Honda and Nissan are in talks to merge by 2026,a historic pivot for Japan's car industry that underlines the threat Chinese EV makers now pose to the world's long-dominant legacy car makers.

The new company would rank the world's third-largest carmaker by vehicle sales after Toyota and Volkswagen. The deal will even outweigh the merge between FCA and PSA back in 2021.

But the proposed integration stems from a vehicle electrification wave rather than a market share loss to other traditional players. In the year ending in November, Toyota's sales were down 1.2%.

Foreign brands have lost ground in the world's biggest market China to BYD and other domestic makers of electric and hybrid cars loaded with innovative software.

Chinse carmakers have seen their market share at home grow to around two-thirds as of July 2024, according to data from the China Passenger Car Association, in a blow to Japanese peers in particular.

A key advantage of Japanese cars is that they consume less energy and hence more cost-saving, but the technology of battery that powers EVs has made the competency trifling.

Moreover EV sales are surging in Southeast Asia, led by China's BYD and Vietnam's VinFast, eating into the car market dominated by Japanese and Korean firms, according to Counterpoint Research.

No panacea

Honda's shares rose as much as 12% following the news on Tuesday though the Nikkei index closed lower. Adding to the gains, it announced to buy back 24% of its issued shares by 23 December next year.

The deal is positive overall for the credit quality of the two Japanese companies, but it carries risks especially for Honda with much weaker debt metrics of Nissan, according to Moody's Ratings.

The agency added, Honda has lower margins in its automotive business compared with its motorcycle business, giving it less flexibility in absorbing Nissan's loss-making operations.

There are also business risks. Former Nissan chairman Carlos Ghosn said he did not believe the Honda-Nissan alliance would be successful, as the two were automakers were not complementary.

Nissan has been struggling with declining sales and profits this year. It announced a plan to cut 9.000 jobs and an executive reshuffle in November as part of its push for a turnaround.

Still both companies have seen their stock prices decline in 2024 following this week's jump, while Toyota enjoyed an around 12% increase in its market cap.

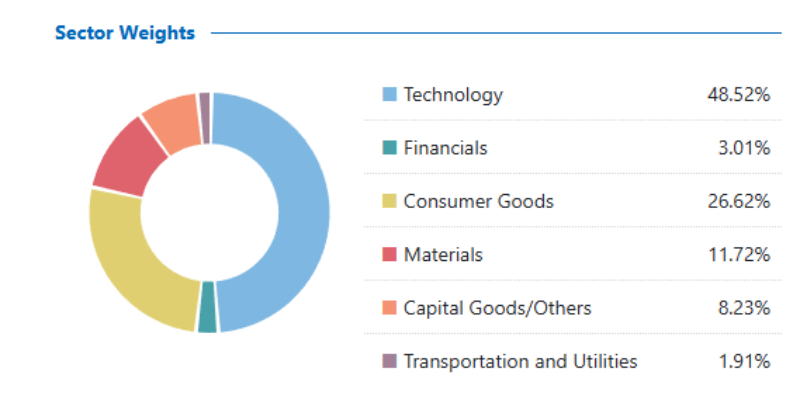

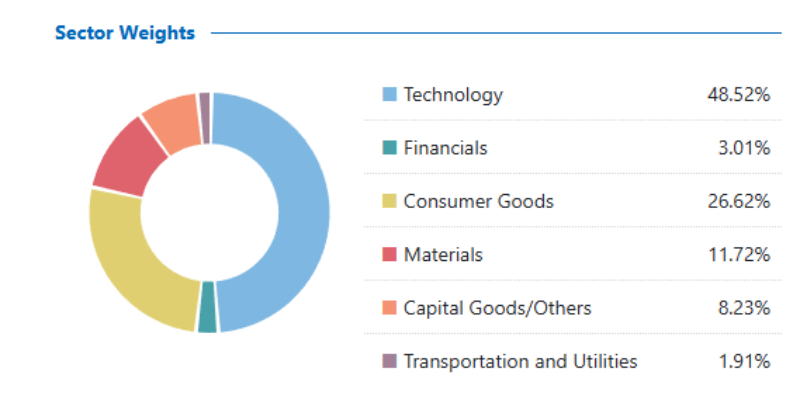

Data compiled by Nikkei shows that consumer goods has the second largest weight in the Nikkei index. Most stocks categorised as automobile and parts in the sector became laggards in the past year.

Broad picture

The Nikkei 225 was up roughly 19% in 2024 largely due to robust exports. But for it has been a different story dollar-based investors as the yen has depreciated by more than 11%.

The performance is far below those posted by its US peers – especially the Nasdaq 100 nothing a gain of over 30%. Even the Hang Seng index and the A50 index have had a better year.

Although the yen's slump and the BOJ's rate hikes supported financial stocks, the limited net inflow shows that the weakness and volatility in the currency are keeping foreign funds away.

This trend is likely to continue in 2025, as traders trim their bets on a yen rally after the Fed's more hawkish tone and the BOJ's rate hike ambiguity help prompt one of the most popular carry trades.

With Trump's return to power, many Asian nations have a rethink of planned monetary easing. If Japan interest rates stay low for longer, we could see a lack of catalyst to push financial stocks higher in 2025.

Chemicals and vehicle manufacturing are the most likely to take a big hit from potential tariffs. Therefore, whether the Japanese stock market can rally further still hinges on the technology sector.

Semiconductor manufacturers will spend a record $400 billion on computer chip-making equipment in 2025-2027. SEMI estimated in September. Japan will be a natural beneficiary of the rush.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.