For investors, in addition to being concerned about whether the business in which they are investing is making a profit or not, they also need to know whether the business has enough cash flow on hand. If they don't, it's very likely that a company that looks like it's performing well will suddenly have a financial crisis without warning. To avoid this, you need to look at the cash flow statement in the financial statements, which can tell investors whether a company really has enough cash flow. Let's take a look at the importance of the cash flow statement and how to analyze it.

Definition and Role of the Cash Flow Statement

Definition and Role of the Cash Flow Statement

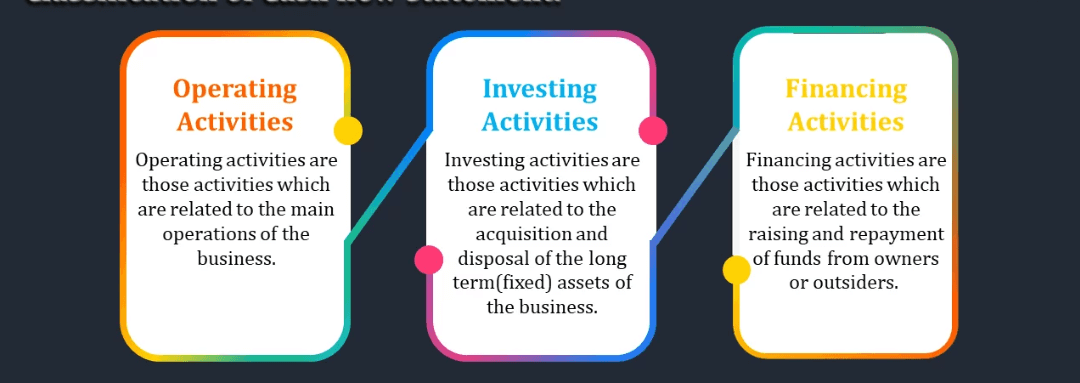

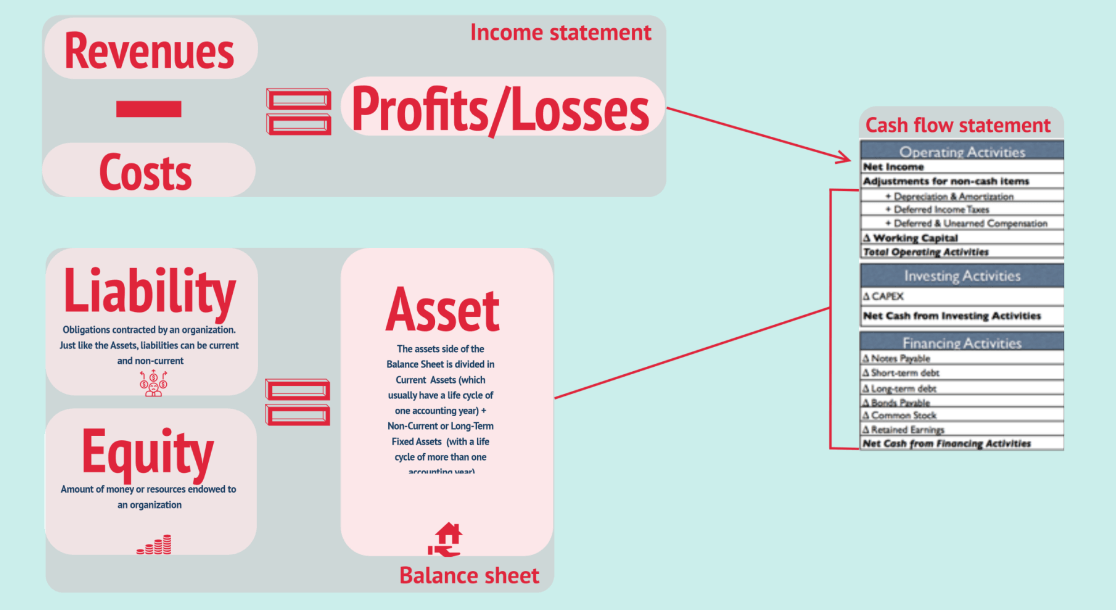

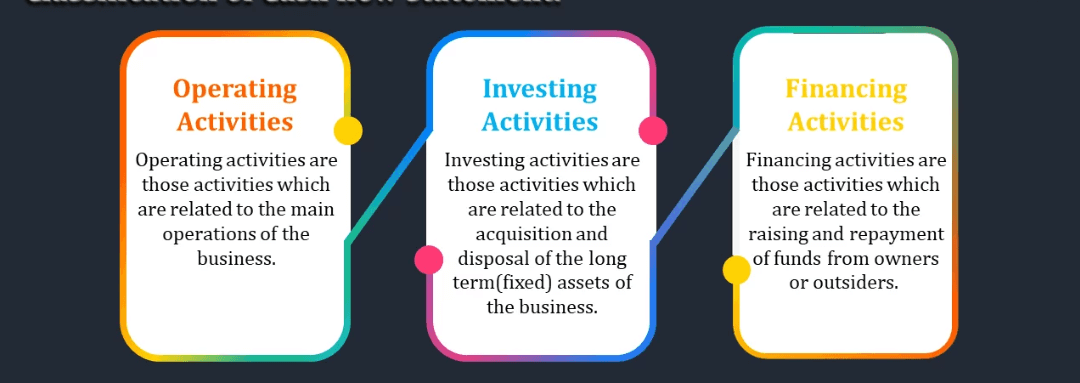

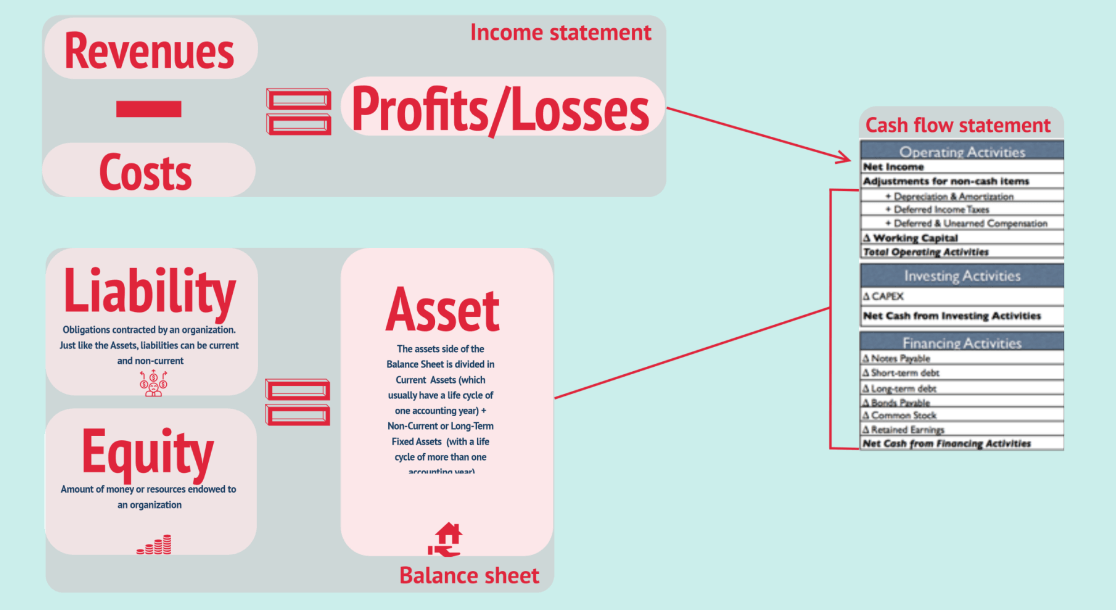

It is a financial statement that is used to record the cash flow of a business over a specific period of time. It shows how the business acquires and uses cash from three sources: operating activities, investing activities, and financing activities. These activities include cash receipts and disbursements and help stakeholders understand the business's cash flows, sources of funds, and uses of funds.

Cash flow from operating activities is the amount of money received or spent by a company through its business activities, through which the true results of the business can be known. Cash flow from operating activities is calculated by subtracting all adjusted non-cash expenses from pre-tax earnings in the income statement. Non-cash expenses are generally accounting losses, such as depreciation and goodwill impairment. Cash flow from operating activities represents how much cash a company can earn from its operations and is the most important information for shareholders.

A company with good operating results will report positive or even steadily increasing cash flow from operating activities over the years. This reflects a net cash inflow from operations. On the contrary, a poorly run company will show negative figures all year round, and investors will have to be doubly careful. Therefore, paying attention to whether the cash flow from operating activities is positive or negative already implies a lot of information.

Cash flow from investing activities summarizes the change in cash from the purchase or sale of assets, including plants, equipment, machinery, and even stocks or speculative instruments. Companies in the growth stage often use the funds generated from operations to reinvest in production facilities or research and development projects.

Therefore, this component is usually negative, which means that the company is willing to or has plans to start more new projects in the future in order to plan for future expansion. Therefore, investors only need to pay attention to the negative cash flow from investing activities to know how aggressive the company is.

On the other hand, when a company sells its assets and the cash flow from investing activities turns positive, investors need to look into the reasons behind it. This is because the sale of assets may have a negative impact on future growth in the long run. Once this happens, investors should pay more attention to understanding the company's motivation for selling assets.

It could be that the company intends to go in a new direction and sell its old tools for assets that it will need in the future. It could also be that the company is having operational problems and is using the sale of assets to obtain funds to support its books or to pay down debt.

Cash flow from financing activities is the money received or paid by the company to banks or shareholders, and the company raises money through debt, equity, or public offerings. Since these financing activities increase the inflow of funds, they are shown as positive in the statement. On the contrary, if the company distributes dividends to pay off debt or acquires a business, etc., money will flow out of the company and will be shown as a negative value in the statement.

Unlike the cash flows from the above two activities, a company that has a positive financing cash flow for a long period of time does not mean that there is a problem with the business. This is because growing companies tend to raise capital to expand their businesses and improve their operating environment. Therefore, the cash flow from the financing activities of these companies is generally positive.

Investors can match the cash flow from operating activities with the cash flow from operating activities. If the operating portion of the cash flow is negative for a long period of time, it probably means that the company is not doing well or that the funds raised are not being used to improve the business environment. As shareholders may not want to continue to raise capital or borrow to continue to operate at a loss, it is best to avoid these companies.

By looking at cash flows from operating activities, investors can see whether a company's core business is profitable and how stable that profitability is. This helps investors identify potential business risks and opportunities in a timely manner. It also helps investors understand the company's actual cash receipts and disbursements, not just the profit figures based on accounting standards. This helps investors more accurately assess a company's earnings quality and cash liquidity.

By analyzing the statement of cash flows, investors can assess whether a company is able to repay its debts and cover its daily operating costs in a timely manner. Healthy cash flow from operating activities ensures that a company has good solvency, while sufficient cash reserves can improve the company's financial soundness.

Simply put, cash flow from operating activities reflects the company's true operating results; cash flow from investing activities shows the company's investment direction and development intentions; and cash flow from financing activities demonstrates the company's financing activities and debt position. Investors can more accurately assess the value and risk of the company based on its analytical results and thus make more informed investment decisions.

Preparation Methods for the Cash Flow Statement.

As a crucial part of the financial statements, it records the inflow and outflow of cash during a specific period, reflecting the operation of the company's funds and solvency. There are two main methods that can be used in preparing this statement: the indirect method and the direct method.

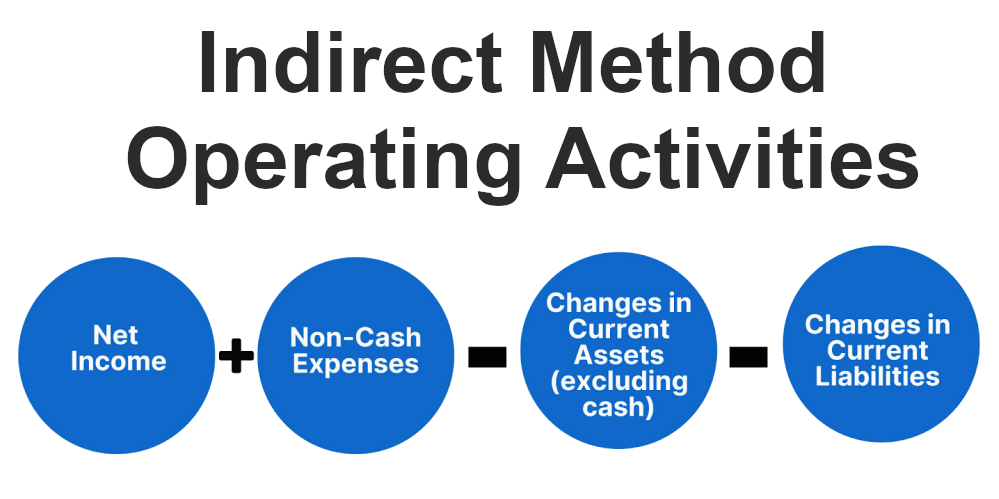

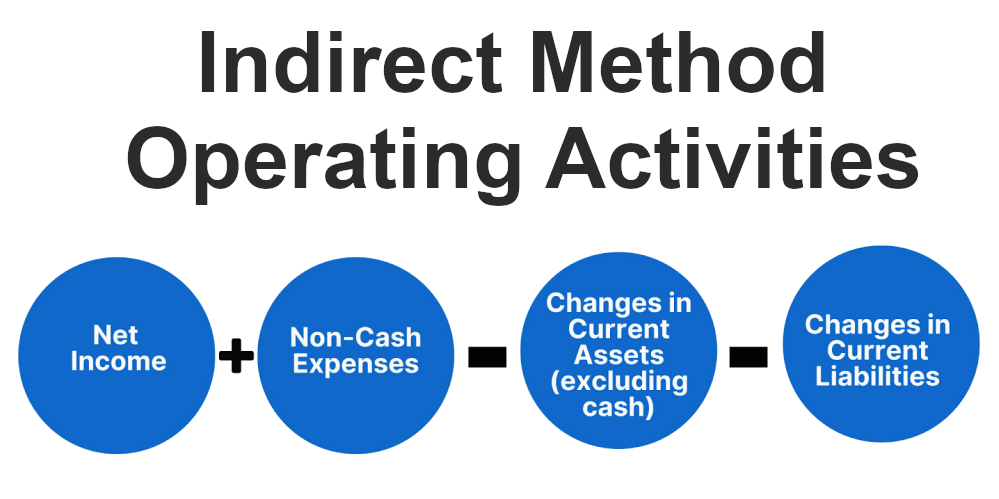

The indirect method of the statement of cash flows is a method derived from adjustments made to the net profit in the income statement, starting with the net profit in the income statement and making a series of adjustments to it to reflect cash flows that differ from the net profit.

The adjustments include adjustments to items in net profit that do not affect cash flow, such as depreciation, amortization, bad debt provisions, etc., as well as items that involve cash flow but are not reflected in the income statement, such as changes in accounts receivable and changes in inventory.

After adjustment, the amount obtained is the cash flow situation related to operating activities. Then the complete cash flow statement is prepared by combining the cash flow situation of investing activities and financing activities. For example, if the indirect method is used to prepare cash flow from operating activities, the basic formula is net profit + non-cash expenses + change in current assets (excluding cash) + change in current liabilities, as shown below.

The indirect method provides an accurate view of the dynamics of a business's cash flow. Users can clearly view the inflows and outflows of funds during a specific period to determine if the business is cash-rich. It also allows users to track changes in accounts receivable and accounts payable. This helps companies develop more effective cash management strategies to ensure timely collection of accounts receivable and management of accounts payable, thereby optimizing cash flow.

With a cash flow statement prepared by the indirect method, companies can better predict future cash flow dynamics. Knowing how cash receipts and expenditures are made each month helps companies better plan future expenditures and investments to ensure financial health.

The indirect method also helps businesses gain insight into seasonal cash flow dynamics and identify potential cash flow problems. This helps companies take timely stEPS to deal with seasonal fluctuations or identify and resolve cash flow issues to maintain the stability and health of their business.

The direct method, as its name suggests, directly reports the various cash inflows and outflows in the statement, which more visually shows the sources and uses of cash in the business. Cash flows are categorized according to operating activities, investing activities, and financing activities to clarify the nature of each cash flow.

For operating activities, the direct method lists cash inflow and outflow items directly related to the sale of goods and the provision of labor services, such as cash sales proceeds and cash payments to suppliers and employees. For investing activities and financing activities, the direct method also directly reports related cash inflow and outflow items, such as purchases of fixed assets, issuance of bonds, and interest payments.

Compared with the indirect method, the direct method is more concise, clearer to prepare, and easier to understand. It is the process of summarizing the various cash flows to arrive at the entire statement. The basic formula for preparing cash flows from operating activities using the direct method is Cash Receipts (Sales + Interest + Dividends) - Cash Payments (Suppliers + Operating Expenses + Interest + Income Taxes + Other) - Other Cash Receipts.

The direct method directly lists the cash receipts and cash disbursements in the statement of cash flows, which is easy to understand and operate and is suitable for a wide range of user groups. And because it directly records where cash flows come from and go, it provides a quick overview of a company's financial position and helps to provide a timely understanding of a business's cash situation.

The direct method does not provide a complete picture of all cash transactions; it only lists total cash inflows and outflows and does not provide a detailed analysis of specific transactions. For long-term success, more comprehensive analysis and planning are required, which cannot rely solely on data from the direct method.

Therefore, in order to gain a comprehensive understanding of a company's financial position, the direct method should be used in conjunction with other methods, such as the indirect method and financial ratio analysis, in order to gain a deeper understanding of a company's cash flow dynamics and financial health.

In practice, different countries and regions may adopt different regulations and standards requiring enterprises to use a particular method of presentation. In the United States, either the indirect method or the direct method of preparation is usually allowed. In other regions, such as China, the direct method is generally required for external disclosures. However, companies need to ensure that cash flow information is accurately recorded and reported to provide stakeholders with accurate financial information to help them make the right decisions.

How to Analyze Cash Flow Statement

It actually serves the function of faithfully presenting business operations, just like the balance sheet income statement. By grasping the three kinds of cash flow, long-term performance status can help investors speculate on the current status of the enterprise's operation and policy and further judge whether increasing the enterprise is worth investing in.

Cash flow from operating activities shows how much cash a company can generate from its core business activities, including accounts receivable, accounts payable, and goods, among others. Cash flow from operating activities can be compared to profits; if profits are much greater than cash flow from operating activities, it means that the company does not have the means to convert profits into cash, and there is a possibility of short-term liquidity problems.

Next, if there is a large increase in accounts receivable and goods, it means that the company may have uncollectible debt or customers are increasing their payment terms, which will reduce the company's operating cash flow. If the company has a significant increase in accounts payable over all other items, this could be a sign that the company is delaying payments to suppliers to improve its cash flow position at the end of the year.

Cash flow from operations should need to be positive so that the company can ensure that it has enough cash to pay for day-to-day operating expenses, taxes, and interest. The company needs to have cash to make these payments without having to borrow to issue stock or sell assets to keep the company running on a day-to-day basis.

Cash flows from investing activities, recorded here, are those related to long-term assets. If a company sells assets in order to obtain cash to purchase or invest in new assets to increase productivity, expand the business, or achieve a strategic goal, this is often considered an active asset reallocation and investment behavior. In this way, the company can utilize the new assets to generate more revenues and profits, thereby enhancing its competitiveness and continued profitability.

However, if a company sells assets to get cash flow to run the company's day-to-day operations, this represents poor cash management. This is because frequent sales of assets to run day-to-day operations may indicate that the company's profitability is challenged and the management may fail to manage the company's liquidity effectively, in which case the company may be in financial distress.

Cash flows from financing activities, which are cash flows related to debt and equity, include the payment of dividends to repurchase or sell stock to acquire or repay debt, etc. For investors who favor dividend earnings, this section shows how much cash the company uses to pay dividends to shareholders.

For example, a company relies on huge loans to expand, resulting in overexpansion. From the balance sheet and income statement, it can only be seen that the company is growing very fast with good prospects. However, the cash flow statement shows that the company does not have enough cash flow to carry out its operating activities. The company's over-reliance on loans may lead to liquidity and repayment problems, and in the worst-case scenario, it may lead to bankruptcy.

You only need to pay attention to whether the cash flow from operating, investing, and financing activities is positive or negative to know the status of the company and the direction of future development. When the company has problems, you can combine the different parts to analyze the situation and be careful when you have doubts.

In a comprehensive analysis, when cash flows from operating, investing, and financing activities are all positive, it may indicate a lack of effective capital utilization by the company, which is a cause for alarm. In this case, the business may be failing to fully utilize the capital for investment or expansion, resulting in the accumulation of capital without creating more value. Investors need to further investigate the business's capital operations and future growth plans to determine its sustainability.

Positive operating and investing cash flows and negative financing cash flows may indicate that the business is growing steadily, expanding its business through earnings and investment, but not relying on external financing. In this case, the business may have sufficient internal cash flow to support its growth without over-relying on external financing. This may be a healthy financial position, showing that the business is expanding its business in a self-sufficient manner.

Positive operating cash flow and negative investing and financing cash flow may indicate that the business is expanding its business while giving back to shareholders or paying down debt. In this case, the business may be aggressively expanding its business, supporting its investments through internal cash flow, giving back to shareholders, or reducing debt through dividends, stock buybacks, or debt repayments. If the business is able to sustain this growth pattern, it may be a quality business to hold for the long term. However, investors also need to keep an eye on a business's debt levels and solvency to ensure it is financially sound.

Assuming that a company has positive operating cash flow and negative investing cash flow today, based on the definitions I have just explained to you, you can tell that the company has been able to generate excess cash from its operating activities during the period and that it may be engaging in related investing activities, such as actively expanding outside the country or purchasing additional production equipment.

Generally speaking, based on these two clues, it may be possible to interpret that he is a growth company worth watching. However, it is important to note that if the free cash flow is negative in the long run, i.e., the amount of operating cash flow is not enough to compensate for the outflow of investing cash flow, Unless the business has very sufficient liquid assets, watch out for the occurrence of liquidity failure.

When analyzing the statement of cash flows, investors need to pay attention to whether cash flows from operating, investing, and financing activities are positive or negative and to trends over time. Different combinations of cash flows may reflect different stages of development and financial conditions of the enterprise, and investors need to consider these factors comprehensively to make informed investment decisions.

How to analyze a cash flow statement

| Aspects |

Method of Analysis |

Significance |

| Operating Activities |

Compare cash flow to income for analysis. |

Evaluate profitability and cash management. |

| Investing Activities |

Analyze asset transactions for trends. |

Review expansion and investment plans. |

| Inancing Activities |

Review debt, equity, and financing trends. |

Evaluate financing and debt management. |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

Definition and Role of the Cash Flow Statement

Definition and Role of the Cash Flow Statement