Living in today's time, everyone wants to be closer to money. But the financial industry, which is recognized to be the closest to money, is riddled with scams. But the reason for this is probably because people know so little about the financial industry. In fact, apart from investors, anyone who understands financial institutions can have a significant impact on their future finances. As a result, this article will provide a systematic explanation of the classification and function of financial institutions. And tell a little bit about how and what they do to make money, in the hope that it will help people stay away from financial scams.

System of Financial Institutions

System of Financial Institutions

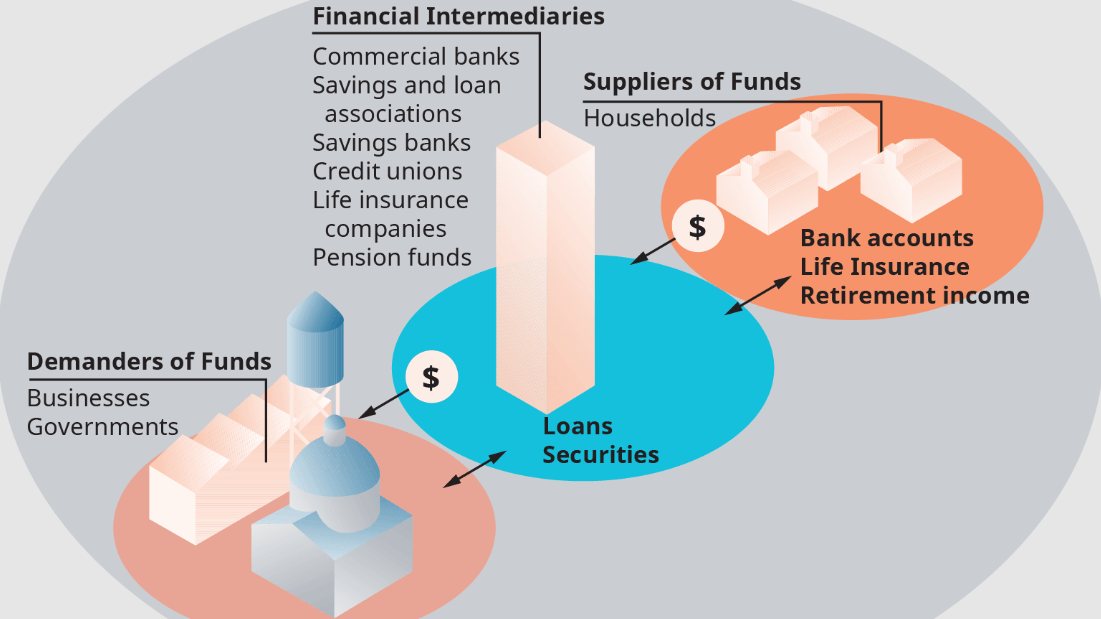

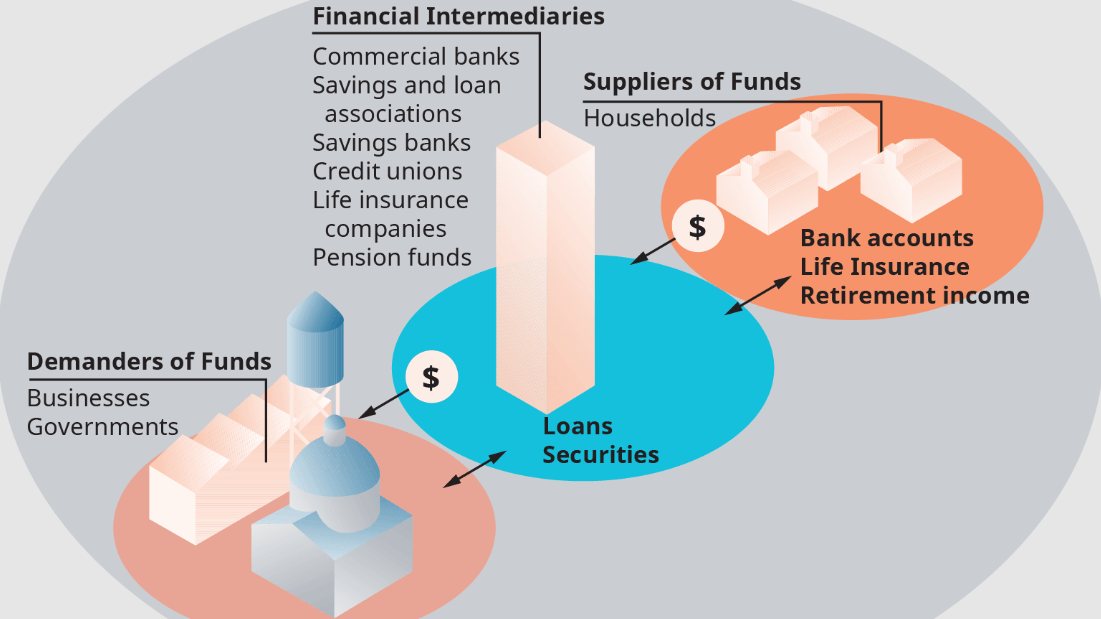

It is also called a financial intermediary and refers to the organization that operates a monetary credit business and engages in monetary and financial activities. Its main assets and liabilities are made up of financial products; in simple terms, it refers to financial intermediaries engaged in business related to financial services, including bank credit businesses, Securities, insurance, trust funds, and so on.

According to the general classification, firstly, it can be divided into indirect financing and direct financing. The financial intermediary of indirect financing is mainly a kind of financial intermediary organization that mediates between the creditor and the debtor funds and carries out the capital financing for the two parties with clear funds. Let's say banks. Ordinary people are most familiar with commercial banks. Without commercial banks, small amounts of money cannot find their way out. Because, let's say, you only have $10.000 of your own money; it can't buy stocks or debt. There's no economies of scale in buying anything, so you can just put it in a bank.

The financial intermediaries of direct financing are the ones that match the two parties in the activities of direct financing and, at the same time, provide services such as planning, consulting, underwriting, securities brokerage, etc. This includes investment banks, securities firms, and other financial institutions. This includes investment banks, securities firms, stockbrokers, and stock exchanges. It is important to realize that without stock exchanges, there would be no way for people to buy stocks.

The second category is deposits and non-deposits. The financial intermediation of deposits is mainly an institution that promotes economic development by taking deposits and granting loans. It mainly includes savings banks, credit unions, and commercial banks, of which commercial banks are the main ones.

The financial intermediary of deposits has a relatively large scale, but it does not have many varieties. That is, we often refer to savings institutions, for example, like the U.S. Savings and Loan Association, China's credit unions, commercial banks, and so on.

There are many non-depository financial intermediaries that are contractually obligated to collect dues from holders of various types of non-depository funds. An insurance company, for example, raises funds by collecting premiums from owners, or policyholders, through insurance contracts. There are also fund companies, which raise funds through the issuance of funds and then take them to apply for investment.

The third category is called bank financial intermediaries and non-bank financial intermediaries. Bank financial intermediaries are financial intermediaries whose core business is deposits and loans, that is, institutions whose main content is deposits and loans and exchange rate settlements, which include central banks, commercial banks, and specialized banks.

Non-bank financial institutions, on the other hand, are financial intermediaries other than banks, such as insurance companies, trust companies, fund companies, leasing companies, pension companies, investment funds, and so on. None of them provide remittance and settlement functions, and deposits are not called deposits but rather collections of premiums.

Finally, financial intermediaries can also be categorized according to whether they are established for the purpose of making profits or not, whether they are not established for the purpose of making profits, and whether they are capital-preserving financial intermediaries. For example, the Agricultural Development Bank of China is a policy-oriented financial institution. Those established for profit are commercial financial intermediaries.

The first function of financial intermediaries is to be able to fulfill the function of deposits. It is both the most basic function of financial intermediation and the most important task of deposit financial intermediation. Because many people have income and expenditure mismatches, this time every month, in addition to the excess money, we hope to be able to put in a financial intermediary to save up.

Secondly, it also has the function of brokerage and trading, that is, financial intermediaries to trade financial products on behalf of customers or provide financial products settlement services. Let's say you have to go through a securities company to buy stocks, and then the broker will have a trading seat in the market through its account system and then buy and sell.

The third is called the underwriting function, which means that financial intermediaries help investors in the market to come and design products and sell these products to other investors. Anything related to finance can be given to financial intermediaries to do, which can help design financial products, do capital operations, and then sell them.

There is another important function called the advisory and fiduciary function. It is the ability to provide investment advice to clients and manage their investment portfolios. These functions are designed to help clients better understand and cope with investment risks, manage their assets, achieve their investment objectives, and ensure that their financial interests are effectively protected.

That is to say financial institutions, which are organizations with financial products as assets and liabilities. The difference between it and an entity is that it mainly does the design, trading, buying, and selling of financial products. For investors, its main functions are deposits, brokerage, underwriting advice, and so on.

The main four types of financial institutions are those that make money.

The first is a non-bank financial intermediary, which, as its name implies, refers to those financial intermediaries that do not belong to the traditional commercial banking system. This refers mainly to organizations that do not have a banking license and are not regulated by banking industry regulators. Such financial intermediaries may provide banking services but are not allowed to hold public deposits, make investments, or collect interest on loans. This is very important and is the core difference between banks and non-bank financial intermediaries.

Generally speaking, brokerage guarantee companies, Internet financial futures brokerage companies, trust companies, and such organizations are non-bank financial institutions. Taking brokerage firms as an example, the most important business income of a securities company is the trading commission, which is the handling fee we need to pay when we buy and sell stocks. In addition, brokerage firms also provide financing and securities financing services. That is to say, they lend money or stocks to their clients, and when they return them, they attach a certain amount of interest.

These interests are also an important source of income for securities firms, and there is also the income gained from the whole process of acting as a professional organization to make investments, that is, the investment management business. These three revenues constitute the main income of the average brokerage firm.

Take the traditional brokerage CITIC Securities 2020 financial information as an example: the composition of its operating income, the proportion of income from fees and commissions, accounted for 29%, interest income accounted for 27%, and investment income accounted for 43%. It can be seen that the ability of this traditional old brokerage firm to obtain income through investment is very strong, and they are not just relying on the brokerage license given to collect interest and transaction fees.

The main way ordinary people deal with brokerage firms is by opening securities accounts and buying and selling stocks. Each brokerage firm offers different services and gives a different percentage of commission, charging from 3/1000 to less than 1/10.000. The exact percentage is determined by agreement between each individual and the brokerage firm, and the minimum fee for each transaction is $5. which is a two-way buying and selling charge. So when you open an account, make sure you talk to the broker about what the commission rate is.

The second is the insurance company, which is a very familiar financial institution. The business model of insurance companies is also very simple, namely, underwriting and investment. The so-called underwriting is actually selling insurance to collect premiums, and investment is the money collected from selling insurance and then invested to earn income.

The profitability of an insurance company is actually the investment yield minus the cost of liabilities, and the difference is multiplied by the size of the invested assets. The cost of liability ratio is the ratio of the cost the company incurs in paying claims and related expenses to its total liabilities. Of course, the real situation is more complicated, but in simple terms, if you buy a financial insurance policy, the 4% return that the insurance company promises to give you is the cost-of-liability ratio.

In terms of underwriting, it is best that the insured are all fine, such as with health insurance, healthy, and free of disease or disaster, so that the insurance company does not have to make a claim. You and I are all happy. In terms of investment, the insurance company only needs to invest the collected premiums to maximize the rate of return as much as possible, and then it will be able to make a stable profit without losing money.

The main sources of income for the insurance company are the three differences: the interest difference, the death difference, and the fee difference. For example, let's say you buy an insurance policy with an agreed-upon interest rate of 4% at the time of purchase. Afterward, the insurance company earns 5% through investment, so there is a 1% spread between the interest rate and the 4% interest rate.

At the same time, the insurance company needs to manage the premiums after collecting them, operate them, etc., and these will naturally incur certain expenses. If the insurance company initially estimated that the management or operating costs would be $500.000. but in the end it only spent $300.000. Then the fee difference is worth 50-30 = 200.000; the extra 200.000. in a sense, is the money earned.

The topic of mortality spread is a bit heavier, and it means that the insurance company hires a bunch of actuaries to figure out an expected mortality rate. Let's say the expected mortality rate is 10%, which means that out of the 100 people who buy insurance, there is a chance that 10 of them will have to pay out when they die. But in reality, only 6 people died, so the difference is 10-6=4. The rest of this is what the insurance company earns.

Taking the information from the financial report of New China Insurance in 2020 as an example, the income structure of this insurance company's insurance business income accounted for 75% of the total income, while the investment income accounted for 25%, mainly these two kinds. When you buy various kinds of insurance, you will deal with insurance companies, and you must find an insurance product that meets your risk needs. The most important function of insurance is actually the protection function, which helps us maintain a normal life even if extreme risks occur.

Therefore, we should focus on the protection function of insurance and the corresponding types of financial insurance products, bearing in mind the profit model of the insurance company. The so-called financial insurance, from the perspective of the insurance company, is, in fact, to take your money to invest, make money in the middle to share the proceeds, and lose money to bear the loss. In this case, it is better to invest on your own or find a professional fund company.

The third is the bank, which is the most familiar financial institution. Banks are from the depositors with low interest rates to absorb excess funds and then with high interest rates to bring those in need of business from which to earn a spread. This seems to be particularly easy; the bank did not do anything on the laying profit; in fact, it did not. This is not. Banks bear at least three very important responsibilities to earn the difference.

First, the production of information. Bank lending often needs some strict process, for example, according to the borrower's business situation, to determine its repayment ability. Then the lending decision can be made, along with the lending amount, lending rate, and other details to determine. Continuous follow-up is also required after this so that the loan can be recovered in time if there is any deterioration in the borrower's business situation.

Therefore, the bank is carefully collecting information about the borrower to overcome information asymmetry and decide whether to borrow money and at what interest rate. This work involves the production of information.

The second is to bear liquidity risk. Depositors put their money in the bank, and there are deposits and withdrawals every day. But there will be a certain amount of money deposited, which the bank can use to make long-term loans. Because the short-term interest rate is lower than the long-term interest rate, the bank uses short-term deposits and long-term loans to realize the spread, which is one of its sources of income.

At the same time, the bank has to manage the liquidity because the loan is long-term and cannot be recovered at any time, but the depositors will withdraw cash at any time to keep a certain amount of money. Depositors can withdraw money at any time without having to bear the liquidity risk, and as the bearer of this part of the liquidity risk, the bank thus obtains a compensatory income.

Thirdly, it is the assumption of credit risk. This means that the credit risk of the borrower is borne by the bank, and if the borrower fails to repay the loan on time, the bank must use its own money to repay.

So behind the seemingly simple spread, in fact, there are many other financial institutions that cannot be assumed to have the responsibility of substitution. For example, information production labor, such as liquidity risk and credit risk bearing, is the bank's special money-making mode.

Taking the financial information of China Merchants Bank in 2020 as an example, its revenue structure in terms of net interest income accounted for 64% of the total revenue, fee and commission income accounted for 27%, and other income accounted for 9%. Of all the interest income, interest on retail loans accounted for 62.3% of the revenue. The breakdown shows that the yield on corporate loans is 3.98. The interest rate on personal loans is 5.89.

In this data set, corporate loans are actually the long-term loans just mentioned. Personal loans are for the average person who deals with banks mainly for access to money and credit card lending. In other words, the interest rate that the average person pays to the bank for using a credit card is 5.89. And that is the bank's rate of return.

The fourth one is investment banking. Investment banking sounds lofty, but it's actually an intermediary that uses money to match the needs of sellers and buyers. The main thing is that some entities and brokerage firms, because of the expansion of their businesses, need funds to increase profits. The investment bank needs to understand this need and go to the market to find willing investors. The source of these funds are those companies that have large amounts of monetary capital, such as funds as well as venture capital firms.

The main business of an investment bank is brokerage and closing services, linking buyers and sellers in different markets to collect commissions. Investment banks provide closing services when a company needs financing. For example, a bank might buy stock in a company and then sell the stock to investors. Then the investment bank may not be able to sell those shares at a higher price and therefore may lose money on the IPO. To counter this risk, some investment banks charge a fixed fee for the closing process.

If the shares are sold to investors at a higher price, the difference in price between the sale and the profit is also the income of the investment bank. In CICC's 2020 financial information, for example, its revenue structure shows that investment banking business income accounted for 24% of the total revenue, stock business income accounted for 23%, and wealth management income accounted for 24%, which are the main sources of income for the investment bank.

Each of these four types of financial institutions has its own unique functions and operating modes and plays a different role in the financial market, playing an important role in economic development and the stability of the financial system through the provision of services such as deposits, loans, insurance, investment, and brokerage.

What are the financial institutions?

| Type |

Financial intermediation |

| Bank |

Commercial banks, investment banks, and central banks |

| Insurance Company |

Life insurance, property insurance, and health insurance |

| Securities Company |

Securities brokers, stock exchanges |

| Trust Company |

Trust funds, property trusts |

| Investment fund company |

mutual funds, Hedge Funds, and Private Equity Funds |

| Pawnbrokers |

Pawn loans, mortgages |

| Fintech companies |

Payment institutions, P2P lending platforms, and digital Currency Trading platforms |

| Credit cooperatives |

Rural credit cooperatives and credit union associations |

| Pension Funds |

Social Pension Fund, Enterprise Pension |

| Financial leasing companies |

Equipment finance leasing and asset finance leasing |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

System of Financial Institutions

System of Financial Institutions