Although known as a precious metal like gold, the price of silver and gold is not comparable. As it is today, with the price of gold skyrocketing, the price of silver has significantly grown, but the price ratio between them is getting higher and higher. This makes people who are interested in silver investments feel curious. For this reason, this article will specify the silver price history, changes, and future trends.

Silver Price History

Silver has long been a favored hard currency in both the East and the West. Its advantages are obvious: it is easy to cast and divide, not easy to corrode, and more popular than gold and more valuable than copper. Silver can be used not only as currency for small daily transactions but also for large transactions.

In ancient times, silver ruled the financial world and was commonly used as a monetary unit, while a thousand taels of silver was a symbol of wealth. According to the real history of the Qing Dynasty slave system, in the twenty-second year of the Daoguang Dynasty, one or two pieces of silver could be sold directly to the servant girl as a slave, which is nowadays absolutely impossible.

The reason for this lies in the introduction of the British Gold Standard Act of 1816. At the same time, the Bolton mint, which utilized steam power, was introduced into the Royal Mint, and the greatness of the machine changed everyone's perceptions. A batch of 427.53 pounds worth of gold coins was quickly struck and distributed throughout the British Empire, quickly replacing silver in the small trade.

As Britain became the first world factory, its unprecedented efficiency brought with it massive imports of raw materials from around the globe. At the same time, its manufactured industrial goods were quickly exported to various countries, and with the massive flow of material and money, the gold standard pound soon became the international currency. It was at this time that large silver mines were discovered in the Americas and Australia, leading to a rapid increase in the silver circulating in the market, and its value depreciated even further. All silver-based countries suffered, and China was one of them.

At the expense of silver devaluation, the gold standard worked well. However, on October 29. 1929. the Great Depression swept the world with the collapse of the U.S. stock market. At the time, it was thought that the total amount of gold in the world was too small and that production was insufficient to cope with the rapidly growing market demand. Anchoring the currency with it was a self-imposed restriction on the supply of money, and in the event of a financial crisis, the government could only watch the depression spread.

The only exception in the world at that time was China, which was still on the silver standard and therefore received attention from other countries. This was mainly due to a plan put forward by American economists to stimulate the consumption potential of China's 4.8 billion people by artificially raising the price of silver and to find outlets for slow-moving goods in order to tide over the economic crisis.

The Chinese were helplessly witnessing an unacceptable situation of 180 million taels of silver flowing out of the country every year in exchange for a bunch of other people's slow-selling goods. As the economy continued to deteriorate, the then-Republican government was forced to implement monetary reforms and abandon the silver standard system. Since then, the world's last silver standard countries have disappeared, and silver has since lost its monetary properties.

But even so, silver, as a metal with excellent thermal conductivity, electrical conductivity, and ductility, did not lose its value. For example, in April 1942. the U.S. War Department launched the Manhattan Project, which utilized more than 12.000 tons of silver as the coils of an electromagnetic centrifuge to create unprecedentedly powerful magnets and ultimately succeeded in creating the atomic bomb.

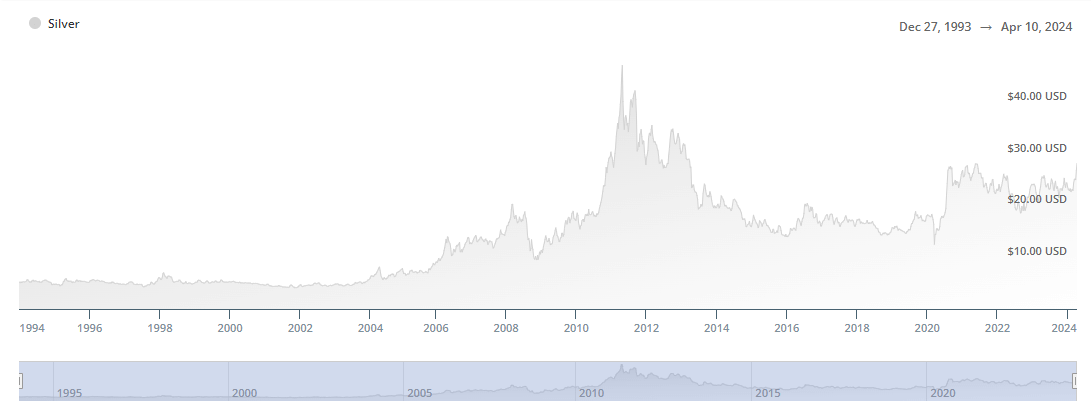

Silver's price in the commodities trade, which appeared to be more transparent after the war, fell dramatically. It wasn't until the 1970s that the Hunt family began to focus on silver. They believed that silver had long been grossly undervalued because the closure of a large number of silver mines had resulted in a huge gap between supply and demand.

The number of silver futures in circulation became very limited, which meant it was an ideal subject for speculation. Between 1973 and 1979. the Hunt brothers purchased a total of 200 million ounces of silver and controlled the entire market. With their deliberate manipulation, one of the longest silver bull markets in human history was able to unfold.

From $2.90 per ounce at the end of 1973 to $19 per ounce at the end of 1979 to $50 per ounce at the beginning of 1980. Such a high rise sent the world into a frenzy of silver smuggling cases, and countries were caught up in it. There was a frantic search for silver, which was melted down into silver bars and shipped to the United States.

And just in the U.S. folk accumulated for centuries of silver products is more than 2.5 billion ounces, such a huge amount began to circulate directly hit the entire market. On January 21. 1980. the New York Stock Exchange issued an emergency notice and declared the silver futures market in a state of emergency. The following day, the Chicago Board of Trade announced a liquidation program in response, yet the price of silver fell in response, and the market experienced a one-sided stampede.

To make matters worse, the Board of Trade increased margins on silver contracts by six times at once, and brokers who had previously lent money to the Hunt brothers demanded that they force the liquidation of their positions, a move that accelerated the silver collapse. At that point in time, the Hunt family still owned 63 million ounces of silver. Such a huge asset, if sold off, would have destroyed the market and triggered the bankruptcy of major banks.

In order to prevent the collapse of the banking industry, the government had to step in and provide the Hunt brothers with a long-term loan worth $1.1 billion to maintain the stability of the market. For this, the Hunt family also paid a huge price, as they had to sell their stakes in oil fields and refineries and mortgage their oil companies to the government.

The Hunt Brothers silver manipulation case is one of the largest speculative events in history, and the price of silver remained in a relatively stable range for a long time after the madness broke. Only in the case of international instability will silver be regarded as one of the investment channels for hedge funds, following the gold market.

Factors Limiting the Rise of Silver Prices

The price of silver in modern times has been artificially devalued too much. For example, on April 11. today's domestic silver price is 6.49 yuan per gram, 50 grams, or only 324 yuan of purchasing power. During the Tang Dynasty, the price of a Luo coin with the surnamewith the surname was about 7.5 taels of silver, equivalent to 7.500 wen or 2.250 yuan. In other words, the true value of silver has shrunk nearly eight times in recent times, and this trend will likely continue until it evolves into another form altogether.

If you therefore think that the value of silver is inherently low and thus the price can't go up, you're sadly mistaken. In fact, the value of silver is not low in quality or scarcity per se, which makes it difficult for the price to rise. On the contrary, silver has always been widely used as an important raw material for currency, industry, and jewelry, and its value is widely recognized.

Not only does silver have monetary properties and investment value, but it also plays an important role in industry due to its excellent electrical conductivity. As a common conductive material, it is also widely used in the manufacture of optical instruments. In addition, silver is often used to make beautiful jewelry and utensils. And its applications include other modern technologies, such as solar panels.

Despite this outstanding real value, silver has struggled to increase in price. One of the main reasons for this is the dramatic increase in the production of silver, which has not been matched by a parallel increase in the demand for silver, resulting in an imbalance between supply and demand.

In ancient times, the only way to get silver was through silver mining, but silver-rich veins—not to mention, not many—on earth are very few, so the production of silver is very limited. Nowadays, although mining technology has advanced, silver mines are still hard to find. But strangely enough, silver production has increased a hundredfold, thanks to the invention of electrolytic silver extraction.

It has been found that there are traces of silver in copper, aluminum, and lead-zinc ores, although their content is much lower than that of silver ores. Due to the huge amount of copper and aluminum ores, these traces of silver cannot be ignored. With the modern use of electrolysis for refining copper and aluminum, silver monomers accumulate directly on the electrodes, making high-purity silver easily accessible. As long as the metal produced by electrolysis can be casually refined into a little silver, perhaps a ton of copper ore in only a little bit of silver, the cumulative yield is quite impressive.

According to scientists' estimates, China's silver holdings exceeded 45.000 tons at the height of the Qing Dynasty. But with Chinese factories refining 24.600 tons of silver in 2021. China is now producing twice as much silver annually as it did in the past thousands of years of digging and refining combined.

But this reason has changed in recent years, and nowadays the demand for silver has increased so much that it is more scarce than one might think. It is important to realize that silver has excellent electrical conductivity, which makes it one of the ideal materials for making photovoltaic devices. Currently, the demand for silver in the photovoltaic industry is 20%, in the power industry 16%, and in the automotive industry it has reached 14%.

In China, for example, the photovoltaic industry consumed about 4.000 tons of silver in 2022 alone. And according to expert forecasts, the demand for silver in the photovoltaic industry may even account for 80% of the total in the next 20 years. In addition to the photovoltaic industry, the demand for silver in the fields of smartphones, microelectronics, 5G communication devices, and photographic materials is also increasing rapidly.

Just these three segments alone consume 50% of the supply of silver, while, according to the U.S. Geological Survey, the world's silver mineral resource reserves of 530.000 tons will be depleted in the next eight years. Even taking into account underground proven reserves, the supply of silver will not exceed 14 years, and the most optimistic estimate is only 20 years.

According to the World Silver Council, unlike gold mining, low-consumption mining of silver has already resulted in about half of all silver being consumed and destroyed. With only about 2.8 billion ounces of current mineable silver remaining globally, silver is by definition already rarer than it used to be, but it still can't outrun gold in terms of price increases.

There is a large human factor in this, which is the result of JPMorgan Chase's suppression. JP Morgan has taken over from the Hunt brothers as the silver manipulators since 2008. when they bought Bear Stearns and became the biggest short seller. They utilized short contracts on silver futures that they could sell in unlimited quantities as the price rose, and they continued to operate for years.

This allowed J.P. Morgan to profit handsomely over the next few years and rapidly increase its assets. However, due to the prolonged period of low prices, silver began to run short in physical terms, and by April 2011. silver had surpassed $50 per ounce for the second time in its history.

With other short sellers in trouble, JPMorgan began to stockpile silver in large quantities.

With its huge physical inventory, JPMorgan was virtually unstoppable in its attempts to depress the price of silver. Once the price fell low enough, JPMorgan was able to add further to its stockpile, increasing its leverage for the next round of shorting. This snowballing strategy of accumulating advantage has given them a strong position in the market and has attracted many followers who follow in his footstEPS and profit from periodic silver shorting operations.

On top of that, the reason that the price of silver has been severely undervalued for a long period of time is because it has been suppressed for a long period of time by stakeholders all over the world. The simple fact is that businessmen who need silver as a raw material for their production want it to be as cheap as possible. So these so-called stakeholders do everything they can to suppress silver. And silver and gold are basically linked to the U.S. dollar, so when the U.S. dollar is strong, the price of silver is easier to suppress.

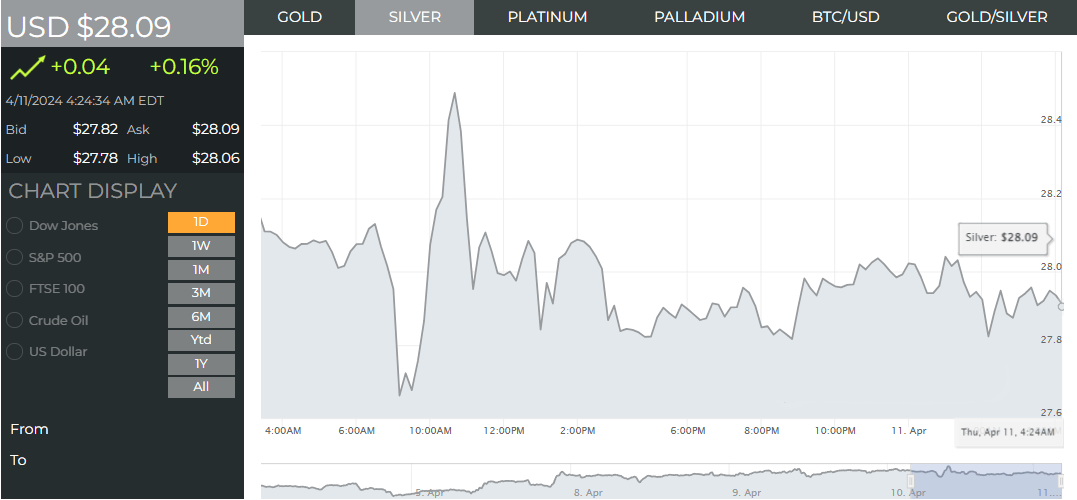

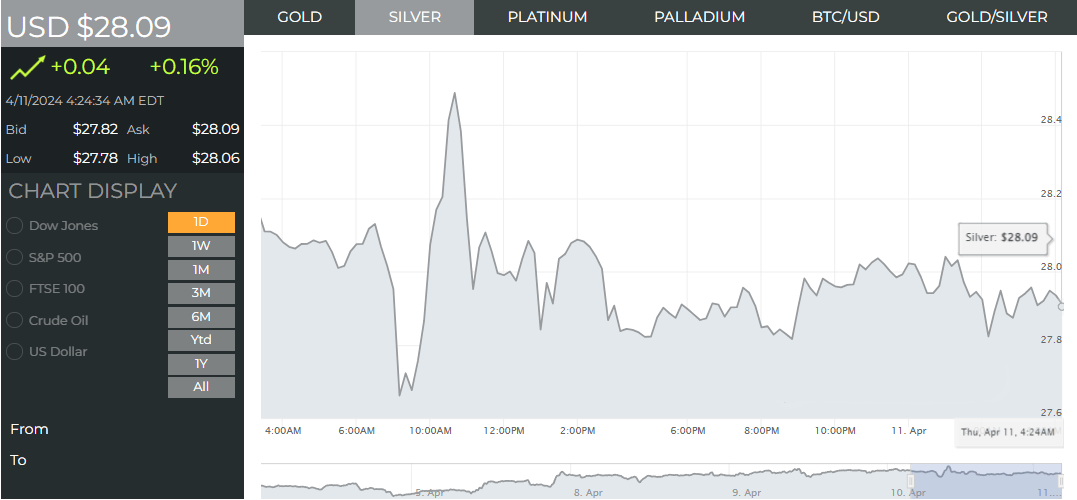

But this year, with the rising price of the gold market, silver prices also got a significant boost. Many economists are also predicting that the price of silver will be very difficult to suppress, which means that a surge will occur.

Conditions Leading to a Surge in Silver Prices

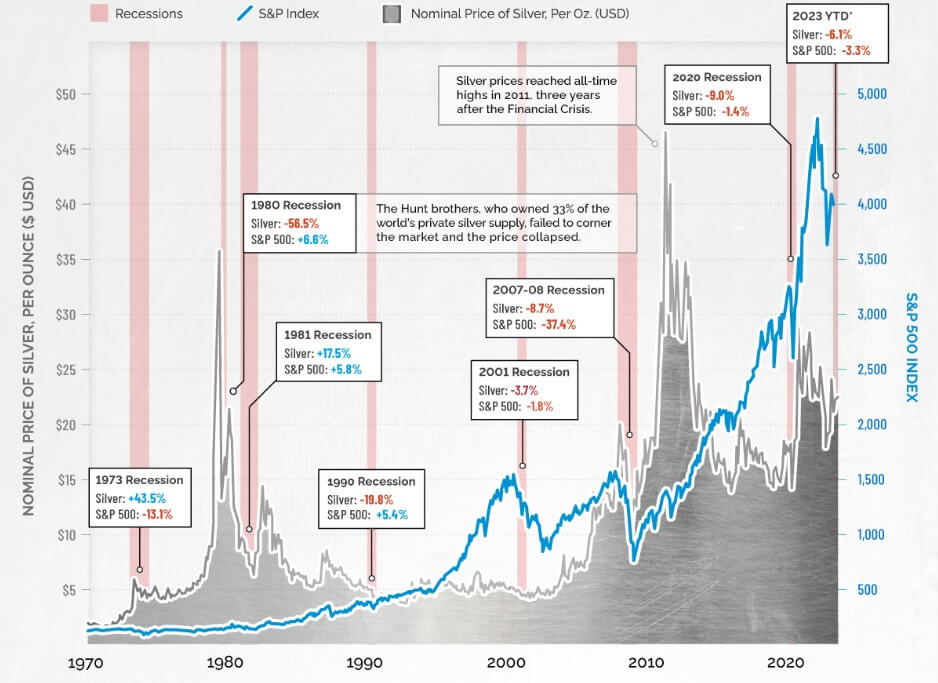

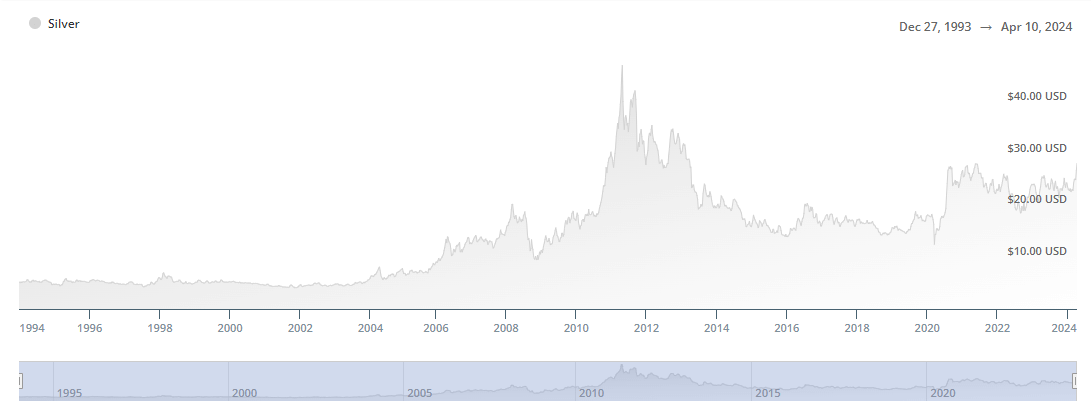

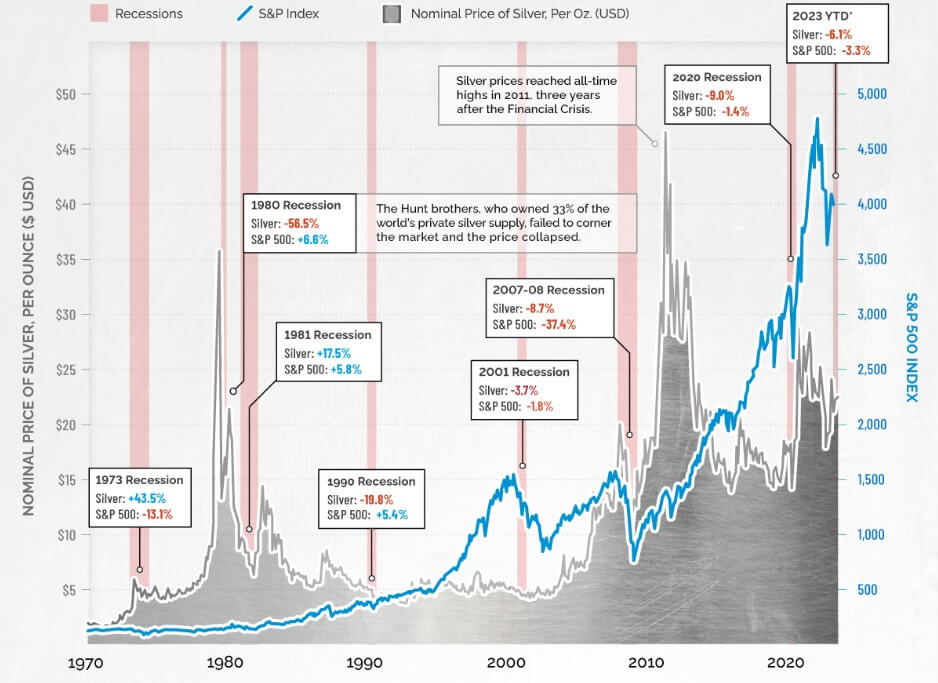

Although the price of silver has been in the doldrums after being suppressed by the financial giants, a spike in its price could happen this year. According to the Silver Institute, silver prices are predicted to have a strong year. There are a number of reasons for this, one of which is that, if you look at historical data, when the economy is shrinking or inflation, silver follows gold in popularity as a value-protecting asset and therefore sees a period of price increases. As you can see in the chart above, silver prices even outperformed the S&P 500 during the recession.

Signs of economic instability or recession often trigger concern among investors, who seek safe haven assets to protect their wealth. Precious metals, especially gold and silver, are often seen as the safe-haven assets of choice. This is due to their stable value in times of economic turmoil and their immunity to inflation and currency devaluation, as their value is not dependent on a particular country's currency.

In such cases, investors usually increase their demand for precious metals, which drives up their prices. Particularly when inflationary and currency devaluation pressures increase, investors are more inclined to turn to precious metals as a safe-haven option. As a result, the precious metals market tends to be buoyant when the economy shows signs of instability or recession, and the prices of precious metals such as gold and silver may be driven higher.

Silver is often viewed as a hedge against inflation because it offers some stability and is somewhat less susceptible to inflation. Unlike paper money, the value of silver does not depreciate due to inflation because it is a physical asset whose value is determined by supply and demand and market factors.

In the case of inflation, the purchasing power of paper money declines, but the value of silver remains relatively stable and may even rise. This is due to the scarcity and practical uses of silver, such as its widespread use in industrial production and as an investment and reserve asset. As a result, investors tend to move their money into physical assets such as silver to protect their wealth from inflation.

And fundamentally, if you look at it, there are three reasons for this, the first being that global demand for silver is expected to reach 1.2 billion ounces in 2024. which will be the second highest level ever. This is mainly due to the strengthening of industrial demand, such as automobiles and solar panels, which is driving the growth in silver demand.

Demand for silver has shown a continuous growth trend with the development of industrial sectors such as automobiles and solar panels. In particular, the rise of new energy vehicles and the widespread use of solar technology have further boosted the demand for silver. This trend signals that the importance of silver in the industrial sector will continue to grow, thus driving its demand to remain high.

In addition, the demand for silver in the consumer sector is also showing an increasing trend. Demand for silverware is expected to increase by 9% and demand for jewelry by 6%. In India, in particular, a boom in jewelry purchases is expected to lead the consumer market, giving new impetus to the growth in silver demand. At the same time, the recovery of consumer electronics will also further push up the price of silver, because silver's wide range of applications in electronic products makes it one of the indispensable materials for the consumer electronics industry.

Thirdly, there are economic factors, as the market is now anticipating that the federal reserve will start cutting interest rates in the second half of 2024. Since the price of silver and interest rates are inversely related, this will favor the price of silver. This is because lower interest rates make it more expensive to hold cash or bonds, which pushes investors to seek other assets for higher rates of return.

It follows that if the Federal Reserve begins to cut interest rates in the second half of 2024. this will provide favorable support for the price of silver. Investors may turn to commodities such as silver for safe-haven assets and seek to preserve value or earn higher returns. This scenario could see an increase in demand for silver, which could have a positive impact on the price.

Overall, silver prices tend to be viewed by investors as a preservation asset to protect their wealth in times of economic turmoil or inflation. Today's unstable economy, increased industrial demand, growing demand in the consumer sector, and changes in interest rates can also cause the price of silver to rise rapidly under certain circumstances, attracting investors to put their money into this safe-haven asset.

Silver price history Changes and future trends

| Historical Changes |

Future Directions |

| Silver was a key currency in ancient times. |

Industrial demand boosts silver's importance. |

| The Industrial Revolution lowered silver prices. |

Rising consumer demand elevates silver prices. |

| A silver price drop leads to economic instability. |

Silver is sought during economic crises for safety. |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.