Understanding market risk and volatility is essential for any investor or trader aiming to make informed decisions. Standard deviation is a fundamental statistical tool that plays a central role in this process.

By quantifying how much returns deviate from their average, standard deviation offers a clear, objective measure of an investment's volatility and risk profile.

What Is Standard Deviation?

Standard deviation is a statistical measure that shows how much individual data points — such as asset prices or investment returns—differ from the mean (average) value.

In financial markets, it is most commonly used to assess the volatility of stocks, bonds, funds, or entire portfolios. A higher standard deviation indicates greater variability and unpredictability in returns, while a lower standard deviation suggests more stability.

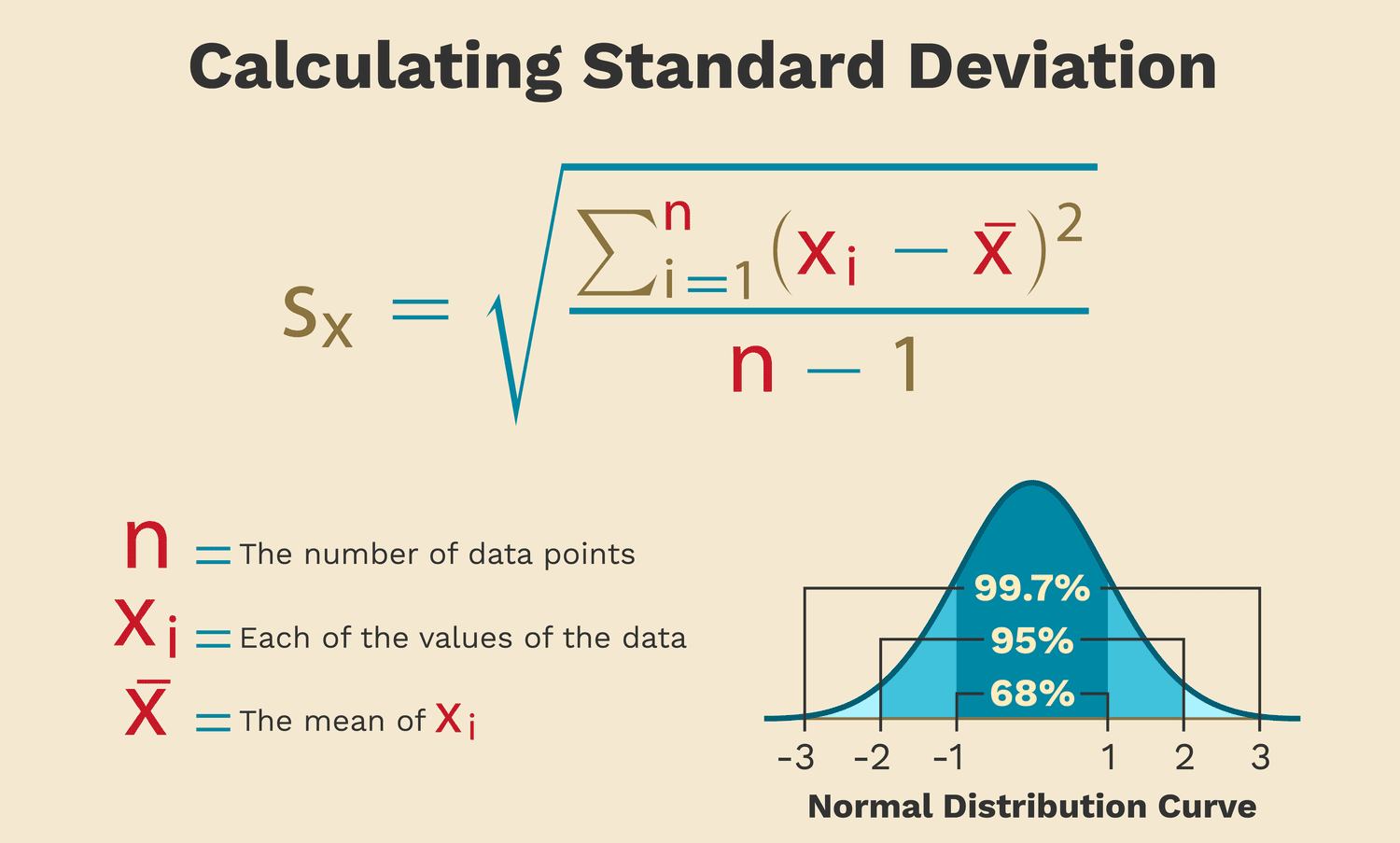

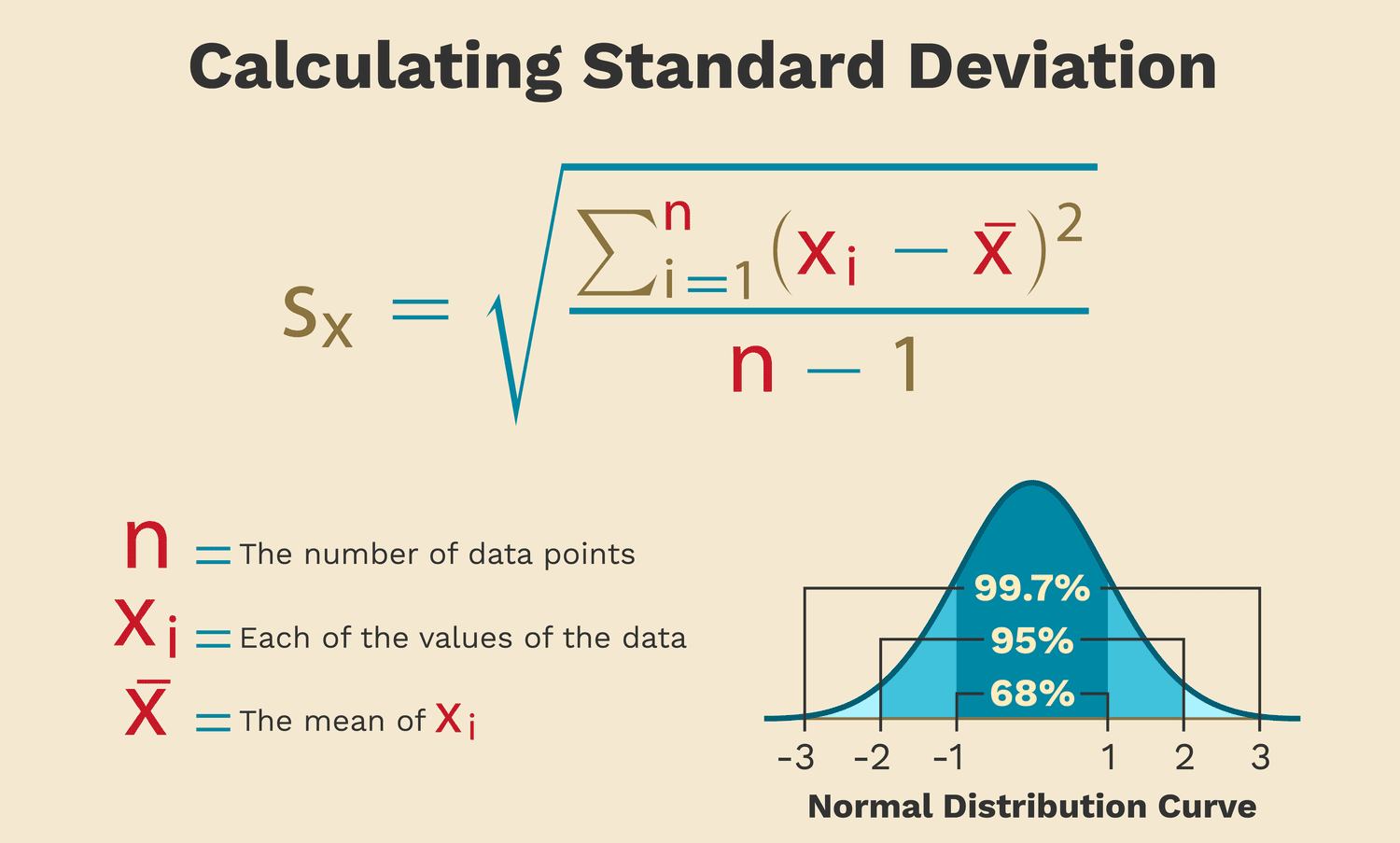

How Is Standard Deviation Calculated?

Calculating standard deviation involves several steps:

Find the mean of the data set (e.g., average return over a given period).

Subtract the mean from each data point to determine the deviation for each period.

Square each deviation to remove negative values.

Calculate the average of these squared deviations to find the variance.

Take the square root of the variance to obtain the standard deviation.

This process transforms the data into a single value that expresses how widely returns are dispersed around the mean, making it easier to compare different investments.

Interpreting Standard Deviation in Finance

In investing, standard deviation is synonymous with risk and volatility. When an asset's returns have a high standard deviation, it means the price fluctuates widely, making it less predictable and riskier. Conversely, a low standard deviation indicates that returns are more consistent and the asset is comparatively stable.

For example, if Investment A has a standard deviation of 10% and Investment B has a standard deviation of 5%, Investment A is considered riskier because its returns are more spread out from the average. This information is invaluable for investors who wish to match their investments to their risk tolerance.

Standard Deviation and Portfolio Diversification

Standard deviation is not only useful for evaluating individual assets but also for building diversified portfolios. By combining investments with different standard deviations and correlations, investors can reduce the overall risk. Diversification works best when assets do not move in tandem, as the volatility of one can offset the stability of another, lowering the portfolio's total standard deviation.

For instance, pairing a volatile stock with a more stable bond can help smooth out returns, resulting in a more balanced risk profile. This principle is at the heart of modern portfolio theory and is widely used by both individual and institutional investors.

Standard Deviation and Historical Analysis

Analysing the historical standard deviation of an investment provides insights into its past volatility and risk. By observing how standard deviation changes over time, investors can identify periods of heightened uncertainty or stability, and adjust their strategies accordingly.

This historical perspective is particularly useful for stress testing portfolios and preparing for different market scenarios.

Real-World Example

Suppose two shares, Share X and Share Y, both have an average annual return of 8%. Share X has a standard deviation of 12%, while Share Y's is only 6%.

Although their average returns are identical, Share X is twice as volatile as Share Y. An investor seeking stable returns might favour Share Y, while a risk-tolerant investor may prefer Share X for its higher potential swings.

Standard Deviation and Risk Comparison

Standard deviation allows for direct comparison of risk across different investments, regardless of asset class. It is especially useful when considering funds, ETFs, or portfolios, as it provides a single number summarising the variability of returns.

However, it should be used alongside other metrics, such as beta or the Sharpe ratio, for a more comprehensive view of risk.

Limitations of Standard Deviation

While standard deviation is a powerful tool, it does have limitations. It assumes that returns are normally distributed, which is not always the case in real-world markets.

Extreme events, known as “black swans”, can occur more frequently than predicted by a normal distribution, leading to underestimation of risk. Additionally, standard deviation treats upside and downside volatility equally, even though investors are typically more concerned about losses.

Practical Tips for Investors

Compare standard deviations when evaluating similar investments to gauge relative risk.

Use standard deviation as part of a broader risk assessment toolkit, not in isolation.

Diversify your portfolio to reduce overall standard deviation and smooth out returns.

Review historical standard deviation to understand how an asset's risk profile has evolved.

Conclusion

Standard deviation is an essential metric for measuring volatility and investment risk.

By understanding and applying this concept, investors can make more informed decisions, compare assets objectively, and build portfolios that align with their risk tolerance and financial goals.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.