In many people's subconscious minds, mergers and acquisitions are a very shiny thing because, after the merger, the enterprise becomes a big business giant. Moreover, the party that takes the initiative to acquire is a rich and powerful tycoon, and the party that is acquired is a poor one. But for investors, the benefits of mergers and acquisitions depend on how the market reacts to the news. Here, we look at the opportunities and risks of M&A for investors.

What is Merger and Acquisition?

Mergers and acquisitions, or M&A for short, stands for mergers and acquisitions. It is the act of a company purchasing the shares or assets of another company, or merging with another company, in order to achieve a strategic business objective.

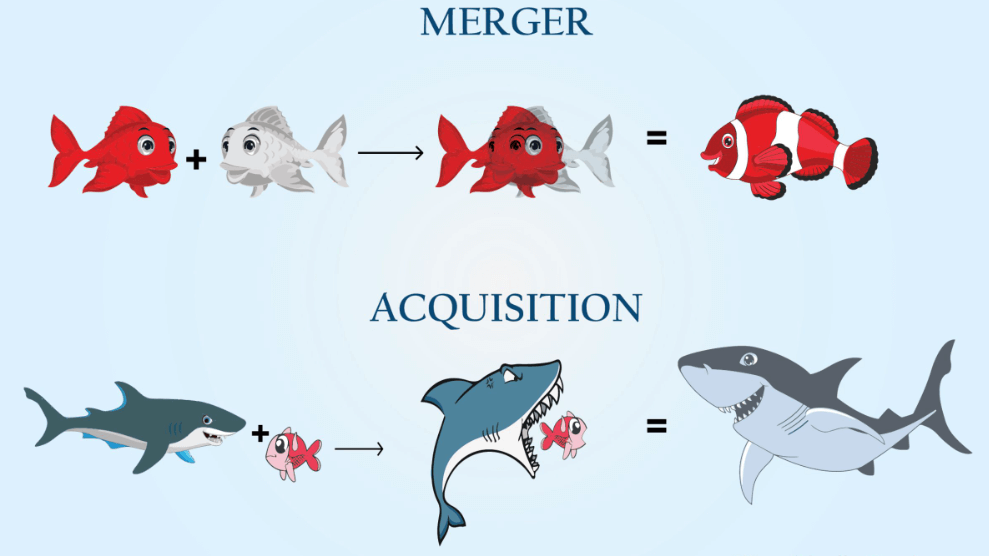

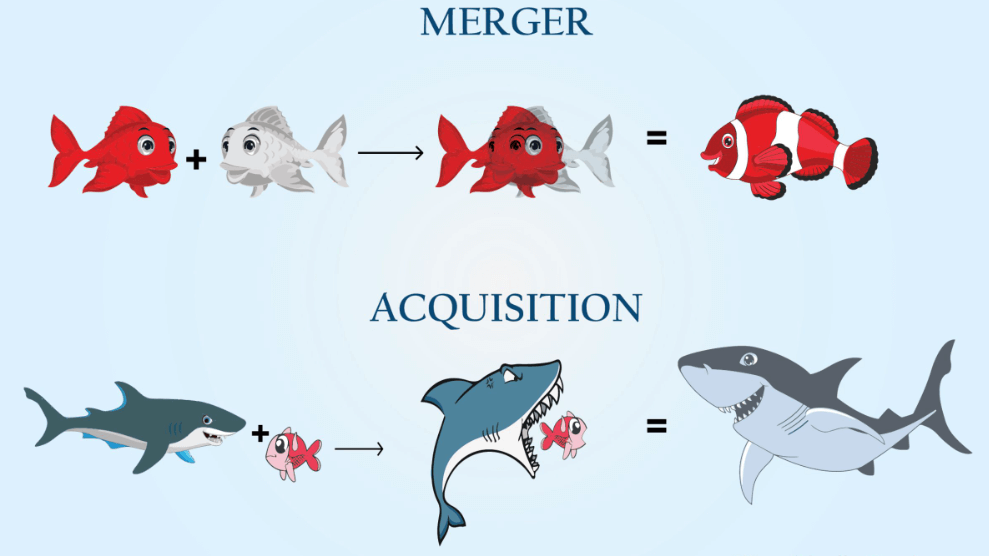

It is like a marriage between two companies; a merger means that the two companies merge to become one. This behavior can be amicable, i.e., both parties reach an agreement and agree to go ahead with the transaction. It can also be hostile, i.e., the purchaser makes an acquisition without the consent of the target company.

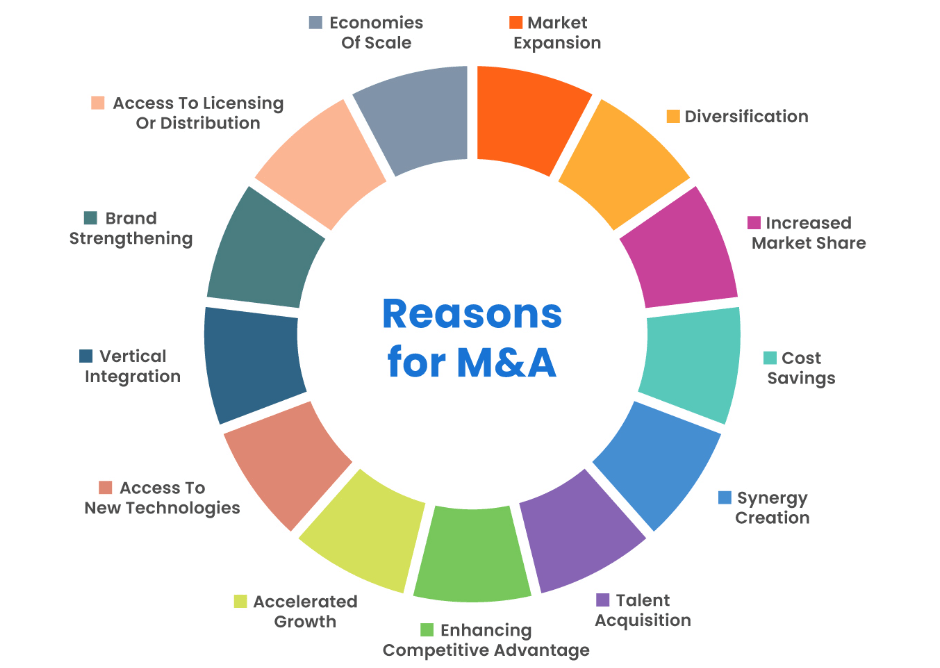

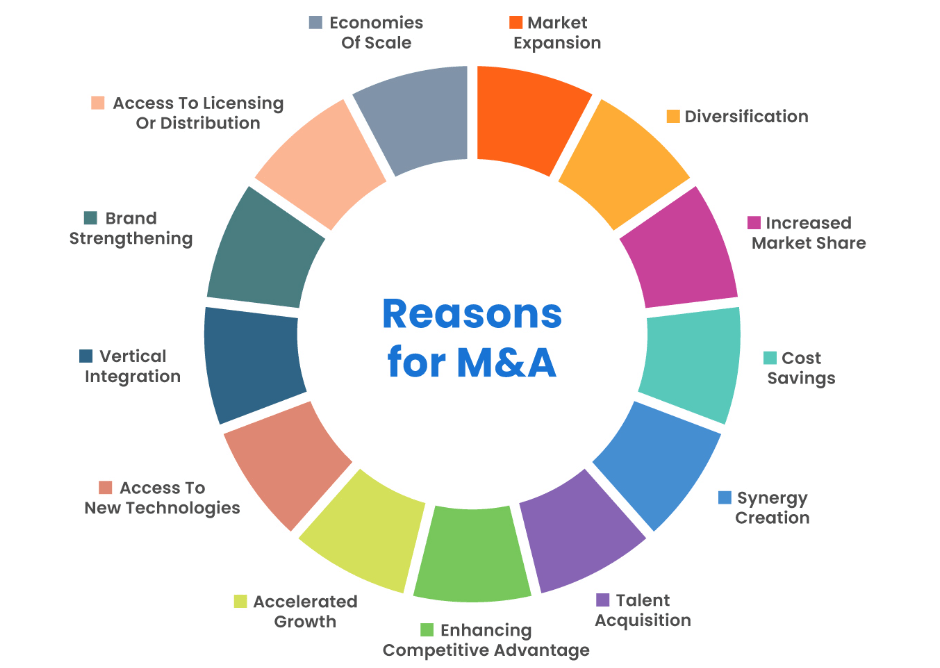

It is usually done to achieve growth, expand market share, acquire new technologies or product lines, save costs, or achieve other strategic goals, or it can be done in different ways, such as an acquisition or a merger.

An acquisition is when one company buys the shares or assets of another company in order to gain control of the target company. It can be a wholly owned acquisition (buying all the shares of the target company) or a partial acquisition (buying a part of the target company).

There is also a merger, which is a combination of two companies to become a new company, which usually requires the approval of shareholders of both parties and a review of relevant legal procedures. It can be a merger of equals (where the shareholders of both companies hold equal proportions of shares) or a merger of unequals (where one company becomes the dominant party and the other becomes the acquiree).

Mergers and acquisitions generally occur between companies in the same industry and are designed to increase market share, improve competitiveness, and realize economies of scale. However, in practice, more than 50% of deals are more like mergers between companies in different industries. For example, manufacturers are acquired by trading companies because the buyer is more motivated by geographic and business expansion diversification.

For example, there was a manufacturer in Malaysia that was planning to sell its company because it was having problems and also wanted to expand its business globally. The Japanese buyer company was interested in it because it had an established equipment factory. So it acquired the company and provided more capital and human resources after the acquisition, as well as a Japanese quality control system and new technological perspectives. In the following year or two, sales and profits increased by more than 150%, so both parties were very happy.

But otherwise, this was not particularly good news for investors. After all, in reality, many company managers are unwilling to distribute the profits they get to their shareholders because they don't want to and can't reinvest them in the company to generate enough profit. This is why they try to find ways to do mergers and acquisitions, in which case it actually does not benefit the company.

Although most mergers and acquisitions are actually bad for the company, psychologically and strategically, they are good news for investment organizations. Because once they see a M&A, they think the company's stock price will go up, so they put a lot of money into it.

However, it is not a good opportunity for individual investors. For example, if the stock price of a small company fluctuates, and at 30 dollars, a large company announces that it will merge and acquire the small company's stock for 40 dollars. The price of the small company's stock then goes from $30 to $38. Because the final merger date has not yet occurred, there is a spread between $38 and $40 on the final merger date.

If you buy the company's stock at $38 at this time, the stock will rise to $40 by the merger date, and you will be able to make a profit on the $2 difference. Basically, the individual investor has a chance to make that profit when it goes from $30 to $38. However, if the stock is bought at $38 and the merger and acquisition is not completed for any reason, the stock could fall back to $30 and lose $8.

Mergers and acquisitions are one of the most important tools for business development and growth, helping companies rapidly expand their businesses, become more competitive, acquire new technologies and markets, and realize economies of scale. However, this is not a very favorable time for individual investors, and it is recommended that you do not purchase stocks easily.

Key Considerations for Companies in Mergers and Acquisitions

There are many issues that must be understood when choosing a company to be acquired, such as the fact that the first priority is to ensure that the books are clear and that the company should have easy-to-understand financial statements and tax returns. If this is all in order and the financials are in good shape with low cash reserves or no debt on the balance sheet, it is a good candidate for a merger and acquisition.

And it also has to have some earnings, such as adjusted annual earnings. Often referred to as Earnings Before Interest and Taxes (EBITDA), it's roughly between $250.000 and $900.000. a range that is often considered optimal for maximizing returns. There are also companies with profit margins that are a bit higher than the industry average and may bring in more revenue.

Choose companies that have been in business for at least 3 years; the longer, the better, which means that the business is past its infancy. Also, choose companies that have mostly cyclical and recurring revenues; this means that there is a steady stream of income, which is important for the stability of the business.

Then look at the size of the company; smaller businesses usually have higher relative profit margins but also require more time and effort. Conversely, larger businesses may require more capital but will grow and expand more quickly. Also, choose those businesses with the highest revenue per employee, as this usually indicates higher efficiency.

Look for a business that is growing; it is usually easier to accelerate growth if it is already moving in the right direction. Also, choose an industry that is likely to grow faster in the future, which will make life and growth easier. And make sure the business is located in a place where the population is growing faster, which helps the business grow. And make sure the market share isn't too small; if it already has 90% of the market, growth will become more difficult.

Look for businesses that haven't fully modernized, which means there are many opportunities for efficiencies and cost savings. Look for businesses with barriers to entry that make it difficult for others to replicate; this can take many forms but is usually a good thing. And think about the future; don't buy a business that could become obsolete in the next 10 years.

Also, diversifying the industry may be better, as many retiring owners can be absorbed or acquired. And look for products or services that are known as necessities because they do well in downturns. Low capital expenditures to make sure that you don't need too much capital to expand your business, as too much debt increases risk.

These issues are all key factors that a company needs to consider when deciding whether or not to go ahead with an M&A and how to implement it. It also needs to conduct thorough due diligence, develop an appropriate strategy, and manage the process effectively to maximize the benefits and minimize the risks of the operation.

Pros and Cons of Mergers and Aquisitions

Whether it's good or bad depends on a number of factors, including a company's strategic objectives, the way it is implemented, the effectiveness of the integration, and the market environment. Through mergers and acquisitions, a company can rapidly expand its market share, enter new markets, or increase its product line, thus improving its competitiveness in the market. It can integrate the resources of both parties, including talent, technology, brand, customers, supply chain, etc., to achieve optimal allocation of resources and complementary effects.

The merged enterprise can usually realize economies of scale, reduce costs, improve efficiency, and enhance profitability. Through mergers and acquisitions, enterprises can obtain new technologies, new products, or new markets, enhance their innovation abilities, and promote enterprise development. Through mergers and acquisitions of companies with stable profitability or market positions, market risks can be reduced, and the stability and risk resistance of the enterprise can be enhanced.

In addition to these benefits, integration after mergers and acquisitions may face problems such as organizational culture differences, business conflicts, and personnel turnover, leading to poor or failed integration. The capital pressure, debt burden, and transaction costs during the M&A process may lead to increased financial risks, affecting the profitability and financial health of the enterprise.

The management team after a merger or acquisition may face new challenges and pressures, and loss of control or mismanagement may lead to a business downturn or failure. It also involves legal compliance issues, contractual disputes, intellectual property rights issues, etc. that may lead to increased legal risks and losses or lawsuits against the business. If there are negative incidents or mismanagement in the process, it may damage the reputation of the company and affect the brand image and customer trust.

These are all issues that M&A companies need to take into account for investors. If the good outweighs the bad in the process, then the market reacts with a higher share price. And if it is bad treatment, then the market will take the stock price down.

In fact, for the acquiree, it is in a situation where it can go in or out. Because it will sell only if the acquirer offers more than the market price, there is always some market premium for the acquiree. So if the investor owns the acquired company, this is equivalent to seizing the opportunity, according to which it can get a larger income.

According to U.S. research, all mergers and acquisitions from the 1970s to 2000 were recorded. The share price of the acquired company generally rises by 10% to 30%, and this value tends to increase over time. In the Chinese market, for example, the acquired company's stock price tends to rise within two to three months, and holding the company's stock can be profitable.

For the acquirer, whether the news is good or bad depends on the circumstances. For example, are both companies intrinsically linked? Can we get a 1+1+2 result? What is the payment method? The answers to these three questions will determine the basic pattern of stock price movements.

In other words, the benefits of a merger must outweigh the disadvantages for the stock price to react positively. That is to say, only if the merger between two companies can be recognized by the market will the stock price be able to react positively. For example, a general intra-industry acquisition is more likely to be recognized by the market and get a rise in the share price. Whereas, a cross-industry acquisition would have to be able to complement the business in order to get a positive reaction in the share price.

It is also important to note what stage the industry is at. With the rise of industry mergers and acquisitions, the market can understand that they are to expand market share and produce a scale effect after the stock price rises. If it happens in a downturning industry, the market is more likely to think that it is a management agency problem, and the stock price will fall.

Meanwhile, when a company is relatively small, the market believes that there is more room for efficiency gains. But if the company reaches a certain size, the market will find it difficult to improve efficiency and will instead encounter the checks and balances of antitrust laws. Therefore, it is common to see in the news that mergers and acquisitions of certain mega-corporations will have a negative market reaction.

The payment methods used in implementing M&A transactions mainly include cash payments, stock payments, and hybrid payments. Different payment methods bring about different stock price reactions. Generally speaking, if cash is used to buy the stock, the price will not fall but may rise slightly, but if the stock is used to buy the stock, the price will fall.

The logic here is simple: the market generally takes paying in cash as a positive sign. Because this represents that the acquirer has abundant cash flow on the books and is focusing on the merger and acquisition of synergies after the efficiency gains, market share is very confident in the case and will use real money to buy. And with stock acquisitions, the signal is relatively weaker, so this is the role of the signal; cash and stock acquisitions will also bring different market reactions.

Therefore, companies need to fully realize the benefits and reduce the risks of mergers and acquisitions. And investors should also pay closer attention to such news to understand its impact on share prices and business prospects in order to make more informed investment decisions.

Types of corporate M&A risks

|

Risk Types

|

Description

|

|

Financial Risk

|

Financial uncertainty: increased debt or worsened metrics. |

|

Organizational Culture Conflict

|

Merging parties' differences can disrupt integration and operations. |

|

Market Risk

|

Competition and market shifts impact merged business positioning. |

|

Management Team Risk

|

New challenges may affect management and performance. |

|

Legal Compliance Risk

|

Legal issues in mergers may lead to losses or lawsuits. |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.