The dollar was steady on Monday

2024-02-19

Summary:

Summary:

Monday's steady dollar faces uncertain easing timing due to persistent inflation. Traders eye June for the first rate cut, per CME FedWatch.

EBC Forex Snapshot

19 Feb 2024

The dollar was steady on Monday as sticky inflation cast doubts on when the

Fed would start its easing cycle soon. Traders expect the first rate cut to come

in June, CME FedWatch tool showed.

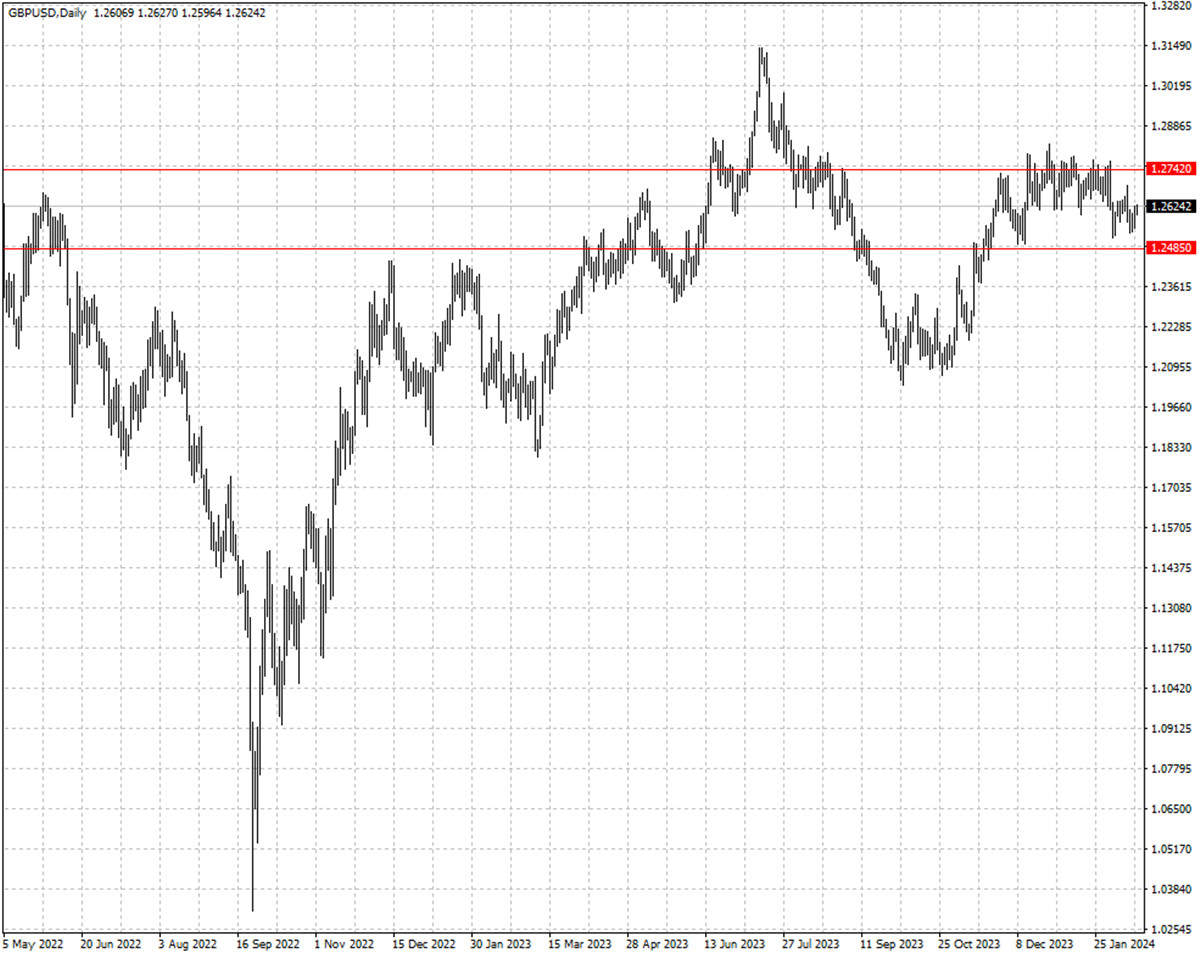

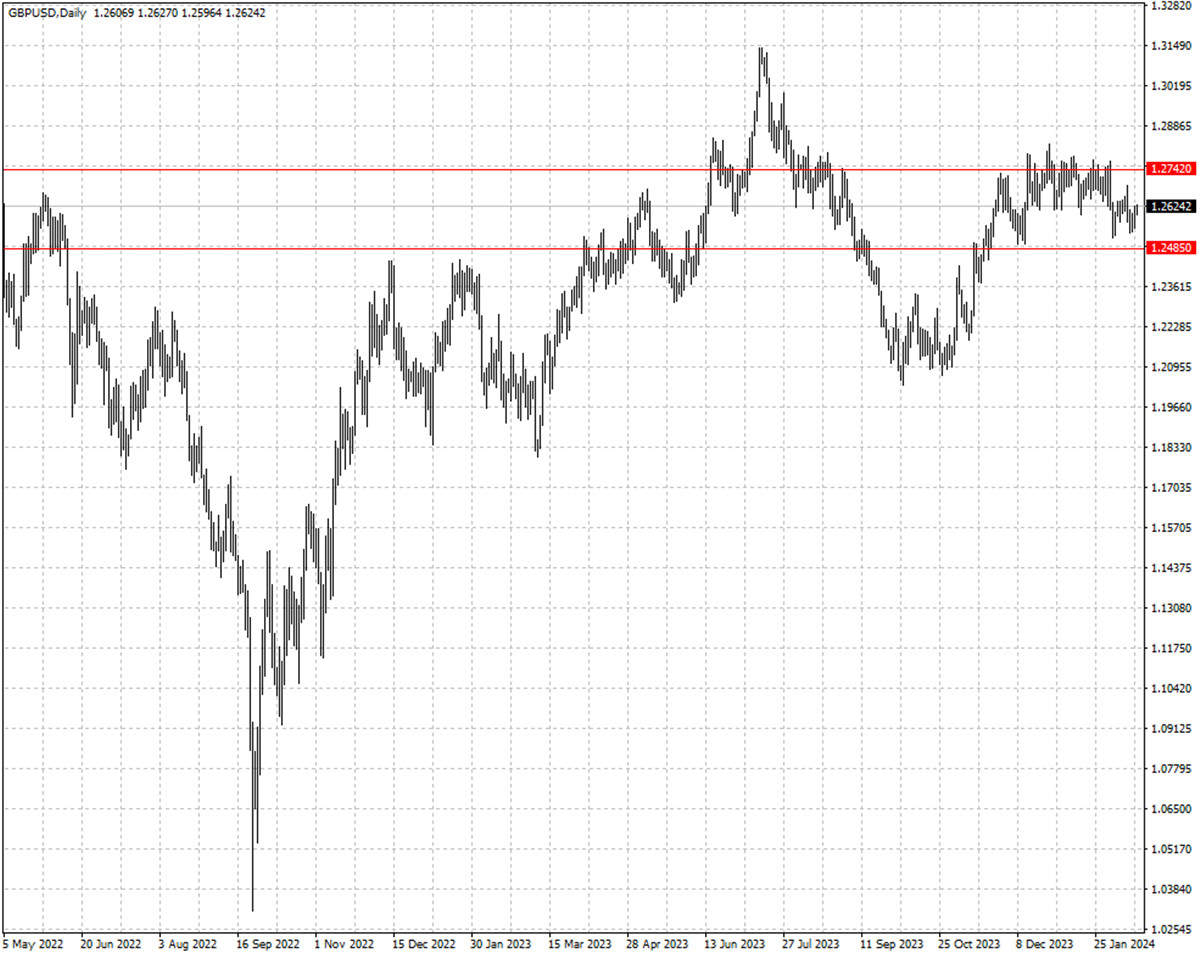

Sterling edged up after data showed UK retail sales grew at their fastest

pace in nearly three years in January. The economy slipped into recession in the

second half of last year as people tight belts.

Andrew Bailey, BoE governor, warned against putting “too much weight” on the

recession as it was expected to be “very shallow”. The central bank upgraded its

forecast for 2024 growth earlier this month.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 5 Feb) |

HSBC (as of 19 Feb) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0724 |

1.1139 |

1.0679 |

1.0883 |

| GBP/USD |

1.2487 |

1.2827 |

1.2485 |

1.2742 |

| USD/CHF |

0.8333 |

0.8728 |

0.8609 |

0.8943 |

| AUD/USD |

0.6500 |

0.6900 |

0.6445 |

0.6614 |

| USD/CAD |

1.3379 |

1.3552 |

1.3369 |

1.3592 |

| USD/JPY |

146.09 |

148.80 |

147.10 |

152.10 |

The green numbers in the table indicate an increase in data, the red numbers indicate a decrease in data, and the black numbers indicate that the data remains unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.