In the family of Precious metals, gold is naturally the uncontested leader. silver is also the most impressive, even though its price has been in the doldrums. Platinum, however, is a different story. Once known for its higher-than-gold price, it has continued to fall, a change that has raised doubts about its future and caused investors to re-examine the value of this precious metal. In this article, we will elaborate on the price trend of platinum and the factors that influence it.

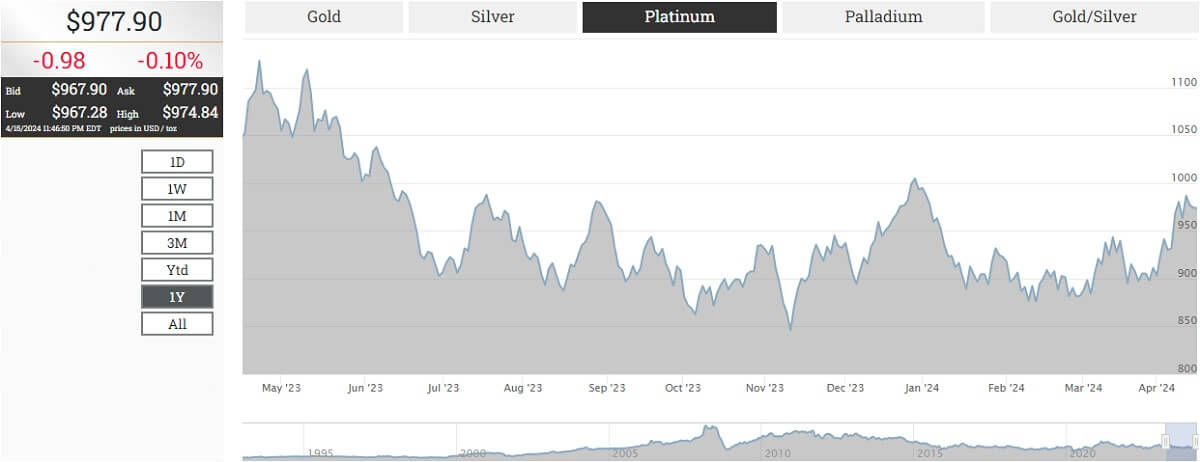

Platinum Price Trend

Platinum Price Trend

Platinum, commonly known as white gold, is a naturally occurring white precious metal that is rarer than gold and therefore relatively expensive. It has always been seen as a strong competitor to gold, but unlike the impression that it is more expensive than gold, the price of platinum has gone through a series of twists and turns, and the trend is very complex.

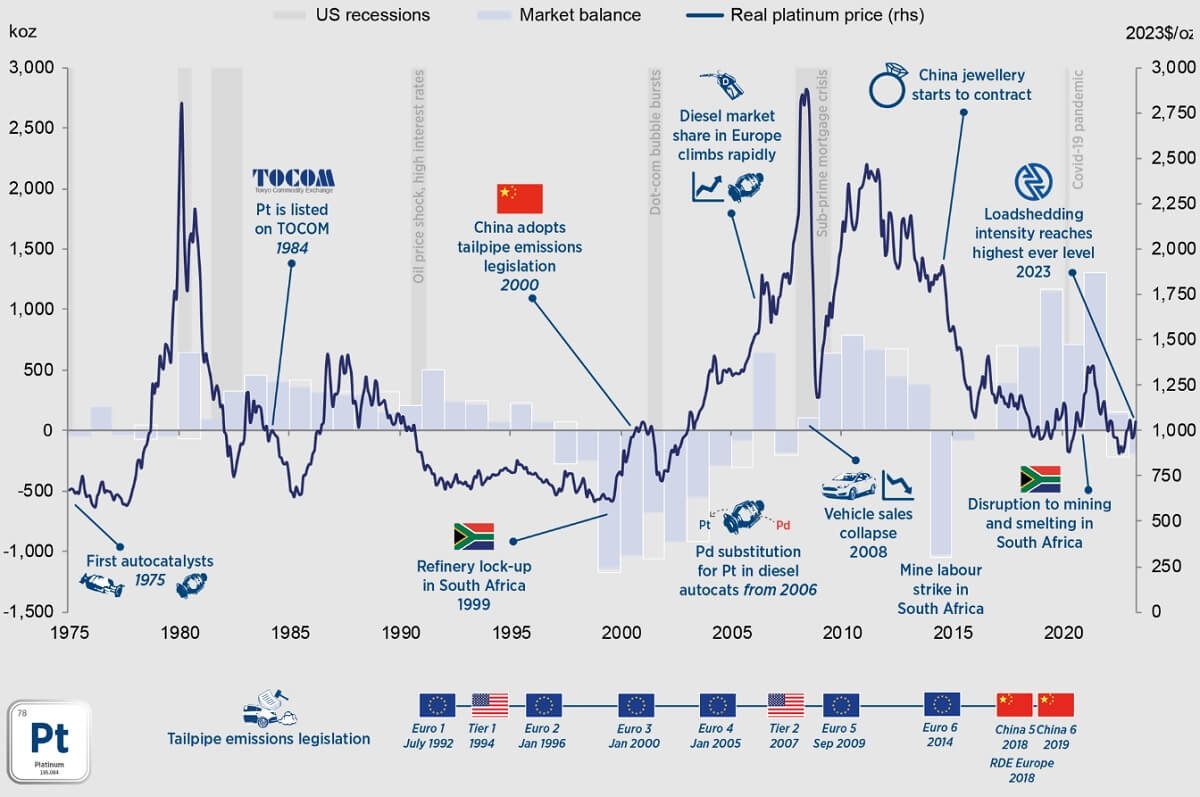

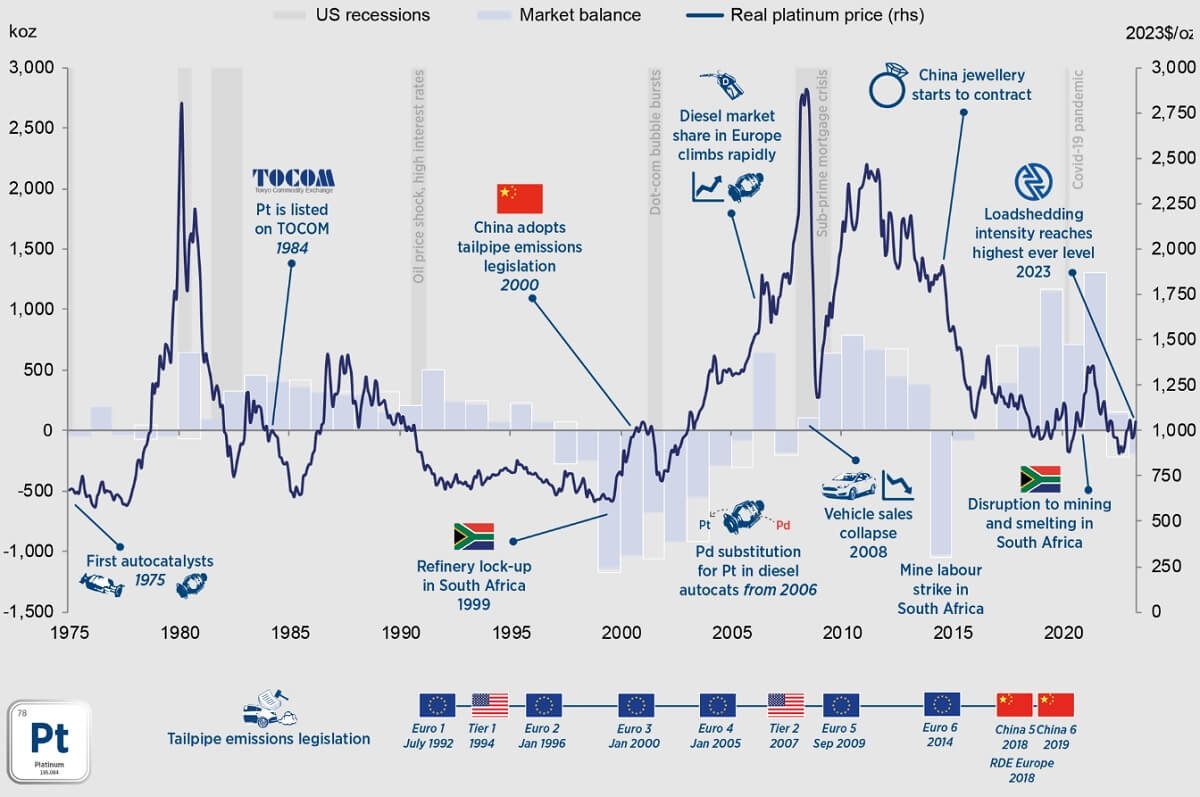

When it was first discovered, it was loved by many aristocrats for its beautiful color and was widely used to make jewelry and other luxury items, so it has always been relatively expensive. In the early 1980s, it was in high demand because of its important use in catalytic converters for automobiles.

During this period, many countries began to set stringent automotive emission standards, requiring automakers to equip new vehicles with catalytic converters to meet these standards. This led to a sharp increase in demand for platinum, driving its price to soar to record highs. Platinum prices had reached all-time highs of over $2.000 per ounce during this period.

Demand for platinum grew steadily in the early to mid-1980s as the automotive industry continued to develop and the global economy grew. In addition to the automotive industry, the use of platinum in other industrial sectors, such as chemicals, electronics, and healthcare, also gradually increased, further driving the growth in demand for platinum.

As a result, during this period, platinum prices were relatively stable and showed a moderate upward trend, fluctuating roughly between $300 and $500 per ounce. Over time, technological developments and further improvements in environmental regulations led to the gradual adoption of more advanced catalytic converter technology by the automotive industry, reducing the demand for platinum. At the same time, the supply of platinum increased, leading to a fall in prices.

Until 1999. south africa experienced a series of refinery blockades, which led to disruptions in platinum production and supply shortages. As South Africa is one of the world's largest platinum producers, these events had a serious impact on supply in the global platinum market. The supply shortage of platinum triggered concerns in the market about a lack of supply, which led to an increase in the price of platinum.

The onset of the global financial crisis in 2008. on the other hand, caused the price of platinum to fall to a level of less than $800 per ounce. This price fall was largely due to a decline in automobile sales as a result of the global recession, which reduced demand for platinum. In addition to the decline in the automotive industry, the global recession is likely to affect demand for platinum in other industrial sectors, such as electronics and healthcare, further amplifying the negative price impact on platinum.

As the global economy gradually recovers, the automotive industry has also begun to revitalize, leading to a gradual rise in car sales. At the same time, governments have become increasingly stringent in their regulation of vehicle emissions, requiring automakers to adopt more advanced emission control technologies. Demand for platinum, one of the main components of catalytic converters, has increased as it plays an important role in reducing tailpipe emissions.

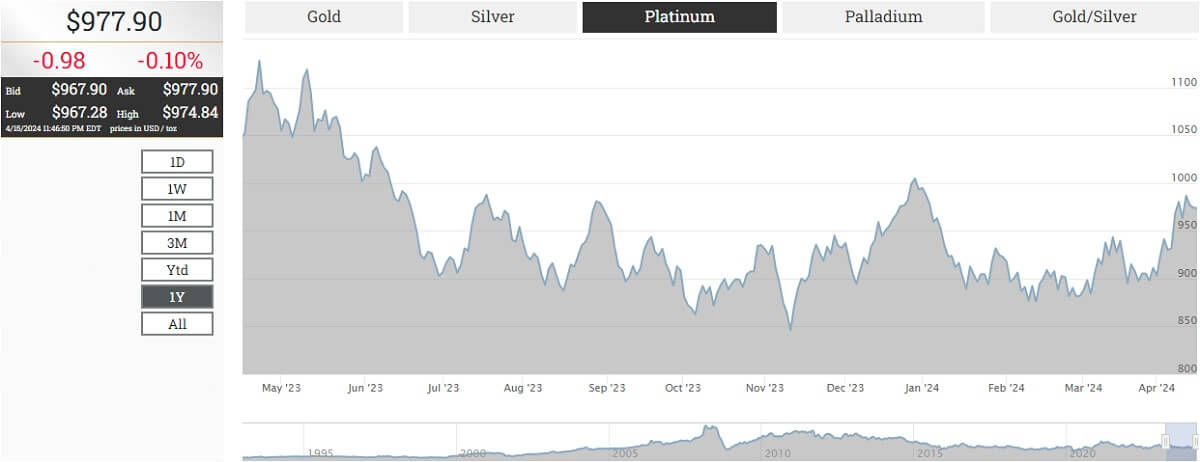

This increased demand for platinum has driven up the price of platinum. At one point in 2011. the price of platinum exceeded the $1.900 per ounce level, reaching an all-time high in recent years. However, subsequent changes in the global economic situation, challenges in the automotive industry, and fluctuations in investor sentiment have led to volatility and declines in the price of platinum. Currently, the price of platinum fluctuates between approximately $900 and $1.000 per ounce.

Overall, the price of platinum is influenced by a number of factors, including the global economy, the automotive industry, policies and regulations, and investor sentiment. As a result, its movements are complex and volatile and require a comprehensive consideration of various factors for analysis and forecasting.

Why are platinum prices falling again and again?

Why are platinum prices falling again and again?

Since the beginning of 2014. the price of platinum has been on a general trend of going lower. Especially in the last year, the price of platinum has experienced dramatic fluctuations and is currently around $940 per ounce. Relative to gold and silver, platinum is becoming severely undervalued.

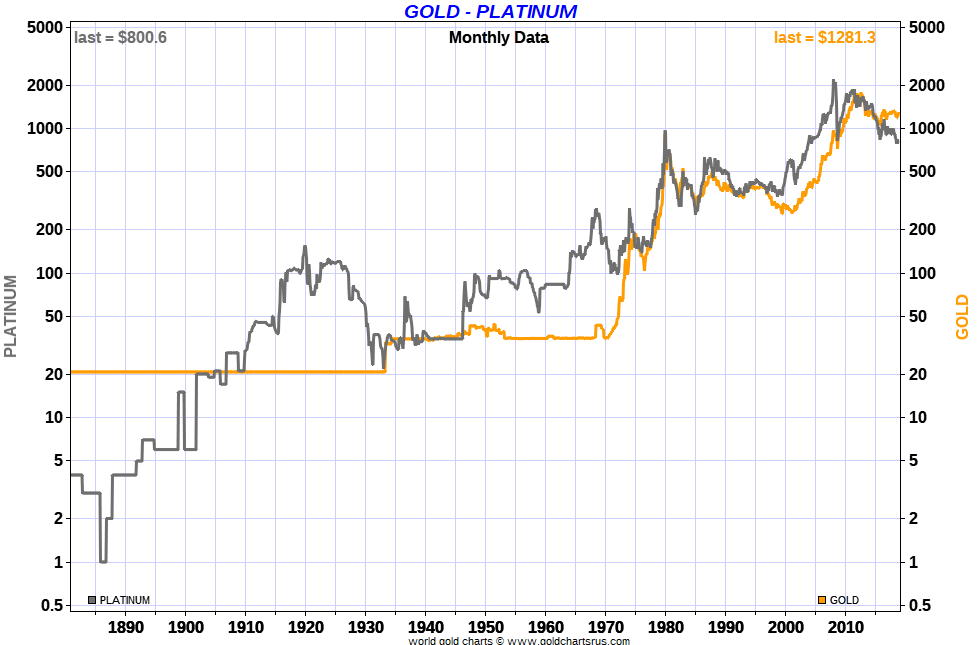

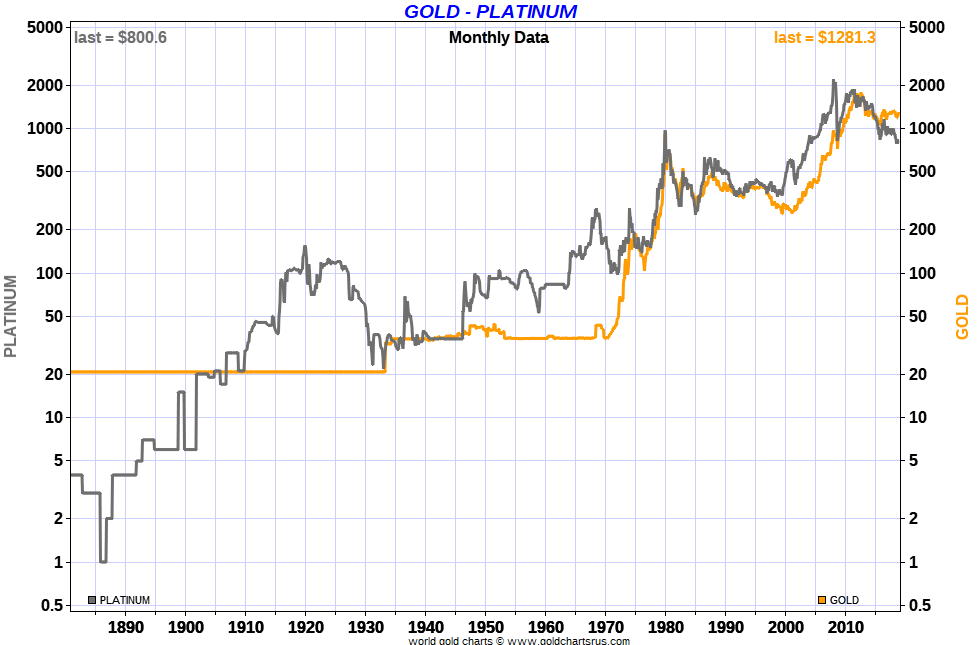

The historical trend of the platinum-to-gold price ratio reflects how undervalued platinum is in the current market. In the past, the platinum-to-gold price ratio has been as high as two times, indicating that platinum was once considered a more valuable precious metal than gold. By normal industry standards, platinum should normally be priced at the same level as gold, or even higher, as demand for platinum continues to increase due to its widespread use in industry.

However, the current platinum-to-gold price ratio is around 0.5. well below historical levels. This suggests that the price of platinum is significantly undervalued relative to the price of gold. This undervaluation may be due to a number of factors, including, but not limited to, declining industrial demand, poor market sentiment, a lack of investor confidence in platinum, and a weak global economy.

Over the past three decades or so, the historical normal for the platinum-silver price ratio has typically exceeded 100. indicating that platinum is typically more expensive than silver. However, this ratio currently stands at just over 40. well below historical levels, suggesting that platinum is severely undervalued relative to silver.

The reasons for the undervaluation of the platinum-to-silver price ratio may be related to the declining demand for platinum in industrial applications. In particular, as the transition to more environmentally friendly and energy-efficient technologies takes place in a number of industrial sectors, the demand for platinum is likely to decrease. In addition, speculative market demand for silver may have influenced the trend of the platinum-to-silver price ratio.

The reasons for the platinum price to fall again and again are complex. First of all, it is closely related to the global economic cycle, especially the sensitivity of the Federal Reserve's monetary policy and inflation expectations. Recession and recovery cycles have a significant impact on the price of platinum, which is closely linked to the market's expectations of monetary policy and future economic trends.

In times of recession, investors typically seek safe-haven assets, such as gold and platinum, to preserve value and hedge against inflationary risks. At this time, demand for gold and platinum usually increases, supporting their prices. Conversely, during a period of economic recovery, investors may be more inclined to invest in risky assets such as equities, and demand for safe-havens may decrease, resulting in lower prices for gold and platinum. As shown above, the price of platinum had two highs during the U.S. recession.

In addition, the Federal Reserve's monetary policy also has an impact on the price of platinum. For example, if the Fed adopts a tight monetary policy and raises interest rates to curb inflation, this may cause investors to shift from assets such as precious metals to fixed-income assets, thus putting pressure on the price of platinum. Conversely, if the Fed adopts an easy monetary policy and lowers interest rates to stimulate the economy, safe-haven assets such as precious metals may be favored, thus supporting the price of platinum.

In addition, inflation expectations are also one of the key factors affecting the price of platinum. If the market expects inflation to rise, investors may turn to physical assets such as precious metals to preserve their value, thus driving up the price of platinum. Conversely, if the market expects inflation to remain low or fall, investors may reduce their demand for precious metals, keeping the price of platinum in check.

At the same time, an increase in the supply of platinum and a decrease in demand will result in the market being oversupplied, which will drive prices down. This supply-demand imbalance can be caused by a number of factors, including a decline in industrial demand, reduced use due to technological advances, and the emergence of substitutes.

Platinum is widely used as a catalyst in automotive manufacturing, chemicals, and other industrial sectors, particularly in automotive emissions control. A decline in automobile sales or a reduction in demand for platinum due to the development of new energy vehicles would affect overall platinum market demand, thereby depressing prices.

Secondly, technological advances could also lead to a reduction in demand for platinum. For example, as the automotive industry transitions to electrification, the catalytic converters used in new energy vehicles may no longer require large quantities of platinum and shift to other materials or technologies. Such technological substitutions will reduce demand for platinum, leaving the market with more supply than demand, which in turn will affect prices.

In addition, the emergence of substitutes could also have an impact on the platinum market. If other materials or technologies can replace the functions of platinum at a lower price or with better performance, the demand for platinum may be affected, leading to a situation where supply exceeds demand.

There is also the fact that a large part of the previous high price of platinum was due to its popularity as jewelry. Thus, the situation in the platinum jewelry market reflects to some extent the volatility of demand in the platinum market as a whole, and there is a close relationship between this and the price of platinum.

In turn, demand for platinum jewelry fluctuates with economic cycles, shifts in consumer preferences, and the overall market climate. In times of economic prosperity, consumers are more willing to purchase luxury goods and high-end jewelry, which may boost demand for platinum jewelry, while in times of recession or uncertainty, consumers may reduce their consumption of luxury goods, resulting in a decline in market demand for platinum jewelry.

At the same time, the level of demand for platinum jewelry plays an important role in the overall platinum market in terms of supply and demand and price trends. When its price is low, consumers are more willing to buy platinum jewelry, which stimulates market demand and helps to support the price of platinum; conversely, when its price is high, consumers may reduce their purchases of platinum jewelry, leading to a decrease in market demand, which in turn puts some pressure on the price of platinum.

Overall, the price of platinum has fallen again and again, probably due to a combination of factors. These include the global economic downturn, declining industrial demand, technological advances leading to the emergence of substitutes, low investor sentiment, and oversupply in the market, which have led to pessimistic expectations and persistent selling pressure on platinum in the market, which in turn has pushed prices to continue to fall.

Why are platinum prices lower than gold?

Many people are under the impression that platinum has always been more expensive than gold. Historical data also shows that the price of platinum has been higher than gold since 1990–2010. But with the recent surge in the price of gold, an ounce of gold even exceeded 2000 U.S. dollars, and in the domestic market, the price of gold per gram is also as high as 600 yuan. But platinum has failed to follow the pace of gold; the price is relatively low. There are multiple reasons behind this phenomenon.

The increase in the supply of platinum stems mainly from the upgrading of mining techniques and the development of new platinum deposits. This has led to a relative increase in the supply of platinum. At the same time, demand for platinum in traditional applications such as catalytic converters in automobiles has declined, partly due to the shift to electrification in the automotive industry, which has reduced the demand for platinum. In addition, the slowdown in global economic growth also affected platinum demand.

With supply exceeding demand, platinum prices came under greater pressure, which further reduced demand for platinum, especially in areas such as jewelry. Increased supply and reduced demand have led to a situation where supply exceeds demand, which has kept the price of platinum from showing signs of rising. In contrast, gold has a more balanced supply-demand relationship, which supports its higher price.

Platinum is mainly used in industry and plays a key role, in particular, in catalytic converters in automobile production. Gold, on the other hand, has a much wider range of uses, and in addition to being a safe-haven asset and an investment, it also has important applications in the fields of jewelry, electronics, and financial products.

As a safe-haven asset, gold is favored by investors around the world, especially in times of economic instability or increased risk of inflation, when investors tend to transfer their funds to safe assets such as gold to preserve their value. This sustained and widespread demand for gold has resulted in relatively stable and high prices.

In contrast, demand for platinum is concentrated in the industrial sector and is relatively low due to factors such as the transformation of the automotive industry and the slowdown in global economic growth. As a result, market demand for gold is more widespread and persistent, while demand for platinum is relatively limited.

As a precious metal with a long history, gold has broad market recognition and liquidity. It is widely accepted globally as an important safe-haven asset and investment tool. The relatively active gold market, with its ease of trading and high price transparency, provides a high degree of liquidity, allowing investors to buy and sell gold with relative ease and to convert it to cash or other assets when required.

In contrast, the market for platinum is relatively illiquid and inactive. Despite its important industrial uses, platinum is far less recognized and less liquid than gold in the investment arena. The platinum market is relatively small, with relatively few transactions and high price volatility, so investors may face greater risks and difficulties when buying and selling platinum.

Investors typically have a high level of confidence in gold as a sound safe-haven asset and value preservation tool. As a result, when economic uncertainty increases or inflation expectations rise, investors tend to turn to gold as a hedge, which drives up the price of gold.

In contrast, investor confidence in platinum is relatively low. The platinum market is relatively small, with inactive trading and high price volatility, which makes investors more cautious about the risks of investing in platinum. As the main use of platinum is concentrated in the industrial sector, its price fluctuations are influenced by industrial demand, and this instability further reduces investor confidence in platinum.

Therefore, compared with gold, investors' willingness to invest in platinum is relatively low, which may lead to a certain degree of inhibition of the rise in platinum prices. At the same time, the impact of technological advances on the platinum market should not be ignored, which has changed the demand structure of some traditional industrial sectors, thus negatively affecting the price of platinum.

With the transition of the automotive industry to electrification, the number of traditional combustion-engine vehicles has decreased, thus reducing the demand for platinum catalytic converters. Platinum is mainly used in catalytic converters in automotive exhaust gas cleaning systems to reduce harmful emissions from exhaust gases.

However, electric vehicles typically do not require catalytic converters as they are powered by electricity rather than fuel, reducing the demand for platinum. This trend has further exacerbated the situation of supply exceeding demand in the platinum market, leading to a continued decline in platinum prices.

In summary, a combination of supply and demand, differences in usage, market acceptance and liquidity, market psychology, and technological developments have led to the decline in the price of platinum relative to gold. However, it is also subject to multiple influences, such as the global economy and political factors, and its price fluctuations are often affected by market expectations and supply, so it is still necessary to analyze its price trend by taking into account a number of factors.

Platinum price trends and their influencing factors

| Time period |

Price Trend |

Influencing Factors |

| Early 80s |

Sharp rise, over $2,000 per ounce |

High demand, strict emissions, and a strong jewelry market. |

| Mid 80's |

Relatively stable, $300-500 per ounce |

Growth, car demand, and more industry use. |

| 1999 |

The decline persists at $900–1000/oz. |

The South African refinery blockade raises supply concerns. |

| 2008 |

Prices are under $800/oz. |

Financial crisis, drop in car sales, and recession impact. |

| 2011 |

Price over $1900 per ounce |

Economic recovery, auto revival, and rising emission control. |

| Recent years |

Ongoing decline, around $900–1000/oz. |

Economic slowdown, lower demand, and tech substitutes. |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

Platinum Price Trend

Platinum Price Trend Why are platinum prices falling again and again?

Why are platinum prices falling again and again?