In the eyes of the public, listed companies have their own golden light and feel very lofty. But in fact, the water here is also very deep. It is important to realize that sometimes some companies may not go through the normal channels to go public. Just as in history, Cao Cao held the emperor hostage, borrowing the Eastern Han Dynasty to successfully list his own company and listing Cao Wei as an example. Nowadays, many companies also have the phenomenon of backdoor listing; investors need to distinguish between the two. Now we will look at the backdoor listing at the end. How?

What is Backdoor Listing?

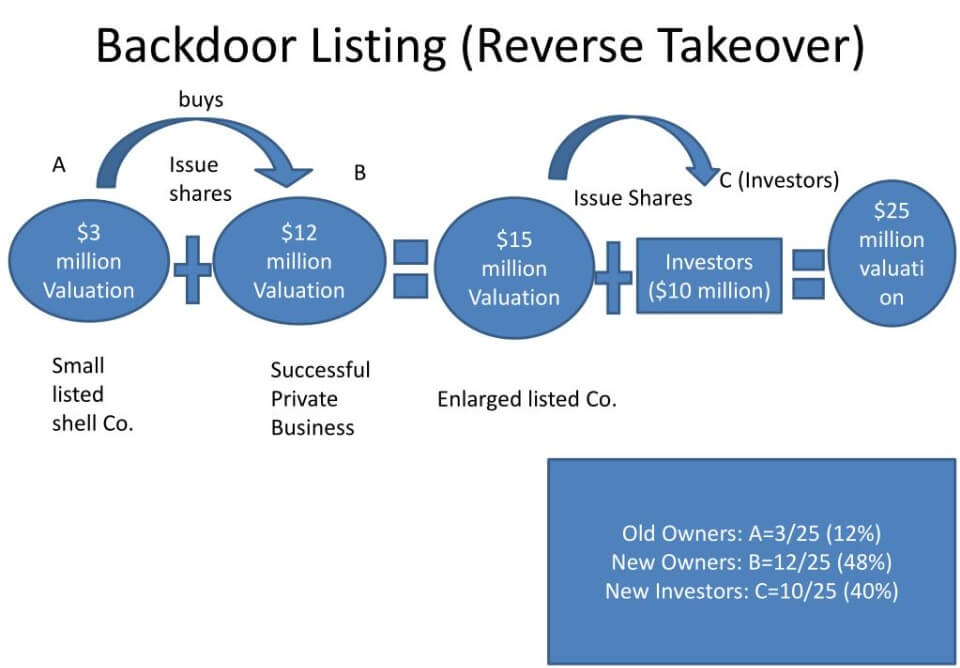

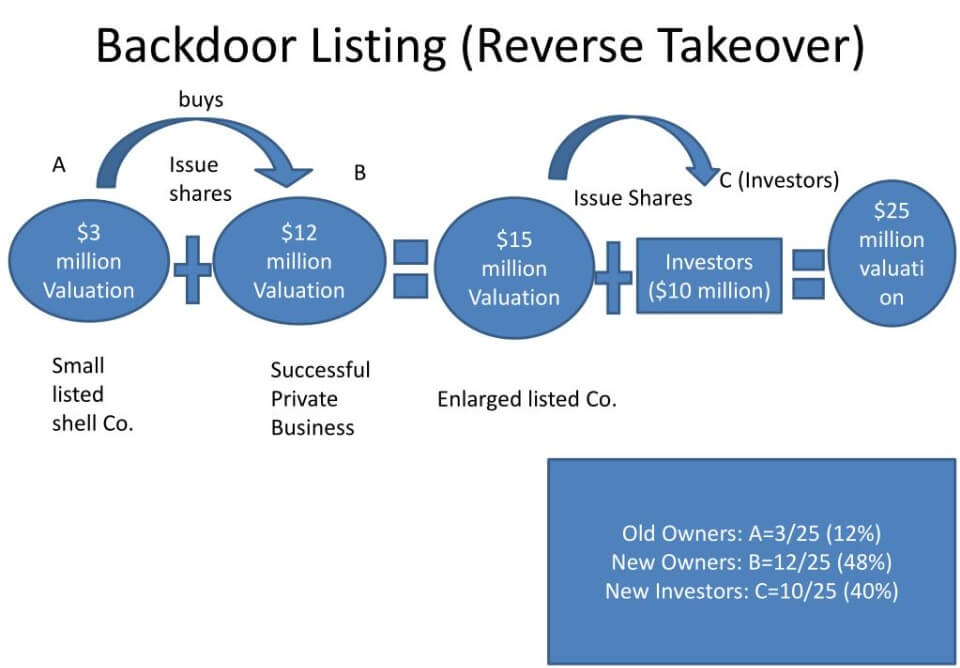

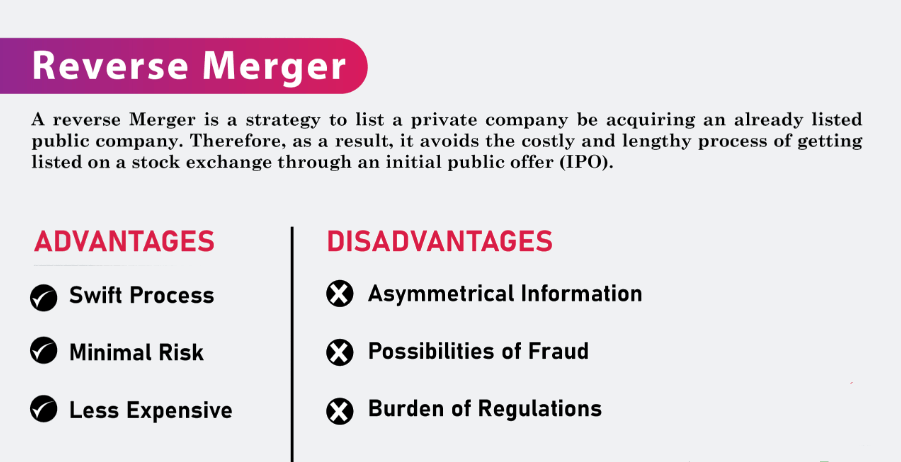

In the modern financial market, it refers to a private company using certain ways to obtain another listed company's control so as to achieve the purpose of listing behavior. It is seen as an alternative way to raise capital and go public quickly, especially for companies that are eager to obtain capital and want to avoid long waits and complex vetting processes. This method allows companies to save time and costs by acquiring or merging with an already-listed company and directly qualifying for listing.

Specifically, it means that a company that is already listed on a stock exchange acquires or merges with an unlisted company (usually a smaller or unprofitable company) to achieve listing. This behavior is also known as a "reverse merger" or "reverse takeover.".

For example, let's say that Company A, an advertising agency, urgently needs to go public in order to obtain capital for business expansion, but the traditional listing process is cumbersome and time-consuming and does not meet the company's urgent needs. In this case, Company A discovers that Company B is already listed on the stock market and therefore can utilize its listing status for a backdoor listing. In short, Company B became the "shell" for Company A's listing.

The two companies reached an agreement in which Company B purchased Company A's equity in the form of partial cash and the issuance of new shares to Company A's existing shareholders. In the legal sense, this appears to be a complete acquisition of Company A by Company B, making it a wholly-owned subsidiary of Company B. However, in practice, Company A is not a wholly owned subsidiary. However, in practice, the original shareholders of Company A held the majority, or even the vast majority, of Company B's shares, thus gaining effective control over Company B and, in turn, Company A. In this way, Company A was able to become a wholly-owned subsidiary of Company B. In addition, Company A's shareholders were able to purchase the shares of Company B by issuing new shares.

In this way, Company A was able to qualify for listing more quickly and could continue to operate as Company A under Company B's name. This strategy allows Company A to avoid the tediousness of the traditional listing process, to achieve listing quickly, and to utilize the platform of the already listed company for fund raising and business expansion.

In a backdoor listing, the already-listed company usually merges its business, assets, and liabilities with the target company by way of a name change or reorganization. The purpose is usually to obtain listing status quickly, circumventing some of the cumbersome processes in the traditional listing procedures while also providing a relatively convenient way to raise capital in the capital market, especially for some start-ups or emerging industries.

In addition to reverse takeover, there are three other modes of backdoor listing: shell merger and acquisition, shell capital injection, and shell reorganization. Each mode has its own specific operation, advantages, and disadvantages. These modes provide different ways for companies to go public to meet their financing and development needs.

A Shell M&A listing is a process whereby a company that is not yet listed goes public by acquiring a company that is already listed on a stock exchange. The acquired listed company is usually a company with a single business or has failed to realize its expected development, while the acquirer hopes to take advantage of the acquired company's listing status to realize its own listing quickly. The main feature of a shell M&A listing is its rapidity, as there is no need to go through the traditional IPO process.

A shell-funded listing is a process whereby a company that is not yet listed goes public by injecting capital into a company that is already listed on a stock exchange and acquiring a controlling interest in or effective control of that company. Unlike a shell M&A listing, under this model, the acquired listed company does not necessarily need to have actual business or assets but exists as a listing tool. The main feature of listing by shell injection is that the amount of capital injection is large and usually requires the payment of a high acquisition fee.

A shell reorganization listing is a process whereby a company that is not yet listed is reorganized by restructuring its business or assets with a company that is already listed on a stock exchange, and then the reorganized company is listed through the reorganized company. In this model, the reorganized company usually has more business or assets and will continue to grow after listing. The main feature of a shell reorganization listing is that the listing is achieved by combining businesses or assets, which has a more substantial business basis than a shell merger and acquisition listing or a shell capital injection listing.

Backdoor listing is an alternative listing channel adopted by enterprises that is simpler compared to traditional IPO listings but still needs to meet certain conditions. And this way, by borrowing the listed company's listed status, we can realize the rapid listing of enterprises, but we need to pay attention to its risk and compliance.

What are the Backdoor Listing Companies?

| Company Name |

Industries |

Shell approach |

| Aqiyi |

Video Entertainment |

Reverse Merger |

| Jingdong Digital |

Fintech |

Shell Capital Injection |

| Vipshop |

E-commerce |

Reverse Merger |

| Car and Home |

Automotive |

Reorganization |

| Pinduoduo |

E-Commerce |

Reverse Takeover |

What are the Conditions for a Backdoor Listing?

Because, in general, a company that wants to go public needs to be approved by the Securities and Exchange Commission, not only is the process more cumbersome, but it is also relatively long. Therefore, enterprises eager to raise funds will take a shortcut to choose the backdoor listing of this special channel to achieve its purpose. And first of all, you need to have a suitable "shell" company; generally, there are some poorly run companies with poor performance that have been listed on the company.

In addition, a company wishing to borrow a shell to go public must also meet the listing standards of the stock exchange, including financial status, profitability, shareholding structure, business scale, and other requirements. These standards ensure the robustness and transparency of listed companies and pose certain challenges to companies wishing to go public.

The listed company and the target company need to reach an agreement on the merger transaction, including the exchange of share ratios, asset valuation, business integration, and other aspects, which ensures a smooth transaction and a balance of interests between the two parties. The length of this phase can vary depending on the company and market conditions, and it usually takes anywhere from a few months to a year.

Moreover, the merger transaction needs to be approved by the shareholders of both the listed company and the target company, which usually requires a general meeting of shareholders to be held for a vote. This process can take anywhere from a few weeks to a few months, depending on the scheduling of the shareholders' meeting and the consideration of the motions.

Merger transactions are subject to review and approval by securities regulators to ensure that the transaction complies with laws, regulations, and market norms and to safeguard investor interests and market stability. The length of the approval process depends on the efficiency of the regulators and the extent of their scrutiny of the content of the transaction, which usually ranges from a few months to a year.

Listed companies are required to fully disclose to investors relevant information about the merger transaction, including the motivation for the transaction, expected effects, risk factors, etc., to ensure that investors understand the content and impact of the transaction and make informed investment decisions. This process may take several weeks or several months.

Upon completion of all approval and disclosure procedures, the merger transaction is formally completed, the shares of the target company are merged into the listed company, and the target company becomes a subsidiary of the listed company, realizing a backdoor listing. The time to complete the transaction depends on the progress and completion of the previous steps and may take several months to several years.

The first step is to choose a suitable shell, which is usually a listed company with poor operation and moderate performance. To be listed companies through direct acquisition of asset reorganization and other ways to inject their own assets to obtain control of the shell company, shell even completed.

Is Backdoor listing Good or Bad.

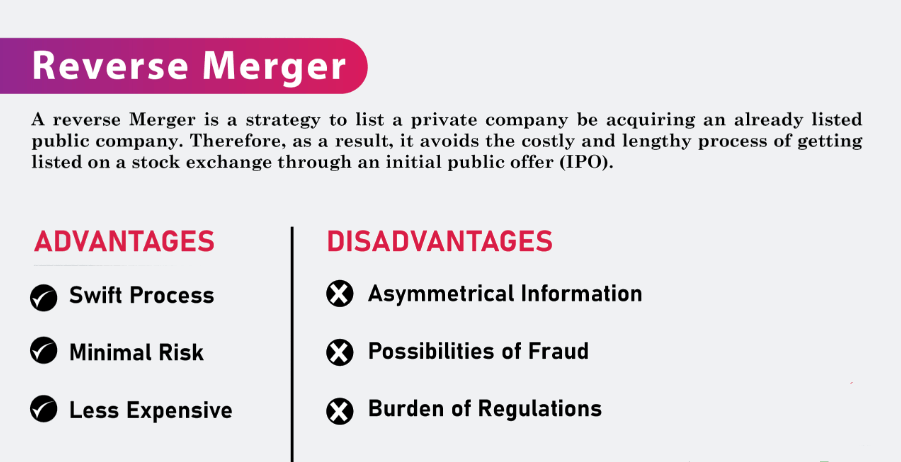

As an alternative to traditional IPOs, it has been favored by some enterprises in recent years. Its advantages lie in the relatively simplified process and low time cost, which enable enterprises to enter the capital market more quickly and obtain financial support and market recognition. However, it also has some risks and disadvantages, such as high acquisition costs, information asymmetry, and changes in shareholding structure, which need to be carefully evaluated and weighed by enterprises.

For shell companies, they face the risk of delisting as their share prices are generally low. However, once a shell company is listed, it tends to stimulate positive investor expectations for the company's shares and may even trigger a surge in speculation, leading to a significant surge in the share price. In this case, the shell company was able to gain a new lease of life in this way, as the shares of the otherwise risky shell company became much more attractive in the market after this.

Investors usually have higher expectations that the listed company will realize improved performance and future growth potential, thus driving up the share price. This positive market reaction further provides listed companies with more opportunities to raise capital and enhance their competitiveness in the market.

For target companies wishing to go public, this fast-track listing also allows the company to access capital market funding more quickly, which can help accelerate the company's growth and expansion. At the same time, it also provides the target company with more flexibility in choosing the right time to go public and better responding to market changes and competitive challenges.

In addition, this approach allows the target company to avoid some of the uncertainties and risks associated with the traditional IPO process, such as market acceptance and pricing uncertainty, thus reducing the risk of going public. It can also enable the target company to enter the capital market faster and attract more investors' attention and capital injection, thus enhancing the company's market position and brand value.

What are the Pros and Cons of Backdoor Listing?

However, backdoor listing also has some potential risks and disadvantages. First, it means that the enterprise must bear higher acquisition costs, including the acquisition price and restructuring costs. These costs may have some negative impact on the financial position of the enterprise, especially if business integration and reorganization are required after the acquisition.

Moreover, if the performance or asset quality of the target company is poor, it may also have a negative impact on the already-listed company, affecting its reputation and share price performance. This may lead to weakened investor confidence in the listed company, a drop in share price, or even trigger investor losses and legal proceedings.

Secondly, there is the problem of information asymmetry and a lack of transparency. As there may be differences in the historical data, financial condition, and operating performance of the shell company and the target company, it is difficult for investors to obtain comprehensive and accurate information about the target company. This uncertainty may make it difficult for investors to accurately assess the value and risk of the business, increasing the uncertainty and risk of investment.

In addition, the shareholding structure of the company may change as a result of the reorganization, which may result in a dilution of the shareholding percentage of the original shareholders. During the reorganization process, the shell company usually issues new shares to the shareholders of the target company as a transaction consideration, which will dilute the shareholding ratio of the original shareholders and reduce their interest in the newly listed company. This may have a negative impact on the interests of the original shareholders, as their control and dividend rights in the company may be diminished.

As it is usually achieved through mergers and acquisitions of delisted companies, this may lead to the listing of some poorly run companies that should have been delisted as shell companies. This phenomenon has seriously undermined the original delisting mechanism of the securities market and may pose risks to investors. In addition, speculation on shelling concept stocks also carries certain risks, as fluctuations in share prices may be affected by market speculation and speculative behaviors, and investors need to be cautious about such situations.

In conclusion, backdoor listing, as an alternative listing to traditional IPOs, provides an alternative financing channel for some enterprises, but it also brings a series of problems and risks. Investors need to be cautious in assessing the risks and rationalizing their investment and financial management when participating in the shares of such listed companies.

Advantages and Disadvantages of Backdoor Listing and IPO Listing

| Features |

Backdoor listing |

IPO (Initial Public Offering) |

| Qualification Methods |

Control acquisition and asset injection. |

Achieve financing via administrative licenses. |

| Audit Criteria |

Lower requirements than an IPO. |

Stricter, per exchange and regulatory rules. |

| Time Cost |

Streamlined process, faster listing timeline. |

Higher, involves lengthy review and approval. |

| Level of Shareholder Sacrifice |

Higher costs mean more equity transfers. |

Relatively small, less sacrifice for shareholders |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.