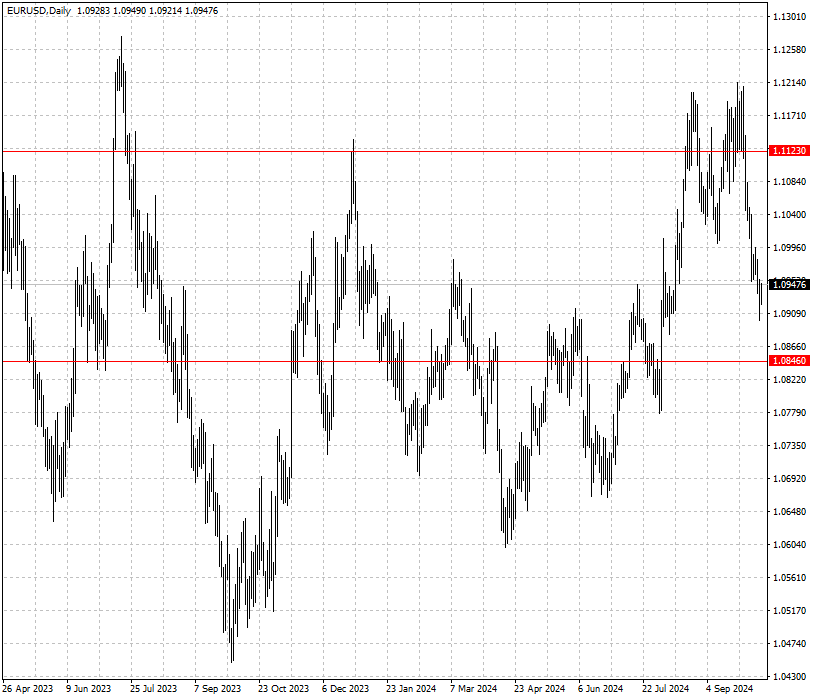

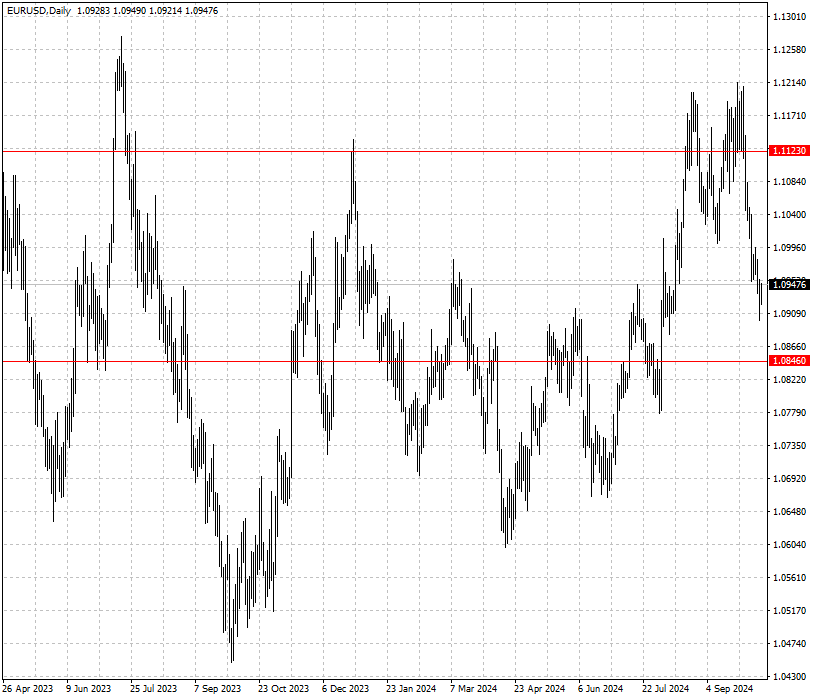

Euro Stabilizes After Rebounding from 2-Month Low

2024-10-11

Summary:

Summary:

The US dollar dipped from a two-month high but is set for a second consecutive weekly gain as weak labor market signals support faster Fed rate cuts.

EBC Forex Snapshot, 11 Oct 2024

The US dollar experienced a decline from its two-month peak but remained poised for a second consecutive weekly gain. This movement was driven by growing speculation that the Federal Reserve may expedite rate cuts following signs of labor market instability.

A sharp increase in new unemployment claims was recorded last week, with factors such as Hurricane Helene and furloughs at Boeing, due to the ongoing strike, contributing to the rise. These developments signal economic disruptions that may prompt the Fed to reconsider its monetary policy timeline.

The euro steadied after bouncing back from a two-month low. Several ECB

policymakers argued their case for another interest rate cut next week though

turmoil in the Middle East fuels volatility in energy costs.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 7 Oct) |

HSBC (as of 10 Oct) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0951 |

1.1214 |

1.0846 |

1.1123 |

| GBP/USD |

1.2923 |

1.3266 |

1.2937 |

1.3319 |

| USD/CHF |

0.8375 |

0.8749 |

0.8465 |

0.8679 |

| AUD/USD |

0.6757 |

0.6950 |

0.6634 |

0.6871 |

| USD/CAD |

1.3420 |

1.3792 |

1.3513 |

1.3813 |

| USD/JPY |

139.50 |

149.00 |

144.16 |

151.89 |

The green numbers in the table indicate that the data has increased compared with the previous time; the red numbers indicate that the data has decreased compared with the previous time; and the black numbers indicate that the data has remained unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.