Successful stock investing requires diligent research. Blindly following tips can lead to losses rather than gains. It's crucial to distinguish between investing and speculation, making informed decisions based on understanding. Hong Kong ranks among the world's premier financial hubs, attracting investors seeking opportunities. Whether seeking higher returns or exploring Hong Kong stock basics, this guide to stock trading and account opening in Hong Kong offers valuable insights for investors.

Basic knowledge of Hong Kong Stocks

It refers to stocks listed and traded on the Hong Kong Stock Exchange, which cover a wide range of industries and sectors,attracting the attention and participation of global investors. As one of the world's leading financial centers, Hong Kong's stock market is known for its openness, robust regulatory regime, and abundant investment opportunities.

The first formal stock market was established in Hong Kong in 1891. and the market has become relatively mature after a long period of development. Hong Kong has a well-established legal system and regulatory bodies,including the Hong Kong Securities and Futures Commission (SFC), which protects the sound operation of the market and investors rights and interests.

Hong Kong's favorable geographical location,connecting Asia with international markets,makes its stock market an important platform for attracting global investors. As a bridge between the East and the West,it has become an important channel for investors to access the Asian market. Many international investors have gained lucrative returns by participating in Asian market investments through Hong Kong's stock market. And in 2014, in order to promote exchanges with Chinese stockholders,it also opened bridges such as the Hong Kong Stock Connect and the Shanghai-Hong Kong Stock Connect,so that mainland stockholders also have more choices.

As one of the international financial centers,Hong Kong is characterized by openness, freedom, and a high degree of internationalization. Highly free capital mobility makes it easy for investors to make cross-border investments and manage their funds. And the openness makes Hong Kong's stock market have wider investment opportunities and higher liquidity, while at the same time increasing the diversity and activity of the market.

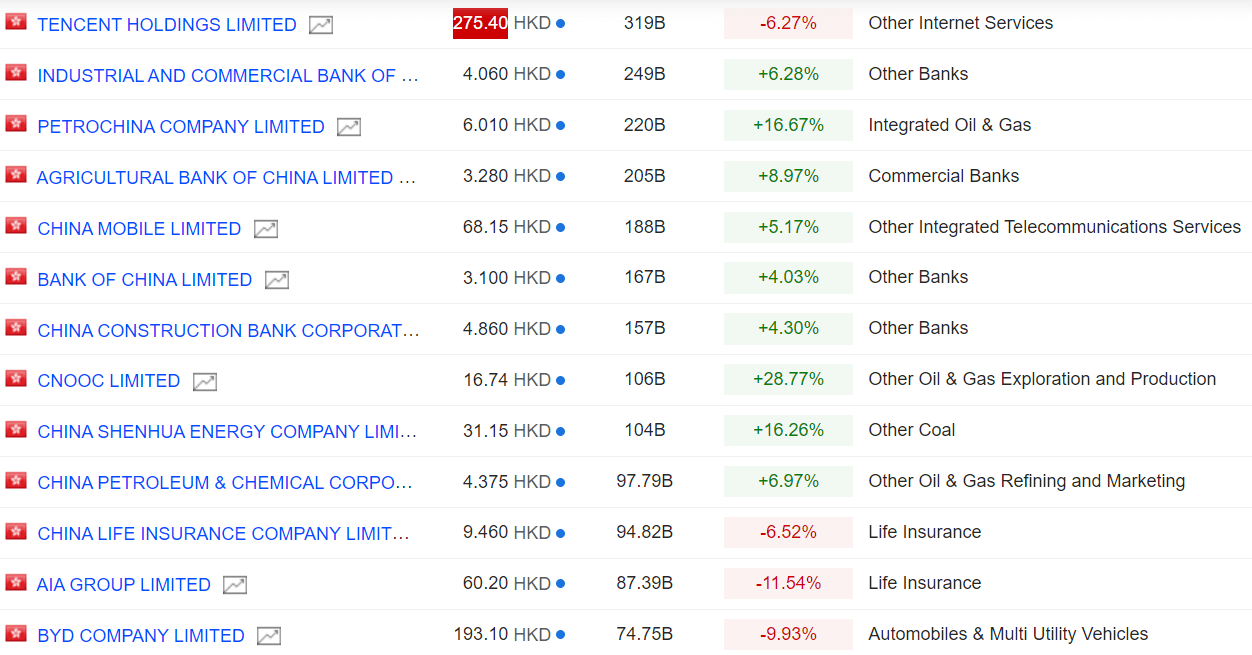

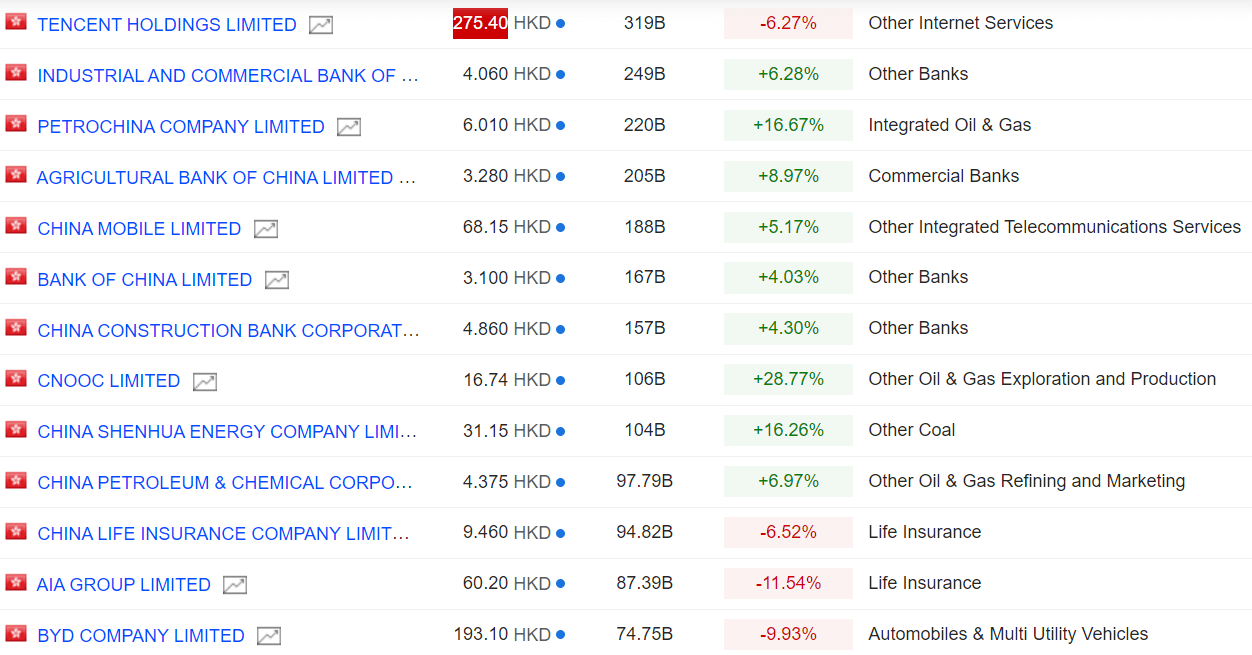

Hong Kong stocks cover companies from all over the world in a wide range of industries and sectors, including finance, technology, real estate, and energy. It is also highly active and liquid, attracting investors from all over the world to participate in trading. Investors can acquire ownership of a company by purchasing it and realizing capital appreciation through changes in stock prices. It also provides a wealth of investment tools and services,including stocks, ETFs, and options,to meet the needs and preferences of different investors.

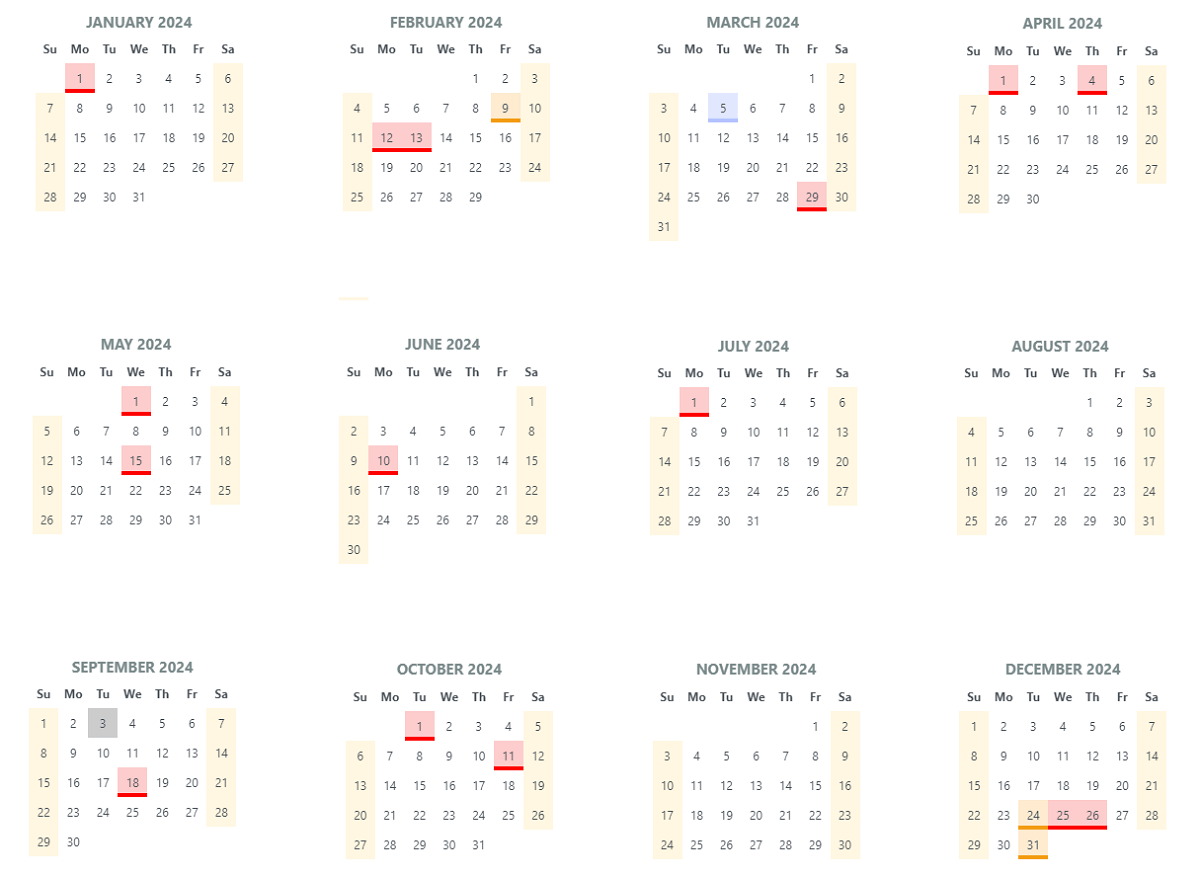

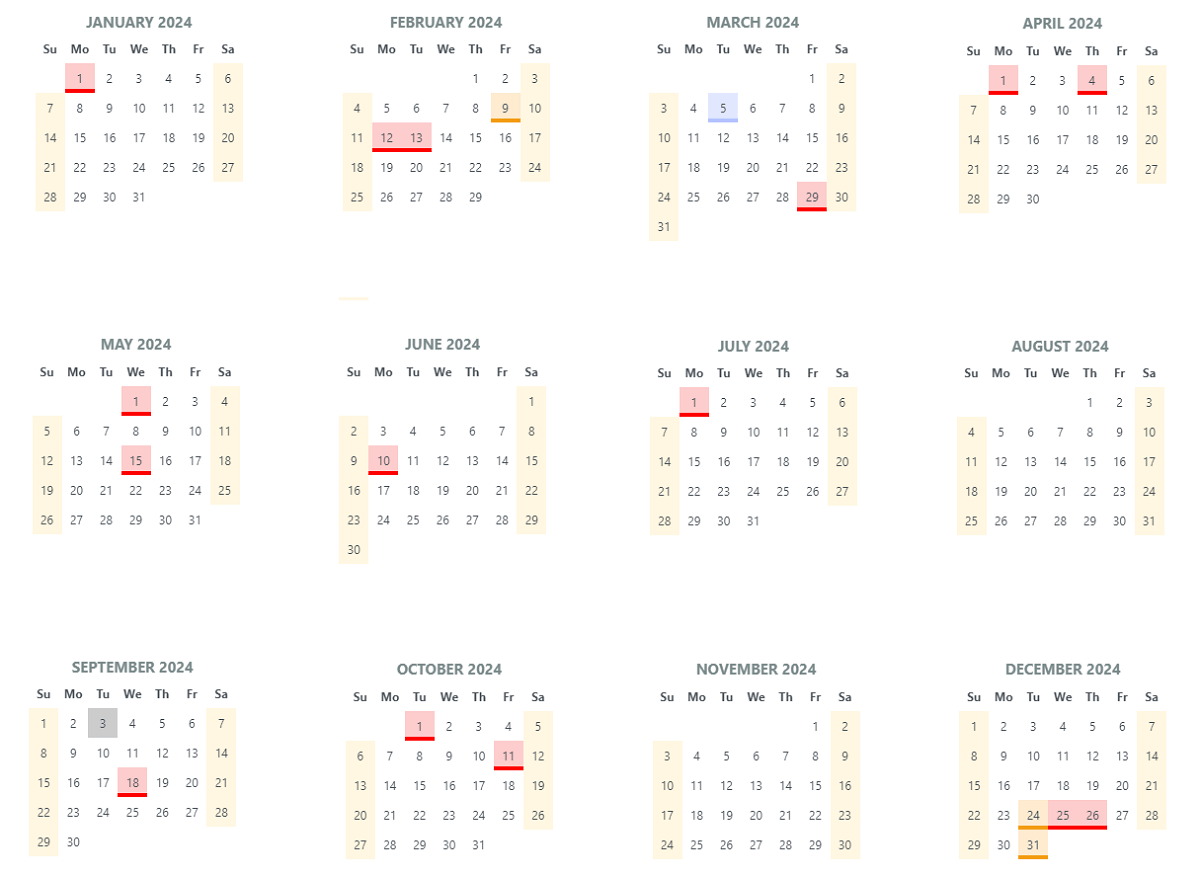

Its trading hours are also more reasonable,and normally there should be one trading session in the morning and one in the afternoon from Monday to Friday. Due to the time difference between the trading hours in other regions,as well as the fact that its holidays are also different from those in other countries, the trading days will also be different,but this allows investors to have enough time to make trading decisions.

The trading rules are flexible, with high transparency and liquidity. It uses the T+0 trading system, allowing stocks bought and sold on the same day. Additionally, there are no limits on percentage changes or a melting period system, meaning stock prices can fluctuate freely during the trading day. This flexibility attracts many investors but also increases market volatility and risk.

Apart from these,there are many other systems to be aware of if you want to invest in Hong Kong stocks. For example,its stock code is made up of five digits,usually with a suffix that identifies the exchange, such as 00005.HK for HSBC Holdings. And its quotation system is the same as that of U.S. stocks in terms of color coding,with both red indicating a drop in stock price and green indicating a rise. This is different from mainland China's quotes, so Chinese investors should avoid the risks associated with inertia.

Overall, the Hong Kong stock market attracts global investors due to its internationalization, diversification, and standardization, playing a significant role internationally. As one of the world's major stock exchanges, Hong Kong's securities market hosts a wide range of international investors and enterprises. Its market scale, capital flows, and internationalization are leading, providing crucial financing and investment channels for both Asian and global capital markets.

Hong Kong Stock Index

Hong Kong Stock Index

It is a measure of the overall performance of the Hong Kong stock market and represents the movement of stock prices within a certain range. There are three major indices: the Hang Seng Index, the Hang Seng China Enterprises Index, and the Hang Seng Technology Index,which have different meanings and roles in the Hong Kong stock market.

These three indices are different in terms of background,industry distribution, and selection of constituents. The Hang Seng Index focuses on Hong Kong local companies; the Hang Seng China Enterprises Index focuses on Mainland Chinese companies; and the Hang Seng Technology Index focuses on technology companies. They are clearly positioned and have their own distinctive features.

The Hang Seng Index,or HSI for short,is the most representative benchmark index for the Hong Kong local market and is used by international investors to measure the overall performance of Hong Kong stocks with the highest Market Capitalization and market coverage,as well as being the most diversified. As one of the most influential stock price indices, reflecting the trend of stock market price volatility in Hong Kong,it is equivalent to China's SSE and the S&P 500 in the United States.

It is compiled by Hang Seng Indexes Company Limited and includes the most representative stocks of large companies on the Hong Kong Stock Exchange,covering a wide range of industries,and is an important reference indicator for the overall performance of Hong Kong's stock market. It is like a cup of authentic Hong Kong-style milk tea,presenting the unique flavor of Hong Kong and reflecting the performance of Hong Kong's stock market.

The Hang Seng China Enterprises Index or HSCEI for short, mainly reflects the share price performance of Chinese companies listed in Hong Kong,including some large-scale mainland Chinese companies. Like the Hang Seng Index, it is an indicator for investors to assess the performance of the stock market in Hong Kong, and it is also one of the most important indicators for judging the performance of Chinese companies in Hong Kong.

Among the three major indices in Hong Kong, it has the highest percentage of Chinese companies among its constituents, consisting of 50 constituent stocks. So much so that the Hang Seng China Enterprises Index is like a cup of Chinese tea with Chinese characteristics, most representative of the performance of mainland Chinese companies listed in Hong Kong.

The Hang Seng Technology Index,or HSTECH, which was launched on July 23, 2020, aims to track the most representative technology stocks within the Hong Kong market. With the growing importance of the technology sector in the global economy,the index has become one of the focal points of investor attention.

It represents the 30 largest companies by market capitalization that are listed in Hong Kong with business lines related to technology themes and includes six different technology themes. So the Hang Seng Technology Index is like an energy drink, reflecting the activity and momentum of the technology sector.

Apart from these three indices,the Hong Kong Small and Mid-Cap Index,or HSSI,is compiled by the Hong Kong Exchanges and Clearing Limited (HKEx) and includes the smaller market capitalization stocks in Hong Kong's stock market. The Hang Seng Utilities Index or HSU, contains stocks of utility companies in Hong Kong's stock market.

These indices can be used to measure the performance of the Hong Kong stock market as a whole and specific sectors.Investors can choose the appropriate index for reference and analysis according to their own needs and investment strategies. And according to their own risk appetite and investment objectives, risk management and diversification, and prudent investment.

Hong Kong Stock Trading Hours and Rules

Hong Kong Stock Trading Hours and Rules

In Hong Kong,the level of activity and prosperity of stock market trading have always been closely linked to the city's booming development. The trading hours of each trading day are divided into morning and afternoon sessions,with a period of market closure at lunchtime. Specifically,Hong Kong's stock market trading hours are divided into the morning trading session,from 09:30 am Hong Kong time to 12:00 noon, in the middle of the market closure of one hour,and the afternoon trading session, from 13:00 to 16:00 introduction.

Trading rules: Hong Kong's stock market is known for its simple,transparent trading system; the trading unit is often used as the basic unit of measurement. In addition,compared to some other stock markets,Hong Kong stocks usually do not have limitations on upward and downward movement,but short-term limitations on upward and downward movement may be set for newly-listed stocks in order to maintain market stability.

If you want to invest in stocks in Hong Kong,you can trade through the online trading platform provided by securities companies,or you can trade over the phone or in person at a securities company's business office. The trading platform provides functions such as buying, selling, and checking stock information,which facilitate investors trading of stocks.

However,when trading stocks,investors may need to pay fees such as commissions and transaction taxes. The exact fee schedule depends on the chosen securities company and Trading Product. Investors should pay attention to the level of fees and service quality when choosing a securities company.

Common types of trading orders in Hong Kong include limit orders,market orders,stop-loss orders, and so on. Investors can choose the right type of order to trade according to their needs and market conditions to achieve the best trading results. It is important to note that in the Hong Kong stock market, investors buy or sell shares in lots when trading. A lot is equal to a certain number of shares,usually 100.

At the same time,Hong Kong has adopted the T+0 trading system,which refers to the settlement and clearing of trades as soon as they occur,i.e., the delivery of funds and shares can be completed on the same day of the trade. This system provides faster liquidity but also increases market instability and risk.

It is important to note that when trading stocks,investors are required to comply with relevant market rules and regulatory requirements,including the prevention of market manipulation,insider trading, and other violations. Violations of trading rules may be penalized,affecting investors trading eligibility and reputation.

Investors can obtain information such as financial reports and announcements of listed companies through HKEx's website or the information platforms provided by securities companies to assist in investment decisions. A timely understanding of a company's operating conditions and financial situation will help investors make sound investment decisions.

The trading system in Hong Kong is relatively sound and provides investors with a convenient, fair, and transparent trading environment, attracting the attention and participation of global investors. However, the trading rules and timing of Hong Kong stocks may be adjusted according to market conditions and regulatory policies. Investors are advised to pay close attention to market dynamics and follow the relevant trading regulations.

How to open an account for trading Hong Kong stocks

| Content |

Things to keep in mind |

| Choosing a stockbroker |

Choose a reputable broker, and understand their rates and service quality. |

| Provide proof of identity and funds. |

Submit an ID and proof of funds for compliance. |

| Fill out the application form. |

Complete the account application form accurately. |

| Signing agreements and documents |

Please sign to confirm your agreement with the trading terms. |

| Deposit funds |

Deposit funds into the securities account in order to start trading. |

| Choose a trading platform. |

Select a suitable trading platform and understand its features. |

| Place a trade order. |

Place accurate stock orders on the platform. |

| Monitor Portfolio |

Monitor portfolios and adapt strategies timely. |

Disclaimer:This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment,security, transaction, or investment strategy is suitable for any specific person.

Hong Kong Stock Index

Hong Kong Stock Index Hong Kong Stock Trading Hours and Rules

Hong Kong Stock Trading Hours and Rules