Berkshire Hathaway may be an unfamiliar name to most people. However, many have heard of it because it is controlled by Warren Buffett, especially its annual shareholders' meeting, which is considered a pilgrimage-like experience by many investors just to catch a glimpse of Buffett. In fact, this company not only perennially occupies the top ten of the market capitalization ranking list but is also the target of many investors for long-term investment. Let's now take a look at Berkshire Hathaway's influence based on its market capitalization and stock analysis.

Berkshire Hathaway Company Profile

Berkshire Hathaway (Berkshire Hathaway) is a diversified investment holding company headquartered in Omaha, Nebraska, United States, and one of the most highly traded companies currently listed on the New York Stock Exchange. The company is led by renowned investor Warren Buffett and is known for its long-term, sound investment strategy and superior performance.

Dating back to 1839. Berkshire Hathaway began as a textile manufacturer founded in Pennsylvania, U.S.A. It won the market by producing a variety of fabrics, such as drapery muslin and shirting fabrics, etc. In 1965. Warren Buffett purchased the struggling company for $7.50 per share.

With globalization and industrial upgrading, the U.S. textile industry declined sharply in the late 20th century, forcing Buffett to gradually shift the company's business focus to an investment and holding model. He used the capital and financial strength accumulated within the company to invest in a wide range of industries and sectors, including insurance, rail transportation, energy, manufacturing, and services.

Berkshire Hathaway consists of two parts: wholly owned or controlled subsidiaries acquired through mergers and acquisitions over the years, covering insurance, railroads, utilities, and energy. In insurance, subsidiaries such as Giroux Street Crossing Automobile Insurance (GEICO) are important in the industry. In rail transportation, Berkshire Hathaway Railway (BNSF Railway) is one of the largest rail carriers in North America.

The energy sector is handled by Berkshire Hathaway Energy and covers power generation, transmission and distribution, and natural gas operations. In addition, the company is involved in a number of manufacturing and service sectors, including precision tools, apparel, furniture, and real estate services.

Another part of Berkshire Hathaway is the investment portfolio, which covers a wide range of asset classes. In addition to its holdings of wholly owned or controlled subsidiaries, Berkshire Hathaway has holdings in a number of well-known companies, such as Apple and Coca-Cola, through equities, fixed-income securities, and non-controlling equity investments. These investments are not only diversified but also provide the company with steady cash flow and capital appreciation, further supporting its long-term investment strategy and financial strength.

Through a wide range of equity investments and acquisitions, Berkshire Hathaway covers a wide range of sectors, including insurance, railroads, energy, retail, and high technology. This diversification strategy has not only helped the company reduce business risks but has also optimized the allocation and efficiency of capital utilization, thus maintaining its competitive edge in the global investment arena.

Meanwhile, as one of the world's largest investment holding companies, Berkshire Hathaway has strong financial strength and large cash reserves. This allows the company to respond flexibly to market opportunities and economic volatility while seeking out and investing in undervalued assets during market adjustments to create more long-term value for shareholders.

Berkshire Hathaway is known for its unique corporate culture and highly autonomous subsidiary management model. Buffett emphasizes trust and long-term strategic coherence by allowing a high degree of autonomy to the CEOs of individual subsidiaries. This decentralized management model not only encourages each subsidiary to maintain relative independence and autonomy, but it also helps subsidiaries make decisions and respond to market changes more quickly, and it promotes innovation and entrepreneurship.

And effective communication and collaboration between headquarters and subsidiaries ensures consistency in overall strategy while allowing each subsidiary to maintain flexibility and responsiveness in its operations to adapt to the changing business environment. This management style safeguards shareholders' interests through shareholders' meetings and transparent communication, allowing each subsidiary the flexibility to strategize according to its own market needs and competitive environment.

In conclusion, Berkshire Hathaway is not only a successful investment company but also a symbol of Warren Buffett's wisdom and business philosophy. Through its firm value investment philosophy and persistent pursuit of financial soundness, the company has set up industry benchmarks globally and become a role model for the investment and corporate sectors to learn from. As times change and markets fluctuate, Berkshire Hathaway remains steadfast in upholding its unique business model and continuing to create value for shareholders and investors.

Berkshire Hathaway Market Capitalization

Berkshire Hathaway Market Capitalization

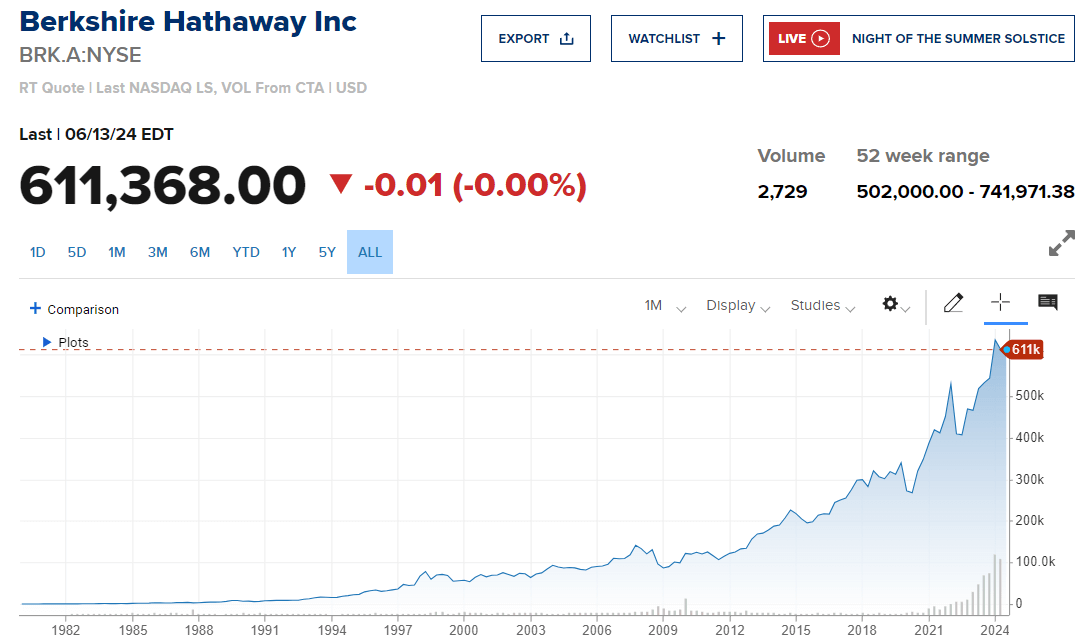

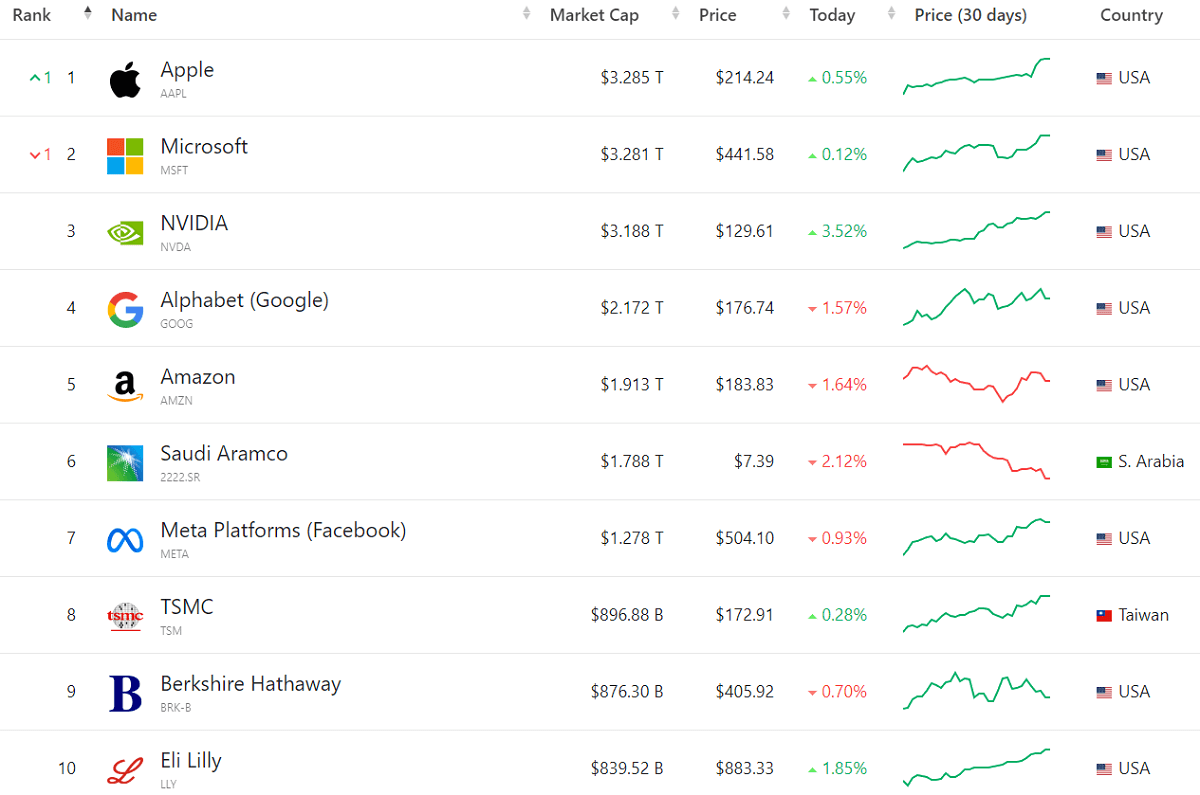

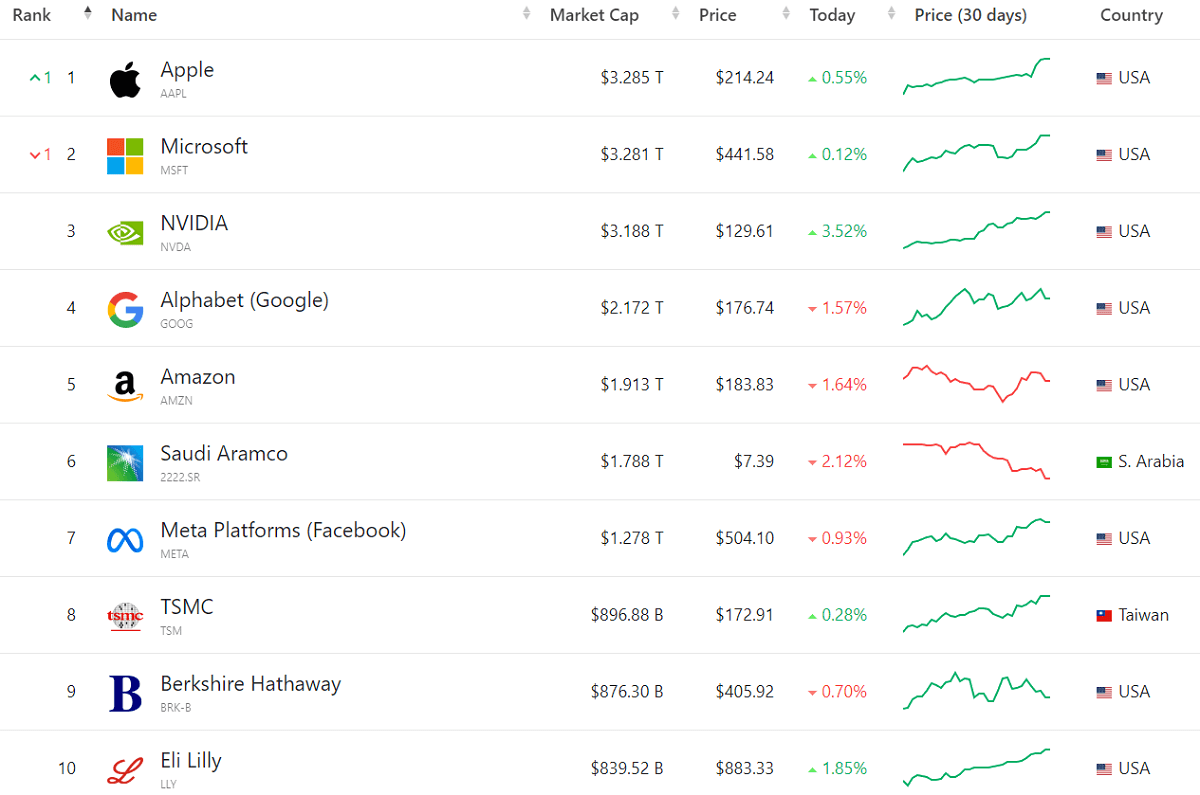

Market capitalization is the current market price of a company's stock multiplied by the total number of shares outstanding, reflecting the market's estimate of a company's overall value. Berkshire Hathaway, a well-known investment company, has consistently ranked among the top 10 in the world in terms of market capitalization. Based on the current total value of all outstanding shares, its market capitalization is approximately $876.3 billion, making it one of the most valuable companies in the world.

Berkshire Hathaway has two common types of stocks, A shares (BRK.A) and B shares (BRK.B), and its market capitalization usually correlates to the fluctuations in the prices of these two stocks. A shares are very expensive, usually in the hundreds of thousands of dollars per share, while B shares are relatively inexpensive, usually in the hundreds of dollars range.

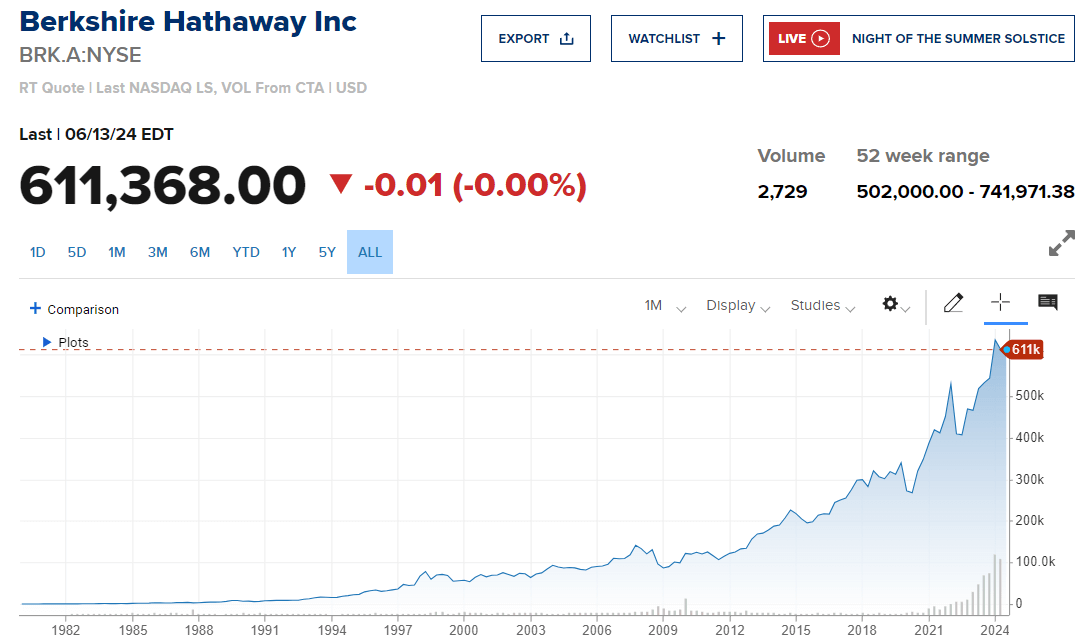

At the same time, a company's performance can also affect its market capitalization. For example, according to the data from the 2023 financial report, the company realized a net profit of $96.223 billion for the whole year, exceeding the market's expectation of $40.8 billion, and revenue reached $364.482 billion, a year-on-year increase of 20.65%. The net profit in the fourth quarter of 2023 was $37.574 billion, a year-on-year increase of 107.8%. As a result, the reaction to the stock price is that it has continuously shown an upward trend, with both the A and B shares having reached all-time highs.

However, in its latest earnings report, Berkshire Hathaway's total revenue for the first quarter of 2024 was $89.87 billion, a decrease of 3.76% from the fourth quarter of 2023. Net income was $12.7 billion, a decrease of 66.19% from the previous quarter. Earnings per share were $5.88. down 66.11% since the previous quarter. The stock price has fallen since the earnings report was released, which in turn has affected the company's market capitalization.

Berkshire Hathaway's market capitalization is not only affected by the company's performance but also supported by its diversified portfolio and sound management strategy. The company holds significant stakes in well-known companies such as Apple, Coca-Cola, and American Express, and these investments not only enhance its market capitalization but also provide solid support for its performance in the market.

The company continues to enhance the value of its portfolio by identifying and investing in quality companies with stable cash flows and long-term growth potential. Apple, the world's leading technology company; Coca-Cola, the world's largest beverage company; and financial services giants like American Express are all key members of Berkshire's portfolio, providing the company with stable income and long-term growth opportunities.

Moreover, overall market conditions and investor sentiment do have a significant impact on Berkshire Hathaway's market capitalization. In times of economic prosperity, investors are typically more inclined to buy stocks, which may drive Berkshire's share price higher and, in turn, boost the company's market capitalization. On the contrary, in times of economic downturn or market instability, investors may reduce their investment in stocks, which may lead to a decline in Berkshire's share price, thereby affecting its market capitalization performance.

In addition, Berkshire Hathaway holds its investments for the long term, which is closely related to its value investing philosophy and its long-term bullishness on quality companies. Holding quality assets for the long term allows the company to fully enjoy corporate growth and dividend returns while avoiding the costs and risks associated with frequent buying and selling. This strategy not only helps to enhance Berkshire's overall ROI but also strengthens the market's confidence in its stability and long-term value, which in turn positively affects the company's market capitalization performance.

Berkshire Hathaway continues to expand its business footprint through ongoing mergers and acquisitions and by investing in new areas of business, and these strategic initiatives have a profound impact on the company's market capitalization. Through mergers and acquisitions, the company is able to quickly acquire new market share and technological capabilities to accelerate business growth and diversification. Each successful M&A is likely to bring new sources of revenue and profit growth to the company, thereby enhancing its financial performance and market position, and hence its market capitalization.

At the same time, Berkshire Hathaway's investment in new business areas is an important part of its expansion strategy. By investing in industries or companies with great future potential, such as high-tech, new energy, or emerging markets, the company is not only able to participate in areas of innovation and rapid growth but also add new engines of growth to its portfolio. These investments are likely to generate high returns in the future, further boosting the company's market capitalization.

And Berkshire Hathaway's success is closely tied to the investment wisdom and experience of leaders like Warren Buffett. The company has long relied on Buffett's strategies and decisions to achieve remarkable success. However, changes in the company's leadership can trigger uncertainty in the market. In the event of his departure or the emergence of other unpredictable factors, it may have a negative impact on the company's operations and market performance. This situation may lead to a change in investors' perception and confidence in the company's future, which may affect the share price and market reaction.

Overall, Berkshire Hathaway's market capitalization has grown consistently over the past several decades, demonstrating its successful investment strategy and sound operational management. The company has effectively increased its market capitalization through long-term holdings of high-quality assets, a diversified portfolio, and precise merger and acquisition activities. These strategies have made it a highly sought-after investor in the global capital markets, as well as a major player in several industry sectors. Over time, Berkshire has continued to strengthen its market position, demonstrating the potential for solid long-term growth and attractiveness.

Berkshire Hathaway Stock Investments

Berkshire Hathaway's stocks are categorized into two types: A shares (BRK.A) and B shares (BRK.B), which correspond to different investor groups and investment strategies. The existence of these two types of stocks provides diversified choices for different types of investors and allows more people to participate as shareholders of Berkshire Hathaway, a globally recognized investment company.

Its A shares (BRK.A.) have significant characteristics and attractions in the stock market. First, BRK.A. is known for its extremely high price per share, often in the hundreds of thousands of dollars or more, which makes it a preferred investment for wealthy investors and large institutions. Second, each BRK.A. share carries more voting rights, which gives investors a greater voice and influence in corporate governance and major decisions.

B shares (BRK.B), on the other hand, have distinctive features and advantages in the stock market. First, BRK.B is cheaper compared to A shares (BRK.A), which makes it an easier way for ordinary investors to enter the Berkshire investment system. Second, BRK.B has fewer voting rights per share compared to BRK.A, which means that investors holding BRK.B have relatively less influence in corporate governance and decision-making.

And while both Berkshire Hathaway A and B shares are known for their rarefied dividend policies, neither stock pays cash dividends very often. Instead, the company prefers to reinvest earnings into business expansion and new investment opportunities, a strategy that demonstrates its orientation toward long-term appreciation and capital growth.

BRK.A. stock is the preferred choice of long-term and wealthy individual investors because of its high value and greater voting power. This reflects Berkshire Hathaway's strategic orientation as a long-term value-investing company and demonstrates the company's strong commitment to the long-term interests of its shareholders. As a result, the high value of BRK.A. stock appeals to investors who want to influence corporate decisions by holding a larger percentage of ownership and more voting rights.

In contrast, the low price of BRK.B. shares makes them more suitable for participation by a wide range of ordinary investors, reflecting the company's strategic intent to provide investment opportunities for different types of investors. However, BRK.B. stock's relatively low voting rights and lack of a dividend policy also mean that holders may be somewhat limited in terms of corporate governance and dividends.

The reason the average person chooses to invest in Berkshire Hathaway is first and foremost because it is led by Warren Buffett and Charlie Munger, two investment gurus known for their superior investment acumen and long-term perspective. Their management style focuses on long-term holdings and value investing, and this solid management strategy provides investors with a stable and reliable investment environment.

Second, Berkshire Hathaway reduces risk through its diversified portfolio. The company holds stock in many types of companies and wholly owned subsidiaries across a wide range of industries, including insurance, railroads, energy, manufacturing, and retail. This diversification strategy helps to balance out economic cycle fluctuations in different industries and enhances the long-term return potential of the overall portfolio.

At the same time, Berkshire Hathaway has strong financials and solid cash flow. This allows the company to remain stable during periods of market volatility or economic downturns and has the ability to respond quickly to market opportunities. This financial soundness provides investors with confidence that the company can consistently create shareholder value over time.

And to invest in Berkshire, there is more than just the option of going to the stock exchange. One is also able to participate indirectly by purchasing some of the ETFs and mutual funds that hold Berkshire stock. Generally speaking, direct stock purchases allow investors to benefit directly from Berkshire's long-term investment strategy and management leadership, while ETFs and mutual funds provide a more convenient way to access Berkshire-related investment opportunities.

Of course, since Berkshire Hathaway is highly dependent on the leadership of Buffett and Munger, in the event that they retire or are unable to continue their management, it could have a significant impact on the company. In addition, despite its diversification, the company remains subject to the overall market environment, and market volatility may adversely affect the company's performance. In particular, BRK.A. stock is not suitable for short-term speculation due to its high price and volatility, and investors need to have a long-term investment perspective and patience.

Nonetheless, Berkshire Hathaway has demonstrated strong growth potential in the capital markets over the long term, considering its solid management strategy and superior investment performance. For example, from 1965 to 2023. Berkshire Hathaway's cumulative gain of more than 40.000 times has resulted in an annualized return of 19.8%, far outperforming the S&P 500 over the same period.

Furthermore, in 2024. Berkshire Hathaway's total return of nearly 12% exceeds the S&P 500's total return of nearly 8%. These numbers are a strong indication that Berkshire Hathaway remains a worthwhile long-term investment option, and its continued outperformance makes it highly attractive in the global capital markets.

Overall, Berkshire Hathaway stock has long been favored by many investors for its sound management and diversified portfolio. Led by Warren Buffett and Munger, the company is known for its superior investment insight and long-term business strategy, effectively reducing risk and enhancing long-term return potential through a wide range of investments covering a variety of industries, including insurance, railroads, energy, and manufacturing.

Berkshire Hathaway's Market Capitalization and Stock Analysis

| Features |

Description |

| Market Capitalization |

Long-term global top 10 |

| Stock Analysis |

Diversified investment strategies and sound management |

| Investor Attraction |

A-share: high net worth investors; B-share: ordinary investors |

| Investment Philosophy |

Buffett and Munger's value investing philosophy |

| Long Term Investment Options |

Recognized as a reliable long-term investment choice |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

Berkshire Hathaway Market Capitalization

Berkshire Hathaway Market Capitalization