EBC Forex Snapshot

20 Feb 2024

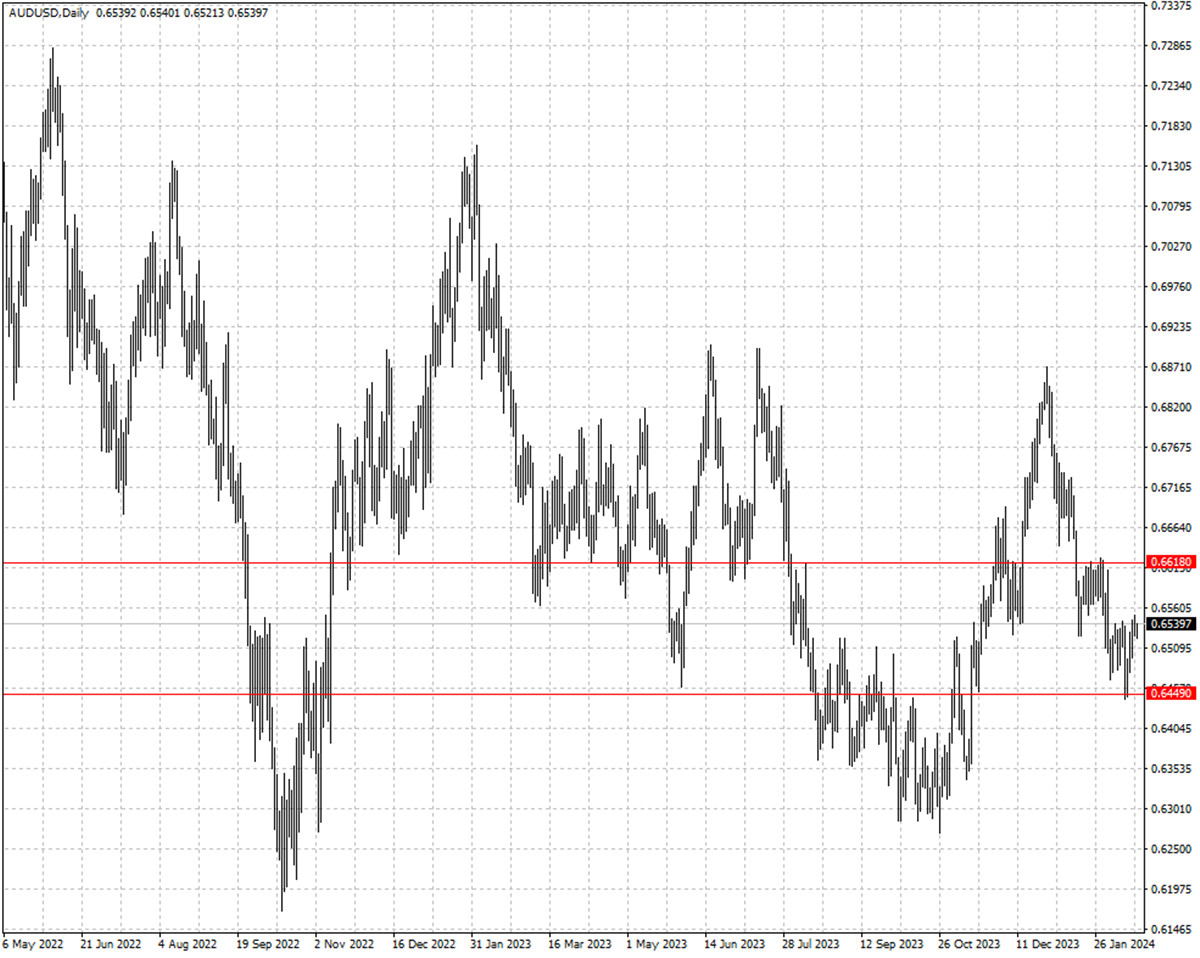

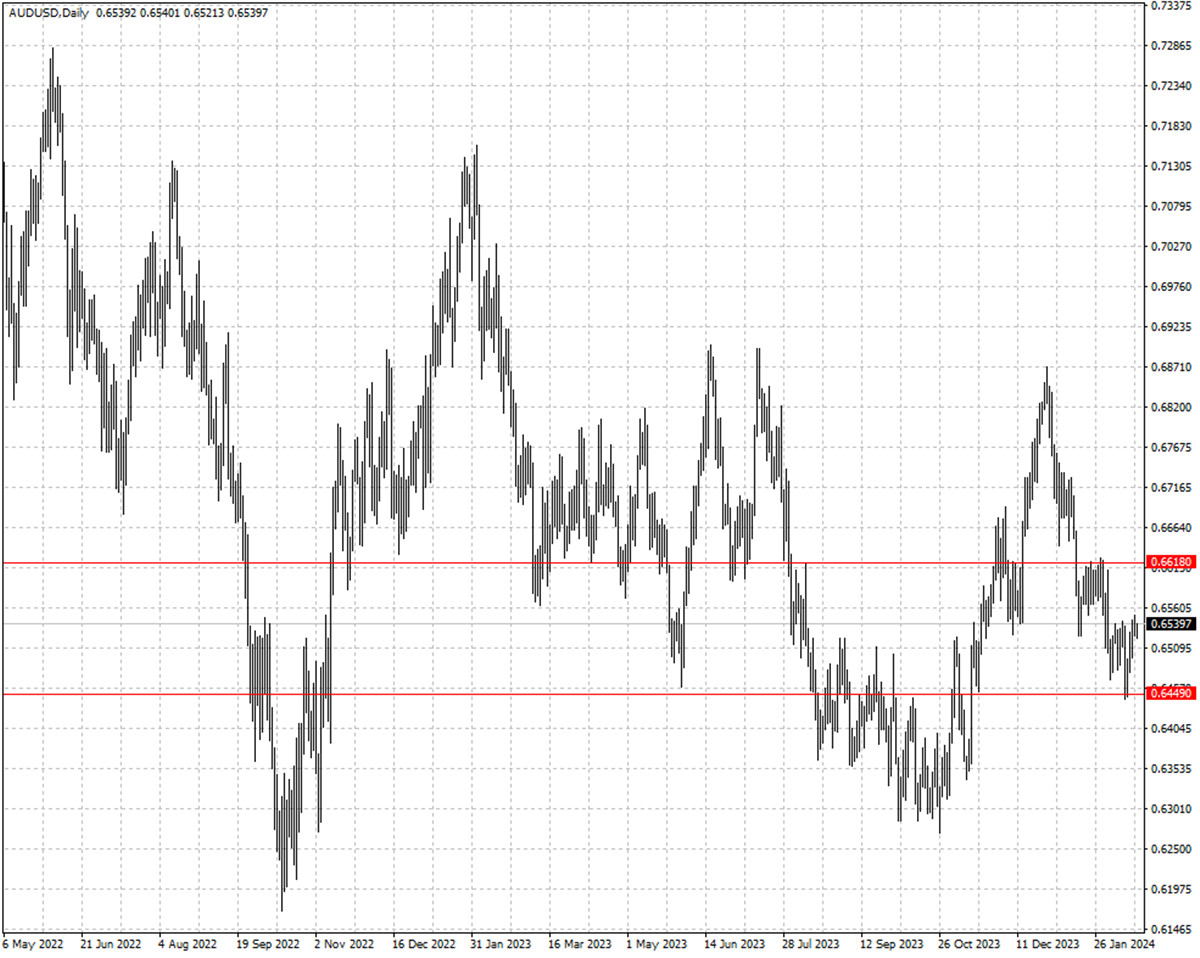

The US dollar rose broadly on Tuesday on mounting expectations of

higher-for-longer interest rates in the US. The australian dollar dropped

despite China’s latest decision to lower LPRs.

The RBA stood pat on its first meeting of the year on cooling inflation,

weaker-than-expected jobs and consumer spending reports while signalling further

tightening is still possible, minutes of the meeting showed.

The country’s benchmark rate is lower than many other developed nations where

inflation are more tamed. Its 425 bps of hikes in the current tightening cycle

trail both the US and New Zealand’s 525 bps.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 5 Feb) |

HSBC (as of 20 Feb) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0724 |

1.1139 |

1.0681 |

1.0885 |

| GBP/USD |

1.2487 |

1.2827 |

1.2481 |

1.2738 |

| USD/CHF |

0.8333 |

0.8728 |

0.8620 |

0.8954 |

| AUD/USD |

0.6500 |

0.6900 |

0.6449 |

0.6618 |

| USD/CAD |

1.3379 |

1.3552 |

1.3372 |

1.3595 |

| USD/JPY |

146.09 |

148.80 |

147.03 |

152.03 |

The green numbers in the table indicate an increase in data, the red numbers indicate a decrease in data, and the black numbers indicate that the data remains unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.