It is very true that more and more of our buddies today go through a company's financial report before buying a stock to understand every aspect of the company's past life to make sure that they are spending their money in the right place. And in this regard, profit margin, gross profit margin, net profit margin, and other three indicators are what most investors or shareholders will also look at. But in fact, in addition to them, there is another indicator that is ignored by everyone, which is EBITDA. and some people know it but also do not know how to use it. Therefore, this article will provide you with an in-depth analysis of the EBITDA concept and the application of the guide.

Meaning of EBITDA financial metrics

Meaning of EBITDA financial metrics

It is the abbreviation Earnings Before Interest, Taxes, Depreciation, and Amortization, which is translated into Chinese as Earnings Before Interest, Taxes, Depreciation, and Amortization, that is, earnings before interest, taxes, depreciation, and amortization. This metric is often used as a tool to assess a company's operating performance because it reflects the profitability achieved by a company in its core business, independent of factors such as capital structure, accounting policies, and depreciation and amortization methods.

Generally, a company's earnings are actually net profit, which is derived from total revenues minus total expenses. Total revenues include revenues from the sale of products or services produced by the company, as well as revenues from other sources of the company, such as interest income, investment income, and so on. Total expenses are the sum of all costs and expenses incurred by the company during the same period of time, including production costs, sales and marketing expenses, administrative expenses, depreciation and amortization, interest expenses, taxes, etc.

When all possible expenses (e.g., costs, expenses, etc.) are deducted from a company's income, in addition to taxes, a pre-tax profit is obtained. Companies usually try to minimize their pre-tax profit through sound cost management and expense control to reduce their tax burden. And when taxes are deducted from the profit before tax, you get the net profit of the company.

However, EBITDA is calculated before deducting operating income tax, before deducting bank interest, and before deducting amortization and depreciation expenses. This is to eliminate the impact that certain factors can have on profits depending on the financing and accounting decisions made by the company.

For example, interest expense depends on the amount of money the company borrows, the interest rate, etc.; taxes depend on the geographic location of the company; and depreciation and amortization depend on the decisions the company has made historically and not on current operating performance. Considering all these factors, EBITDA is used to assess the core operating capacity of the company.

Interest expense is the interest paid by a company on its debt and is usually associated with the company's financing activities. Companies with high levels of debt may experience a decline in net income due to large interest payments, which can affect investors' assessments of their operating performance. Excluded interest expenses can help highlight the true profitability of a company in its operating activities, independent of its debt structure.

The exclusion of pre-tax and post-tax is designed to highlight the level of profitability of a business before tax without having to consider the impact of its tax strategy or tax rate. It makes it easier for investors to compare financial performance between businesses without the interference of tax factors, resulting in a more accurate assessment of a business's value and potential.

Depreciation is the reduction in value of an asset due to wear and tear, aging, or technological obsolescence over the course of its use. Since depreciation is a non-cash expense, it reduces the net profit of a business but does not affect its cash flow. By excluding depreciation expenses, it is possible to improve the actual profitability of the business during its operations without being affected by the diminishing value of the assets. This allows investors to better assess the business performance of the business without being affected by the depreciation of assets.

Amortization is the process by which the value of intangible assets (e.g., patents, goodwill, copyrights, etc.) diminishes over time. Unlike physical assets, intangible assets usually do not have a definite physical form but have significant value in business activities. Amortization expenses are excluded, thus providing a more accurate picture of a company's operational performance with respect to intangible assets. The pass enables investors to have a clearer picture of the actual profitability of the business without being affected by the diminishing value of intangible assets.

Thus, EBITDA helps measure the profitability of a company based on its business operations. This is because it excludes factors related to capital structure, accounting policies, and taxes and focuses on the profitability of the core business. This allows investors to better compare profitability between companies without the interference of non-operational factors.

How EBITDA is calculated from statements

As an unofficial financial metric, not all income statements list it directly. So to finally get such an indicator, investors need to find some data from the financial reports themselves to finally arrive at EBITDA (earnings before interest, taxes, depreciation, and amortization).

The first thing that can be found at the bottom of the profit and loss statement (also known as the income statement) is the net profit, which indicates the amount of money left over from the company's total revenues minus its total costs and expenses for a given period. Also found in the income statement is interest expense, which is the interest expense paid by the company and is usually listed before net profit.

Similarly, if the income statement includes tax expenses, they should be added to the previous total. This is the tax expense paid by the company and is usually listed after interest expense. Depreciation and amortization expenses, on the other hand, can usually be found on either the balance sheet or the income statement, where they would typically be in the cost of operations or cost of goods sold accounts. On the balance sheet, they are usually in the fixed assets and intangible assets accounts.

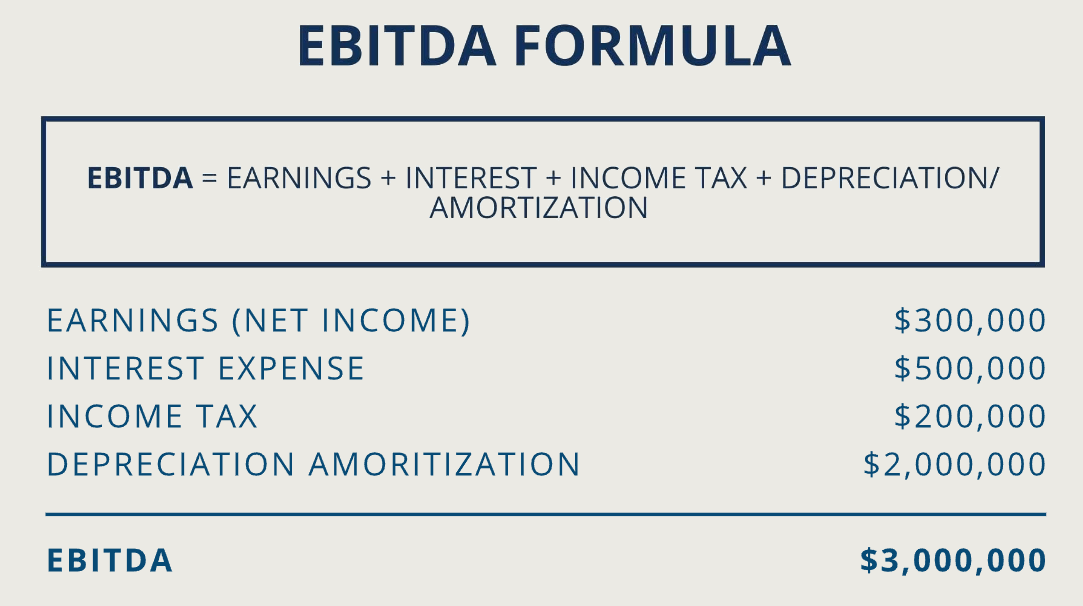

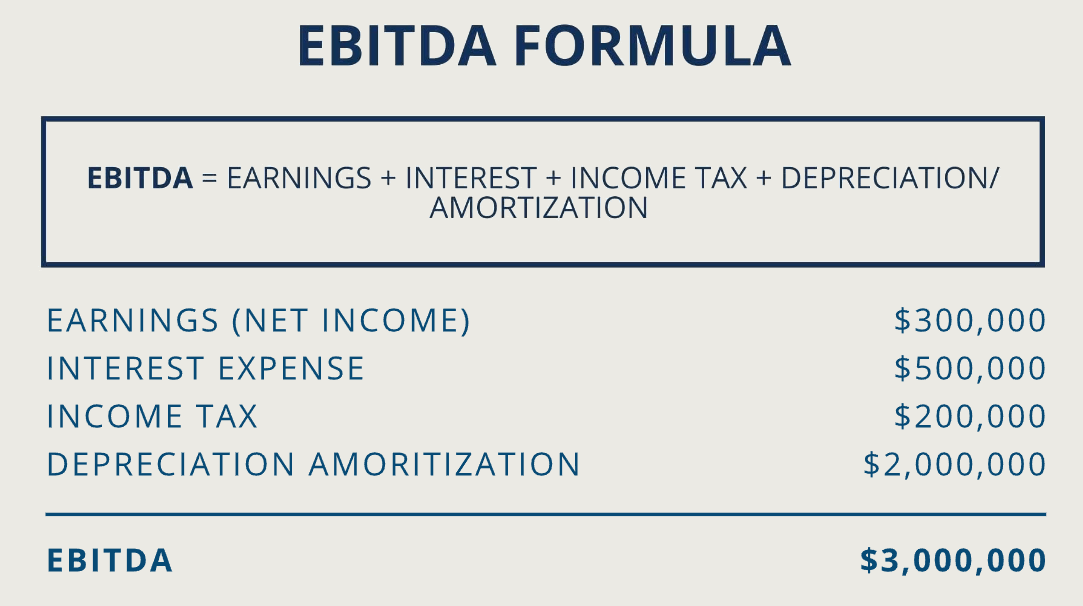

Once you have found these items, you can get a value by bringing these numbers into the formula: EBITDA = Net Income + Interest Expense + Tax Expense + Depreciation Expense + Amortization Expense. There is another formula that can be used, and that is to simply use Earnings Before Taxes + Interest Expense + Depreciation Expense + Amortization Expense, which will also give you the same value.

To illustrate, for example, assume that sales revenue is $1,000,000 and operating costs are $600,000, resulting in a gross profit of $400,000. Selling and administrative expenses are $200,000, resulting in an operating profit of $200,000. Depreciation expense is $50,000, and amortization expense is $20,000. Interest expense is $30,000, and income tax expense is $40,000. EBITDA is then $200,000 + $50,000 + $20,000 + $30,000 + $40,000 = $340,000.

In general, a higher EBITDA (earnings before interest, taxes, depreciation, and amortization) usually indicates that the company is profitable in its operating activities. This could mean that the company's core business is performing well, generating more operating income and achieving higher profits without considering interest, taxes, depreciation, and amortization.

Practical application of EBITDA

As a financial indicator, it has its advantages and limitations. And in general, it is not well utilized by the average investor. Basically, it is used by many investment banks and foreign banks. They see two benefits to the indicator:

The first is that it is the most intuitive presentation of profitability after excluding factors such as financial operations, capital expenditures, government taxes, etc., so it can be used to analyze the profitability efficiency of a company only with respect to its business model. It can also be used to calculate the profitability of a company's business operations based on an intuitive view of profitability, independent of interest expense, tax expense, and depreciation and amortization expense due to capital expenditures.

Secondly, in the case of mergers and acquisitions or bank lending, there are not only public companies but also small or unpublished companies. Therefore, cash flow statements are not always available, making it difficult to understand the status of all non-cash items.

In this case, EBITDA becomes a very useful indicator because it provides a figure close to the cash flow from operating activities, which helps investors or lenders assess the profitability and solvency of the business. Although it is not exactly equivalent to cash flow, it can be used as a reliable alternative indicator for assessing the financial position and business performance of a company.

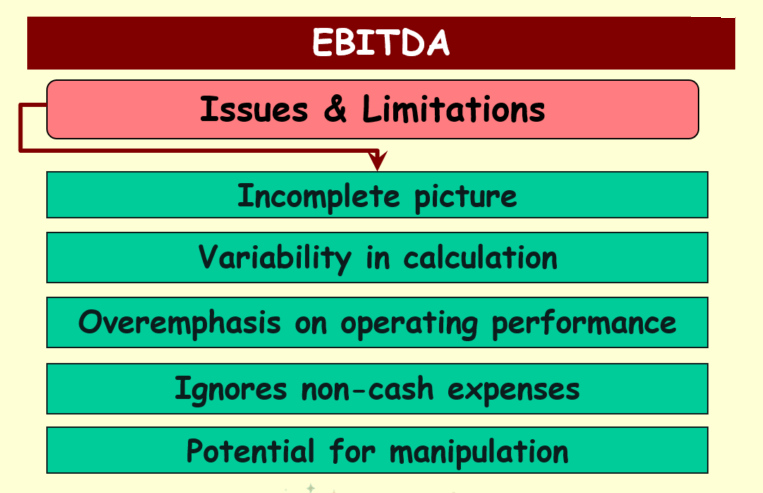

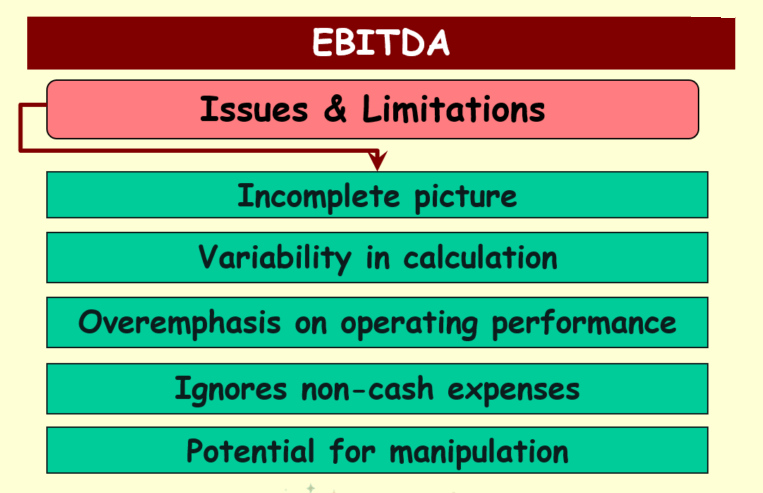

That's why it's a good metric to use to determine how good or bad a company's profitability is, and comparing it to its competitors will make more sense. But with the good comes the bad, and in practice, the advantages of EBITDA are also its disadvantages. Because it takes out the things that a company needs to face, the actual expenses of operation, deliberately deducted, will overestimate the profitability of the company, as shown in the figure below.

While many companies use it to represent the ability of the entire company to generate cash, the stock god Warren Buffett hates this metric. This is because this metric has a depreciation charge, and the number can be easily manipulated. A slight adjustment can make it look higher than it really is.

Therefore, in practice, investors generally use it to calculate its ratio to total debt. This financial ratio can be used to measure whether a company's profitability is sufficient to cover all of its debt, so investors can use it to analyze a company's ability to repay its debt. It is calculated by dividing total external borrowings by EBITDA; the higher this ratio is, the more profitable the company is and the more easily it can cover its entire debt, thus having a greater ability to pay off its debt.

A value calculated by this formula that is greater than 5 means that this company will have to earn more than 5 years to pay off all of its debt. Such a situation may indicate that the company has a relatively weak debt repayment capacity because of the long debt repayment cycle. On the other hand, it can also be said that the financial leverage is relatively high, i.e., the company's debt is high relative to its profitability, and there is a high level of financial risk.

It is used in particular because the cash is spent when the company purchases plant machinery and equipment, i.e., when it makes capital expenditures. However, the subsequent depreciation and amortization expense of the plant machinery and equipment is amortized proportionately above the statement of cash flows each year because of accounting principles and is not really a cash outflow.

So add the depreciation and amortization expense back to the net benefit before tax deduction in order to represent when the company really created cash inflows or outflows. Since cash must be used to pay off the bank loan, it would be used to represent the cash capacity to calculate the company's ability to pay back the money.

There is also the ratio of it to interest expense to calculate the EBITDA interest coverage multiple, a financial ratio that is used to measure whether a company's profitability is sufficient to cover its interest expense. The higher this ratio is, the more profitable the company is and the easier it can pay its interest expenses, thus being more debt-stable.

Another way of applying this is the EV/EBITDA valuation method, which compares a company's enterprise value to its earnings before interest, taxes, depreciation, and amortization. It is a common business valuation method used to assess the value of a company's investment. In this case, EV stands for enterprise value, which includes Market Capitalization, debt, and minority interest and is used to indicate the overall value of a business.

The level of this ratio reflects the valuation of the business at the current market price. Typically, a ratio below the industry average may indicate that the business is undervalued and is a potential investment opportunity. A ratio above the industry average may mean that the business is overvalued and may not be an ideal investment option.

One of the advantages of this method is that it eliminates the effects of capital structure and accounting policies, making comparisons between different companies easier. However, when applying this ratio to valuation, care must be taken to compare two companies in the same industry, as the ratio can change from industry to industry.

Generally, it is more useful in valuing capital-intensive businesses, such as manufacturing and telecommunications. The financial performance of these industries is more affected by capital expenditures, depreciation, and amortization because of the large investments required to purchase equipment, build infrastructure, and conduct research and development.

By using this ratio, investors can get a better idea of the actual profitability that a business achieves from its operations, independent of capital expenditures, depreciation, and amortization. It more accurately reflects the business's operating conditions and profit potential. This helps investors evaluate companies in these industries more comprehensively and provides more reliable data and references for investment decisions.

To summarize, although EBITDA has various flaws, it is still a useful financial indicator and does have certain advantages in assessing a company's profitability and solvency. It can provide investors with valuable information to help them better understand and evaluate the financial performance of a company.

Practical application of EBITDA

| Utilization |

DESCRIPTION |

| Evaluating profitability |

Measures the profitability of the core business. |

| Calculate EBITDA interest coverage multiple |

Measure earnings coverage of interest expenses. |

| Used in the EV/EBITDA valuation approach. |

Estimate business value compared to profits. |

| EBITDA Total Debt Ratio |

Measure whether earnings can cover all debt. |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

Meaning of EBITDA financial metrics

Meaning of EBITDA financial metrics