The first thing many people think about when investing is the rate of return, that is, how much profit this investment will bring in the end. Others will consider the cost, but only the cost of capital, forgetting the opportunity cost. These are the things that you should consider when choosing an investment product and investment method. It is important to realize that when you make a choice, you are missing out on another choice. Every choice comes with a price, and this is the opportunity cost. This article will therefore come to talk about the meaning and importance of opportunity cost.

What is Opportunity Cost?

It is the cost of the best alternative that is foregone in order to choose a certain action. In simple terms, it can be understood as the value that can be gained by putting a certain amount of resources into a certain use and then giving up the value that can be gained in other uses. It is an important concept in economics as it helps one to consider the efficiency of choices and resource allocation.

Society has limited resources to satisfy the unlimited desires of human beings. Therefore, in making choices, one must decide which desires to satisfy as well as which desires to give up. Of the many options given up in the choice process, the one with the highest value is known as the opportunity cost.

Imagine if a cell phone, laptop, and camera all broke at the same time, each valued at $5.000. This is when you are taken by your dad to an electronics store and told that you can pick one out as a birthday present. What would be the choice between wanting three of the electronics but only being able to have one of them?

Assuming that the most wanted item is a new cell phone, followed by a laptop, and finally a camera, the natural choice would be the cell phone as a birthday gift. In this case, the opportunity cost of getting the cell phone is the next best option: the laptop. Some may wonder why the laptop was dropped when the camera was clearly dropped.

The fact is that out of these three items, it is specified that only one of them can be chosen. Even if you don't choose a cell phone as a birthday gift, you can't get both a laptop and a camera. Therefore, the option of a laptop and camera does not exist at all. Since this option cannot be chosen, it cannot be an opportunity cost.

Also, although no money was spent on the cell phone, note that in the selection process, an opportunity to get a laptop was given up, as well as the satisfaction of getting a laptop, in favor of getting a cell phone. So by definition, the opportunity cost of getting a cell phone is always the laptop.

This means that the opportunity in it must be an optional item, and if it is not an optional item, it is not an opportunity. For example, if a farmer only knows how to grow wheat, vegetables, and pigs, real estate is not an opportunity for farmers. Another example is that if you only want to eat bean paste cake or chocolate chip pancakes, then doughnuts can never be an opportunity cost.

There is also the fact that it must refer to the item that has the highest return on the opportunity given up; for example, for a farmer, if raising pigs has the highest return, then the opportunity cost of growing wheat and vegetables is both raising pigs. This means that the gains that can be made from growing wheat and vegetables are given up in favor of raising pigs. Thus, for this farmer, the cost of growing both wheat and vegetables is equal to the expected return from raising pigs. In contrast, the cost of raising pigs is the gain that could have been obtained by giving up growing vegetables.

Economics assumes that people are guided by rationality to optimally allocate limited resources to maximize benefits. Any kind of resource is finite, and finite resources can be used for many purposes, and using resources for one purpose necessitates giving up other options at the same time.

Opportunity cost is a very important concept in financial planning and investment decision-making; it not only includes the amount spent directly but also involves the potential benefits of giving up other investment opportunities. Considering it when making decisions can help one more fully evaluate the long-term impact of different options.

In financial planning, in addition to the benefits gained directly, one needs to weigh the costs associated with the alternatives lost. On the balance sheet, in addition to the amount paid, the loss of earnings due to the foregoing and other investment opportunities should be included. This helps to give a more accurate picture of the financial position.

In terms of investment returns, including them in the calculation can help assess the potential returns of different investment options. It and the power of compound interest can have a significant impact on finances, and some small decisions may prevent you from realizing your goal of wealth freedom. For example, taxes and lost investment opportunities need to be considered when moving money from one traditional retirement account to another.

As another example, Mr. A started investing $500 per month at age 18 and retired at age 55 with at least $1.4 million in assets, which equates to a passive income of more than $7.000 per month. Ms. B, on the other hand, did not start her financial investing until she was 30 years old and had only $500.000 in assets at 55 years old at the same annualized interest rate.

In the end, Miss B gets less than half of Mr. A's wealth. To compete with Mr. A's $500 investment, Miss B must invest $1.333 per month. This case illustrates the damage caused by choosing to spend income when young instead of focusing on the cost of saving and investing.

In conclusion, opportunity cost exists everywhere in life, and it can be used to analyze many areas. Good use of it to analyze the pros and cons of utility-maximizing choices is preferred by rational people. Understanding it helps people make wise decisions with limited resources, utilize resources more efficiently by considering the costs associated with foregone choices, and achieve optimal financial planning and investment decisions.

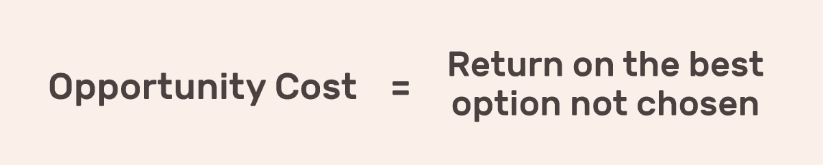

Calculation of Opportunity Cost Formula

It is often difficult to quantify as it relates to the value of the best alternative choice forgone. However, determining the value of the best alternative choice is a complex process, so it is usually a conceptual idea rather than a number that can be directly calculated.

Suppose there is a sum of $1.000. and one can choose to invest this sum in the stock market with an expected annual return of 8%, or one can choose to deposit this sum in a bank with an annual interest rate of 3%. If one chooses to invest in the stock market, then the opportunity cost is the return from foregoing the deposit in the bank. The calculation is as follows:

Expected return from the stock market = $1.000 x 8% = $80; return on bank deposit = $1.000 x 3% = $30; opportunity cost = return on bank deposit = $30. Therefore, the cost of choosing to invest in the stock market is then $30. i.e., giving up the return on the bank deposit.

With this example, it can be seen that it is based on the value of the best alternative choice given up. To compare this to the value of the choice made, the following formula can be used: Opportunity Cost=Value of the Next Best Alternative + Value of the Chosen Option.

As can be seen from the previous example, the opportunity cost is lower than the gain, and therefore the loss of choice. And when it is high, it usually means that the value of the best alternative given up by making a certain choice is high. In other words, choosing a certain action leads to the abandonment of other alternatives that may bring higher gains or greater benefits. Therefore, when it is high, it means that the choice made may result in a greater opportunity loss or miss.

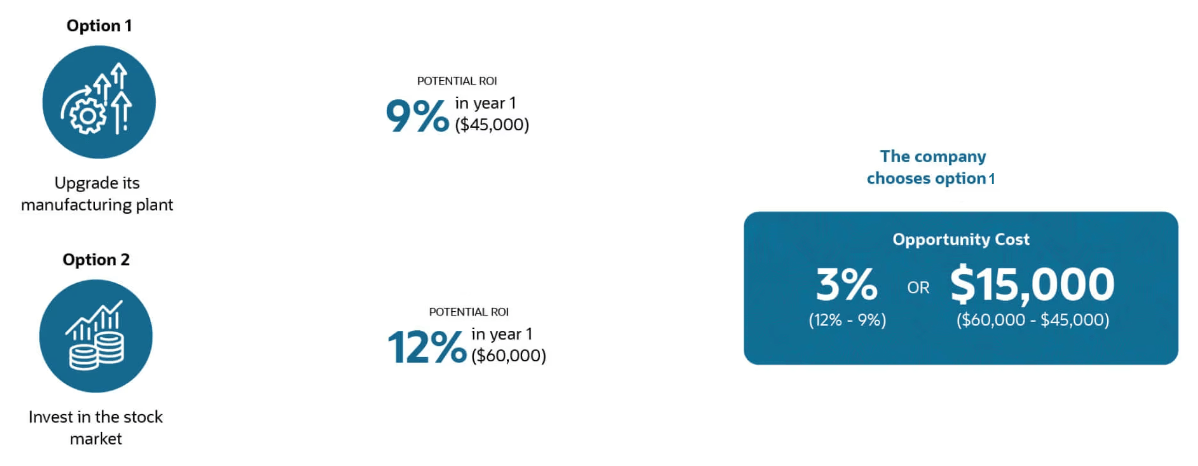

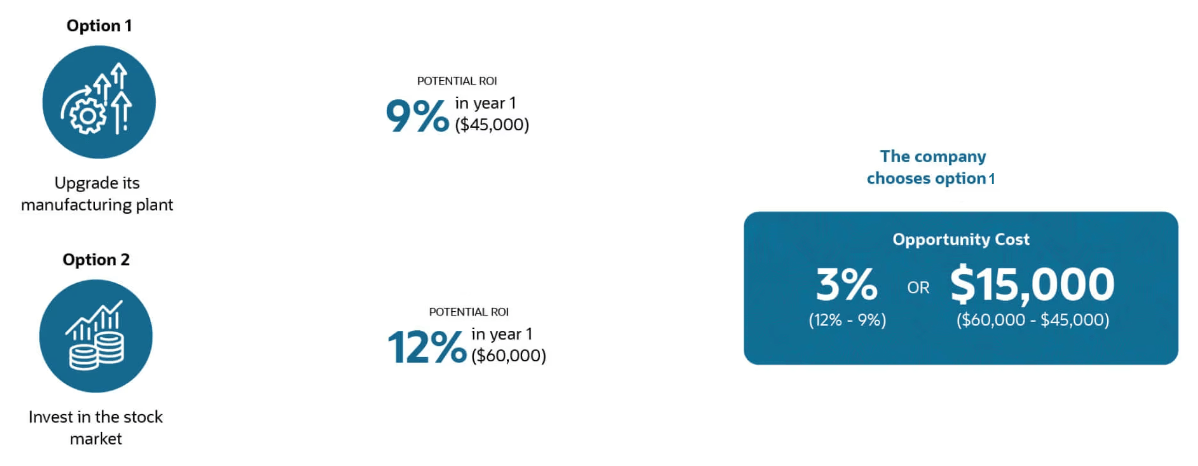

For example, in the chart below, Company XYZ has $500.000 available. At this point, there are two investment options. The first is to upgrade the manufacturing plant, which has a potential annual return on investment of 9%, or $45.000. The second option is to invest in the stock market, which has a potential annual ROI of 12% and a return of $60.000.

The first option is to upgrade the manufacturing plant. The cost of this option is higher, and the loss is 12% minus 9%, or a 3% ROI. Or that means 60.000 minus 45.000. or $15.000.

Knowing the calculation of opportunity cost enables one to make more informed decisions in investing, as one is able to take into account the losses that may be incurred by abandoning a particular investment. By comparing the costs of different investment options, the most profitable investment can be chosen, thus maximizing the return on investment.

The Importance of Opportunity Cost

The Importance of Opportunity Cost

It is the value of other choices that is lost when a choice is made. In other words, when you choose one option, you give up the potential benefits of other options. This concept is especially important in investing. This concept helps us understand the trade-offs and potential losses involved in making decisions and helps optimize the use of resources and the quality of decisions.

For example, if one invests in an underperforming stock, continuing to invest additional money may expose one to a greater risk of loss. Switching funds to a well-performing stock, on the other hand, may help turn a loss into a profit. From this perspective, continuing to invest in an underperforming stock means giving up the opportunity to invest in a great stock, which is the opportunity cost.

Being overly obsessive about the money, time, energy, and emotion that have already been put in can lead to even greater losses, as it may mean continuing to invest in a project that is impractical or does not have potential. In addition, being overly obsessive can lead to missing out on other, better options, as attention is overly focused in one direction and other possible opportunities are overlooked.

Stopping losses and adjusting investment strategies in a timely manner is crucial, as it helps to avoid greater losses due to the compounding effect. Stopping losses in a timely manner means continuing to invest money when losses exceed a certain level, while adjusting the investment strategy means adapting the portfolio to new situations and maximizing potential gains based on market conditions and investment objectives.

Sunk costs already paid should not be considered when making plans or investments. Because sunk costs are past expenses that can no longer be recovered, they should not influence current and future decisions. Decisions should be based on current opportunities and potential future gains, not past inputs. It is wise to admit defeat and adjust your strategy at the right time, because this will help you get out of bad old patterns and look for a new direction. By having the flexibility to adjust your strategy, you can better adapt to changing market conditions and maximize future returns.

Opportunity cost is an important concept in investing that helps investors make informed decisions. By weighing the expected returns and risks of different investment opportunities, investors can find the most valuable options. When it comes to asset allocation, it helps investors compare the returns and risks of different asset classes to find the right portfolio for them.

For example, suppose an investor is faced with a variety of investment options, such as buying stocks, bonds, and real estate. By considering the expected rate of return of each investment and the corresponding level of risk, the investor can determine the opportunity cost of each investment. They can then select the portfolio that best meets their needs based on their investment objectives and risk tolerance. In this way, investors can make better use of limited resources and maximize returns in the investment process.

It allows investors to weigh the benefits of different options when it comes to the use of funds. For example, an investor may be faced with a variety of options, such as buying land or investing in stocks. By considering the expected returns and risks of each option, investors can make optimal decisions to maximize their return on investment.

Long-term investment planning considers it, which allows investors to enjoy the compounding effect over the long term by choosing to defer spending and use the money for investment. This means that they can earn higher returns on their investments in the future rather than consuming the funds immediately. By investing money in higher-yielding investment vehicles and allowing the investment returns to be reinvested for compounding growth, investors can build more wealth in the future.

When evaluating an investment project, it helps investors compare the potential returns of the project with those of other possible investment opportunities. By using methods such as NPV or IRR, investors can quantitatively evaluate different investment projects and compare them to other potential investment opportunities.

Taking it all together, investors can better understand the relative value of each investment program and make informed choices in their investment decisions. By selecting investment projects with higher potential returns and lower relative risks, investors can maximize their long-term investment returns.

Opportunity cost therefore plays a key role in the investment project evaluation and decision-making process, helping investors optimize their portfolios and achieve better financial performance. Get this issue out of the way, and you'll have a lot less to worry about in stock market investing. The returns will also grow by leaps and bounds, and your level of performance will soar.

The Importance of Opportunity Costs in Investing

|

Investment decisions

|

Importance

|

|

Optimizing resource utilization

|

Helps find the most valuable investment options. |

|

Potential loss assessment

|

Evaluate the lasting impact of investment choices. |

|

Considering the cost of foregone options

|

Avoid missing out on better investment opportunities. |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

The Importance of Opportunity Cost

The Importance of Opportunity Cost