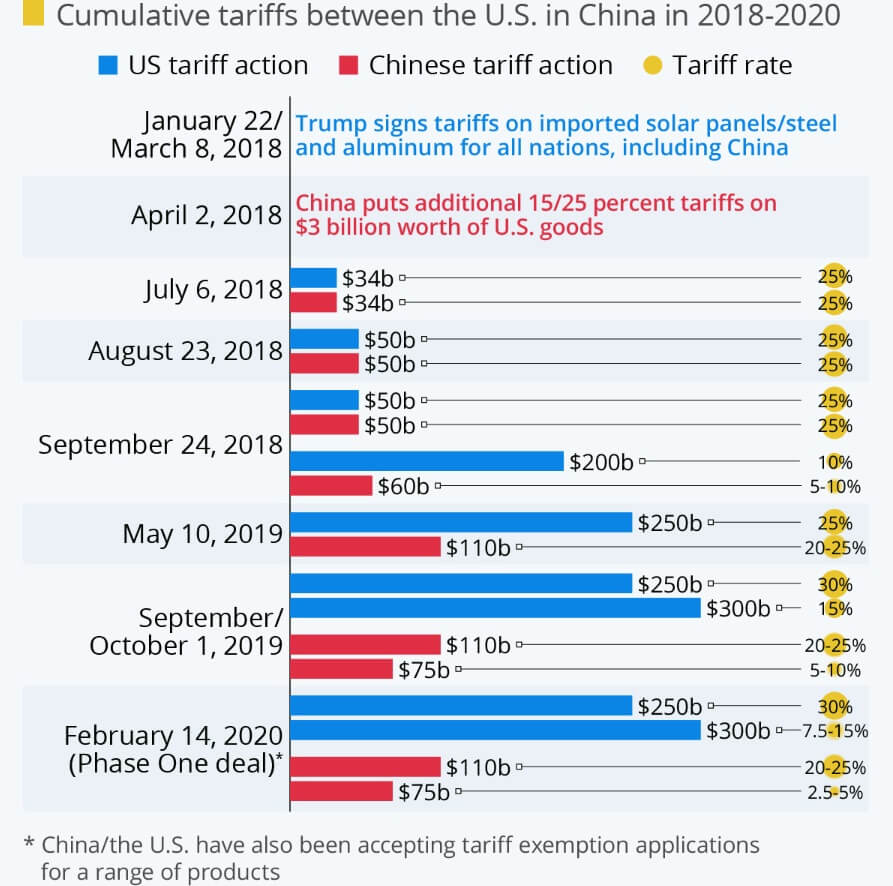

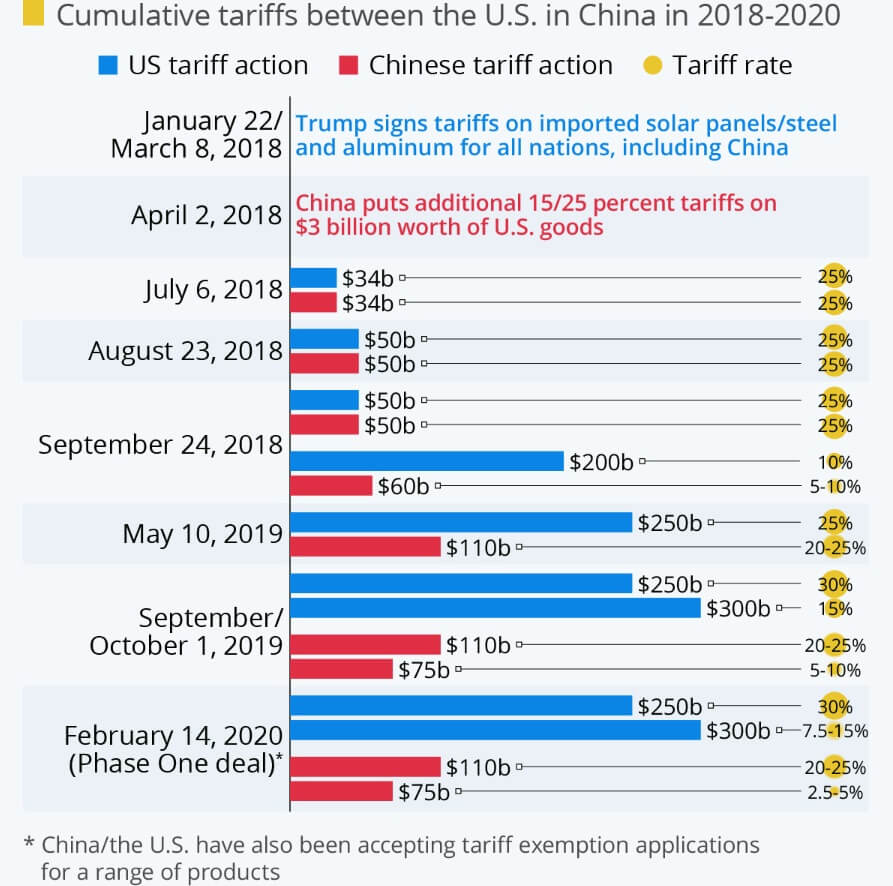

The context of the US-China trade war can be seen as a classic case of this definition, especially after the US government expressed strong dissatisfaction with China's trade deficit and intellectual property rights issues. The two countries implemented a series of tariff increases and other trade-restrictive measures, triggering a trade conflict that lasted for a long time and had a wide range of impacts.

One of the tools of the trade war is the increase in tariffs, which is a policy measure used by countries to protect their industries and regulate competition in the market by raising taxes on imported goods. This practice increases the price of imported goods and reduces their competitiveness in the domestic market, thereby protecting national industries from foreign competition. At the same time, tariff increases also serve as a form of taxation that generates additional revenue for the government to support national economic development and other public expenditures.

Then there are the various non-tariff measures, also known as trade barriers, that are put in place to protect national industries or to restrict the entry of specific goods into the domestic market. These measures, which include technical standards, sanitary and quarantine requirements, licensing systems, etc., are designed to impede the entry of foreign goods and thus protect domestic industries from external competition. For example, mandatory compliance of imported goods with specific technical standards or through strict sanitary and quarantine procedures can effectively restrict the inflow of certain foreign goods.

Trade barrier measures also include import and export quotas, which are used to limit the quantity of specific commodities imported and exported in order to protect the relevant domestic industries or to regulate market supply and demand. These measures are usually set by the government to limit the quantity of certain goods that can be imported or exported within a specific period of time, and those exceeding the quota are usually subject to additional tariffs or other restrictions. Import and export quotas can effectively control the volume of international trade in specific commodities, protect domestic industries from excessive competition, and also be used as a trade policy tool to adjust the balance of supply and demand in the domestic market.

Subsidies, on the other hand, refer to the provision of financial or other forms of support by the government to domestic enterprises in order to reduce their production costs or to keep the prices of their products below the market price so as to enhance their competitiveness in the international market. This form of trade barrier can be implemented through direct financial assistance, tax breaks, cheap financing, and preferential electricity prices. The objectives of subsidies include promoting the development of domestic industries, increasing export competitiveness, expanding market share, and protecting domestic employment.

However, they can lead to international trade tensions, such as non-tariff barriers and the abuse of trade protectionism, increasing the risk of trade tensions and disputes. The implementation of quota systems may increase market uncertainty, affect business operations, and lead to trade disputes when they are implemented opaquely or without reasonable justification. Subsidized measures may lead to unfair international trade, triggering trade disputes and countervailing investigations.

One of the most notable trade wars in recent years has been the trade dispute between the U.S. and China. In 2018. the U.S. unilaterally imposed tariffs on a large number of imports from China, covering a wide range of industries and products, such as steel, aluminum, and high-tech products. In response, China took retaliatory tariff measures, targeting U.S. agricultural, automotive, and energy products, among others.

This trade conflict has led to an impact on both economies, particularly on core issues such as trade surpluses and industrial policy, which have generated widespread concern and discussion. This trade dispute has also created uncertainty in global markets, affecting the investment decisions of multinational corporations and the stability of global supply chains.

In addition, the U.S.-China trade war has had an equally profound impact on individual investors. Investors were exposed to greater risks due to increased policy uncertainty and market volatility, which affected corporate profits and heightened stock market volatility. He advises investors to adopt a prudent investment strategy, ensure asset portfolio diversification, and have sufficient cash reserves to withstand the risks associated with market volatility.

Impact of the Trade War

It has wide and far-reaching impacts on the global economy, society, and politics, which need to be considered and responded to in a comprehensive manner. On the economic front, increased tariffs will lead to higher costs for imported goods, which will have a significant impact on businesses that rely on imported raw materials. Enterprises may thus face upward cost pressures and have to consider adjusting production costs or raising product prices to maintain profits, which may cause consumers to bear higher purchasing costs.

At the same time, higher prices of imported goods have a direct impact on the purchasing power of consumers, especially as higher prices of everyday consumer goods increase the cost of living. Consumers may have to pay more for necessities, which may cause them to reassess their purchasing decisions or adjust their budgets to the new economic environment.

Economic uncertainty then usually leads businesses to be cautious about capital expenditures and hiring, postponing investment and expansion plans. This caution may slow economic growth, while globalized supply chains increase business operational risk due to the potential disruption of trade wars, further impacting market responsiveness and overall economic efficiency.

Through the imposition of tariffs or other trade barrier measures, countries may restrict market access for products from each other's countries, forcing firms to reevaluate supply chain strategies. This uncertainty and disruption can lead to production delays, inventory problems, and additional cost burdens, affecting the overall operational efficiency and market responsiveness of firms.

At the same time, retaliatory measures by the other country, such as the imposition of tariffs or other trade restrictions, often lead to a reduction in exports, which directly affects production and employment in the relevant industries. Affected industries may face reduced market share and pressure on profits, while companies need to adjust their supply chains and market strategies to adapt to the new trade environment, with negative impacts on overall economic growth and the job market, especially in export-dependent countries and industries.

At the societal level, trade wars often lead to pressure on firms to reduce exports and increase costs, especially in industries that rely on imported raw materials. In such cases, businesses may be forced to consider cost-cutting, which may include measures such as layoffs, thus directly affecting the job market and economic stability.

The economic uncertainty and rising cost of living it triggers usually lead to a decline in consumer confidence, and consumers may manage their spending more cautiously, delaying higher spending and optional purchases. This change in consumer behavior directly affects the retail, restaurant, tourism, and other service sectors, while reducing demand in the manufacturing and service sectors, affecting the functioning of the overall economy and the job market.

At the same time, it may also exacerbate social income inequality, with higher commodity prices putting greater economic pressure on low-income groups as companies pass on costs to consumers. Therefore, governments and businesses need to take proactive measures to restore consumer confidence, boost economic activity, and mitigate the impact on vulnerable groups.

Moreover, trade wars not only have economic repercussions but may also exacerbate political tensions between countries. Such tensions could lead to impediments to cooperation and exchanges between countries in other areas, including security cooperation, scientific and technological innovation, and international governance. For example, it could lead to a deterioration in diplomatic relations, making it more difficult to solve international problems, which in turn affects the advancement of global governance and multilateralism.

Moreover, if a trade war has a serious negative impact on the economy and people's livelihoods, this could directly affect the reputation and support of the ruling government. Economic instability and rising costs of living usually trigger public discontent and protest sentiments, especially if unemployment rises, inflation increases, or consumer purchasing power declines.

The government may thus face public censure and be accused of not being able to respond effectively to economic challenges, which in turn affects its governing base and political reputation. In democracies, such a situation may lead to voter distrust of the ruling party or government, which in turn affects the outcome of the election and the political situation as it unfolds.

At the same time, trade wars may weaken the effectiveness of the Global Trade Organization and the multilateral trading system. When countries resort to bilateral trade measures, such as imposing tariffs and enforcing trade restrictions, this not only affects the rules and order of global trade but also exacerbates the spread of unilateralist and protectionist tendencies.

This trend may lead to a greater tendency for countries to take unilateral action rather than resolve trade disputes and economic frictions through multilateral consultations and mechanisms. The weakening of the global trading system not only makes trade rules more uncertain but also makes it more difficult to reach consensus and cooperation among countries, thus affecting the stability and sustainable development of the global economy.

In the long run, trade wars often lead companies to adjust their supply chain strategies, such as finding suppliers in other countries or setting up local factories, to avoid the impact of high tariffs. This change in strategy not only affects business operations but also profoundly alters the structure of the global economy, as firms may, for example, shift their production bases to South-East Asia or their home countries to adapt to changes in trade policy, with implications for the global trade landscape in the long run.

In addition, the uncertainty it creates makes firms more cautious about technological innovation and capital investment and may delay investment in research and development and the expansion of productive capacity, jeopardizing the potential for long-term economic growth. These shifts in the global economy have also prompted countries to seek to diversify their trading partners and markets, potentially driving an increase in regional trade and bilateral agreements to cope with uncertainty and reduce dependence on the global trading system.

The U.S.-China trade war has had an equally profound impact on individual investors. As a result of increased policy uncertainty and market volatility, corporate profits are affected, stock market volatility increases, and investors are exposed to greater risk. Investors are therefore advised to adopt a prudent investment strategy, including ensuring asset portfolio diversification and adequate cash reserves. This will not only help protect against the risks associated with market volatility but also identify investment opportunities in the midst of volatility, thereby maintaining solid asset growth and long-term value.

Overall, it is usually unfavorable for all parties, leading to slower economic growth, market turmoil, and social problems. As a result, the international community usually prefers to resolve trade disputes through negotiation and consultation in order to avoid further escalation of trade wars, thereby promoting stable and sustainable growth of the global economy.

Trade War between China and the United States

Trade disputes have been around since time immemorial, and the ones that have had a greater impact include the global trade war during the Great Depression in the 1930s, the U.S.-Japan trade war in the 1980s, the U.K.-EU Brexit trade dispute from 2016 to the present day, the U.S.-EU trade war that has begun in 2018. and the most high-profile U.S.-China trade war.

The trade dispute between China and the U.S. refers to the economic conflict between the two countries that began in 2018 by imposing tariffs and other trade barriers on each other in an attempt to protect their respective economic interests. This trade dispute involves several aspects, including trade deficits, intellectual property protection, and technology transfer.

The U.S. has long had a large trade deficit with China, meaning that the value of U.S. imports from China far exceeds the value of its exports to China. And the Trump administration believes that this deficit negatively affects the U.S. economy, not only weakening the competitiveness of the U.S. manufacturing sector but also leading to a large number of job losses.

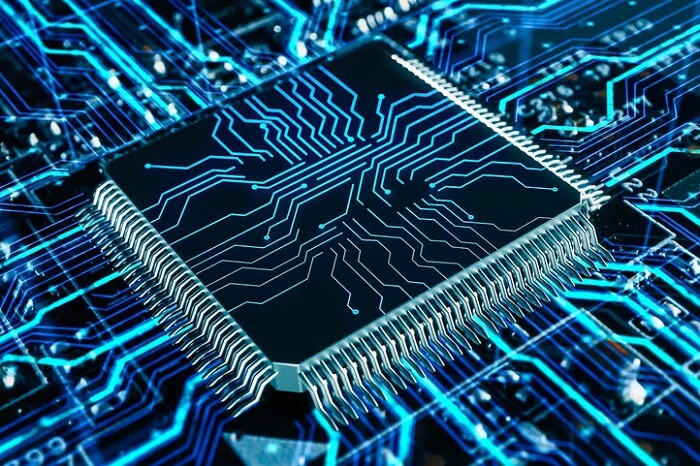

Meanwhile, the U.S. also accuses China of having problems with intellectual property protection, mainly theft of intellectual property and forced technology transfer. The U.S. believes that the Chinese government and enterprises have acquired, copied, or utilized the technology and innovations of foreign companies through illegal means, which seriously infringes on the intellectual property rights of U.S. companies and creates an unfair competitive environment for their operations in the Chinese market.

In particular, in certain industries, China requires foreign companies to cooperate with local companies when entering the market or forces foreign companies to share their technology and business secrets with Chinese companies through technology transfer, which is seen as forcing companies to transfer their technology to China.

In addition, the Trump administration has argued that China engages in a variety of unfair trade practices, including providing financial subsidies to its own companies and manipulating the exchange rate of the renminbi, which are seen as harming U.S. economic interests. Subsidies enable Chinese companies to produce and sell products at lower costs, while exchange rate manipulation affects the trade balance and industrial competitiveness between the United States and China, leading to increased trade tensions between the two sides.

Based on these reasons, in March 2018. the United States announced a 25 percent tariff on $50 billion worth of Chinese goods, focusing primarily on high-tech products. In July 2018. the United States further imposed tariffs on $200 billion worth of Chinese goods. In September 2018. the United States again imposed tariffs on $267 billion worth of Chinese goods.

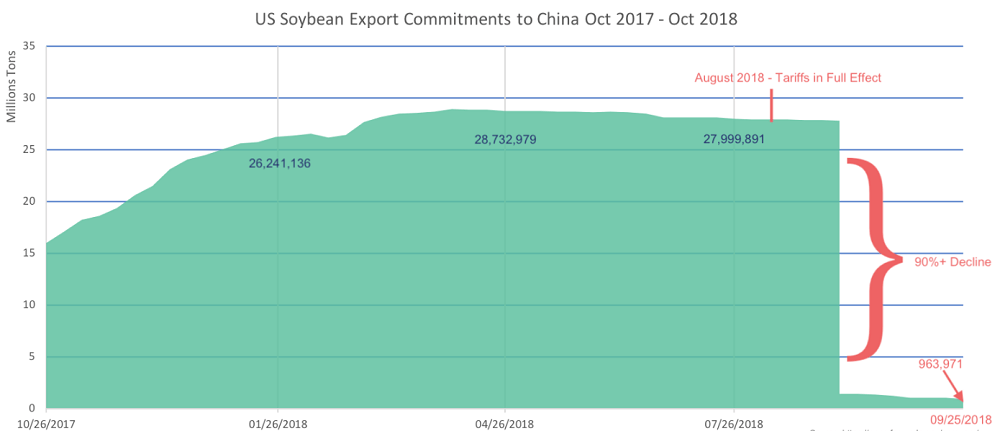

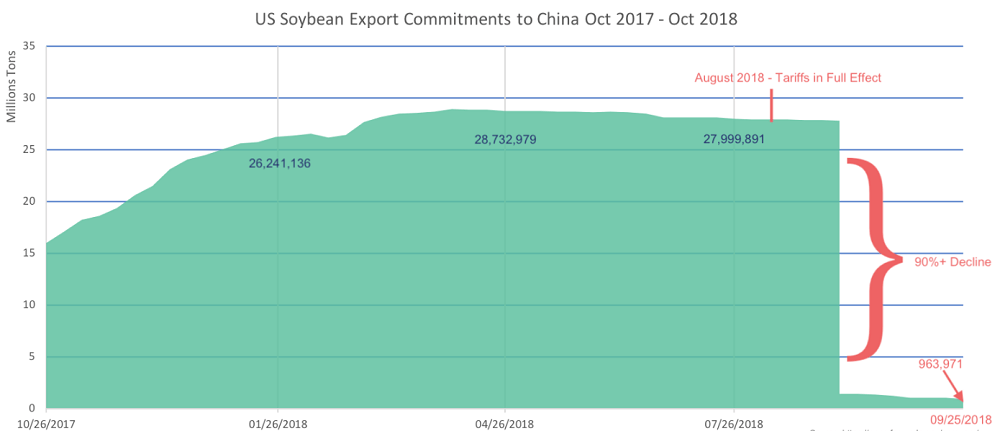

After the United States imposed several tariffs on Chinese goods, China also imposed retaliatory tariffs on U.S. agricultural products, automobiles, and energy products. This series of measures has further strained the trade war between the US and China, and the trade relationship between the two sides has entered a more confrontational phase.

In addition to implementing retaliatory tariffs against the U.S., the Chinese government has taken a series of other measures to mitigate the economic impact of the tariffs. These measures include increasing imports from other countries, boosting domestic consumption, and promoting economic restructuring and industrial upgrading with the aim of reducing dependence on the U.S. market and enhancing the resilience and sustainability of the domestic economy.

The major economic impacts of this US-China trade war include a decline in the volume of US-China trade, particularly affecting export-oriented enterprises dependent on the US market; disruptions in the global supply chain, forcing enterprises to re-adjust their production and supply layouts; and a slowdown in economic growth in both China and the United States as a result of the trade dispute, which in turn affects the stability of the global economy and its growth prospects. Together, these factors have exacerbated uncertainty and market volatility in the global economic environment.

Meanwhile, trade tensions between the United States and China, particularly the mutual imposition of tariffs, have led to a reduction in exports, disruptions in supply chains, and a slowdown in global economic growth. This uncertainty has also caused businesses to be more cautious in their investments and increased volatility in the stock and currency markets, further eroding investor confidence and market stability.

Moreover, as a result of the reduction in exports and market uncertainty that it triggered, many export-dependent industries and enterprises have been under pressure to lay off workers, especially in the manufacturing and agricultural sectors. These industries have been most directly affected by the trade dispute and have had to take measures such as layoffs to cope with the economic pressure due to reduced orders and higher production costs.

In response to the impact of this trade war, China has undertaken a variety of measures, including tax cuts and fee reductions, increased fiscal spending, and support for small and medium-sized enterprises (SMEs), aimed at stabilizing the economy and cushioning the impact of the trade dispute. These policies have helped to reduce business costs, stimulate consumption and investment, and maintain stable employment and productive vitality, thereby promoting the long-term healthy development of the economy.

In addition, promoting consumption upgrading and infrastructure development are important measures to expand domestic demand and reduce dependence on external demand, which will help stabilize economic growth and enhance overall economic efficiency. Developing other international markets is an effective strategy to reduce dependence on the U.S. market, and through diversified market layout and strengthened international trade cooperation, it enhances the competitiveness and market share of enterprises and promotes the sustainable development of the economy.

An important measure for the U.S. in the face of trade conflicts and market changes is to help affected farmers and enterprises tide over the difficult times through subsidies and assistance programs. These programs can include direct financial subsidies to reduce the financial pressures faced by businesses and farmers and ensure their sustainability.

In addition, the government can help farmers and enterprises adjust their production and business strategies to cope with market changes and uncertainties by providing technical support and training. These measures will not only help stabilize the income and employment of the affected groups but also protect the country's important agricultural and manufacturing base and promote the long-term health of the economy.

In January 2020. the U.S. and China signed the first phase of a trade agreement, which signaled an attempt to resolve the long-standing trade dispute through negotiations. Under the agreement, China agreed to increase its purchases of U.S. goods and services by about $200 billion over the next two years, covering a wide range of areas such as agricultural products, manufactured goods, energy, and services.

In response, the U.S. postponed some scheduled tariff increases and committed to phase out some existing tariffs. The achievement of this agreement provides a more stable and predictable trade environment for businesses on both sides, while also bringing some relief and a recovery of confidence in global markets.

Despite the first phase of the trade agreement, the trade dispute between the U.S. and China still involves many fundamental issues that have yet to be resolved. Progress in subsequent phases of the negotiations has become more complex and difficult as they have been disrupted by factors such as the new crown epidemic and political tensions. These issues, including intellectual property protection, market access, and technology transfer requirements, are core issues that have long plagued both sides.

Therefore, while the first phase of the agreement has eased some of the tensions, further in-depth negotiations and cooperation are still needed to achieve a comprehensive and stable trade relationship. And through this series of measures and responses, the economic structures of China and the U.S. and the global trade pattern are also changing. In other words, the impact of the trade war continues.

The Nature and Global Impact of Trade Wars

| Category |

Description. |

| Trade War Definition |

Tariffs and barriers to economic protection provoke conflicts. |

| Main Means |

Tariffs, quotas, subsidies, and non-tariff measures. |

| Fuse |

Restrictive measures trigger retaliation, creating a vicious cycle. |

| Economic Impact |

Costs rise, and market uncertainty increases. |

| Social Impact |

Rising cost of living, declining confidence. |

| Political Impact |

Political tensions and international cooperation were hampered. |

| Trade System Impact |

A rise in protectionism threatens the multilateral trading system. |

| Long-term economic impacts |

Supply chain restructuring, boosting regional trade. |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.