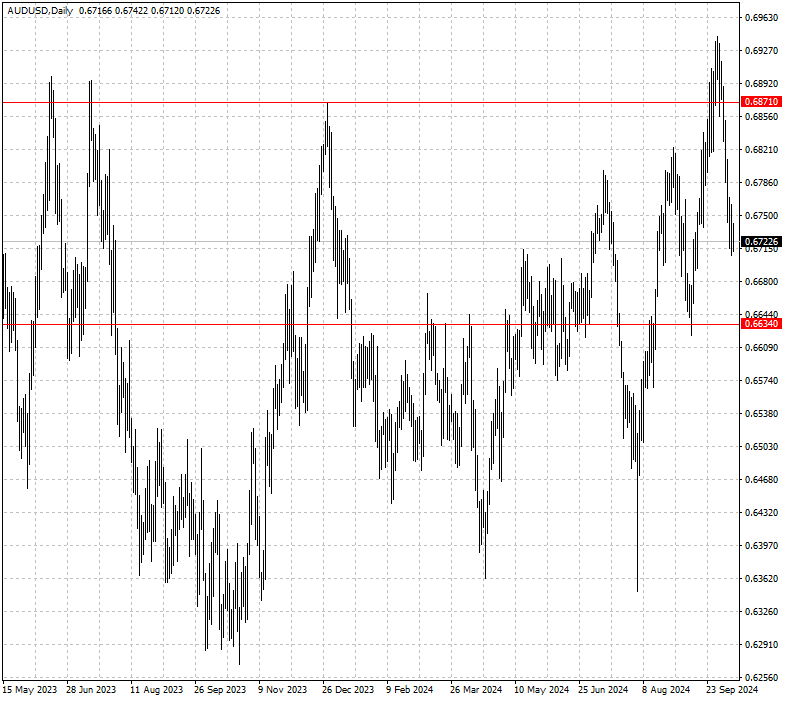

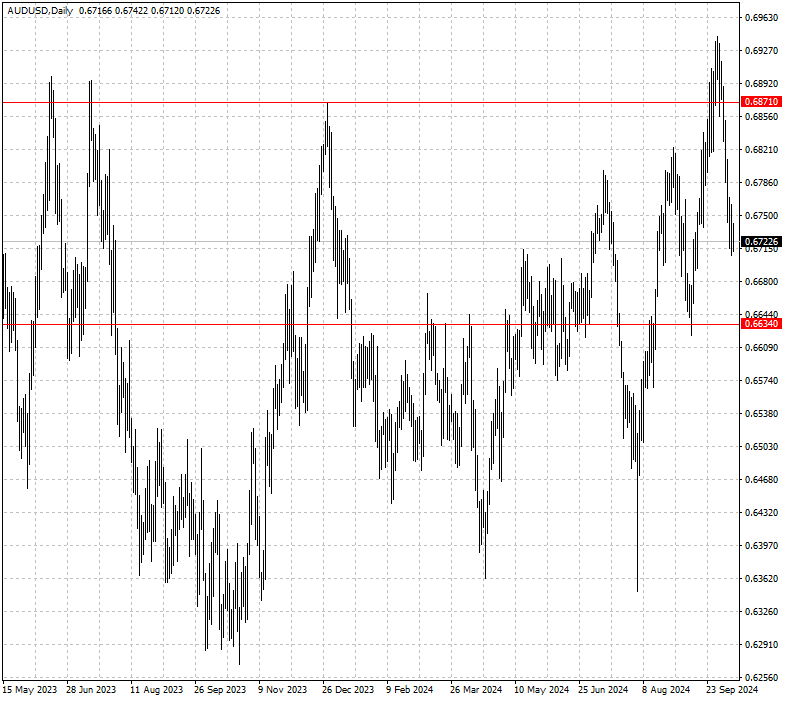

Australian Dollar Rebounds from Mid-September Lows

2024-10-10

Summary:

Summary:

The US hovered near a two-month high on Thursday as markets grew confident in the Fed's patient monetary policy ahead of a key inflation report.

EBC Forex Snapshot, 10 Oct 2024

The U.S. dollar remained close to a two-month high on Thursday as market participants grew increasingly confident that the Federal Reserve will adopt a patient approach to monetary policy. This comes ahead of a key inflation report that could further influence the Fed's next steps.

The minutes from the September FOMC meeting revealed support for a gradual pace of rate cuts, although there were divisions among policymakers. While most officials agreed on a cautious approach, some favored a more aggressive quarter-point rate cut. This divergence highlights the challenges the Fed faces as it seeks to balance inflation control with economic growth.

The Aussie rallied from its weakest since mid-Sep, after a stimulus

announcement by China's state planner fell flat. Iron ore has been whipsawed in

recent sessions after reclaiming the $100 level.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 7 Oct) |

HSBC (as of 10 Oct) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0951 |

1.1214 |

1.0846 |

1.1123 |

| GBP/USD |

1.2923 |

1.3266 |

1.2937 |

1.3319 |

| USD/CHF |

0.8375 |

0.8749 |

0.8465 |

0.8679 |

| AUD/USD |

0.6757 |

0.6950 |

0.6634 |

0.6871 |

| USD/CAD |

1.3420 |

1.3792 |

1.3513 |

1.3813 |

| USD/JPY |

139.50 |

149.00 |

144.16 |

151.89 |

The green numbers in the table indicate that the data has increased compared with the previous time; the red numbers indicate that the data has decreased compared with the previous time; and the black numbers indicate that the data has remained unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.