In the investment field,'settlement date' is a term that often appears, but for many people it may be unfamiliar or difficult to understand because it is not common in daily life. However, it is actually a very important concept, especially with its significant impact on market volatility. An in-depth understanding of the meaning of settlement date and its potential impact is therefore crucial to successful investing.

What is Settlement Date?

What is Settlement Date?

It refers to the date on which both parties to a transaction agree to complete the exchange of money. In futures contracts, it marks the expiration of the contract, and the buyer and seller must fulfill the terms of the contract and complete the delivery of the asset. In stock trading, the settlement date is the date on which the stock and funds are delivered, marking the official completion of the transaction. At this time, the buyer needs to pay for the purchase of shares, and the seller needs to deliver the corresponding shares.

In stock trading, the settlement date is a key part of ensuring the legitimacy and integrity of the transaction. It is the date on which the buyer pays for the shares, and the seller must transfer the shares to the buyer. The exchange is responsible for ensuring that this process runs smoothly, that both parties fulfill their respective obligations, that the funds and shares are delivered correctly, and that ownership of the shares and payment of the funds are formally confirmed.

It also plays an important role in market stability. It ensures the stability and fairness of transactions, reduces the occurrence of trading disputes, and maintains the overall trust and order of the market. By completing the final settlement of all transactions, the settlement date helps maintain the orderly operation of the market and enhances the confidence of market participants in the trading process.

In futures trading, the date is the final date of contract settlement, and all open futures contracts must be completed on this day. Settlement is usually categorized into physical delivery, which involves the exchange of actual commodities, and cash delivery, which involves the payment of profit and loss through cash, and traders usually close out their positions before that date to avoid the obligation of physical delivery.

This practice helps traders avoid the complex procedures and potential market volatility of dealing with actual commodities by ensuring that their trading activities are limited to the purchase and sale of futures contracts and do not involve the delivery or receipt of actual commodities. As a result, the strategy of closing out positions prior to the settlement date is a common risk management method for many futures market participants.

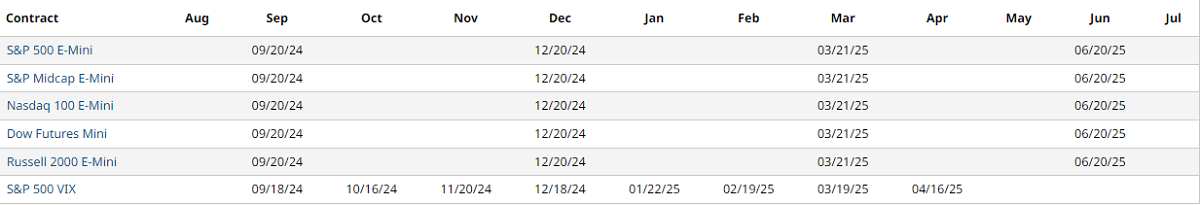

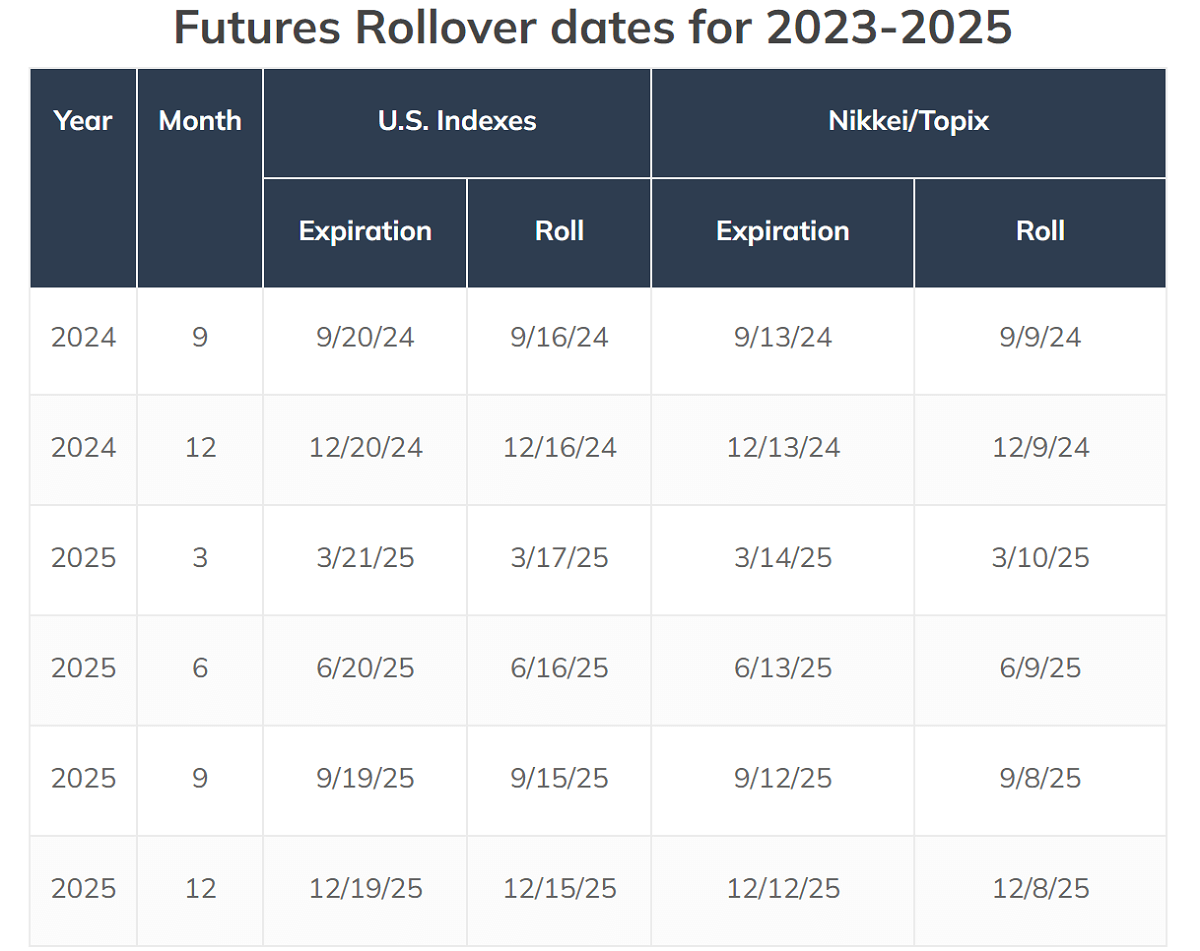

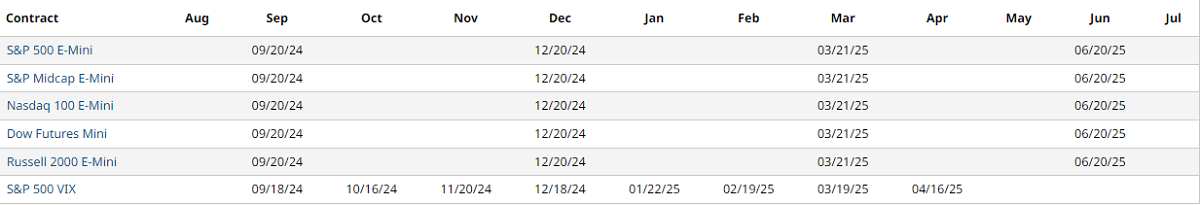

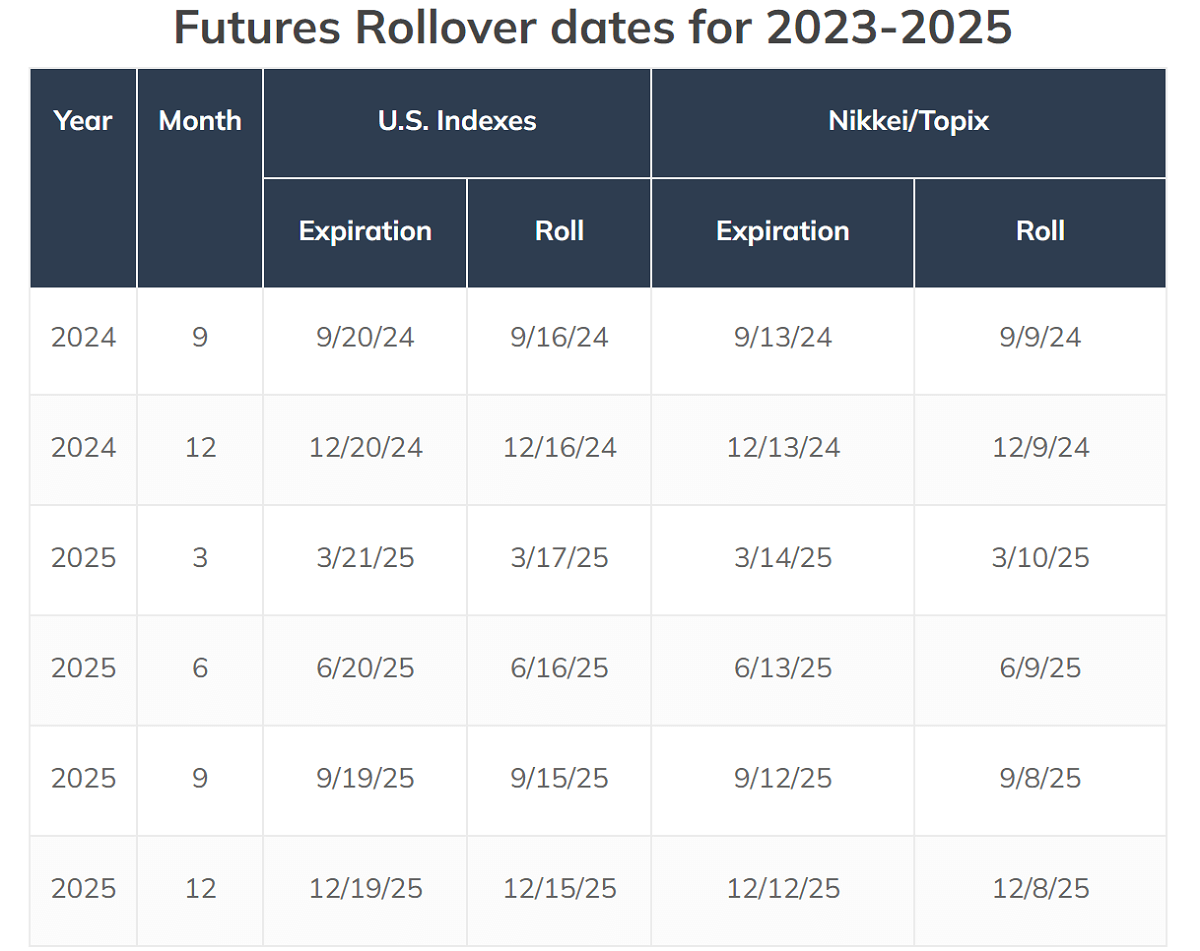

The settlement time of futures contracts is determined by the futures exchanges, and different types of futures varieties often have different schedules. For example, the time of agricultural futures is usually affected by seasonal factors, and exchanges will determine the appropriate settlement time based on the production cycle and storage needs of agricultural products. This seasonal arrangement ensures that the futures market is able to adapt to changes in the production and supply of agricultural commodities, thereby providing market participants with a reasonable delivery schedule that is in line with the actual pace of production and consumption.

Although the actual proportion of futures delivery is relatively low, it plays a crucial role between the futures and spot markets. The delivery mechanism essentially builds an important price bridge by ensuring that futures contracts match the price of the actual commodity at maturity. Such a bridge helps to bring futures prices and spot prices into convergence, thereby facilitating the price discovery process in the market and improving its efficiency.

Through delivery, price signals in the futures market can accurately reflect the supply and demand situation in the spot market, helping investors and producers make more informed decisions and enhancing the linkage between the futures market and the spot market. The effective transmission of such price signals enables market participants to adjust their strategies according to the actual supply and demand situation, improving the overall efficiency of the market.

However, the settlement date may also trigger significant market volatility, especially when futures contracts are close to expiry. Investors need to pay special attention to the arrangement of the last trading day in order to avoid holding open positions at a later date. If positions are not closed in a timely manner, investors may be exposed to unexpected physical delivery or cash settlement, resulting in unanticipated market risks and additional costs.

To summarize, it is crucial for investors to understand the settlement date and its related regulations. For example, investors should pay attention to the futures dates, understand the quality standards of the commodities, and deal with matters related to physical delivery or cash settlement. These preparations not only help to successfully complete the futures contract but also help to manage trading risks and make more accurate investment decisions.

What if I Don't Close My Position on the Settlement Date?

What if I Don't Close My Position on the Settlement Date?

In order to avoid making the actual delivery, most investors choose to close their positions before the settlement date. After this day, the open positions will enter the delivery phase. Prior to this date, investors have a final opportunity to close or rollover their positions to avoid the risk of physical delivery. The exact treatment will vary depending on the type of futures contract and market rules.

For futures contracts that require physical delivery (e.g., oil, gold, soybeans, etc.), the settlement date is usually arranged around the last trading day of the contract's expiry month. For example, WTI Crude Oil Futures contracts are usually delivered around the 20th day of the contract expiry month. On this date, open positions will enter the physical delivery process, where the actual commodity is delivered or received according to the terms of the contract.

If the position is not closed by then, it will usually enter the physical settlement process. This means that physical settlement or receipt of the underlying commodity is required in accordance with the terms of the contract. In the case of a seller, a specified quantity of the commodity must be delivered to the buyer on or before the same day. Conversely, in the case of the buyer, the corresponding quantity of the commodity needs to be received and paid for on that day. The whole process will be based on the contract requirements to complete the actual delivery of the commodity to ensure that both parties to the transaction fulfill the terms of the contract.

Futures companies usually automatically transfer open positions to the delivery process and are responsible for arranging physical delivery or informing you of the exact arrangements for delivery. If investors wish to avoid physical delivery, it is best to contact the futures company in advance to find out the specific options for rollover or closing out the position in order to avoid unnecessary trouble.

For financial futures contracts (e.g. stock index futures, Treasury bond futures), the settlement date is usually set on the last trading day of the contract's expiry month. This means that a financial futures contract will be settled on a specific date in the expiry month. For example, the S&P 500 futures contract is scheduled for the third Friday of the expiration month. Traders need to pay special attention to this date to ensure that the relevant closing or cash settlement operations are completed beforehand to avoid the obligation of actual delivery.

If an open position is not closed on the settlement date, the financial futures contract will be automatically cash settled. In other words, open positions will be settled at the market price, and profit and loss will be calculated, thus avoiding the actual operation of physical delivery. This approach simplifies the settlement process and reduces the complexity of physical commodity delivery.

In terms of settlement amount, cash will be received or paid accordingly based on the difference between the market price of the contract and the settlement price. The futures company is responsible for the cash settlement on the date and calculating and executing the relevant operations. The final settlement result will be automatically reflected in your account, ensuring the smooth completion of the trading process.

If you wish to avoid the actual delivery of the futures contract, you can also choose to carry out a rollover operation beforehand. A rollover operation consists of closing an expiring contract before expiration and simultaneously opening a new contract, usually for the next month. This method allows you to continue to hold a market position without having to physically deliver or take delivery of the underlying commodity, thus avoiding the complexity of physical delivery.

When doing a rollover, you need to contact the futures company in advance to find out the exact requirements and process of the rollover. The futures company will usually assist you in completing the rollover operation to ensure that the opening of the new contract and the closing of the old contract go smoothly. This avoids the obligation of actual delivery and maintains the consistency and flexibility of your investment strategy.

Forced closeout means that when an investor does not close out a position before the settlement date, the futures company or exchange may intervene to force the position to be closed out to avoid default or unnecessary delivery. This measure aims to ensure that all open positions are dealt with before expiry, thus preventing problems or disputes during trade execution. The purpose of forced liquidation is to maintain the stability of the market and the fulfillment of contracts and to prevent potential risks arising from investors' failure to deal with their positions in a timely manner.

During the process of forced liquidation, the futures contract will be liquidated at the current price in the market, which may result in additional costs or losses. If the market price is not favorable to the investor, the forced closeout may result in significant financial loss. Investors are therefore required to closely monitor market developments and close their positions in advance or take necessary measures to avoid additional costs and losses due to market fluctuations.

If a position is not closed on the settlement date, the contract for physical delivery will be subject to the physical settlement process while the cash-settled contract will be cash-settled. In order to avoid physical delivery, investors can also choose to roll over their positions in advance. Therefore, before that, investors should plan ahead and maintain communication with futures companies on how to properly handle open positions.

The Impact of Settlement Date on the stock market

The Impact of Settlement Date on the stock market

Its impact on the stock market is usually seen in changes in market volatility and trading behavior, especially on settlement days associated with the stock index futures and options markets. On this day, open options contracts are settled in the manner specified in the contract. It is usually accompanied by greater market volatility due to the impact on the market caused by less liquid markets and the closing and shifting operations of institutional investors.

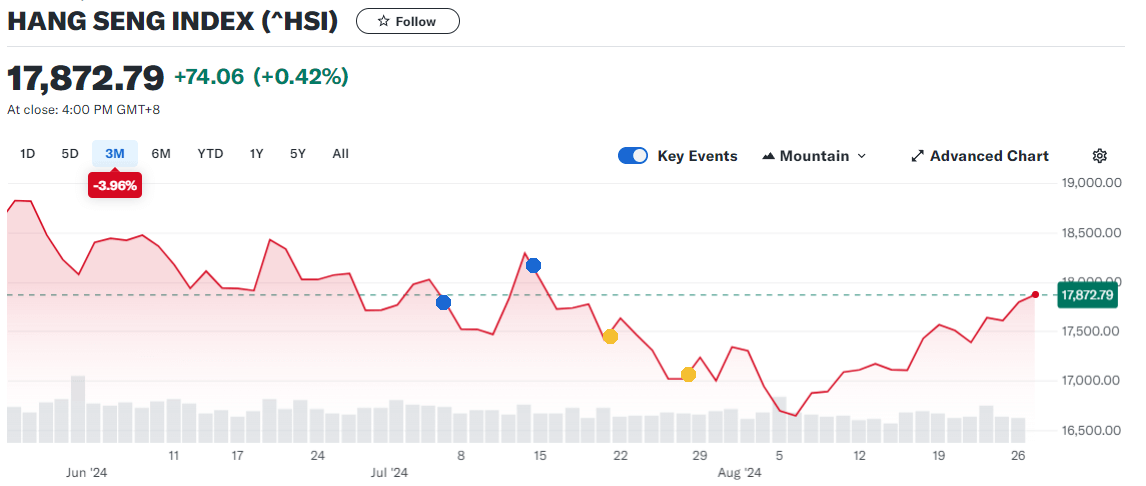

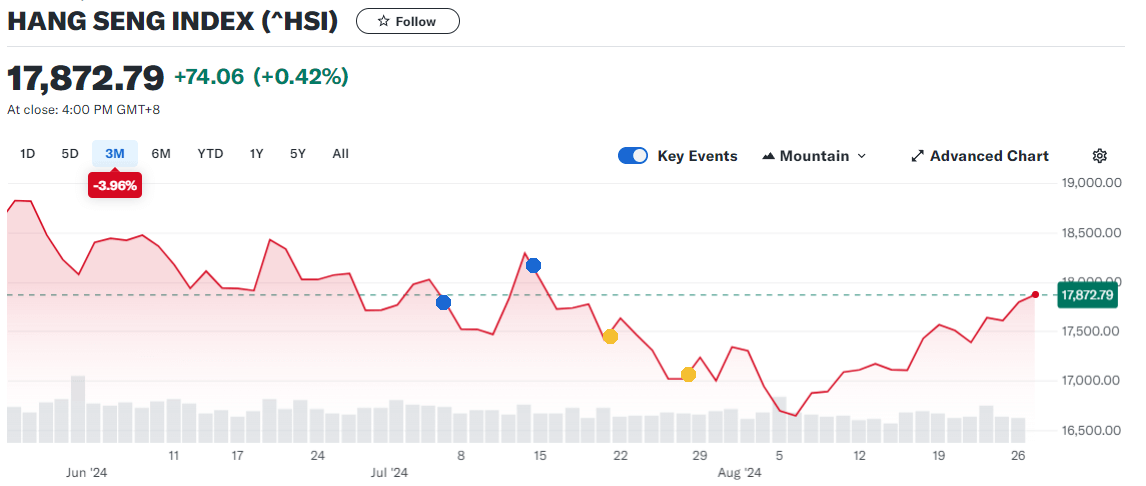

The stock market tends to fluctuate significantly in its proximity. This is mainly due to the fact that many investors will adjust their positions prior to it, including closing positions, rolling over (rolling contracts), or making hedging trades. These operations usually trigger a large number of buying and selling behaviors, leading to increased market volatility. For example, on the settlement day of Hong Kong stock options, the volatility of the broad market is usually higher, reaching 5% or more on certain dates.

Historical data shows that such broad market volatility will also exhibit certain patterns. As shown in the chart above, the Hang Seng Index had plunged by 2.26% on the first two settlement dates of the July options, while it rose by 3.63% on the last two dates. This volatility not only affects the broader market but also has a noticeable impact on the performance of individual stocks, such as Meituan, Jingdong, and Alibaba, which have also shown significant volatility.

Prior to this, futures and spot prices tended to converge, as futures prices ultimately needed to match spot prices. Market participants would use arbitrage trading to narrow the spread between futures and spots. spots.? This convergence effect, while it may lead to short-term price changes in the stock market, is usually a sign of market effectiveness, indicating that the futures market is converging to the spot market price.

As for the settlement date, institutional investors tend to carry out a large number of closing and transferring operations, and this large-scale trading activity may lead to sharp fluctuations in market prices. When an institution needs to close an option position, a large number of buy and sell orders will be concentrated in the market, which in turn will have a significant impact on the price, leading to drastic price movements within a short period of time.

In addition, large-scale trades made by holders at the expiration of an options contract can also have a significant impact on market prices. These transactions usually involve a large number of buy or sell orders, and around the settlement date, the market can experience significant price fluctuations as a result of these concentrated trading behaviors, which can drive prices up or down.

Institutional investors and traders often adjust their portfolios as settlement dates approach, including by making position adjustments or hedging trades. This behavior may have a short-term impact on the prices of individual stocks or indices, especially in market environments where trading volumes are low and price fluctuations may be more pronounced.

A large number of futures contracts need to be hedged by selling stocks, which may trigger a concentrated sell-off and lead to a decline in the stock market. At the same time, arbitrage trading can exacerbate market pressures. As the date approaches, arbitrage behavior, taking advantage of the difference between futures and spot prices, may increase selling pressure in the market, which could further drive down Stock Prices.

Settlement dates may trigger significant changes in liquidity, especially around the expiration of futures on a particular stock or index. Fluctuations in liquidity may widen bid-ask spreads and increase transaction costs, thereby affecting the overall performance of the market. Such changes in liquidity usually make the bid and ask prices in the market more volatile, which in turn has a negative impact on the normal functioning of the market.

In addition, it may also lead to a drying up of market liquidity. As a result of increased risk, some market participants may reduce their trading activities, which in turn reduces market liquidity. When the market is illiquid, a large number of sell orders may lead to a rapid decline in stock prices as buyers are unable to effectively offset the pressure from sellers. At the same time, imbalances in liquidity, especially when trading is concentrated, may exacerbate short-term volatility in the market, leading to sharp price swings.

Technical factors also play an important role in market volatility. For example, the triggering of a technical stop-loss order can trigger a massive influx of selling into the market, which can exacerbate a price decline. When market prices fall below key support levels, automatically triggered stop-loss orders can trigger more selling pressure, further pushing prices downwards. This mechanism not only adds to the downward pressure on the market but may also lead to sharp price movements within a short period of time, amplifying the magnitude of price fluctuations in the market.

Settlement dates usually have a significant short-term impact on the stock market, particularly through increased volatility and trading volume, which may lead to market spikes or crashes. This effect is particularly noticeable in stock index futures and options, especially on special days such as the four witching days. Investors therefore need to closely monitor market developments, remain sensitive to relevant information, and take into account possible market influences in order to make more informed investment decisions.

Meaning of settlement date and its potential impact

| Definition |

Potential impact |

| The settlement date is when the contract expires. |

Delivery or settlement must take place. |

| Short-term price changes from position shifts. |

Potential for high short-term volatility |

| Open positions are either delivered or cash-settled. |

Investors face delivery obligations. |

| Market liquidity may drop near the settlement date. |

Higher transaction costs and wider spreads |

| Investors must decide before settlement. |

Need to adjust strategy in time to avoid risk |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

What is Settlement Date?

What is Settlement Date? What if I Don't Close My Position on the Settlement Date?

What if I Don't Close My Position on the Settlement Date? The Impact of Settlement Date on the

The Impact of Settlement Date on the