The name Johnson & Johnson is familiar to many people, as its products such as milk bottles and talcum powder have grown up with many people. But since its talcum powder was involved in a cancer lawsuit, the brand has not only become less common in everyday life. It has also suffered a major blow in the stock market: its shares plunged 10 percent and its market value evaporated by more than $40 billion, the biggest one-day drop in 16 years. Despite this blow, Johnson & Johnson remains at the top of the global market capitalization list. Next, we'll take a closer look at Johnson & Johnson and its stock performance from an investment perspective.

History of Johnson & Johnson

Johnson & Johnson, or J&J for short, is one of the world's leading healthcare companies. The company's business spans medical devices, pharmaceuticals, and consumer products, with over 250 subsidiaries and product sales in more than 170 countries. As a constituent of the dow jones industrial average and a Fortune 500 company, it is known for its reputation for corporate excellence and continuous innovation.

The company was founded in 1886 by brothers James Wood Johnson and Robert Johnson. They chose New Brunswick as the location for the company's headquarters because of its high level of industry and proximity to the Raritan Canal, which provided easy access to the company's operations.

The company initially focused on producing plasters, gauzes, and bandages in response to the growing problem of bacterial infections in the late 1800s. Since its founding, Johnson & Johnson's commitment to improving healthcare has been fuelled by a spirit of innovation and product development that has propelled the company into the world's largest diversified healthcare, nutraceutical, and care products company. Today, the company is known worldwide as a leading manufacturer of healthcare products with an extensive product line and a reputation for innovation.

Throughout the company's history, Johnson & Johnson has created several groundbreaking products. For example, a commercially available first aid kit was introduced in 1888. an innovation that effectively addressed the inability of railway workers to receive timely treatment for their injuries. In 1890. the company transformed medical sutures into affordable dental floss for consumers. Although the invention of dental floss was not of the company's making, this transformation greatly contributed to the popularity of the product, making dental floss an essential tool in daily oral care.

In addition, baby powder, introduced in 1894. became an important source of revenue for Johnson & Johnson and had a profound impact on the company's future growth, and in 1920. a company employee invented Band-Aids to solve the problem of dealing with his wife's injuries, a product that would go on to become one of the best-selling products in the company's history. These innovations not only enriched the company's product line but also solidified its leadership position in the global marketplace.

As the company entered the 20th century, it began to expand internationally, acquiring a number of companies. In the 1920s, it introduced Modex sanitary pads and anti-flu masks. In the 1950s, the company ventured into the pharmaceutical industry, acquiring, among other things, the Zlag chemical plant in Switzerland and McNeil Laboratories in the U.S. In 1976. during the tenure of its chairman, James Burke, the chairman of the board of directors, he was confronted with the Tylenol Affair (the Tylenol incident) when he took quick steps to restore the company's reputation and succeeded in getting Tylenol to regain market share.

Since the 1980s, Johnson & Johnson has expanded its business through a steady stream of acquisitions, including companies in the medical care industry, eye care industry, and biotechnology. The company became a market leader with the introduction of its first daily disposable contact lenses in 1993. and in 2002 it acquired Alza, a leader in drug delivery. During the 2000s, the company continued to drive growth through acquisitions and investments.

Despite its history of notable success, the company has faced challenges, particularly in cancer cases related to baby talcum powder. In 2012 and 2017. it was awarded large payouts for the potential link between tobacco powder and ovarian cancer, and in 2018. it was awarded $4.67 billion in damages for this issue.

These cases have put a strain on the company's finances and reputation, but Johnson & Johnson remains committed to maintaining its global leadership. As a giant in the healthcare industry, the company has achieved steady growth, with revenues growing from $65bn in 2011 to $96.3bn by 2023. thanks to its high-quality products and strong reputation.

Since its founding, Johnson & Johnson has expanded with diversified businesses and innovative products, growing from a medical supply manufacturer to a global pharmaceutical giant. Its success stems from continuous innovation, a globalization strategy, and a broad product pipeline that has placed it firmly at the forefront of the global healthcare industry.

Johnson & Johnson Pharmaceuticals and Medical Devices, Inc.

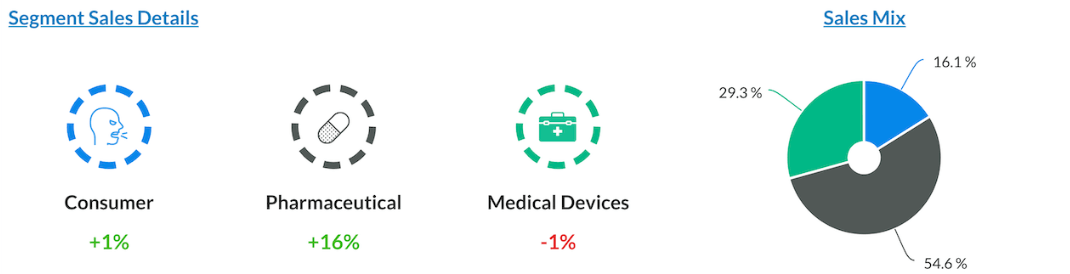

The company is organized into three main operating divisions: the pharmaceuticals division, the medical devices division, and the personal care products division. These divisions are Johnson & Johnson's primary revenue generators, with the Pharmaceuticals division experiencing significant growth through innovation and market expansion, the Medical Devices division remaining stable in the face of the outbreak, and the Personal Care Products division experiencing a slight revenue decline.

As Johnson & Johnson's number one revenue-generating division, the Pharmaceuticals segment focuses on developing innovative medicines across the fields of immunology, oncology, neuroscience, and infectious diseases. Immunology drugs treat autoimmune and inflammation-related diseases, such as rheumatoid arthritis; oncology drugs are used to treat blood cancers and solid tumors; neuroscience drugs target central nervous system disorders such as depression and Parkinson's disease; and infectious disease drugs are used to treat bacterial and viral infections.

Johnson & Johnson's Pharmaceuticals division has several market-leading drugs, such as Stelara (ustekinumab), for the treatment of moderate-to-severe plaque psoriasis and Crohn's disease; Darzalex (dalimumab), for the treatment of multiple myeloma; Imbruvica (ibrutinib) for the treatment of chronic lymphocytic leukemia (CLL) and small lymphocytic lymphoma (SLL); and Xarelto (ibuprofenib) for the treatment of chronic lymphocytic leukemia (CLL) and small lymphocytic lymphoma (SLL); as well as Xarelto (ibuprofenib) for the treatment of chronic lymphocytic lymphoma; and Xarelto (rivaroxaban), an oral anticoagulant for the prevention and treatment of thrombophilia.

The company's pharmaceuticals division is also active in research and development globally, working to develop new drugs and treatments. The company conducts extensive clinical trials to evaluate the safety and efficacy of new drugs and partners with academia, research institutes, and other pharmaceutical companies to drive innovation and research and development. The company also invests in biopharmaceuticals, covering cutting-edge technologies such as gene therapy, cell therapy, and immunotherapy.

Its pharmaceutical products are marketed globally, and the company has manufacturing, R&D, and sales facilities in several countries, with global market demand and policy changes having a profound impact on the business. Recently, the company has also continued to drive new drug approvals and launches and expand its product pipeline, while making strategic investments in biotechnology and emerging therapies to address growing healthcare needs and challenges.

Of course, Johnson & Johnson's Pharmaceuticals division faces multiple challenges and risks, including patent expiration, drug safety issues, and drug price controls. Patent expiration can lead to generic entry into the market, undermining sales and pricing, as in the case of Stellara, whose patent is about to expire in the U.S. and the European Union.

While companies mitigate this risk through acquisitions and collaborative R&D, drug efficacy and safety issues can lead to lawsuits, recalls, and brand damage, with Johnson & Johnson's pharmaceutical division having paid $8.3 billion in litigation costs over the past decade. In addition, U.S. government controls on drug prices, particularly drug pricing legislation pushed through by the Biden administration, could limit drugmakers' pricing power.

Its second-largest share, Johnson & Johnson's medical devices division, operates in four main divisions: surgical products, orthopaedics, ophthalmology, and interventional. Through a series of acquisitions, particularly between 2008 and 2011. the company consolidated its market position in these areas. The global market for laparoscopic devices is expected to reach $22 billion over the next five years as the company's strategy shifts from general surgical products to advanced products, such as energy instruments and anastomoses, in response to changing market demands.

Over the past decade, the company divested its slow-growth divisions of diabetes and diagnostics to focus its resources on more promising markets. However, comparative analyses have shown that despite these adjustments, the Medical Devices division's adjusted margins have declined and revenue growth has fallen short of expectations.

As a result, it is again aggressively investing in the emerging area of digital surgery, integrating surgical robotics, artificial intelligence, and advanced imaging to develop next-generation surgical products. In 2019. Johnson & Johnson acquired Always Health and launched the Monarch platform, which utilizes robotic technology to improve bronchoscopy. In addition, the company's VERB Surgical is developing the OTAVA system, which aims to challenge the existing da Vinci surgical robots through greater flexibility and smaller size.

In the surgical products segment, the company's strategic focus has shifted to advanced products such as energy instruments and anastomoses, with the market set to continue to grow over the next few years as the energy instruments market is expected to be expansive. Through the acquisition of Maggedae Medical, an electrosurgical instrument company, Johnson & Johnson has further expanded its energy instrument product line.

In orthopedics, the company's $20 billion acquisition of Swiss orthopaedic company Census in 2012 significantly boosted market share, but segment revenues declined due to a slowdown in the global orthopaedic industry. To address this challenge, the company is in the process of acquiring Autodoxy, a robot-assisted surgery company, to expand its business. Additionally, through strategic acquisitions in ophthalmology and interventional therapies, the company has strengthened its market position in contact lenses and interventional products, and the interventional therapies segment is expected to grow at a CAGR of 6% to 9% over the next five years.

In summary, Johnson & Johnson's Pharmaceuticals segment is expected to continue its market leadership position as it excels with continued innovation and a strong product pipeline. The Medical Devices segment demonstrated strong market competitiveness and stable profitability, but the Orthopaedics segment is challenged by slowing growth and intense competition in the surgical robotics space. Nonetheless, the company maintained solid financial performance through effective strategic alignment and business expansion.

Johnson & Johnson Stock Performance Analysis

Johnson & Johnson Stock Performance Analysis

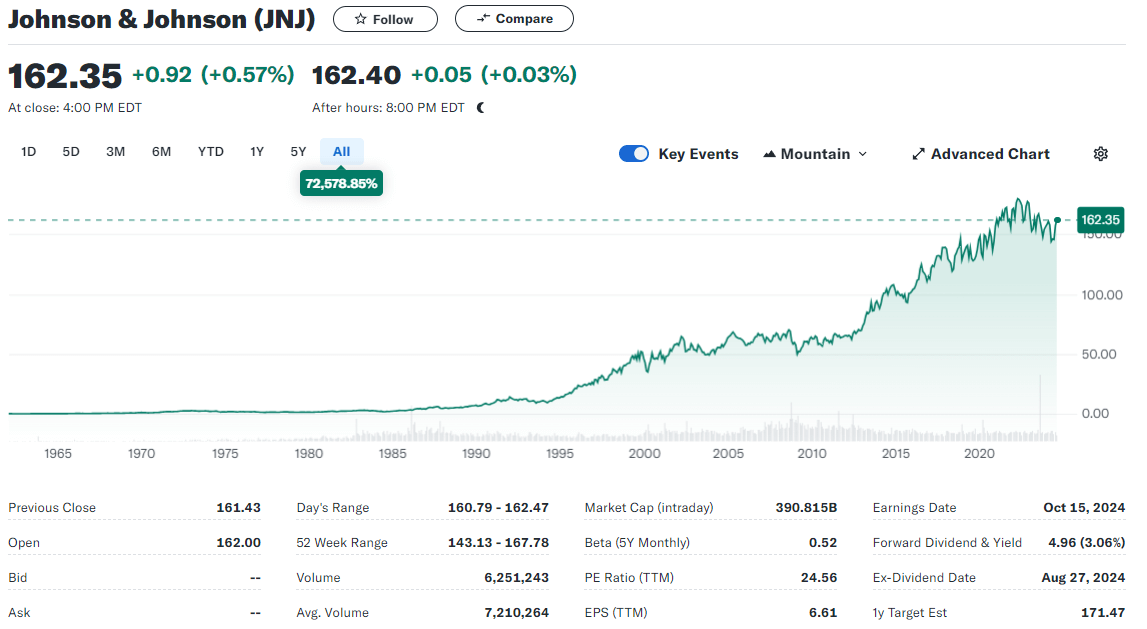

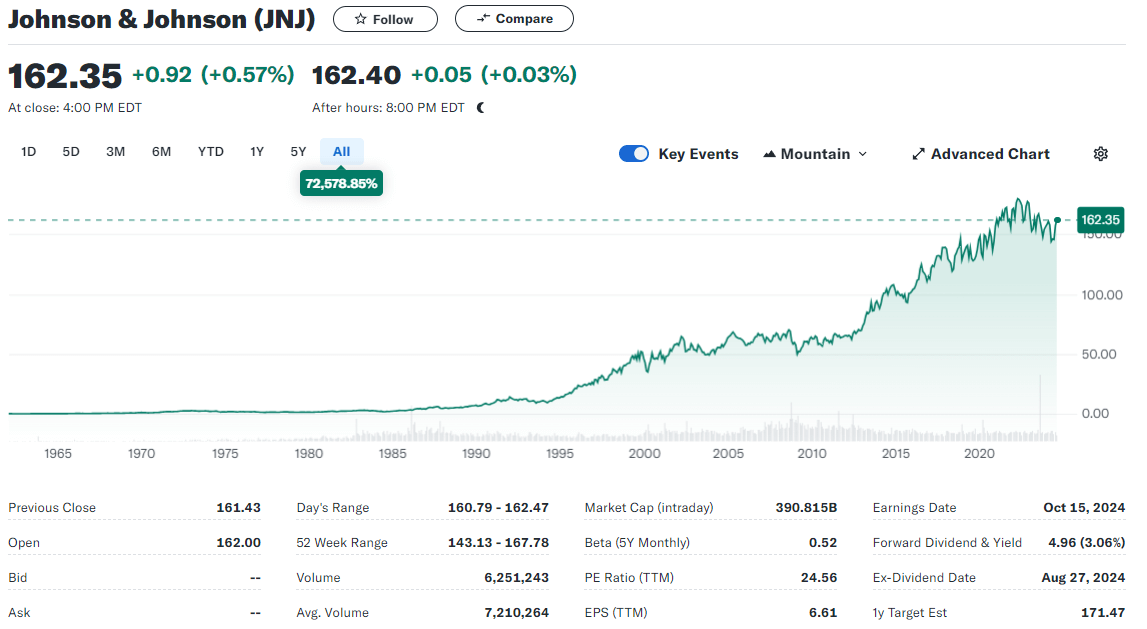

Against the backdrop of this year's U.S. stock selloff, the healthcare and pharmaceutical sectors have performed particularly well, with Johnson & Johnson (ticker: JNJ) demonstrating strong stability. The company's market capitalization stands at $390.8 billion, close to its five-year high of $181. Johnson & Johnson's stock price has fallen less compared to other tech stocks, highlighting its stability and resilience as a medical products company.

In terms of revenue and profitability, Johnson & Johnson has shown continued growth. Total revenue increased from $81.1 billion in 2018 to $96.3 billion last year, operating income grew from $2.1 billion to $2.34 billion, and net income rose from $15 billion to $35 billion. These figures show that the company has maintained solid growth in both revenue and profitability.

Current assets of about US$615.35 billion were sufficient to cover current liabilities of US$4.6 billion, demonstrating good short-term solvency. Long-term liabilities stood at about $2.6 billion, with a total debt-to-revenue ratio well below 4. indicating strong solvency. Retained earnings grew from $10.6 billion to $12.3 billion, reflecting the continued growth and financial soundness of the company's accumulation.

Meanwhile, the company's cash flow position is strong, with operating cash flow higher than investing cash flow, indicating that the company generates sufficient and stable cash from operations. Free cash flow increased from US$18bn to US$19bn, demonstrating the company's ability to manage cash flow well while maintaining stable growth, which provides a solid foundation for its continued investment and development.

In terms of the price-to-earnings ratio (PE ratio), it is currently 24.0. which is lower than the industry standard of 25.0. indicating that Johnson & Johnson's share price is at a reasonable level relative to its profitability and meets the investment requirements. This valuation level reflects the company's balance between profitability and share price, further enhancing its attractiveness as an investment option.

Moreover, Johnson & Johnson excels in terms of dividend safety and dividend growth. The dividend yield has stabilized between approximately 2.6% and 2.64%, close to its five-year average. The company's dividend has grown at an average annual rate of 9% over the past 20 years and has remained at 6% to 7% in recent years, demonstrating the company's strong ability to pay and grow its dividend consistently over time. Compared to some tech companies that don't pay dividends, this is an attractive yield that provides investors with a solid return.

Meanwhile, based on a 3.9% annual growth rate and a 7.5% discount rate, the company's fair share price is $163. compared to the current share price of $162.35. This suggests that Johnson & Johnson's share price is close to its reasonable valuation level, which may provide a more appropriate entry point for investors. In the current market environment, this proximity to a reasonable valuation may help investors seek potential investment opportunities in the solid healthcare sector.

However, it is important to note that while Johnson & Johnson's stock price has performed solidly through this year's market volatility, its revenue growth has been only 1.9% over the past year, indicating a slow growth trend. This slow growth could impact the company's future profitability and shareholder returns.

It is also important to look at the company's history of problems. For example, the company has faced legal action over baby talcum powder that contained talcum powder, a possible carcinogen. The company knowingly continued to sell this product and adopted delaying tactics in the litigation, attempting to avoid liability through bankruptcy and other means. These issues revealed problems with the integrity of the company's management and could have a negative impact on the company's reputation and future growth.

In conclusion, Johnson & Johnson's financial performance is solid, and almost all financial indicators meet the investment criteria. The company's stable performance in the market provides strong long-term investment value, and the current share price is reasonable for investment. However, investors still need to pay attention to the risks facing the company, including slow revenue growth and historical issues. These risk factors may have an impact on the company's future performance and shareholders' interests and should therefore be considered thoroughly when making investment decisions.

Johnson & Johnson and its stock performance

| Company Profile |

Stock Performance |

| A global leader in the healthcare industry |

market cap $390.8bn, near five-year highs |

| Businesses include drugs and medical devices. |

Stock price near fair value |

| Founded in 1886 |

Revenue growth of 1.9% over the past year |

| Markets in more than 170 countries |

Risks: slow growth and past legal issues |

| Products: medical devices, drugs, care items. |

A good time for investors to enter |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

Johnson & Johnson Stock Performance Analysis

Johnson & Johnson Stock Performance Analysis