Ratings are very commonly used in today's society. For example, before people go to a restaurant, they will look at the reviews of other consumers on Dianping, and those with high ratings will be more interested in trying it out. Similarly, individuals who want to take out a bank loan need a credit score; the higher it is, the more likely they are to take out a loan, and the higher the loan amount. And in the investor world, there is also a credit score, which is a team of professionals who score debt to make it easy for investors to quickly determine the risk of defaulting on a debt. Let's take a look at this key indicator of how investments and markets are affected: the credit rating.

What is Credit Rating?

It is the process of assessing the level of credit risk of a bond issuer, borrower, or financial product, reflecting the likelihood of default of a subject or a bond. Its main purpose is to provide investors with information about a debtor's ability to repay its debts and to help assess and understand investment risks so that they can make investment decisions accordingly.

The main purpose is to provide investors with information about the debtor's ability to repay debts, help them assess and understand investment risks, and thus make investment decisions accordingly. Generally speaking, the higher the grade of this rating, the less likely it is to default.

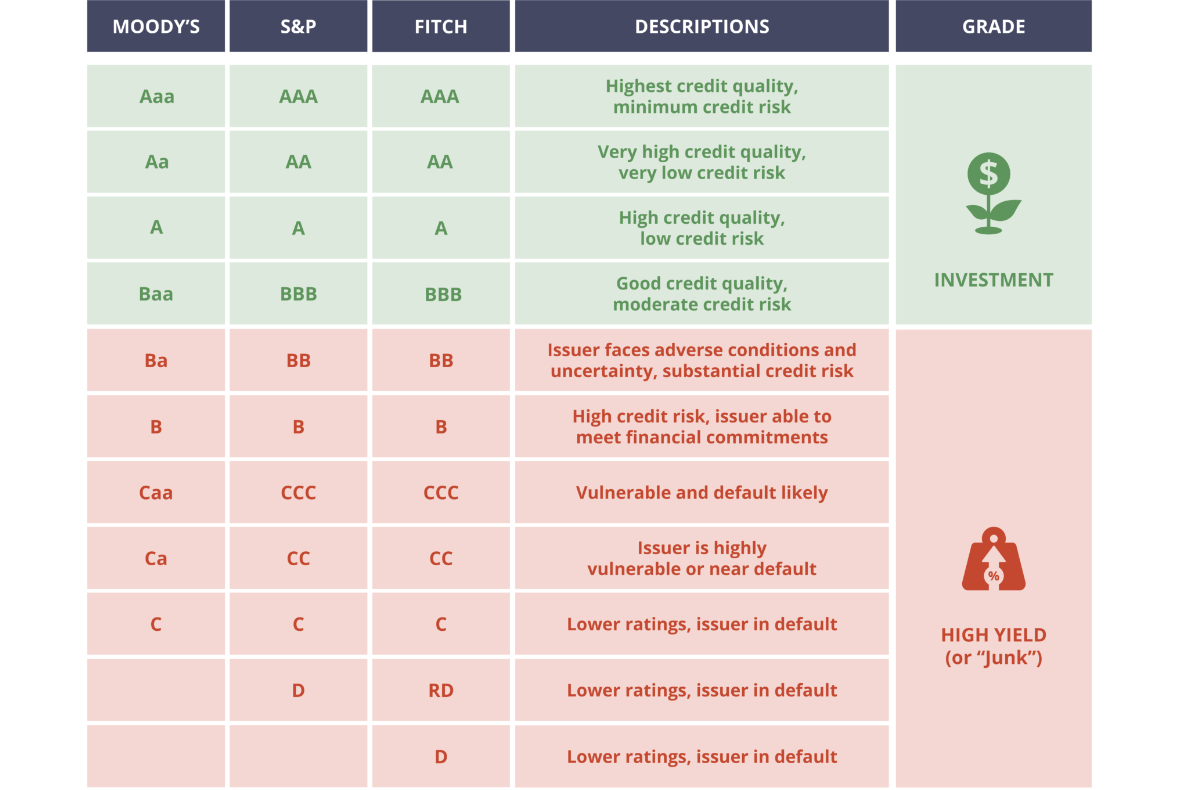

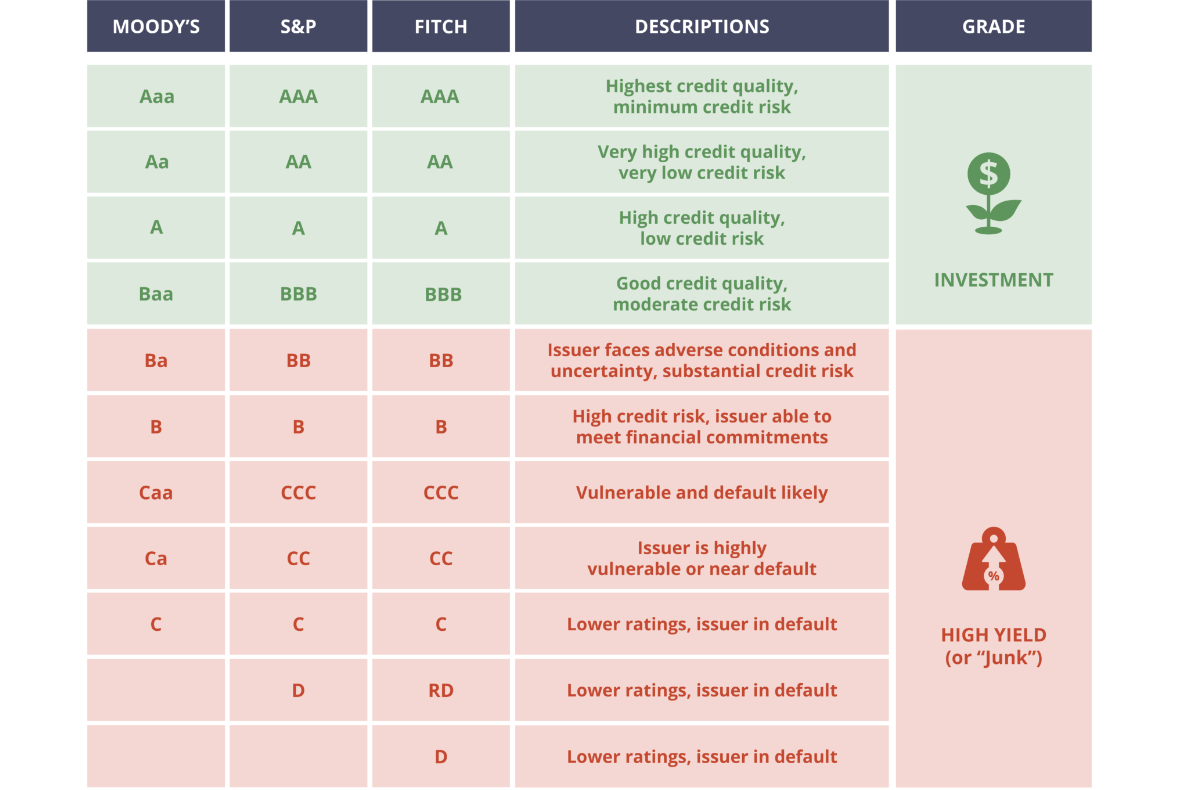

And its rating, too, is delineated by professional credit rating agencies. For example, today, the most famous international professional has three rating agencies: Standard & Poor's, Moody's, and Fitch. These three have different rating standards, but there is correspondence between them. For example, S&P and Fitch's BBB rating corresponds to Moody's BAA rating.

These agencies assess the credit quality of a debtor by analyzing its financial condition, operating performance, industry outlook, and other factors and assigning a corresponding rating grade. Rating grades are usually expressed in letters (e.g., AAA, AA, A, BBB, etc.) or simple descriptions (e.g., Excellent, Good, Acceptable, etc.), and the grades ranging from high to low reflect different levels of credit quality and default risk of the debtor.

In general, the higher the rating, the safer the investment, but the lower the return and the lower the cost of financing for the business. Conversely, the lower the rating, the riskier the investment, but the higher the return.

It can also be divided into sovereign ratings, corporate ratings, and bond ratings. Where the bond rating cannot be higher than the corporate rating and the corporate rating cannot be higher than the sovereign rating. For example, China's rating is A, so all companies in China will not be rated higher than A internationally.

Bonds are also categorized according to credit ratings, where a BBB rating or higher is called an investment-grade bond, which is basically unlikely to default. For example, China Merchants Bank is rated BBB internationally, Tencent and ICBC are A, and Apple is AA. Those below BBB are called high-yield bonds, also known as junk bonds. The yield difference between high-yield bonds and investment-grade bonds is called the credit spread.

In fact, it's not just the gap between A-rated and B-rated that's big, but also the gap between AAA and A. For example, in 2021. Fitch downgraded all four major Australian banks from AA to A+. It's a one-level change, but it's across a big grade. Going from two A's to one A means going from a high score to the upper middle.

It's also important to note that rating agencies derive their revenue from the companies that receive the ratings, so they are not independent agencies judging, and there will be a certain amount of subjectivity. The agency will be afraid that if the score is too low, the client will find another agency to rate in the future, and they will lose performance. Also, if a company packages the debt issued several times before rating it, it will be difficult to distinguish the true value of the packaged debt.

For example, before the financial crisis of '08. many banks packaged subprime mortgages and prime debt to be rated by rating companies. On the one hand, they didn't want to offend their customers, and on the other hand, using the blindfold method, they would use most of the high-quality assets in the package to rate the whole debt highly. On top of that, the rating process refers to a lot of historical data. Therefore, there is a certain lag effect, so it does not completely predict the future trend.

Credit rating has an important role in the financial market, which can not only help investors assess the risk and determine the investment strategy but also provide debtors with financing costs and financing channels. At the same time, it is also one of the most important tools for regulators and government agencies to supervise the financial market and protect investors.

There are several levels of corporate credit ratings.

|

Credit Rating

|

Description

|

Significance

|

|

AAA

|

Excellent |

Very low risk of default |

|

AA

|

Good |

Very low default risk |

|

A

|

Acceptable |

Low default risk |

|

BBB

|

Medium |

Certain default risks |

|

BB

|

Poor |

Higher default risk |

Criteria for Grading Credit Rating Agencies

The three main credit rating agencies in the world are Moody's, S&P, and Fitch, with the first two being American companies and the third being European. Apart from that, there are many other smaller companies, but in terms of the global market, Moody's and S&P dominate more than 80% of the market.

The main business of these agencies' ratings is long-term and short-term debt for national governments, local governments, financial institutions, funds, treasury management, insurance companies, corporate utilities, and so on.

Among them, the ratings for governments are all obligatory, competing to score government debt from a marketing point of view. In turn, according to this, we can determine the macroeconomic trends, which can gain more credibility and visibility. Then, rating the debt of institutional companies is what makes these agencies profitable.

These three major companies grade short-term and long-term debt, which can be roughly categorized into A, B, and C grades. Long-term debt has a greater impact than short-term debt and is more common at the state level. That's why there is more attention paid to it, and the ratings are broken down more finely. Of these, the AAA grade is considered the strongest score. For investment organizations, on the other hand, ratings below BBB are generally considered junk investments and too risky.

Each rating company has its own method of scoring, and generally, when they start scoring, they contact and talk to the various management departments of the company, then collect various materials on finances and operations and analyze the data. This is the same system that banks use to score the credit of individuals who have taken out a loan to buy a house, and it's called the 5Cs of credit analysis.

The first quality is character, which is used to measure a debtor's subjective assessment of a borrower's credit and quality. For individuals, it looks at the individual's credit history and other people's evaluations, and for businesses, it looks at the management team's experience, the history of debt, and the company's reputation.

The second is capacity, or cash flow, to measure the borrower's ability to repay on time. For an individual, it is looking at his salary flow, his monthly income, and the nature of his job, whether it is stable or not. Full-time scores are higher than part-time scores. For a business, it's looking at the data profile of its financial statements.

The third is capital, which measures the ratio of the borrower's capital to his investment. For a mortgage, it's looking at the ratio of the down payment; for a business, it's looking at the ratio of their own investment to the loan. Entrepreneurs are required to pay their own savings before taking out a business loan so that they can be trusted with a bank loan.

The fourth one is the condition, which is used to measure the investment potential of the borrower. For personal property, one has to look at the appreciation of this house, municipal planning, neighborhood amenities, and so on. For businesses, look at their bargaining power in competition; for example, Apple and Samsung have more bargaining power than other cell phone manufacturers. Other things are the stage of development of the company, whether the industry it is in is a sunset or a sunrise industry, etc.

The last one is collateral, which is used to ensure that the debtor recovers the principal amount from the debt. Mortgages look at the ratio of the market value of the house to the LVR and other possible mortgages. Businesses look at assets such as plant and equipment, warehousing, offices, and so on.

The criteria for assigning credit rating scores are usually set by the rating agencies and are based on the credit quality and repayment ability of the bond issuer, borrower, or financial product. While different rating agencies may have slightly different classifications, generally speaking, AAAs are of the highest credit quality, with very low credit risk and a debtor with a very strong ability to repay.

AA, on the other hand, has high credit quality and very low credit risk, and the debtor is highly solvent. is higher credit quality and lower credit risk, and the debtor is highly solvent.

BBB has good credit quality and acceptable credit risk; the debtor has some ability to repay the debt, but there is still some uncertainty. BB, B, and CCC have lower credit quality and higher credit risk; the debtor's ability to repay the debt is weak, and there is a greater risk of default.

CC has very low credit quality and very high credit risk; the debtor's solvency is very weak and may default. d is a default status, indicating that the debtor is no longer able to fulfill its debt service obligations.

These rating grades are usually expressed as letter grades in descending order from AAA (highest) to D (default), where each grade may be modified by a plus or minus sign to indicate a more precise level of credit quality. It is worth noting that different credit rating agencies may have different rating systems and grades, but they are broadly similar to the basic principles outlined above.

The Important of Credit Rating

The Important of Credit Rating

First and foremost, it has a wide-ranging impact on the financial markets and the economic system, as the credit rating of a debtor directly affects its cost of financing. Debtors with higher ratings are usually able to raise funds at lower interest rates because investors perceive a lower risk of default and are willing to offer them more favorable financing terms. On the contrary, a lower-rated debtor may have to pay higher interest rates to attract investors, which will increase its financing costs.

Secondly, it also affects the availability of market financing for debtors. Debtors with higher ratings are more likely to obtain financing support from the market because investors are more willing to buy their bonds or provide loans. Conversely, debtors with lower credit ratings may face the challenge of increased difficulty in obtaining financing.

And it can also affect market liquidity and stability. Higher-rated debtors typically have access to broader market support and relatively high market liquidity. In contrast, debtors with lower ratings may be exposed to market illiquidity and price volatility.

Then it also has an important impact on investor confidence and trust. A high rating usually implies that the debtor has a high credit quality and a low risk of default, which can attract more investors. Conversely, lower ratings may trigger investor concerns and risk-aversion behavior, leading to capital outflows and financing difficulties.

For example, Fitch downgraded all four major Australian banks from AA- to A+, and the difference can be seen through the conference's explanation of the two grades. That is, from a very strong credit to a stronger one, the likelihood of being affected becomes greater. For example, this rating downgrade is mainly for the long-term lending of the big four banks.

And the lower the rating, the more interest the big four banks have to pay to finance themselves. With central bank interest rates unchanged, this will cause the falling profits of the big four banks to snowball even more. The impact of such a chain reaction could expose investors in the stock market to the risk of dividend cuts from the big four banks.

For investors in the debt market, the big four's bond returns would then rise. For bank depositors, they may face a fall in the yield on deposit interest. Meanwhile, those with personal and business loans may face the risk of rising interest rates on their loans.

Credit ratings are therefore crucial to investors because they provide important information about a debtor's ability to repay its debts. Investors often rely on it to assess the risk level of an investment and make investment decisions based on it.

As one of the key indicators for investors to assess the risk of default by a bond issuer or borrower. Higher ratings typically indicate a lower risk of default, while lower ratings indicate a higher risk of default. Investors can gauge the risk of their investments based on the rating scale and adjust their portfolios accordingly.

It also serves as a reference for investors to formulate investment strategies and decisions. For example, some investors may prefer to buy highly rated bonds or lend to highly rated borrowers because they usually have a lower default risk and the corresponding investment return is relatively stable.

It also has a direct impact on the pricing of bonds or borrowings and the level of interest rates. Higher-rated bonds typically have lower interest rates because investors are willing to pay lower rates of return for lower-risk investments. Conversely, lower-rated bonds may need to offer higher interest rates to attract investors.

They may also help investors avoid bad investments and reduce investment risk. By evaluating a debtor's creditworthiness, investors can better protect their investments and avoid losses from defaults. And they allocate their portfolios according to different ratings to achieve a balance of risk and return. In general, investors may prefer to hold highly rated assets in their portfolios to stabilize the overall performance of their portfolios.

Therefore, credit ratings have an important influence in the financial market, which directly affects the cost of financing for debtors and the availability of financing in the market, as well as investor confidence and market liquidity. And it provides an important frame of reference for investors to help them make informed investment decisions.

Ranking of credit ratings of countries in the world

|

Country

|

grading

|

|

Germany

|

AAA |

|

Canada

|

AAA |

|

Australia

|

AAA |

|

Netherlands

|

AAA |

|

Sweden

|

AAA |

|

Switzerland

|

AAA |

|

Singapore

|

AAA |

|

Denmark

|

AAA |

|

Norway

|

AAA |

|

luxembourg

|

AAA |

|

Liechtenstein

|

AAA |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

The Important of Credit Rating

The Important of Credit Rating