The Japanese yen did not start off the year on a strong note as expected,

losing around 5% against the dollar so far. Easing inflation in Japan and rosy

economic prospects in the US have dragged on the currency.

The core CPI in Tokyo, a leading indicator of nationwide inflation trends,

rose 1.6% in January from a year earlier, government data showed, slower than

expectations for a 1.9% gain.

Nationwide inflation has exceeded the 2% inflation target for more than a

year. The focus is shifting to whether wages will rise enough to underpin

consumption.

Meeting minutes show that BOJ board members were split on the likely timing

and sequence of an exit from negative rates. Fund titans are bracing for the

monumental moment of policy normalisation.

The BOJ is expected to raise benchmark to 0% in March or April, before hiking

to 0.25% by year-end, said Pimco in a report. Morgan Stanley MUFG and BNPP see

the first rate hike in March.

Three-month dollar/yen implied volatility has fallen through January to its

lowest in about seven weeks, a sign that traders were outright bullish on the

yen.

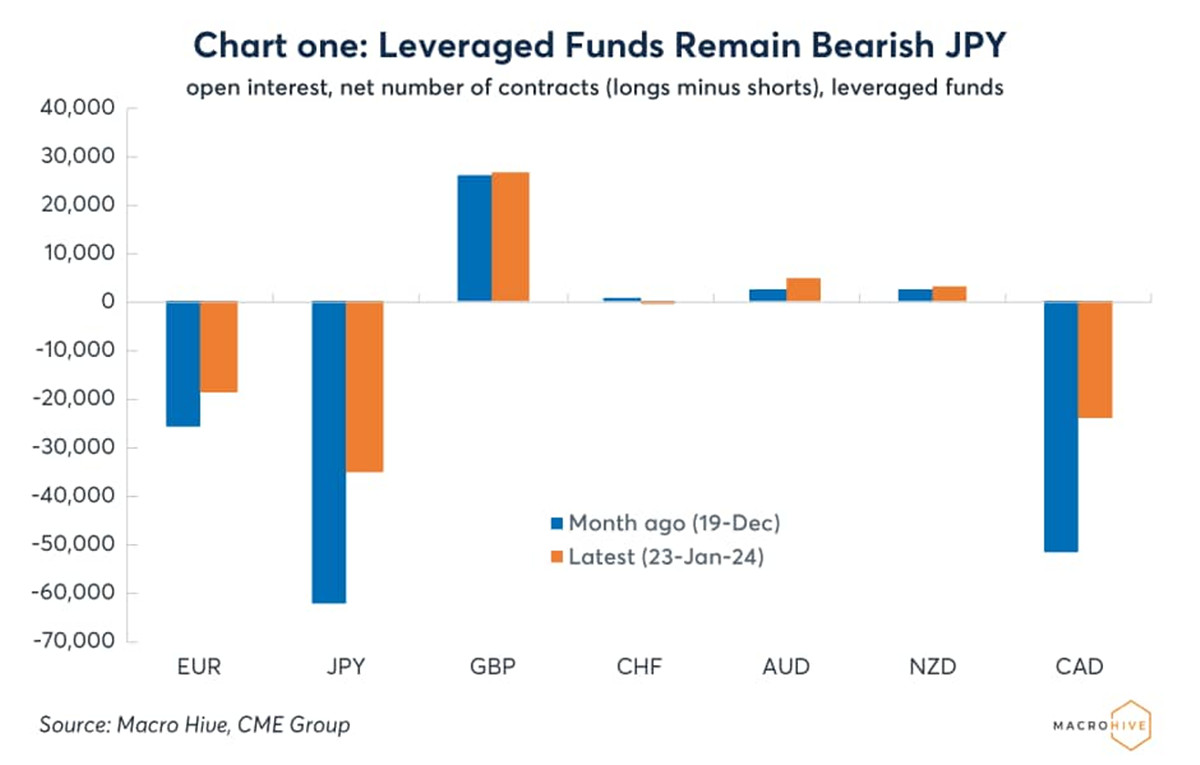

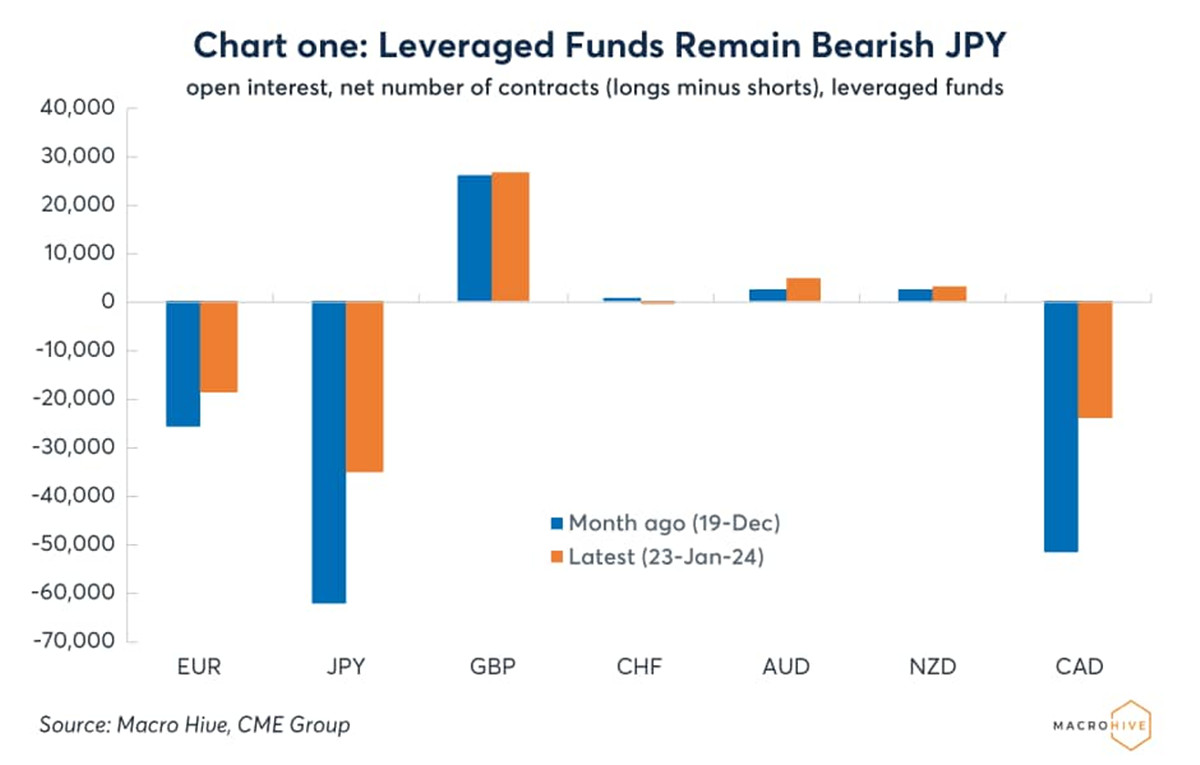

Leveraged funds had materially decreased JPY exposure, reducing their short

positioning by 43% by 23 Jan, according to CME Group. It was still the most

shorted among seven major currencies.

Golden window for pivot

Nominal cash earnings rose 1.0% in December from the previous year, with the

help of a 0.5% gain in winter bonuses, the labour ministry reported. The growth

missed forecast of 0.4%.

Still that was an acceleration versus a month earlier, signalling underlying

momentum in favour of rate hikes. Data for full-time workers showed growth of

2%, hitting the mark for a fourth straight month.

“The possibilities are high at this point” for an April move by the BOJ as

“the overall numbers for base-up wages are getting quite strong,” said Harumi

Taguchi, principal economist at S&P Global Market Intelligence.

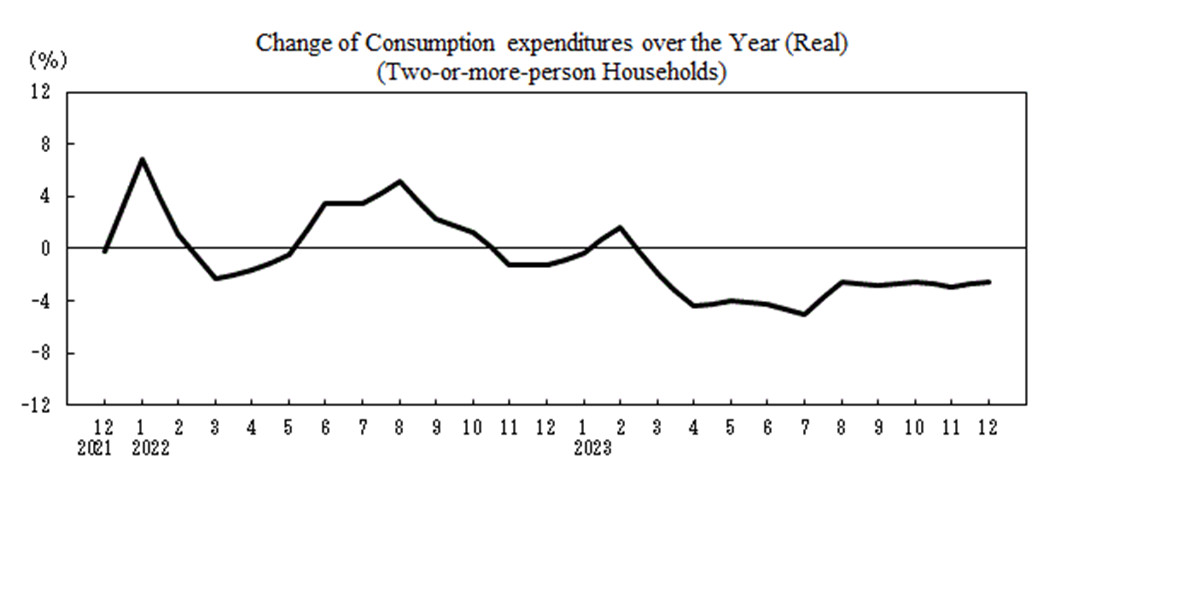

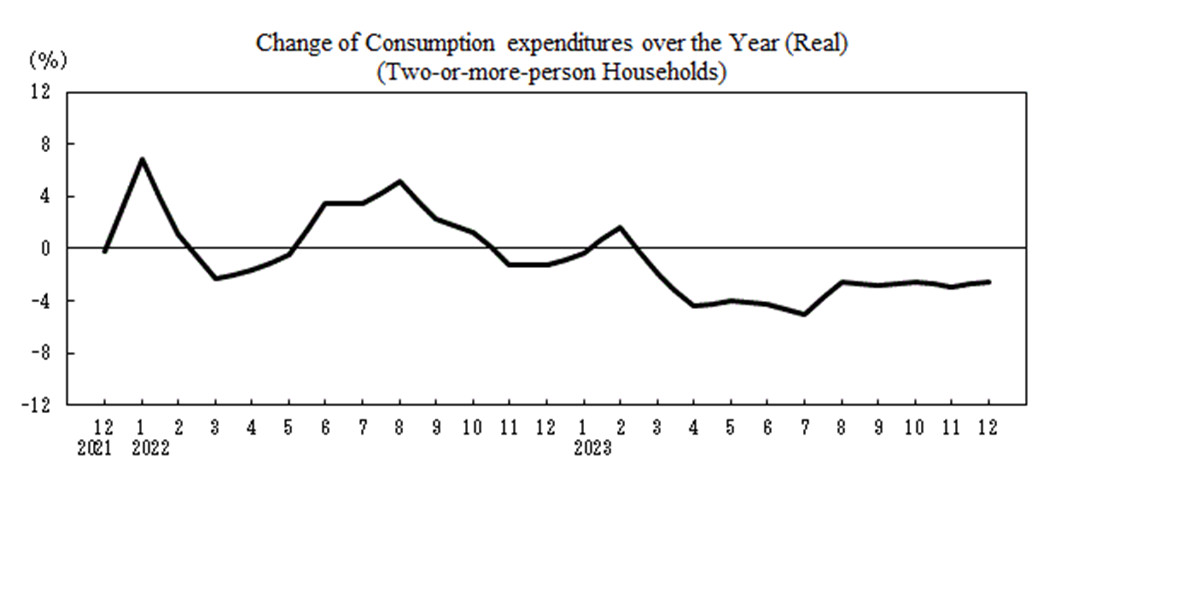

However, household spending dropped for a tenth consecutive month. Annual

wage negotiations kicked off last month amid hopes for the largest pay hike in

three decades.

A survey of 37 economists also revealed that big firms are likely to offer a

3.80% average wage hike this year, surpassing last year’s 3.58% gain.Some large

companies reportedly pledged an increase of as much as 7%.

Forsmall and medium-sized companiesthat are unable to follow suit, PM Fumio

Kishida has been introducing a slew of measures including tax breaks to offset

rising labour costs.

Japan’s biggest commercial banks are letting money accumulate in negative

interest-rate accounts at the central bank — another sign that the world’s last

sub-zero rate policy is coming close to the end.

“The data could keep weakening and they could run out of justification for

normalising”ifthe central bank stands on pat for too long, said Stefan Angrick,

senior economist at Moody’s Analytics.

Counterforce to appreciation

The US dollar has regained its strength at the start of the year, hitting its

two-month peak earlier this week. Swaps traders are amping up their bets on a

cut in May.

The US economy and the labour market have both outpaced expectations, with

GDP growing at a 3.3% annualised pace last quarter, and employers adding 353,000

jobs last month.

Several Fed officialssignalled not rush to although ChairJerome Powell left

little doubt thatthe central bank would start loosening at some point of the

year.

BofA pushed back their forecast for the first rate cut to June from March,

citing a dearth of inflation readings before May and the Fed preferring to make

policy changes at meetings with new quarterly economic projections.

Goldman Sachs economist now expect the Fed to act at April’s meeting versus

March previously. Barclays similarly sees the first rate cut in May instead of

March.

Financial markets are at risk of more volatility than many people expect when

the BOJ ends its negative interest rate and the Fed cuts borrowing costs,

according to BlackRock’s chief investment strategist in Tokyo.

The yen was the worst performer among G10 currencies in the previous month,

which fuels scepticism over a great comeback predicted for this year.Economists

at MUFG Bankwere not swayed though.

“The yen will strengthen in 2024 as the drivers of JPY depreciation start to

reverse – falling global inflation and yields, a rate hike and an end to YCC by

the BOJ and a shrinking of the energy trade deficit will all add to yen demand,”

the bank said.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.