The Money Flow Index (MFI) is a technical indicator that helps traders assess market conditions by analysing price movements and trading volume.

Often referred to as a volume-weighted Relative Strength Index (RSI), the MFI measures the strength of money flowing into and out of an asset over a specified period.

Unlike other momentum indicators focusing solely on price, the MFI measures both price and volume, making it a more comprehensive tool for identifying trends, overbought and oversold conditions, and potential reversals. This unique characteristic makes it particularly useful for beginner and experienced traders looking for reliable signals to enter or exit trades.

Understanding the Money Flow Index (MFI) and Formula

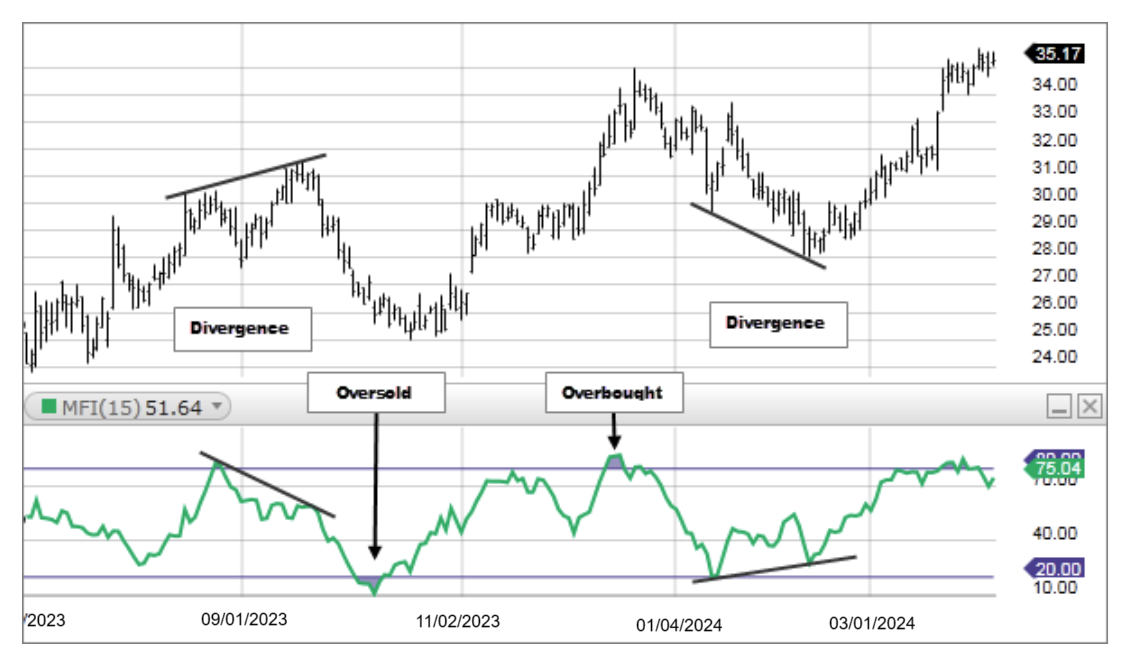

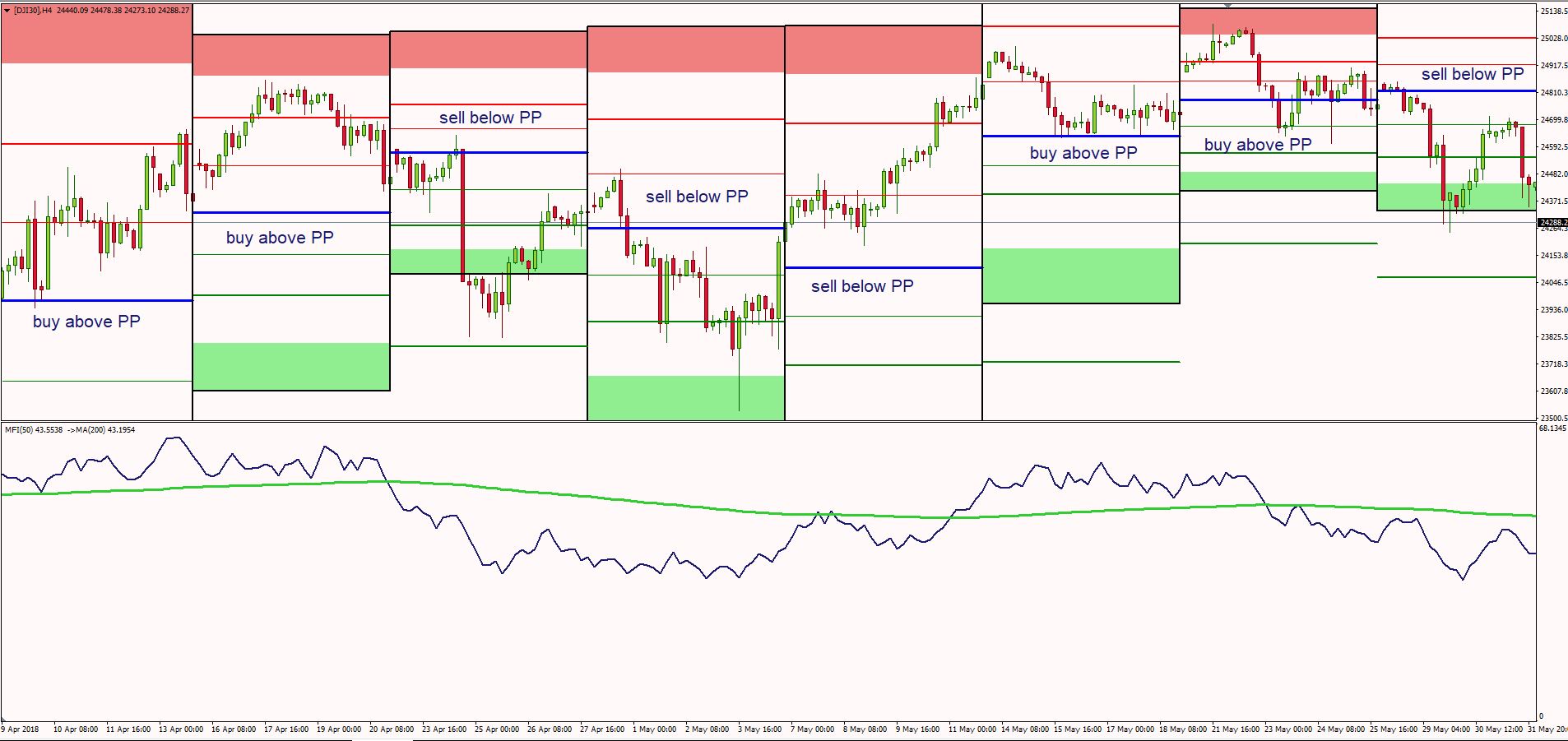

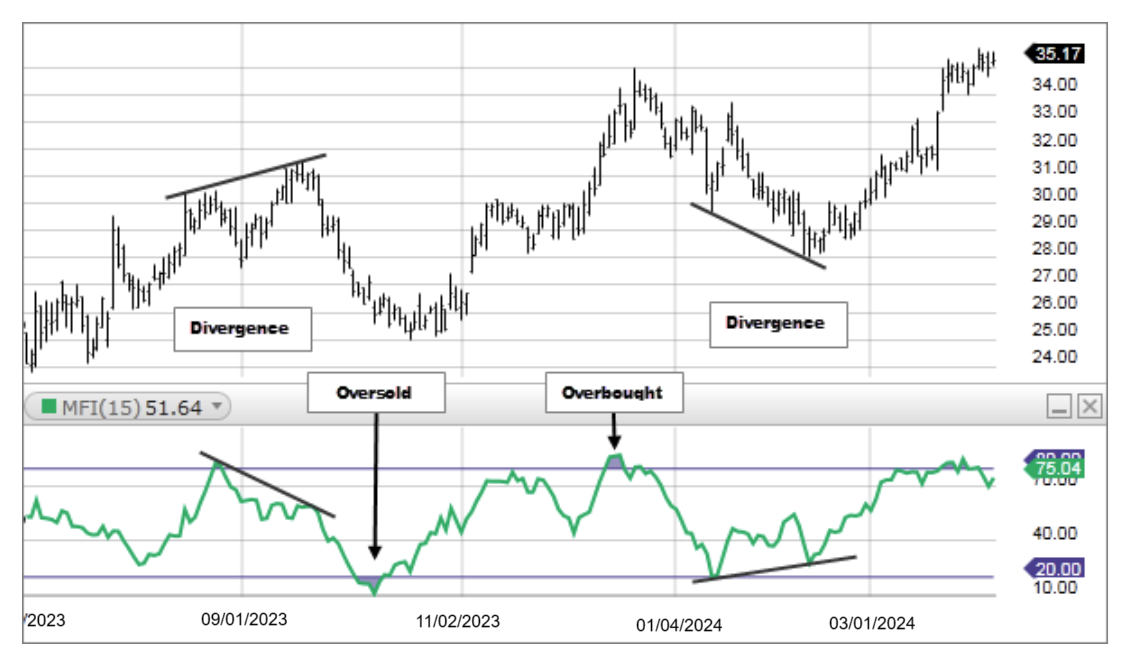

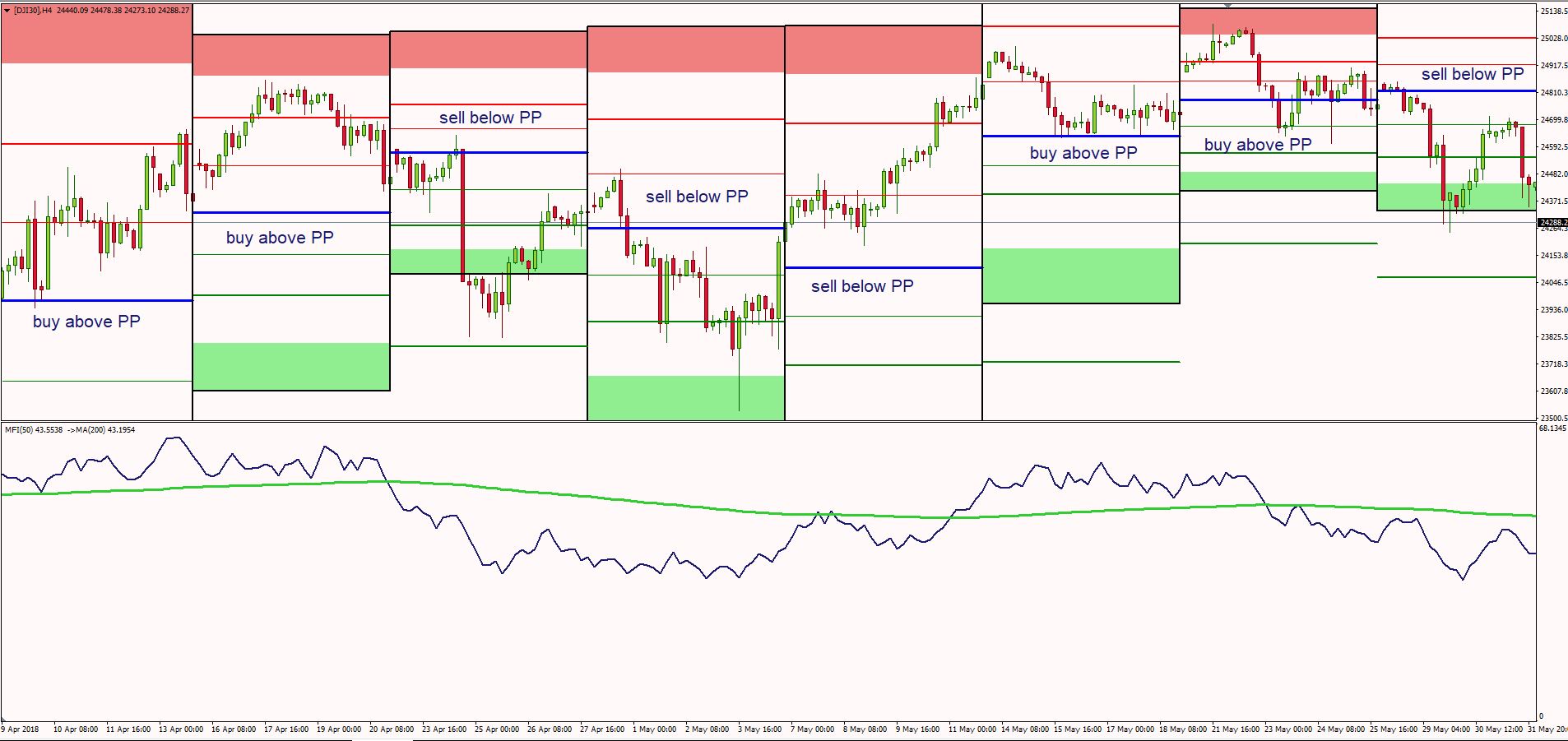

The MFI operates on a scale of 0 to 100, where values above 80 indicate an overbought condition, suggesting that an asset may be due for a price correction, while values below 20 signal an oversold condition, indicating a potential price increase. It is used in stock, forex, and cryptocurrency markets, where volume affects price action critically.

The calculation of the MFI involves multiple steps. First, the typical price is determined by averaging the high, low, and closing prices of a given asset. The money flow is then calculated by multiplying this typical price by the trading volume. Next, the positive and negative money flow is derived based on whether the typical price has increased or decreased compared to the previous period.

The money flow ratio is obtained by dividing the total positive money flow by the total negative money flow over a selected period, usually 14 days. Finally, the MFI is calculated using the formula. Listed are the full steps of using the MFI:

Typical Price = (Low + High + Close) / 3

Raw Money Flow = Volume x Typical Price

Money Flow Ratio= 14-period Positive Money Flow / 14-period Negative Money Flow

Money Flow Index (MFI) = 100 – [100 / (1 + Money Ratio)]

Example of Applying the MFI Formula

As mentioned above, the MFI is calculated using a 14-period timeframe, which is the most commonly used setting. Assume we have the following data for a stock over 14 days:

High Prices: 52, 53, 54, 55, 54, 56, 57, 55, 54, 56, 58, 57, 59, 60

Low Prices: 50, 51, 52, 53, 52, 54, 55, 53, 52, 54, 56, 55, 57, 58

Close Prices: 51, 52, 53, 54, 53, 55, 56, 54, 53, 55, 57, 56, 58, 59

Trading Volumes (in millions): 1.5, 1.8, 2.0, 2.3, 2.1, 2.4, 2.7, 2.5, 2.2, 2.8, 3.0, 2.9, 3.2, 3.5

Firstly, we determined the typical price. By applying the (Low + High + Close) / 3 formula for the first day with (50+52+51) / 3, we would get a TP value of 51 with 52.00, 53.00, 54.33, 53.00, 55.00, 56.00, 54.00, 53.00, 55.00, 57.00, 56.00, 58.00, 59.00 following next.

Then, multiply your TP value by the volume displayed on each day, and you will get 76.50, 93.60, 106.00, 124.96, 111.30, 132.00, 151.20, 135.00, 116.60, 154.00, 171.00, 162.40, 185.60, 206.50 respectively.

Following up, it's time to determine the money flow. For example, if today's TP is greater than yesterday's, add the Raw Money Flow to the Positive Money Flow (PMF). Vice versa, if today's TP is less than yesterday's, add the Raw Money Flow to Negative Money Flow (NMF). If today's TP is equal to yesterday's TP, do nothing. For our example, we calculate:

93.60, 106.00, 124.96, 132.00, 151.20, 154.00, 171.00, 185.60, 206.50

Total PMF = 1324.86

111.30, 135.00, 116.60, 162.40

Total NMF = 525.30

1324.86/525.30

Total MFR == 2.52

The final step is to calculate the MFI using the formula. In this example, the formula will be something like this: 100 – [100 / (1 + 2.52)], giving us an answer of 71.59.

With an MFI of 71.59, the asset is nearing the overbought zone (above 80), indicating buying pressure. If the MFI continues to rise and crosses above 80, it may suggest a potential price correction or reversal. Conversely, if the MFI starts declining, it could indicate that momentum is shifting, and traders may look for a selling opportunity.

For beginners, a straightforward trading strategy using the MFI involves identifying extreme overbought and oversold conditions and combining them with other technical indicators. The first step in this strategy is to monitor the MFI for readings above 80 or below 20, which signal potential reversals. Once an extreme reading is detected, traders should seek confirmation from other indicators such as moving averages, candlestick patterns, or trendlines.

For a buy trade, if the MFI falls below 20 and starts turning upward while the price reaches a support level or forms a bullish candlestick pattern, it may indicate a good entry point. Traders can enter a long position with a stop-loss placed below the recent low to protect against further downside risk.

For a sell trade, if the MFI rises above 80 and starts turning downward while the price nears a resistance level or forms a bearish candlestick pattern, it may suggest a selling opportunity. Traders can enter a short position with a stop-loss above the recent high and aim to take profits when the MFI drops toward the 50 level, indicating weakening bullish momentum.

Common Mistakes to Avoid When Using the MFI

While the MFI is a powerful tool, traders should know common pitfalls that can lead to inaccurate trade decisions. One of the biggest mistakes beginners make is relying solely on the MFI without considering other aspects of technical analysis. Although the MFI provides valuable insights into money flow and momentum, using it in isolation can lead to false signals.

Another mistake is misinterpreting overbought and oversold conditions as immediate reversal signals. Just because the MFI reaches 80 or 20 does not guarantee that the price will reverse immediately. In strong trending markets, assets can remain overbought or oversold for extended periods before changing direction.

Thus, traders should seek confirmation from price action and other indicators such as the RSI, moving averages, and volume analysis before executing trades based on extreme MFI readings.

Conclusion

With everything considered, the Money Flow Index is a valuable tool for beginners looking to improve their trading strategies by incorporating volume analysis into their technical approach.

By identifying overbought and oversold conditions, spotting divergences, and confirming support and resistance levels, they can develop a structured approach to trading with greater confidence and eventually achieve long-term success in financial markets.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.