In stock trading, we are often challenged by the monotony of the market. Fortunately, flexibility and profit opportunities can be added to investing by introducing option strategies, especially call options (call option). Not only does it help us profit when the market rises, but it also provides a degree of risk hedging. In the next section, we will take a closer look at call options and how they can be bought and sold for profit, and see how they can be used to optimize your investment strategy and achieve a more robust return on your investment.

What is Call Option?

What is Call Option?

It is a financial contract that gives the holder the right to buy a specific asset (e.g., a stock) at a predetermined price (the strike price) before a specific expiry date. The holder has the right to buy the asset at the strike price before the expiry date but is under no obligation to have to do so. The seller, on the other hand, has an obligation to sell the asset at the strike price if the buyer decides to exercise the right.

In other words, the holder of a call option has the right to purchase an asset (e.g., a stock) at a predetermined strike price by a specific time in the future. While this right gives the holder the opportunity to buy the asset at a lower price when market conditions are favorable to them, the holder is not compelled to have to execute this right.

If the market price is higher than the strike price, the holder can exercise the right to buy the asset at a lower price and thus make a profit; if the market price is lower than the strike price, the holder can choose not to exercise the right, and the maximum loss will only be the cost paid when the option was purchased (the option premium).

Simply put, a call option is like a coupon issued by a restaurant that allows you to buy a steak at a specific price at a certain time in the future. The'specified price’ is the strike price of the option, and the ‘time in the future’ is the expiry date of the option. In the options market, this right comes at a cost, called the option premium.

The strike price (or exercise price) is the price at which the option holder can purchase the underlying asset in the future. Typically, if the market price is higher than the strike price, the holder will choose to exercise the option, as this will allow them to buy the asset at a price lower than the market price, thus making a potential profit.

If the market price is higher than the strike price, the holder can exercise the right to buy the asset at a lower price and make a profit, while if the market price is lower than the strike price, the holder can choose not to exercise the right, and the maximum loss is limited to the amount paid to purchase the option (i.e., the option premium).

It also has a fixed expiry date on or before which the holder must decide whether to exercise the option. During this period, the holder can choose to purchase the underlying asset at the strike price or choose not to exercise the option, at which point the loss is the premium paid.

In order to acquire a call option, the buyer pays a fee known as the option premium or royalty. This fee is paid for the right to purchase the underlying asset at the strike price at some time in the future and must be paid whether or not the option is exercised. The option fee limits the buyer's maximum loss while providing the potential to profit from an increase in the price of the underlying asset.

Suppose a call option is purchased that allows for the purchase of one share of stock at $50 three months from now. If the market price of the stock rises to $60 after three months, the stock can be purchased at $50 and then sold at the market price of $60 for a $10 profit (net of option premium). If the market price is below $50. the option can be chosen not to be exercised, and the loss is only the initial premium paid.

When an investor expects the price of the underlying asset to rise, they can profit by purchasing a call option without actually purchasing the asset. This allows the investor to realize gains by purchasing the asset at a predetermined strike price when the asset price rises. This strategy allows investors to benefit from rising asset prices without directly incurring the cost of holding the asset.

Investors with large cash holdings who are concerned about missing out on investment opportunities can hedge against potential price increases by purchasing call options to lock in a predetermined purchase price. This allows them to purchase the underlying asset at a lower strike price even if the market price rises, thus avoiding losses due to the rise in the market and preserving the opportunity for further profit.

In summary, call options are an important part of the options market, allowing investors to capture potentially high returns at a relatively low cost. Through this tool, investors are able to effectively manage risk during market volatility and realize profits when the price of the underlying asset rises.

Call Option’s Long and Short

Call Option’s Long and Short

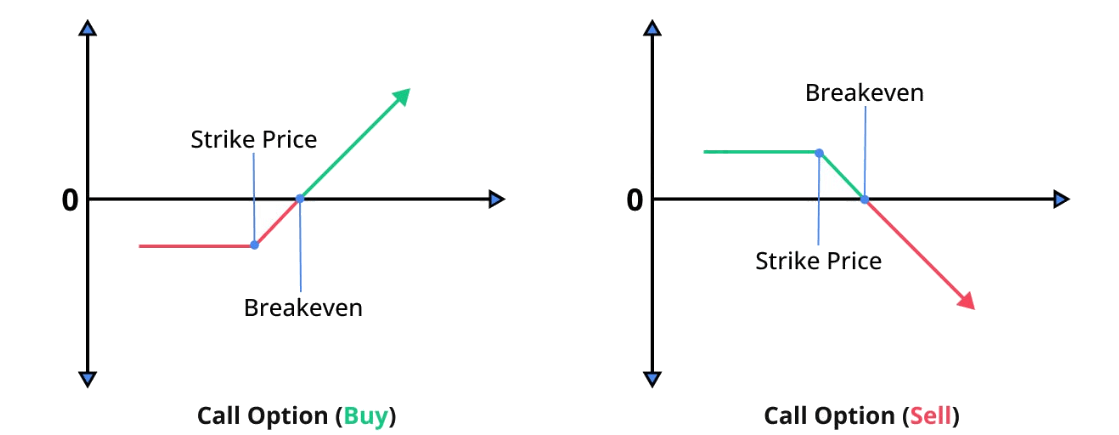

In call options trading, long call and short call represent the different trading positions of the option buyer and seller, forming the two main strategies in options trading. The significant difference between the two in terms of risk, return, and mode of operation makes them play different roles in investment strategies.

A call option long is a party that buys a call option, i.e., the buyer of the option. This strategy gives the holder the right to buy the underlying asset at a fixed strike price on or before the expiry date of the option, but it is not mandatory. This means that a long position can choose to exercise the option when the market price is higher than the strike price, thereby purchasing the asset at a lower strike price and making a profit.

Investors usually employ this strategy when they expect the price of the underlying asset to rise, hoping to make additional gains by purchasing it when the price rises. This approach allows investors to capitalize on investment opportunities arising from price volatility by taking potential profits from the difference between the market price and the strike price without actually purchasing the asset.

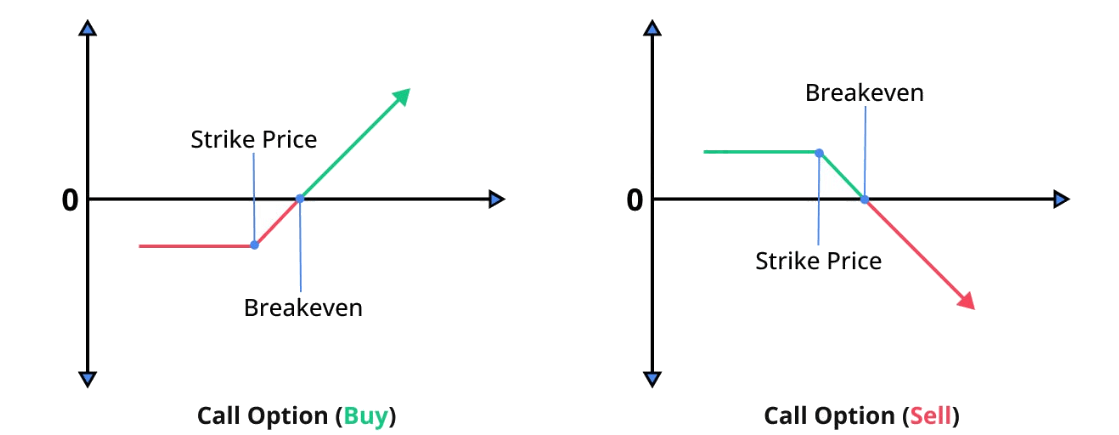

This type of trading has a theoretically unlimited profit potential as the price of the underlying asset can continue to rise, theoretically with no upper limit. The formula for calculating the actual profit is: actual profit = (market price - strike price) - option premium. As the price of the underlying asset continues to rise, so does the potential profit, so investors can gain an unlimited amount of income from the rise in the price of the asset.

At the same time, this type of trading also has a limited risk feature, which provides investors with effective protection. Even if the market does not move as expected, the investor's maximum loss is limited to the initial premium invested. If the market price is lower than the strike price at expiration, resulting in the option having no exercise value, the long position will not be profitable, but the loss will be limited to the premium paid. This risk limitation allows the investor to control losses while taking full advantage of potential gains from rising prices.

Example: Suppose a call option is purchased at $2 per share, which allows one share of stock to be purchased at $50 three months later. If the stock price rises to $60 after three months, exercise the option to buy at $50 and sell at $60. earning $10 per share (less the $2 option premium for a net gain of $8). If the stock price does not rise above $50. you can choose not to exercise the option for a maximum loss of $2 in option premium.

A call option short is the party who sells the call option, the seller of the option. As a short seller, one receives a premium for selling the option and commits to sell the underlying asset to the buyer at the strike price at the expiration of the option. If the buyer exercises the option, it must sell the asset at the strike price. This strategy is often used when the price of the underlying asset is not expected to rise above the strike price, thus earning the option premium as a gain.

When the investor believes that the price of the underlying asset will not rise significantly or will fall, the option is sold to earn the option premium. If the price of the underlying asset stays at or below the strike price, the option will not be exercised, and the seller gets to keep the option premium as profit. However, if the market price rises significantly, the seller is exposed to higher risk and potentially unlimited losses.

This type of transaction faces theoretically unlimited risk because the price of the underlying asset can rise indefinitely. If the price of the underlying asset rises significantly, the seller must sell the asset at a strike price below the market price, which could result in a large loss. Since there is no upper limit to the market price, the seller's loss may also be unlimited, especially if the price of the underlying asset is much higher than the strike price; the loss will increase directly.

Its maximum profit is the option fee (premium), which is the fee the seller receives when selling an option. This fee represents the maximum gain a short can make. If the price of the underlying asset does not exceed the strike price by the time the option expires, the option will lose its intrinsic value, and the seller gets to keep the option fee as profit.

Example: Suppose a call option is sold at $2 per share and the option has an exercise price of $50. If the stock price does not exceed $50 at expiration, the buyer does not exercise the option and earns a $2 premium. If the stock price rises to $60. the buyer will exercise the option and must sell the stock for $50. even though the market price is $60. for a loss of $10 (less the $2 option premium for a net loss of $8).

In short, the two strategies reflect different market expectations and risk tolerances. A call option long expects the price of the underlying asset to rise in order to exercise the option for an unlimited return, while the risk is limited to the option premium. In contrast, a short position expects the price to stay the same or fall in order to earn the option premium, but is exposed to theoretically unlimited risk.

How Call Options Generate Profits?

How Call Options Generate Profits?

Depending on the type of transaction, how a call option profits depends largely on the relationship between the market price of the underlying asset and the strike price of the option. Different market price levels determine the actual profit or loss for the buyer and seller, thus affecting their investment returns.

In the case of a buy-call option, the profit is calculated as follows: net profit = (market price - strike price) - option premium. The market price is the market price of the underlying asset at the time of expiry of the option, the exercise price is the purchase price specified in the option contract, and the option premium is the fee paid for purchasing the option.

When the market price is higher than the strike price, a profit can be made by exercising the option to purchase the underlying asset at a lower strike price and sell it in the market at a higher market price. For example, if the strike price is $50. the market price is $70. and the option premium is $5. the net profit will be $15 (i.e., the market price of $70 minus the strike price of $50 minus the option premium of $5).

When the market price is equal to the strike price, the call option will not be exercised because there is no additional profit from exercising the option. In this case, the loss is limited to the option premium. For example, if both the strike price and the market price are $50 and the option premium is $5. the net loss would be $5. the option premium.

When the market price is lower than the strike price, an investor will generally not exercise a call option because it is more cost-effective to purchase the asset at the market price. In this case, the maximum loss is limited to the option premium. For example, if the strike price is $50 and the market price is $40 and the option premium is $5. the net loss is $5. the option premium.

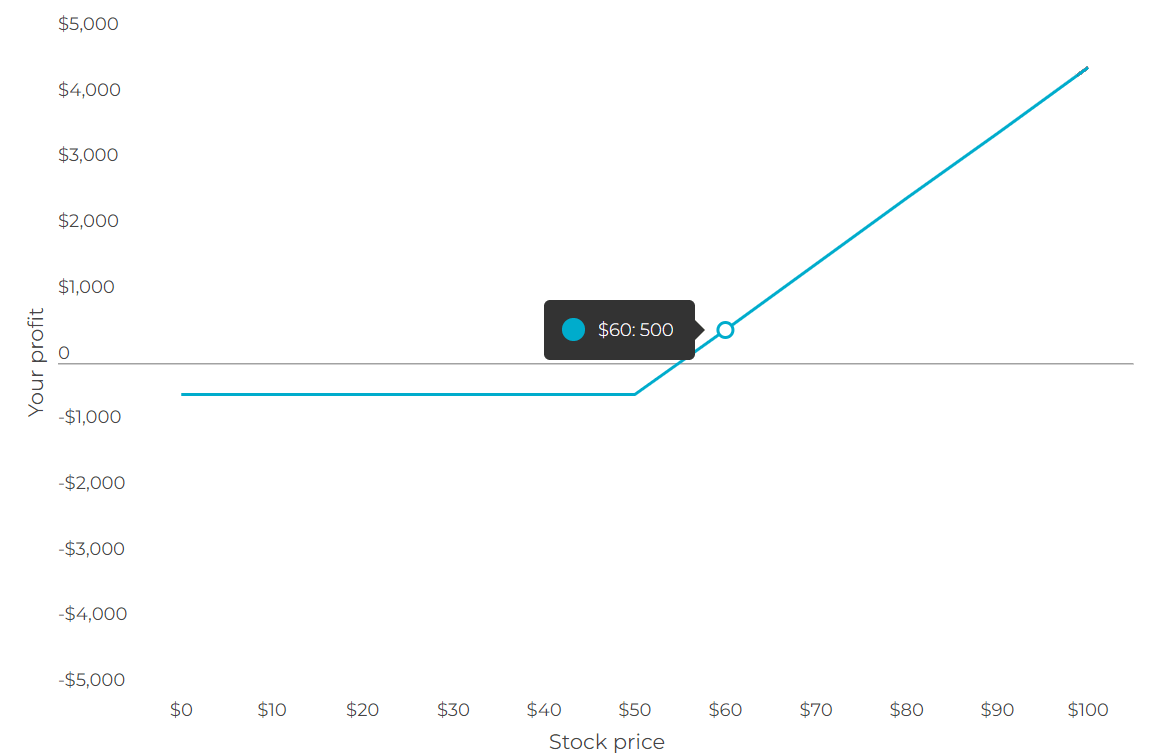

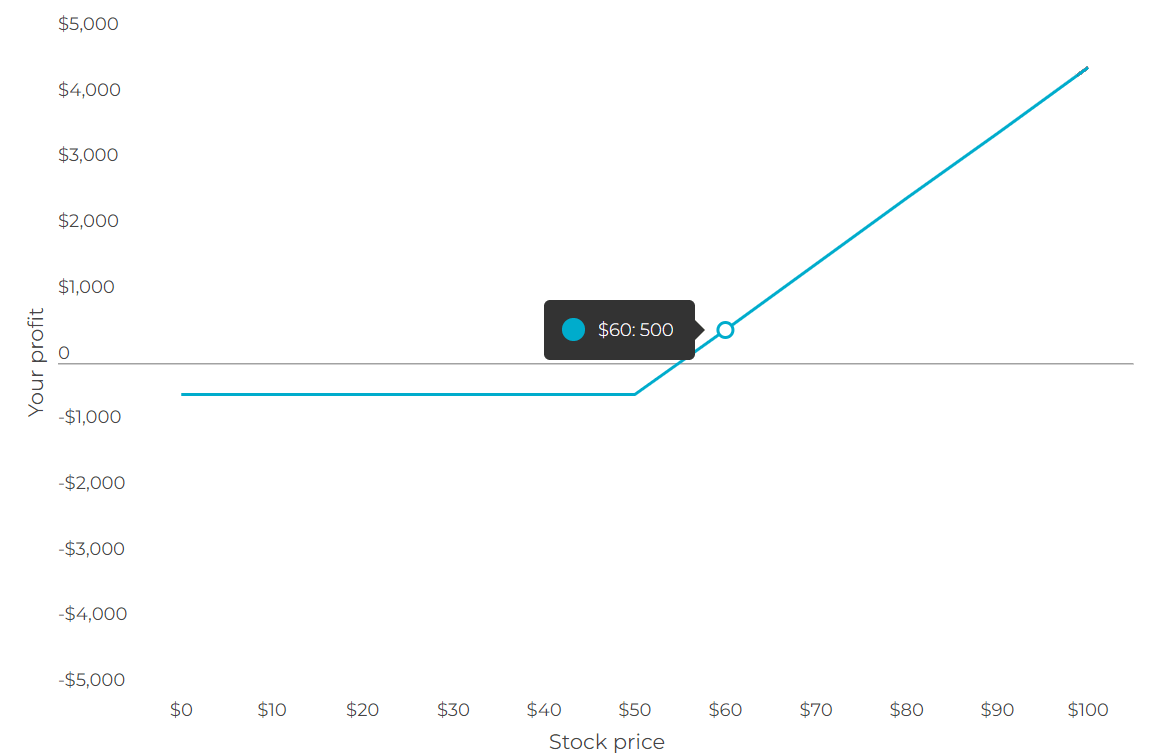

The breakeven point is a key concept in options strategy, which indicates where the profit and loss in an options trade is balanced. In the case of a call option, the breakeven point is equal to the strike price plus the option premium. This means that profits begin to be realized when the market price exceeds this break-even point.

For example, if the strike price is $50 and the option premium is $5. then the breakeven point is $55. When the market price exceeds $55. a profit will be realized from the trade. As shown above, when the price is $60. the investor gains $500. This break-even point helps the investor to judge the starting point of profitability of the option and assess the potential return on investment.

In the case of selling a call option, on the other hand, the maximum profit at this point is equal to the option premium (royalty), which is the fee the investor receives at the time of the sale. If the market price of the option is lower or equal to the strike price at expiration, the option will not be exercised, and the seller gets to keep the premium as profit.

If the market price is higher than the strike price, the buyer may exercise the option. The underlying asset needs to be sold at the strike price, and the market price is higher, thus facing a loss. The maximum loss is theoretically unlimited because the market price can rise indefinitely. Calculation: Maximum loss is (market price - strike price) - option premium.

The break-even point for this type of transaction is derived from the formula: strike price + option premium. At this price level, the seller's total gain or loss is zero. If the market price exceeds this break-even point, the seller begins to face a loss, while if the market price falls below this point, the seller is able to keep the option premium as profit.

Suppose a call option is sold at a premium of $5 per share with an exercise price of $50. In this case, the maximum profit is $5. which is the option premium you received. The break-even point is $55 (strike price of $50 + option premium of $5), at which point the gain or loss is zero.

If the market price rises to $100. the investor needs to sell the asset at an exercise price of $50. at which point the maximum loss is $45 ($100 minus $50 minus $5). The actual profit or loss can be determined by calculating the actual market price, strike price, and option premium.

Thus, the profitability of buying a call option depends on the increase in the price of the underlying asset. By calculating the difference between the market price and the strike price and deducting the option premium, the actual net profit is arrived at. Profit from selling a look is dependent on collecting the option premium and hoping that the price of the underlying asset does not exceed the strike price, thus retaining the premium as a fixed income.

Call options and their buy and sell profit way

| projects |

Buy Call Option |

Sell call options |

| Rights |

The right to buy an asset at a set price. |

Receive the premium and accept the risk. |

| Cost |

Payment of premium |

Receive premium |

| profit way |

Profit if the asset price exceeds the strike. |

No profit if the price stays the same or falls. |

| Risk |

Possible total loss of premium |

Loss if the price exceeds the strike. |

| Objective |

Expected price increase |

Expected price to remain constant or fall |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

What is Call Option?

What is Call Option? Call Option’s Long and Short

Call Option’s Long and Short How Call Options Generate Profits?

How Call Options Generate Profits?