Just as Mrs. Japan might take advantage of the low interest rate of the yen to hedge her interest rate, Chinese also like to protect their property by buying gold. Although precious metals such as gold and silver have always been an investment option pursued by high-end individuals, they are important investments and financial commodities in the financial market. Nowadays, precious metal trading has also come into the ordinary household, prompting which many investors are eager to try. For this reason, this article will introduce precious metal investment novices to methods and channels for trading in precious metals.

Pros and Cons of Precious Metal Trading

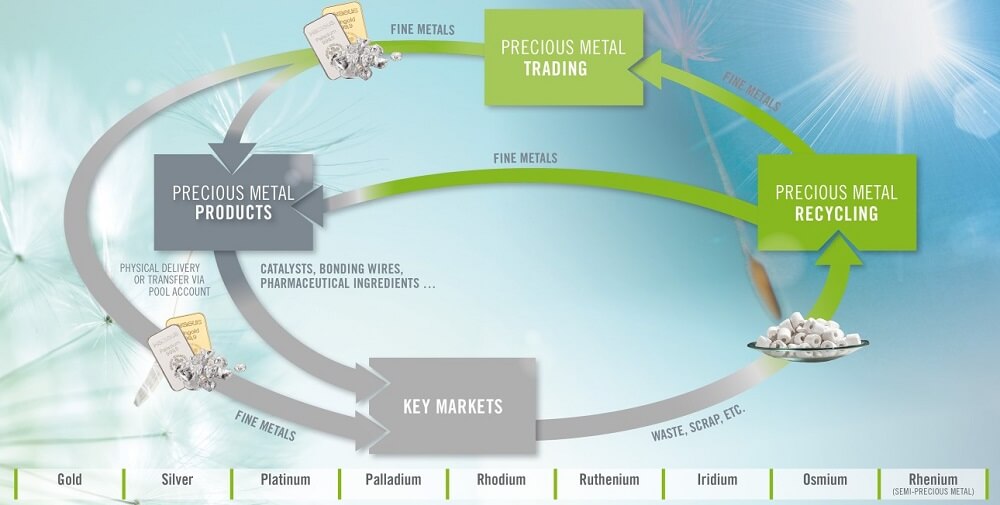

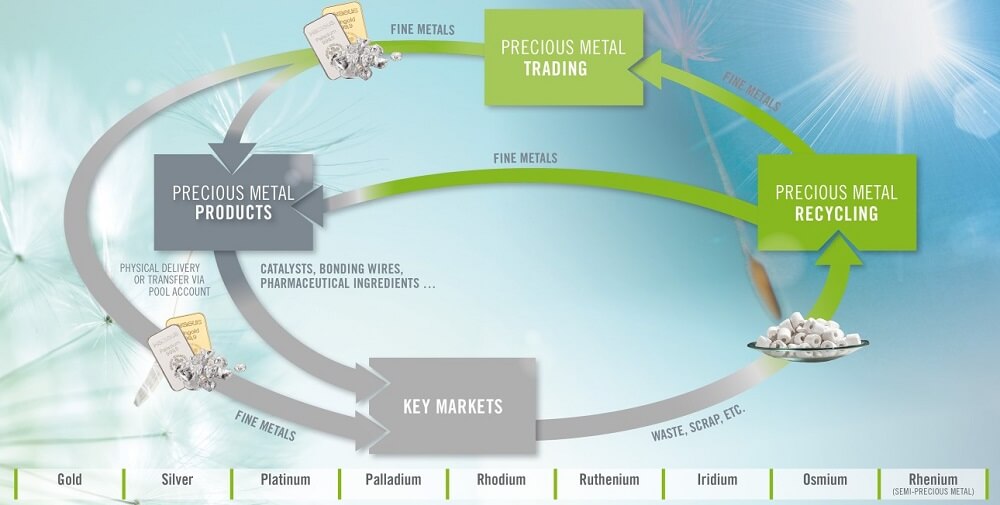

Precious metals refer to the rare metal elements found in nature, including the well-known gold and silver, as well as platinum, palladium, rhodium, and others. They typically possess high economic value and utility, and have long been widely recognized as sought-after investment options. Their investment value is particularly prominent during economic crises, such as periods of inflation or interest rate changes.

The scarcity of precious metals gives them the property of preserving value, as the supply is relatively limited. Production is also subject to strict processes and regulations, so the supply does not fluctuate as dramatically as other commodities. Precious metals also have relatively limited reserves and long production cycles, so their value is relatively stable.

At the same time, they have a wide range of uses in industry, jewelry, electronics, and other fields, and this diverse demand supports their value. For example, as the most well-known gold and silver in the precious metals, they not only have the durability of ductility and good thermal conductivity, electrical conductivity, or thousands of years of human transactions using the currency.

In addition to gold and silver, platinum and palladium are also among the precious metals that investors should pay attention to. Platinum is a very rare and versatile precious metal, and its price is usually higher than that of gold. Platinum is mainly used in automotive catalysts, jewelry manufacturing, electronics, and medical devices.

The automotive industry is one of the key drivers of platinum demand, as platinum is widely used as a catalyst in automotive exhaust gas treatment systems. Platinum prices are often affected as global automobile sales and production figures fluctuate. For example, an increase in automobile sales may lead to higher demand for platinum, driving up its price.

And they have a special symbolic significance in many cultures and therefore hold some intrinsic value in cultural exchanges and traditions. In some cultures, the precious metal is seen as a symbol of wealth, power, and status and is therefore often used as a valuable gift on occasions such as weddings, celebrations, and gift exchanges.

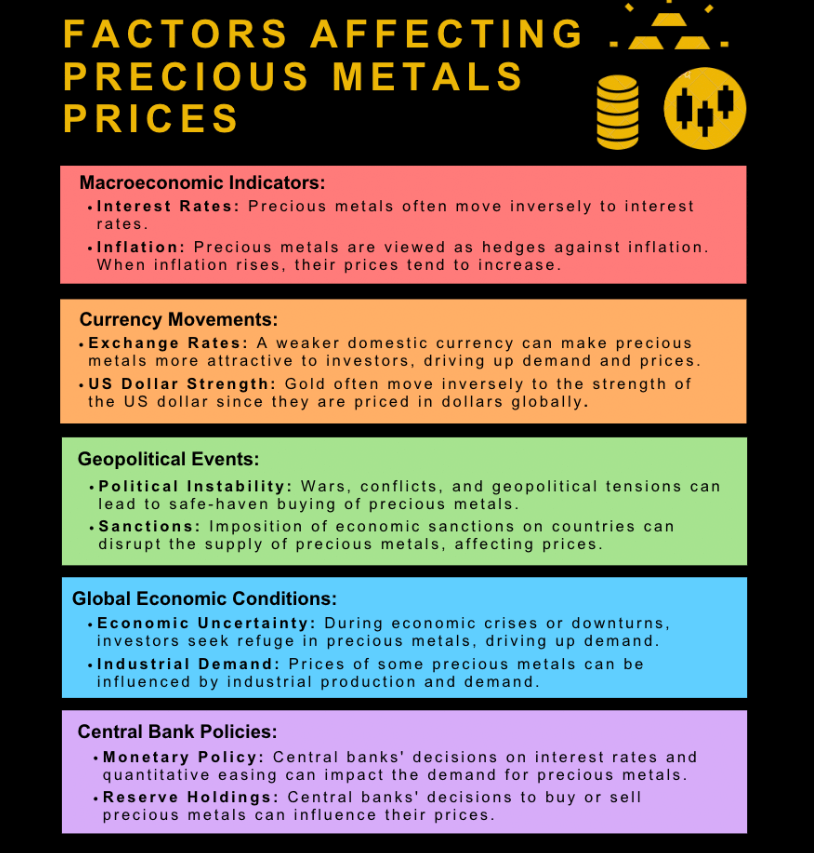

Most importantly, investors often turn to precious metals as a safe-haven option in times of economic instability and increased inflationary risk. Because of their scarcity and relatively stable value, precious metals tend to maintain their value, and sometimes even increase it, in times of financial turmoil.

For example, the value of gold and silver is determined by the market 24 hours a day, every 7 days, and is relatively unaffected by the laws of supply and demand. Demand for gold and silver tends to increase when uncertainties such as problems in the financial system, rising inflation, the outbreak of war, or political crises affect them.

In the past few years, the return on precious metal investments has far exceeded that of financial products such as stocks and funds. The price of gold went from $251 per ounce in 2000 to a high of $1.920 per ounce, achieving a 665% increase. And silver's highest achievement is 900%; platinum also turned over five times as much. Together with the leveraged design of some precious metal products, the actual return for investors may be even higher.

As the classic saying goes, antiques in times of prosperity and gold in times of chaos. In view of today's China's a-share turbulence, the international and European debt and U.S. debt crises are within the context of an economic slowdown and high inflation. Precious metals with the function of maintaining the hedge deserve more and more attention, all the way up.

Of course, trading precious metals is not risk-free. For example, when the global economic situation is favorable, investors may turn to other higher-risk investments. But potentially more rewarding investments, which could lead to a decline in the price of precious metals. In addition, the supply of precious metals can be affected by factors such as the production costs of mining companies, new mineral discoveries, and improved extraction techniques, leading to price fluctuations.

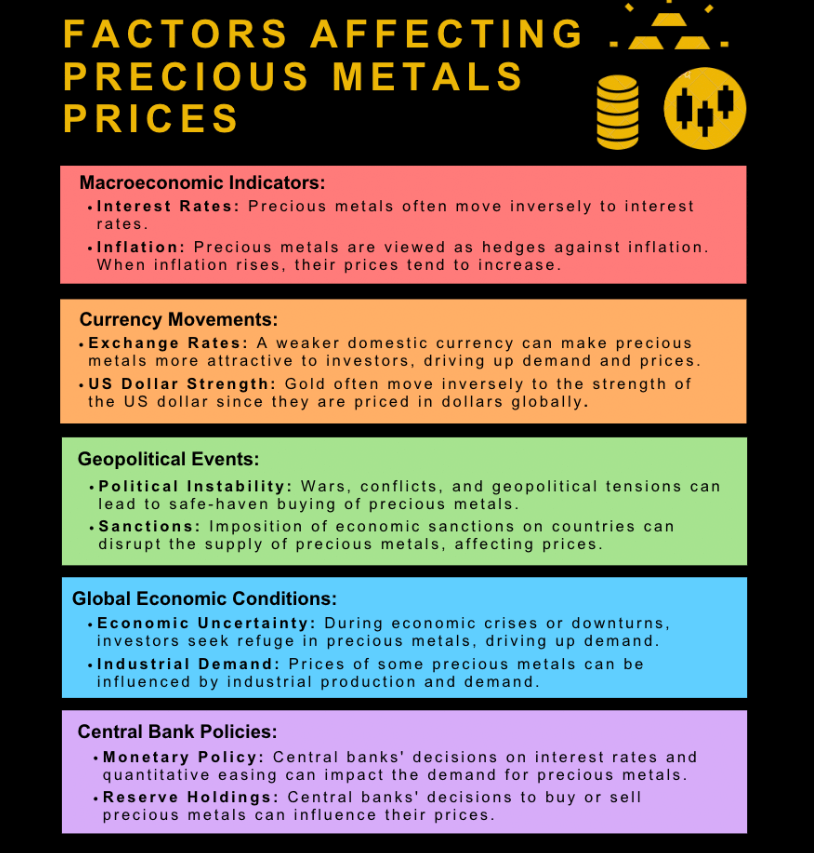

Precious metals such as gold and silver are considered to be stores of value, and their value remains relatively stable even in the face of currency devaluation. Trading precious metals is therefore seen as a strategy to protect a portfolio from inflation and currency devaluation. However, a suitable investment strategy can only be found by understanding the characteristics of each precious metal and the factors that influence its price, and by combining them with investment objectives and risk tolerance.

Ways to Trade Precious Metals

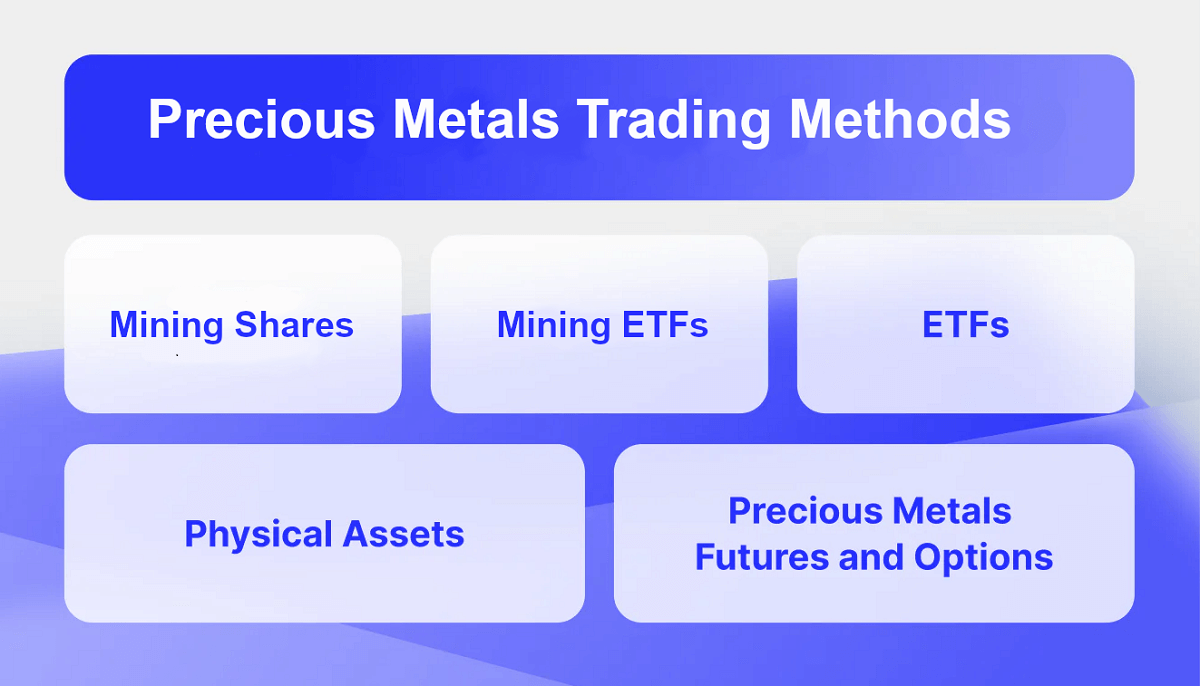

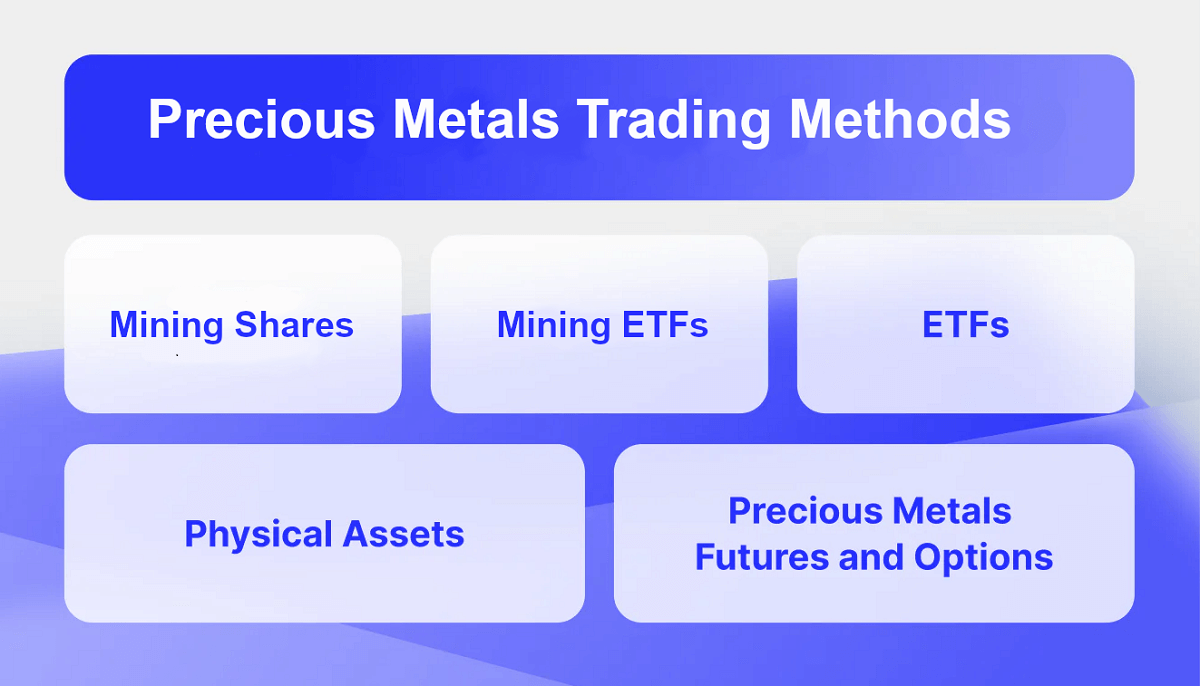

After understanding the characteristics and price-impact factors of each precious metal, you should also choose the appropriate investment method if you want to trade precious metals. For example, whether to choose physical investment or ETF fund investment. Investors can make the right choice according to the different characteristics, risks, and applicable people of each method.

The first is the physical precious metal investment, including gold, silver, and so on. Physical precious metals are the physical gold and silver that can be seen and touched, such as gold bars, silver ingots, and gold and silver coins minted in various countries. Physical precious metals have real value and stable historical performance and can be used as a hedge asset in times of financial crisis or inflation. This approach is safe, reliable, and has a value-preserving function, which makes it suitable for those who pursue steady investment.

The two most recognized gold and silver coins on the market are the American Eagle Gold Coin (American Eagle) and the Canadian Maple Leaf Gold Coin (Canadian Maple Leaf). However, it is important to note that you should not easily invest in age-old gold and silver coins; their price is primarily a function of scarcity rather than the value of the metal itself, as is the case with antiques.

Investing in precious metals in their physical form is one of the safest forms of investment; it is effectively a form of self-insurance for asset preservation. In the event of a real-world disaster, gold and silver can be turned into hard currency for obtaining food to keep your family safe. The benefits of investing in food precious metals are low volatility, low risk, and some psychological comfort.

But at the same time, it is not without its drawbacks. Because of the physical nature of precious metals, they require secure storage space. If it's a small amount, it's not a bad idea to keep it in a safe at home. But if it is a large amount of physical precious metals, then finding a safe storage room is more troublesome. After all, you can't just deposit it in a bank, or you may not be able to get to it when you need it.

And if you go to a precious metals exchange and rent a separate secure storage room, then there is another cost involved. This means that storage and insurance costs are higher, and safe storage needs to be considered. In addition, physical precious metals are not easily divisible and tradable and may be illiquid.

It is also possible to participate in the gold, silver, and other precious metals market through precious metals exchange-traded funds (ETFs). Compared to physical precious metals, the benefits of precious metal ETFs are that they do not require storage space and are easy to trade with good liquidity. Moreover, they are linked to the trading price of physical gold and silver, so they have the investment characteristics of physical precious metals.

These characteristics are suitable for investors who do not want to hold physical precious metals but want to use them as a means to preserve the value of their assets. But we need to pay attention to the management fee and third-party risk. After all, despite the fact that they are collateralized by physical gold and silver, there is no substantial ownership of the collateral as an investor. Then again, ETFs have management fees that can erode some of the profits.

For investors investing in precious metals ETFs, you can adopt a diversification strategy to reduce the risk of a single asset by investing in multiple precious metals ETFs at the same time. At the same time, monitor the market situation and the performance of the ETFs on a regular basis and make timely adjustments to the investment portfolio to cope with market fluctuations and risks.

Apart from that, there are precious metal futures available for trading. The concept of futures is to commit to buy or sell the underlying at a certain price at a future date. Because futures are inherently very risky, a certain level of expertise is required to be able to participate in the precious metals market through futures contracts.

Moreover, the purchase and sale of futures do not require the total amount of the transaction to be provided, but only a very small margin, for example, 10%. This is equivalent to a natural increase in leverage. Many times, the underlying very small price fluctuations can cause huge losses or profits in futures trading, so they have to be operated by professionals. However, compared to Crude Oil futures, for example, precious metal futures require very little storage space and are very easy to deliver.

For investors who are interested in trying their hand at precious metals futures investing, they can learn and utilize technical analysis methods such as chart patterns, trend lines, and technical indicators to aid in decision-making and predicting market movements. Understand market news and fundamental factors to adjust trading strategies in a timely manner and respond flexibly to market changes.

It may also be possible to invest in shares of mining companies that invest in precious metals, which has the advantage of both profiting from the growth in the price of gold and receiving incentives to pay dividends. Perhaps it is also possible to invest in shares of mining companies that invest in precious metals, which has the advantage of both profiting from the growth in the price of gold and receiving incentives to pay dividends.

The share prices of mining companies reflect not only changes in the price of precious metals but also changes in the company's operating costs. For example, during the time of the New Crown Virus epidemic, mining companies saw a corresponding reduction in their mining costs due to lower energy prices. As a result, the stocks of precious metal mining companies have increased significantly in value over the last few years.

But at the same time, more homework has to be done because the management of the company's operations and prospects for sustainability have to be taken into account. As with all stock investments, the investor has to have a deeper understanding of the company's fundamentals, assets, and liabilities. Therefore, this type of precious metals trading is suitable for those who have some investment experience and are willing to take a greater risk.

Investing in precious metal mining company stocks requires focusing on the fundamentals of the industry and the company and understanding factors such as production costs, reserves, and management teams. A diversification strategy can be adopted by investing in multiple mining company stocks to reduce the risk of a single company. At the same time, regular tracking of company performance and industry dynamics ensures timely adjustment of the investment portfolio.

For some people who don't want to do their homework to research single mining company stocks, there are also mining ETFs to invest in. The advantage is that you can enjoy the profits and stock price growth of the entire precious metals mining industry without too much risk concentrated in a single company's stock. However, the reward is proportional to the risk, so it is suitable for lazy people and those with a slightly weaker risk tolerance to participate.

The downside, of course, is the possibility of missing out on the extra returns of a single stock that outperforms the market average, in addition to the management fee. For long-term investors, you can choose to build up a position in precious metals mining ETFs gradually by investing regularly in a fixed amount. This strategy helps diversify risk while also benefiting from the long-term growth in precious metal prices.

For those with a deep gambling streak and those who want to make short-term plays, there are options for precious metals derivative investments, including derivatives such as leveraged ETFs on precious metals mining companies. But mining stocks are already risky in their own right, and adding the risk of leverage makes it difficult for many to stomach.

Also, in order to achieve 2x leverage, a combination of instruments such as futures options and reverse repos have to be utilized. And the price of these leveraged ETFs will continue to depreciate over time, even though the price of the mining shares themselves has not changed much, so they are only suitable for short-term operations.

For investors investing in precious metal derivatives, they should choose the timing of trading carefully and avoid blindly following the trend or chasing after the market. Adopt strict stop-loss and take-profit strategies to control risks and prevent larger losses due to market fluctuations. At the same time, a timely adjustment of positions and a flexible response to market changes.

The above are common precious metal trading methods. Investors can choose the appropriate trading method according to their own investment objectives, risk appetite, and capital size. It should be noted that after determining a good trading method, investors should also find suitable trading channels, such as exchanges.

Trading Precious Metal Channels

Trading Precious Metal Channels

For investors, it is crucial to choose the right precious metal trading channel for them. For example, exchange trading, over-the-counter trading, financial institutions, online trading platforms, physical markets, etc. Different trading channels cover different sizes of trading methods.

Among them, exchange trading is one of the most dominant, covering a global scope and providing standardized trading contracts. The more famous futures exchanges, such as the New York Mercantile Exchange (NYMEX), London Metal Exchange (LME), Chicago Mercantile Exchange (CME), and other major exchanges, are large in scale, covering a global scope and providing standardized precious metal trading contracts.

OTC trading, on the other hand, includes over-the-counter (OTC) markets and trading platforms, which vary in size and offer more flexible trading options but are also relatively riskier. In the OTC market, investors can trade directly with other investors without having to go through an intermediary or an exchange. This approach is usually more flexible, and the size and terms of the transaction can be adjusted by mutual agreement.

In addition, some trading platforms for precious metals also offer OTC trading services, where investors can trade with other investors, enjoying a wider choice of markets and a more convenient trading process. Then there are online trading platforms, including a variety of online brokers and trading platforms. They vary in size but usually offer convenient trading methods and a wealth of trading tools. Investors can trade precious metals such as gold and silver through these platforms.

Financial institutions such as banks, Securities companies, and other financial institutions provide trading services for precious metals on a larger scale, with a certain degree of professionalism and credibility assurance. Some stock exchanges (e.g., Toronto Stock Exchange, NASDAQ, etc.) provide trading in precious metal-related stocks. As for the banks, currently in China, the major banks have closed the trading window for precious metals.

In addition, the physical market is also an option, especially for investors who have a need for physical precious metals. The physical market refers to the trading of physical precious metals in gold exchanges, jewelry markets, and other venues. The scale is relatively small, but investors and buyers who have a demand for physical precious metals can choose to trade in these markets.

In addition to these major trading channels, there are a number of other forms of trading. For example, precious metals can be traded through the financial derivatives market, which includes futures contracts, options, and contracts for difference (CFDs). These derivatives allow investors to trade on leverage, thereby gaining greater returns or taking greater risks during market volatility.

Some precious metals trading firms and brokers also offer trading signals and analytical services to help investors make more informed trading decisions. These services may include technical analysis, fundamental analysis, and market commentary that help investors better understand market dynamics and trends.

There are also a number of specialized precious metals investment funds (ETFs) available to investors. These funds usually use precious metals as the underlying assets and track the performance of the corresponding market indexes through the purchase of precious metal derivatives or physical precious metals. ETFs provide a convenient way for investors to access the performance of the precious metals market through securities trading without the need to hold physical precious metals directly.

Overall, these precious metals trading channels vary in size and reach, catering to the needs and preferences of different investors. Investors can choose the most appropriate trading channel and instrument according to their investment objectives, risk appetite, and capital strength.

Precious Metals Exchange

|

Symbol

|

Grade

|

Name

|

% Change

|

|

OUNZ

|

A |

Merk Gold Trust ETV |

0.71 |

|

FGDL

|

A |

Franklin Templeton Holdings Trust Franklin Responsibly Sourced Gold ETF |

0.64 |

|

GLD

|

A |

SPDR Gold Trust ETF |

0.62 |

|

SGOL

|

A |

ETFS Physical Swiss Gold Shares |

0.68 |

|

GLDM

|

A |

SPDR Gold MiniShares Trust |

0.67 |

|

AAAU

|

A |

Perth Mint Physical Gold ETF |

0.65 |

|

PHYS

|

A |

Sprott Physical Gold Trust ETV |

0.78 |

|

GLTR

|

B |

ETFS Physical Precious Metal Basket Shares ETF |

1.14 |

|

PIT

|

B |

VanEck Commodity Strategy ETF |

-0.07 |

|

SIVR

|

C |

ETFS Physical Silver Shares Trust ETF |

1.53 |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

Trading Precious Metal Channels

Trading Precious Metal Channels