The phrase ‘banking is the mother of all industries’ is a familiar one, and as banks are considered by many to be one of the most stable industries in the world, bank stocks are often considered to be a preferred long-term investment in investment portfolios. However, the collapse of Silicon Valley Bank has certainly left many investors sceptical. Nonetheless, the recent strong earnings performance of bank stocks has renewed investor interest. But before we act, we need to take a look at the key metric of capital adequacy. Next, let's dive into the definition, impact, and regulatory standards of capital adequacy.

What does capital adequacy ratio mean?

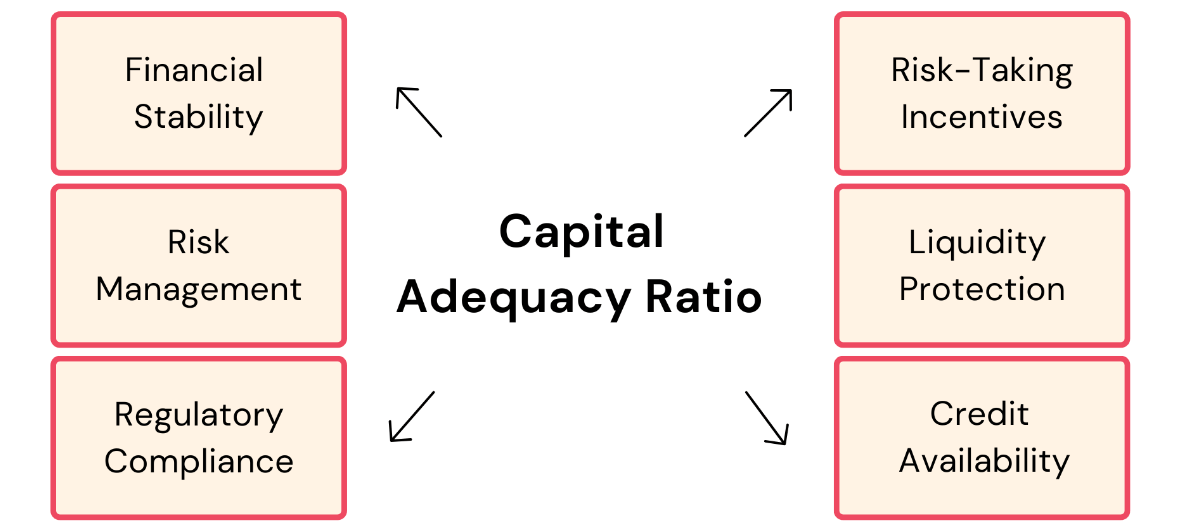

Known as the Capital Adequacy Ratio, or CAR for short, it is an important measure of a bank's financial health and risk tolerance, representing the ratio of a bank's total capital to its total risk-weighted assets. This indicator reflects whether a bank has sufficient capital to absorb potential losses, cope with risks, and maintain stable operations.

As an important component of the financial system, the soundness of banks is crucial. By requiring banks to maintain a certain capital adequacy ratio, regulators ensure that banks have sufficient buffers in the face of economic challenges, thereby avoiding insolvency due to insufficient capital. This regulatory measure not only maintains the stability of individual banks but also helps safeguard the safety and stability of the financial system as a whole.

It also has a direct and immediate impact on banks' lending and investment decisions. When the capital adequacy ratio is low, banks may face regulatory constraints that restrict them from making new loans or risky investments to avoid further increasing risks. In this case, banks may be more cautious in choosing who to lend to and what to invest in in order to maintain capital levels and meet regulatory requirements.

Banks with higher capital, on the other hand, have greater financial flexibility and risk tolerance, and they are able to engage in a wider range of financial activities, including expanding their lending business and exploring high-yield investment opportunities. This adequate capital base not only enhances the market competitiveness of banks but also promotes economic growth and financial market activity.

A high capital adequacy ratio implies a low level of leverage for banks, which suggests that banks have more adequate capital reserves in their balance sheets. Even when holding some risky assets (e.g., junk bonds), banks are better able to withstand potential financial losses.

This is because adequate capital provides a buffer for banks to withstand a certain level of loss without falling into immediate financial distress even if they face a decline in the value of or default on these risky assets. In this way, high capital not only enhances a bank's soundness but also increases its risk tolerance in the face of market volatility and economic uncertainty.

During a financial crisis, a low capital adequacy ratio may lead to a liquidity crisis or even bankruptcy of a bank, which may have a knock-on effect on the entire financial system. For investors, it is an important indicator to judge whether financial institutions have sufficient cushion to cope with systemic risks. If the capital of the banking system is low, it may trigger market panic and affect investors' asset allocation and risk appetite.

For example, during the 2008 financial crisis, many banks faced severe financial crises due to over-leveraging and under-capitalization. Regulators in many countries and regions have strengthened capital adequacy regulations after the crisis, requiring banks to increase their capital reserves to minimize future financial risks.

The capital adequacy ratio is a key indicator for investors when assessing the investment value of bank stocks or financial institutions. A high ratio not only indicates that the bank is highly risk-resistant but also implies that the bank will not face excessive financial pressure during an economic downturn. In addition, investors can analyze its trend to determine the bank's future growth potential and profitability.

Overall, the capital adequacy ratio is the foundation of a bank's sound operation, and it ensures that the bank remains stable in the face of risks. This indicator not only reflects a bank's financial health but also affects its market trust and growth potential. Adequate capital enables banks to respond effectively to economic fluctuations and loan defaults, thereby enhancing their market competitiveness and attractiveness.

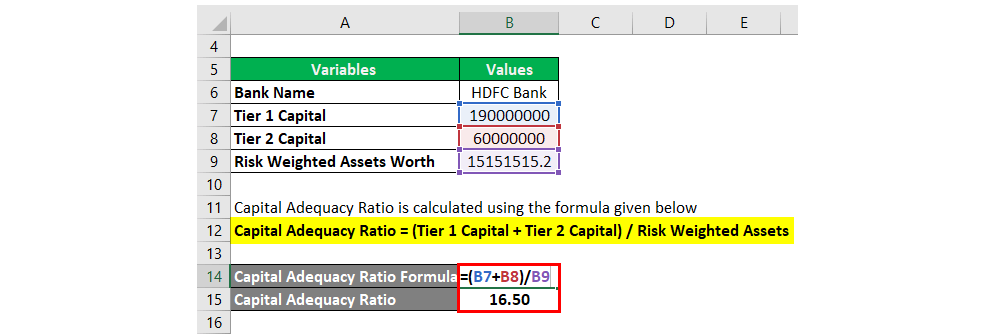

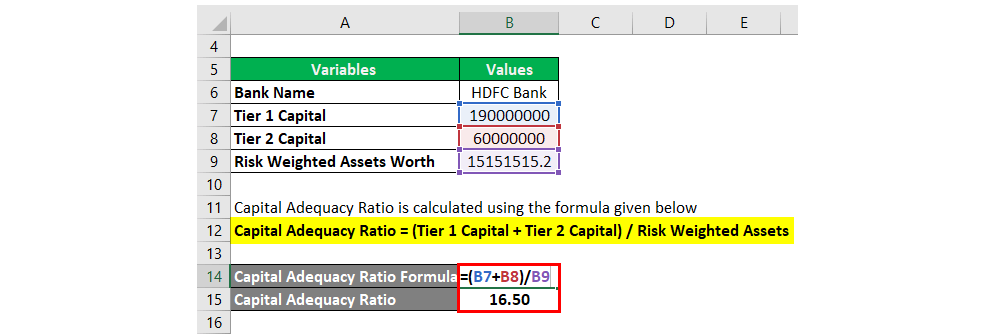

The formula for calculating the capital adequacy ratio

The formula for calculating the capital adequacy ratio

By comparing a bank's capital to its risk-weighted assets, the capital adequacy ratio reflects the bank's ability to withstand potential losses. It is calculated as Capital Adequacy Ratio = Bank Capital ÷ Risk-Weighted Assets x 100%, as shown above. It reflects the financial soundness of a bank in the face of market volatility and potential risks and is an important metric used by regulators to assess the health of banks.

Bank capital is categorized into three main tiers: Core Tier 1 Capital (CET1), Tier 1 Capital, and Tier 2 Capital. Core Tier 1 capital is the highest quality capital, including common equity and retained earnings, among others, and can provide the most immediate cushion in the event that a bank faces financial difficulties. Therefore, the adequacy of Core Tier 1 capital directly affects a bank's risk tolerance and long-term stability.

Tier 1 capital comprises not only Core Tier 1 capital but also other preferred shares, etc., while Tier 2 capital, which includes subordinated debt, etc., is of relatively low quality and serves mainly as an additional buffer in the event of a major financial crisis. Through this multi-tiered capital structure, banks can deal with various risks in a more comprehensive manner and ensure financial soundness and safety.

Risk-weighted assets are the total amount of a bank's assets weighted according to their risk level. Higher-risk assets such as junk bonds are given a higher weighting, while lower-risk assets such as Treasury bonds are given a lower weighting. This weighting helps to more accurately assess a bank's overall risk level and ensures that its capital is able to cope with potential risks.

Higher capital adequacy ratios mean that banks are more risk-tolerant and better able to cope with market volatility and potential losses. Adequate capital enables banks to maintain sound operations in the midst of economic uncertainty and financial market turbulence, thereby enhancing their ability to cope with risk. Such robust performance enhances investor and customer confidence, making banks more reliable in the marketplace and more effective in attracting investment and business cooperation.

Conversely, a lower capital adequacy ratio may indicate that the bank is under greater financial stress and has a weaker risk appetite. In such cases, banks may need to take measures, such as increasing capital or reducing risky assets, to improve their capital levels and ensure the stability of their operations.

For example, if a bank has total assets of $10 million, which include $8 million of high-risk assets (e.g., junk bonds) and $2 million of low-risk assets (e.g., Treasury bonds), If the bank's capital is $2 million, the capital adequacy ratio is $2 million ÷ $8 million = 25 percent.

The level of 25% usually indicates that the bank's capital adequacy ratio is well above the minimum requirement, showing that the bank is very sound in capital management, with a strong risk tolerance and a high margin of safety. It can enhance a bank's risk tolerance in the face of market turbulence or economic downturn and improve its overall financial soundness.

Is a higher capital adequacy ratio better?

Is a higher capital adequacy ratio better?

As an important indicator of a bank's risk resistance and financial soundness. Generally speaking, its higher level means that a bank is more capable of absorbing potential losses and protecting the interests of depositors and investors. However, a higher capital adequacy ratio is not infinitely better, and a balance needs to be found between safety and profitability.

The higher it is, the more favorable it is in terms of enhancing resilience to risk. It enables banks to absorb potential credit losses more effectively and to respond proactively to loan defaults and market volatility. In addition, banks with higher ratios show greater resilience in recessions and financial crises, thereby reducing the risk of insolvency.

And in terms of boosting market confidence, higher capital adequacy ratios can also enhance the trust of investors and creditors, as these banks are in a more robust financial position. In addition, their higher can also be a competitive advantage in attracting customers and business in a highly competitive market.

At the same time, maintaining a capital adequacy ratio higher than the regulatory requirement not only ensures compliance and avoids regulatory constraints such as restrictions on dividends or business expansion, but also provides an additional cushion that gives banks greater operational flexibility in the face of unexpected risks.

However, in terms of reducing the efficiency of capital utilization, excessive capital may lead to opportunity costs as it is not invested in higher-yielding loans and investments, thus reducing the efficiency of capital utilization. In addition, too much capital may also dilute the return on investment (ROE) for shareholders by generating less revenue per unit of capital.

Moreover, holding more capital may increase a bank's cost of capital, as the cost of equity is usually higher than that of debt, which can lead to a decline in overall profitability. In addition, in an environment of marketised interest rates, excessively high capital adequacy ratios may put banks at a competitive disadvantage in terms of interest rates and fees, thereby weakening their market competitiveness.

At the same time, the excessive pursuit of high capital adequacy ratios may lead to an irrational allocation of banks' resources, making them overly conservative in the market and missing opportunities to support the development of the real economy. In addition, such a strategy may bias the bank's business structure in favor of robustness, affecting its flexibility and balance in achieving its long-term strategic objectives.

Therefore, the ratio between bank capital and risk-weighted assets is not as high as possible. Banks should reasonably position their capital levels according to their own risk appetite, market environment, and strategic objectives while maximizing the efficiency of capital use by optimizing their asset mix and enhancing their risk management capabilities. Flexibly responding to economic cycles and market changes, they should dynamically adjust their capital strategies to achieve the best balance between safety and profitability.

In turn, when assessing the investment value of a bank, investors need to take into account the balance between it and profitability rather than simply pursuing a high capital adequacy ratio. While higher capital enhances a bank's ability to resist risk, an excessively high level of capital may reduce the efficiency of capital utilization and profitability. Therefore, investors should focus on how banks can achieve an effective balance between capital soundness and earnings growth.

Of course, while a higher capital adequacy ratio is not always better, it remains a fundamental criterion for assessing a bank's financial health. If it falls below the prescribed minimum, the bank may be exposed to greater financial risk and may not be able to absorb potential losses effectively. Such a situation would affect a bank's stability and ability to operate, making it more susceptible to financial difficulties under economic stress or market volatility, and may even trigger regulatory measures or restrictions.

Regulatory standards on capital adequacy

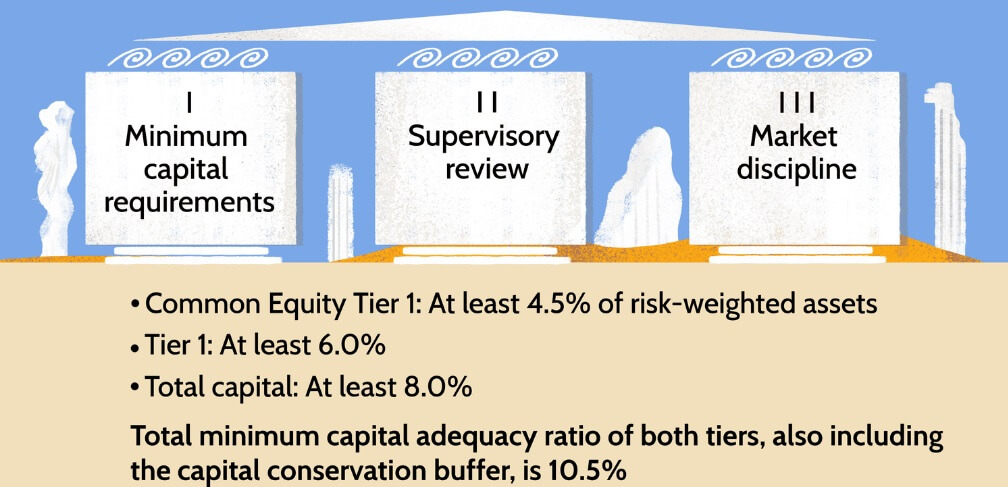

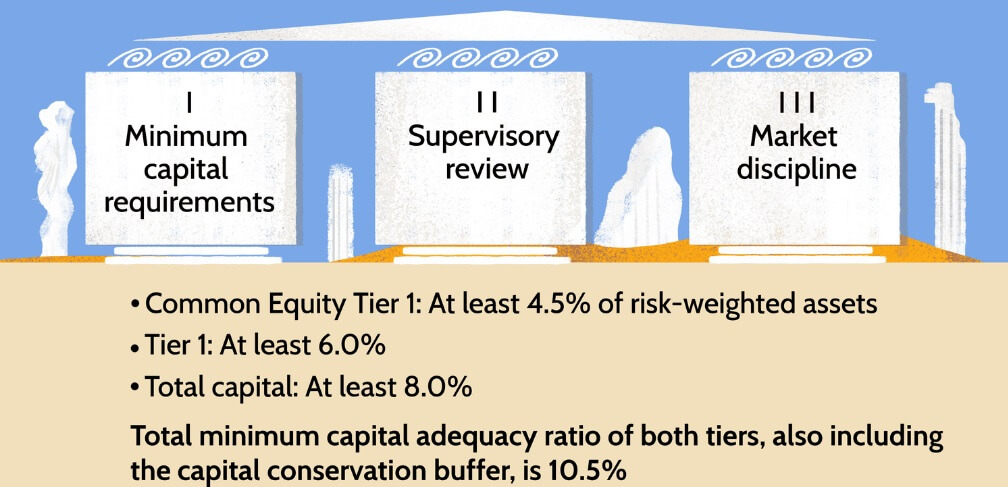

The regulatory standards for capital adequacy are primarily set by the Basel Accords, the international regulatory framework for the banking industry. The Basel Accords are designed to ensure that banks maintain sufficient capital to meet the risks they take, thereby protecting the overall stability of the financial system. Through these standards, regulators can effectively monitor the capital position of banks and reduce systemic financial risks.

The major regulatory standards are: Basel I, issued in 1988. is the beginning of the global financial regulatory framework. The Accord was the first to propose that banks need to maintain a capital adequacy ratio of at least 8 percent. This means that banks must have capital of at least 8 percent of their risk-weighted assets and is designed to ensure that banks have sufficient capital reserves to absorb potential losses, thereby enhancing the stability and resilience of the financial system. This requirement marked the first harmonisation of capital management standards in the global banking sector and laid the foundation for subsequent capital regulation.

Basel II, implemented in 2004. builds on Basel I and introduces more granular risk assessment standards. The Accord not only requires banks to continue to maintain a minimum capital adequacy ratio of 8 percent but also builds on this with more precise weightings for credit risk, market risk, and operational risk. By introducing sophisticated risk measurement methods and enhanced regulatory requirements, Basel II aims to improve the accuracy and effectiveness of banks' risk management, thereby further strengthening the robustness and stability of the banking system.

Basel III, introduced in the wake of the 2009 financial crisis, introduced significant enhancements to bank capital requirements. In addition to maintaining the minimum 8 percent requirement, the Accord introduced higher capital standards and stricter liquidity management requirements to enhance the resilience of the banking system. By requiring higher quality capital and increasing liquidity coverage ratios, Basel III aims to improve banks' resilience to economic shocks and prevent future financial crises.

Banks are also required to have core tier 1 capital (comprising mainly common equity and retained earnings) of at least 4.5 percent of their risk-weighted assets. In addition, the Tier 1 capital adequacy ratio, which includes core Tier 1 capital and additional Tier 1 capital (e.g., preferred shares), must be at least 6 percent of risk-weighted assets. These standards ensure that banks have sufficient high-quality capital to absorb potential losses and enhance their overall soundness and resilience.

In addition, the agreement requires banks to maintain an additional capital buffer of 2.5 percent on top of the minimum capital adequacy ratio of 8 percent. This requirement aims to enhance the banks' ability to cope with economic uncertainties and financial stresses so that they can maintain sound operations in times of economic downturn or market volatility. The capital buffer provides banks with additional capital reserves to absorb possible losses and protect their stability and continuity of operations.

The countercyclical capital buffer is a provision that allows regulators to require banks to maintain additional capital reserves in times of economic prosperity. Its requirement, which usually ranges from 0 percent to 2.5 percent, is adjusted according to economic conditions and the stability of the financial system to ensure that banks have sufficient capital to absorb losses and maintain stable operations during economic downturns. This measure is intended to enhance the robustness of banks during fluctuations in the economic cycle in response to the risk of a potential economic downturn.

The leverage ratio requirement is an important metric introduced by Basel III, which requires banks to maintain a leverage ratio of at least 3 percent. This means that a bank's capital relative to its total assets must not fall below 3 percent. This requirement aims to limit banks' use of leverage and prevent excessive borrowing, thereby enhancing the stability of the financial system and ensuring that banks maintain sufficient capital to meet potential risks even as their balance sheets expand.

While the Basel Accord provides a global regulatory standard, national regulators may set higher capital requirements based on their own economic conditions and financial system characteristics. For example, China requires commercial banks to maintain a capital adequacy ratio of at least 11.5 percent, which includes additional buffer requirements to ensure the stability of the financial system and the resilience of banks.

In other jurisdictions, such as the EU and the US, bank regulators also set different capital adequacy requirements depending on the size and systemic importance of the bank and other factors. These requirements may be higher than the Basel III minimum standards to address financial risks and economic conditions specific to the country in order to safeguard financial stability and protect investors' interests.

These regulatory capital adequacy standards aim to ensure that banks have sufficient capital to cope with economic uncertainty and market volatility, thereby reducing the risk of financial crises, protecting depositors, and preserving the stability of the financial system. Through these measures, regulators enhance the resilience of banks and prevent the spread of systemic risks.

Capital adequacy ratio's definition, impact, and standards

| Impact |

Regulatory standards |

| Its adequacy improves the risk buffer. |

Basel I At least 8 percent. |

| Low is restrictive; high provides more room. |

Basel II: 8% with risk assessment standards. |

| Adequacy boosts trust and competitiveness. |

Basel III: Core Tier 1 4.5%, Tier 1 6%, total capital 8% + 2.5% buffer. |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

The formula for calculating the capital adequacy ratio

The formula for calculating the capital adequacy ratio Is a higher capital adequacy ratio better?

Is a higher capital adequacy ratio better?