Ever since Japan's economy started to recover and there were whispers of a rate hike, the buzz in the market about a rate hike in Japan has been intensifying. And on March 19. 2024. the Bank of Japan finally made the decision to announce a 10-basis-point increase in interest rates, a decision that has once again sparked discussion. Because its impact is not only limited to Japan itself but will have an impact on the financial situation of all countries and will continue to affect the global economy. For this reason, this article will talk about the reasons for Japan's interest rate hike and its impact.

Reasons for Japan's Interest Rate Hike

It refers to the action taken by the Bank of Japan to raise the benchmark interest rate or adjust monetary policy to curb inflation. Raising the benchmark interest rate is a monetary policy tool implemented by the central bank to regulate economic activity and control inflation. When the central bank believes that the economy is overheating or that the risk of inflation is high, it may take measures to raise the benchmark interest rate.

The Bank of Japan Interest Rate Resolution is the meeting at which the Bank of Japan decides on monetary policy. It is basically held eight times a year (2 days each time) and is decided by a majority vote of the president, two vice presidents, six deliberators, and a total of nine policy board members. Each time, the policy rate is announced at noon (Japan time), and the president's press conference is held at 3:30 p.m. (Japan time).

And on March 19. 2024. the Bank of Japan's interest rate resolution announced three important changes in monetary policy: firstly, it ended the negative interest rate policy that lasted for 8 years and raised the policy prime rate from -0.1% to 00.1%, which signified that the central bank was taking an important step towards normalizing its monetary policy and getting rid of deflation.

Secondly, the BOJ eliminated its Yield Curve Control (YCC) policy and is no longer committed to keeping long-term yields on Treasury bonds around 0%. Now, only when yields rise rapidly will the central bank consider increasing its purchases of Japanese government bonds to ensure that financial conditions remain accommodative. This move has largely restored the role of Treasury rates in the market.

Then came the BOJ's decision to scale back its purchases of risky assets. Purchases of exchange-traded funds (ETFs) and real estate investment trusts (REITs) were halted, and plans were made to gradually reduce purchases of commercial paper and corporate bonds, which are expected to cease in about a year.

It is important to realize that since the bursting of the real estate bubble in the late 1980s, the Japanese government has adopted an overly harsh austerity policy. These factors have led to a prolonged downturn in the Japanese economy, allowing a generation of people to adapt to an unchanging economic environment. And in order to stimulate economic growth and boost inflation, the Bank of Japan adopted a series of unconventional monetary policies, such as quantitative easing and negative interest rate policy. But the effect was limited and even deflationary.

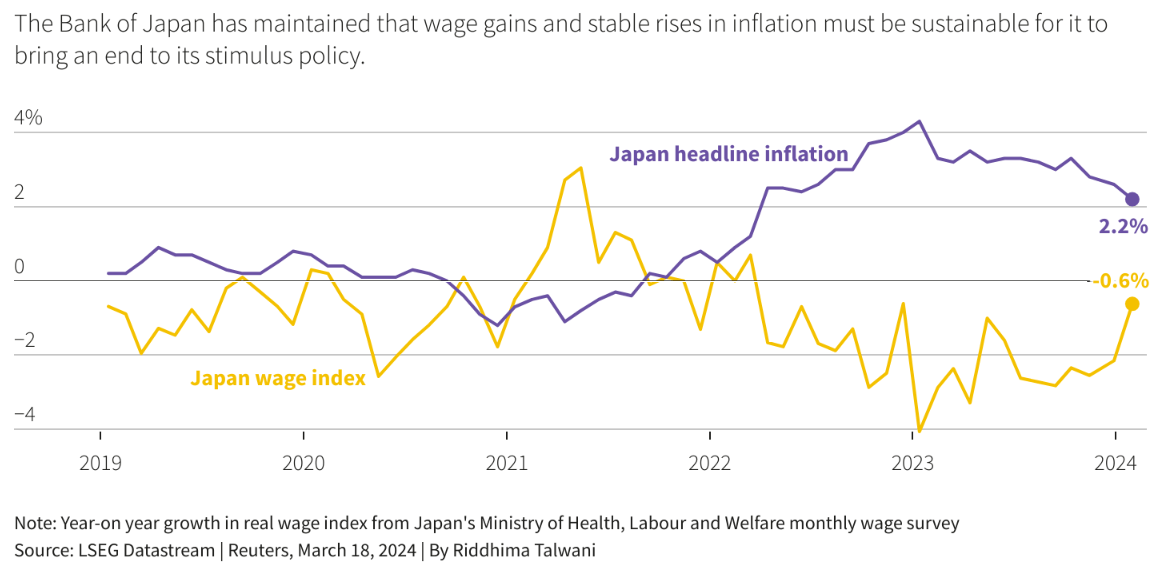

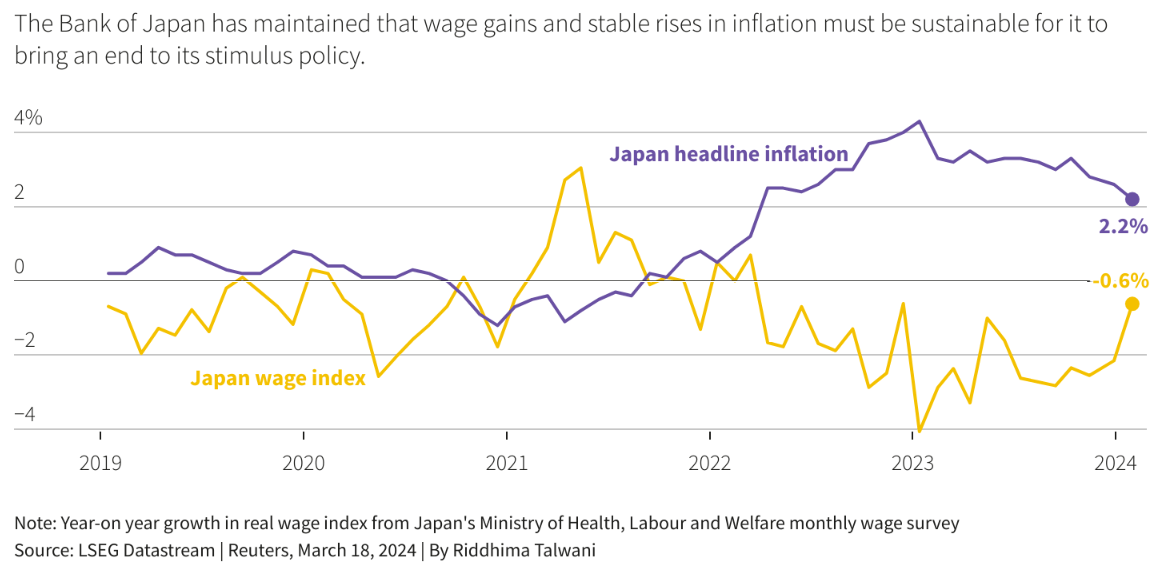

And recently, because of the global economic situation, the Japanese economy has seen a shift in growth. At the same time, deflation has eased, with Japanese inflation reaching the 2% mark. But the problem is that the rise in inflation is not coming from within, but rather from rising energy costs due to the Russia-Ukraine war and the impact of the depreciation of the yen.

So there were challenges such as companies' reluctance to raise wages, leading to public discontent, and the yen's depreciation affecting domestic consumption. These pressures have prompted firms to start increasing wages, such as the willingness of large firms to raise wages in the Great Labor Negotiation of 2024. which suggests that wage levels are rising in Japan.

But as labor costs rose, the BOJ also had to face pressure to adjust its monetary policy to keep inflation in check. Ultimately, the BOJ's decision to end its negative interest rate policy and raise interest rates marks the official entry of the Japanese economy into an era of moderate inflation and positive interest rates. This shift may disrupt people's daily lives, but it also lays the foundation for sustainable economic growth.

To summarize, the main reasons for Japan's interest rate hike include addressing inflationary pressures, promoting wage increases, supporting economic recovery, and adjusting monetary policy. This decision aims to balance the relationship between inflation and economic growth and to push the Japanese economy towards a healthier and more stable development.

The Impact and Significance of Japan's Interest Rate Hike on Japan

The Impact and Significance of Japan's Interest Rate Hike on Japan

Japan's monetary easing has been going on for 22 long years, and negative interest rates have been around for 8 years. Before the interest rate hike, the Japanese were living in a world where nothing about money-related things would change. For example, wages hadn't increased in nearly 30 years, home loan rates were near zero, and the stock market barely rose or fell. Under these circumstances, the Japanese economy and society will face a series of major impacts and challenges as the Bank of Japan implements its policy of raising interest rates.

First, rising home loan rates will become the norm, which could lead to higher rents and also put some pressure on house prices. For the government, the huge size of the debt means that interest payments on the debt will increase significantly, and it may be necessary to make up for the shortfall in increased spending through, for example, higher taxes.

In addition, the cost of borrowing debt for business operations will also rise, possibly leading to higher selling prices for goods, while companies may look for ways to cut costs. However, if interest rates are raised too quickly or too much, it could lead to negative economic reactions, such as a rise in the unemployment rate. As for the real estate market, the BOJ's conference emphasized that it will maintain an accommodative monetary policy, suggesting that a future interest rate hike is unlikely, which has provided some support to the real estate market.

However, the situation in the Japanese real estate market is not optimistic. Despite reports of a 40% rise in the Japanese housing market, this is not the case. Only metropolitan areas such as Tokyo and Osaka, which have good transportation and facilities, have seen an increase in the price of new homes, while other areas or second-hand homes have not seen a significant increase.

In addition, for foreign investors, there is the exchange rate to consider, and the depreciation of the yen has had a considerable impact on investment returns. In addition, as Japan begins to raise interest rates and mortgage rates rise, the incentive for people to buy homes may decline, making the polarization of the real estate market more pronounced.

High-end properties in Japan are likely to benefit more as the affluent are more able to afford the cost of mortgages in a high interest rate environment, while the mid- and low-end markets may be challenged by declining purchasing power. So while there has been a surge in some properties, this has only been for specific types of property and only reflects the rising economic power of a small group of people. For most foreign investors, the returns from buying and selling Japanese property have not been promising.

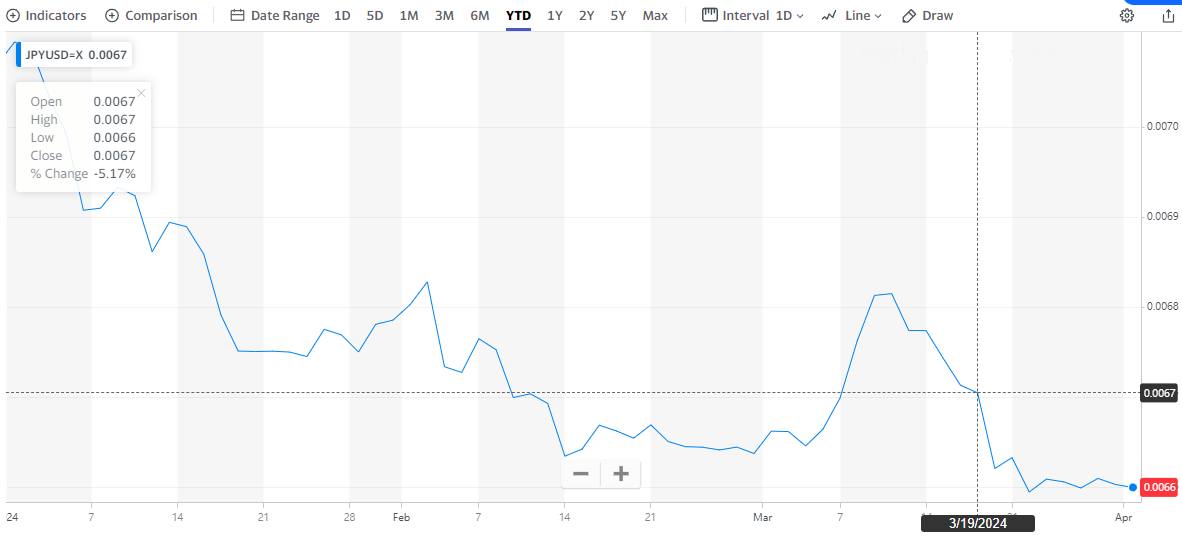

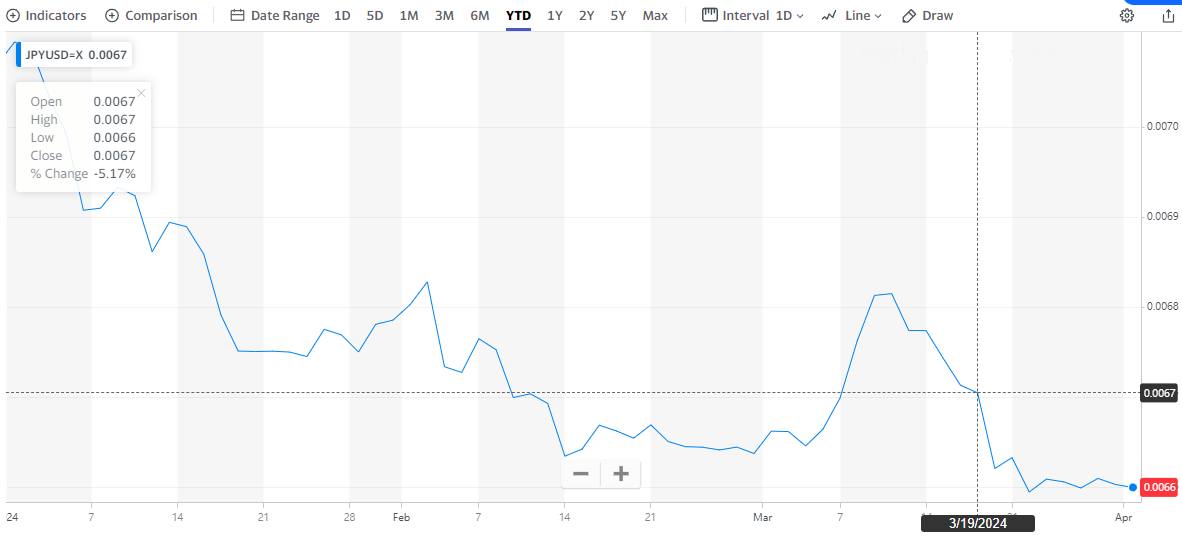

Because of the previous years of negative interest rates, the yen has been seen as a safe-haven currency, and many investors have taken advantage of the spread between it and the U.S. dollar to engage in arbitrage trading. Therefore, with the Japanese interest rate hike, many investors are particularly concerned about its impact on the yen. And before the market has raised the yen, it is expected that higher interest rates will attract more money into Japan, which in turn will make the yen stronger.

The yen's trend has not been as strong as expected after Japan's interest rate hike, but instead has seen a relative depreciation. This phenomenon is puzzling because it is generally believed that interest rate hikes lead to an appreciation of the domestic currency. However, the yen has shown the opposite trend. This is mainly due to the fact that the market is not expecting a future rate hike, as the Bank of Japan emphasized in its release that it will maintain an accommodative monetary policy, suggesting that a future rate hike is unlikely.

Meanwhile, the U.S. economy continues to improve and inflation levels are higher than expected, so the likelihood of a rate cut is relatively low, resulting in the U.S.-Japan interest rate gap not narrowing quickly. As a result, investors are not in a hurry to convert the dollar into yen, which led to the yen not showing the expected appreciation.

The impact of Japan's interest rate hike on the stock market is, first of all, because it leads to market sentiment fluctuations. Investors expectations of future economic trends and interest rate policy uncertainty will increase, triggering fluctuations in market sentiment. Secondly, the interest rate hike means a rise in borrowing costs, which may have an impact on corporate earnings and investment decisions, especially for highly indebted companies. The increased cost of funds may lead to a decline in profitability, thus affecting share price performance.

In addition, the interest rate hike is part of the central bank's monetary policy, which may imply a change in the central bank's expectations of inflation and economic growth, and the market will be concerned about the central bank's future policy adjustments and stance, as well as the impact on the economy. In addition, due to the high interest rate environment, investors may prefer fixed-income assets and reduce their allocation to risky assets such as equities, which may put some pressure on the stock market.

Finally, the Bank of Japan holds a certain percentage of the Japanese stock market, and a rate hike could mean that the central bank would need to adjust its equity holdings, possibly by selling stocks to balance its asset portfolio, which could also have some impact on the market.

Overall, Japan's interest rate hike marks a new stage in the country's economy and has important symbolic and substantive implications. It indicates that the Japanese economy is moving in a more robust and sustainable direction, laying the foundation for future economic growth.

However, interest rate hikes have complex implications for investors and the economy, and market developments should be closely monitored and investment strategies adopted to deal with the uncertainty.

Impact of Japan's Rate Hike on Global Economy

Impact of Japan's Rate Hike on Global Economy

The interest rate hike measures taken by the Bank of Japan will not only have a certain impact on its domestic economy, but this policy change may also have a chain reaction on the global capital market, affecting the decision-making and capital flows of global investors. This is because, as the world's third-largest economy, Japan's central bank's monetary policy adjustments can have a significant impact on the global financial market.

Moreover, according to historical data, whenever the Bank of Japan conducts an interest rate hike, global markets tend to be unfavorable and even trigger a new round of economic crisis. This repetition hints at the sensitivity and importance of Japan's economic policy to the world, making global investors very concerned about it.

It is important to realize that interest rate hikes by the Bank of Japan have often triggered market volatility, which may lead to shocks in the global stock and currency markets. For example, after Japan's interest rate hike in 1989. there was a succession of bursting bubbles in the Japanese stock and property markets. After another interest rate hike in 2006. the housing market bubble in the United States burst, triggering the global financial crisis. These events show that interest rate hikes by the Bank of Japan often trigger significant changes and volatility in global markets.

There was also the Bank of Japan's rate hike to 0.25% in August 2000. which was followed a few weeks later by the bursting of the Nasdaq bubble, triggering a more than two-year-long downturn; the two rate hikes in July 2006 and February 2007. which were followed by a 9% one-day drop in the Chinese stock market in the days afterward; and the collapse of Bear Stearns's credit hedge fund a few months later, which triggered the global financial crisis.

Of course, the historical data does not mean that this rate hike will have the same serious consequences. But at the present time, the Federal Reserve is likely to conduct quantitative easing, or interest rate cuts, at the same time. The adoption of opposite interest rate policies by these two globally influential economies could lead to chaos in the global financial markets.

Moreover, over the past 22 years, Japan has been implementing an extremely loose monetary policy, including measures such as continuously maintaining low interest rates, printing large quantities of money, and purchasing Treasury bonds in order to stimulate economic growth. This situation has led to a massive outflow of funds to overseas markets for arbitrage trading and investment. These funds usually use leverage and are very sensitive to exchange rate movements. In the event of a change in Japan's monetary policy, these funds could return quickly and have a significant impact on international financial markets.

That is to say, the Bank of Japan's interest rate hike means an increase in the cost of yen funding, which triggers a wave of carry trade openings, which in turn leads to global capital reallocation. At the same time, the rate hike may also trigger volatility in the bond and equity markets as it affects borrowing costs and liquidity, which in turn affects investors' investment decisions.

During a rate hike cycle, bond prices usually fall, resulting in bond holders facing losses, while the stock market may experience a correction or decline, especially for popular sectors such as highly valued technology stocks. Such market volatility may lead to fluctuations in investor sentiment, which in turn affects the stability of the financial market as a whole.

As one of the developed countries with one of the highest debt ratios in the world, Japan's debt ratio has reached an alarming level. With a debt balance of over 260% of GDP as of 2024. Japan has become one of the major challenges facing the global economy. Whether Japan's interest rate hike policy will disrupt its debt balance and thus trigger a global financial crisis has become a concern for many.

In addition, the Bank of Japan's interest rate hike policy may also have an impact on the global currency market. As the third-largest economy in the world, Japan's monetary policy adjustments may trigger fluctuations in other major currencies. Especially for asian countries, the trend of the yen has an important impact on their exports and exchange rates, so the Bank of Japan's policy adjustments may trigger fluctuations in the currency markets of the entire Asian region.

On the other hand, the performance of the Japanese economy will also have an impact on the global economy. If the BOJ's interest rate hike policy leads to a slowdown or even a recession in Japan's economic growth, this will affect countries and regions that trade with Japan, especially in Asia. The weakness of the Japanese economy may affect the global supply chain, which in turn will exert a certain degree of drag on global economic growth.

Overall, the impact of a rate hike in Japan will depend on many factors, including the magnitude and speed of the hike as well as the reactions of other central banks. Investors therefore need to closely monitor the BOJ's monetary policy decisions and understand their potential impact on global markets. They also need to adopt appropriate risk management strategies to adapt to possible market volatility and changes.

Impact of Japan's interest rate hike on the global economy

|

Impact

|

Description

|

|

Capital Markets

|

Interest rate hikes can lead to volatility in global capital markets. |

|

Economic Policy

|

Interest rate hikes signal economic recovery and guide global economic policy. |

|

Trade Chain

|

The strength of the Japanese economy may affect global trade and supply chains. |

|

Exchange Rates

|

Yen exchange rate shifts affect Japan's exports and global currency policies. |

|

Economic Confidence

|

Adjustments influence global confidence and shape investor and business outlooks. |

|

Debt Ratio Concerns

|

Apan's debt and interest rate hikes may worsen global instability. |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

The Impact and Significance of Japan's Interest Rate Hike on Japan

The Impact and Significance of Japan's Interest Rate Hike on Japan Impact of Japan's Rate Hike on Global Economy

Impact of Japan's Rate Hike on Global Economy