After broadly missing the 2023 stock rally due to being overly pessimistic

about the impacts of high borrowing costs on economy, Wall Street forecasters on

the whole have been turning increasingly bullish.

Goldman Sachs, RBC Capital Markets, and UBS have already raised their 2024

year-end calls for the S&P 500. The median target by nearly a dozen equity

strategists tracked by Bloomberg currently sits at 4,950.

The benchmark index cleared the 5,000 hurdle for the first time earlier this

month. The VIX is sitting at 13.97, near its historical lows, a sign of restored

confidence following the great loss the market posted last Tuesday.

Even some staunch bears have turned more positive. Morgan Stanley’s Mike

Wilson expects the rally to broaden and advising investors to stick with

large-cap, quality growth stocks.

JPMorgan has maintained the lowest year-end target among its peers, calling

for the index to drop to 4,200 by the end of 2024. But the bank’s trading desk

is opposed to that view, citing the above-trend GDP growth.

They expect that strength to translate into positive revenue growth and for

big technology names to propel the stock market — which has hit record after

record this year — even higher, just “at a potentially slower pace.”

Rate in the rear-view mirror

The latest fund flow data shows global investors increase their bets at a

faster pace. Almost $60 billion flooded into stock funds in the past four weeks,

the biggest such splurge in two years.

Goldman Sachs upgraded its rating on global equities to "overweight" on signs

of improvement in global manufacturing activity, after starting the year with a

"neutral" rating across assets.

The bank boosted their forecast for the S&P 500 to 52,00 from 5,100,

among the highest on Wall Street, and projected higher profits for the

technology and communication sector.

Corporate America has delivered another solid quarter. Profits for S&P

500 firms expanded 7%, extending a recovery from a contraction in the first half

of 2023, data compiled by Bloomberg.

BofA’s Savita Subramanian has implied her intention to potentially raise

forecast. She said “the biggest risk to the S&P 500 in the near term is

upside” in an interview this month.

The world’s largest economy continues to shine while recession stalks Europe

and Japan. That ongoing divergence has led to the decoupling of US equities and

bonds that are struggling with still-hot inflation.

Some point out that the expansion of Fiscal Policy has been underestimated.

Legislation have helped channel more than $1tn of investment so far into the

economy in recent years.

Peak euphoria

Bull options are so popular that their cost for the average stock in the

S&P 500 was almost on a par with bearish puts. The difference, known as call

skew, reached the highest level since 2021.

Credit default swaps, or instruments designed to hedge exposure to credit

risks, retreated as the Markit CDX North American High Yield Index and a similar

investment-grade CDS tracker both hit a two-year low.

A host of similarities between tech stocks now and previous bubbles suggest

the Magnificent Seven could register more gains ahead before a major retreat,

BofA strategists led by Michael Hartnett said.

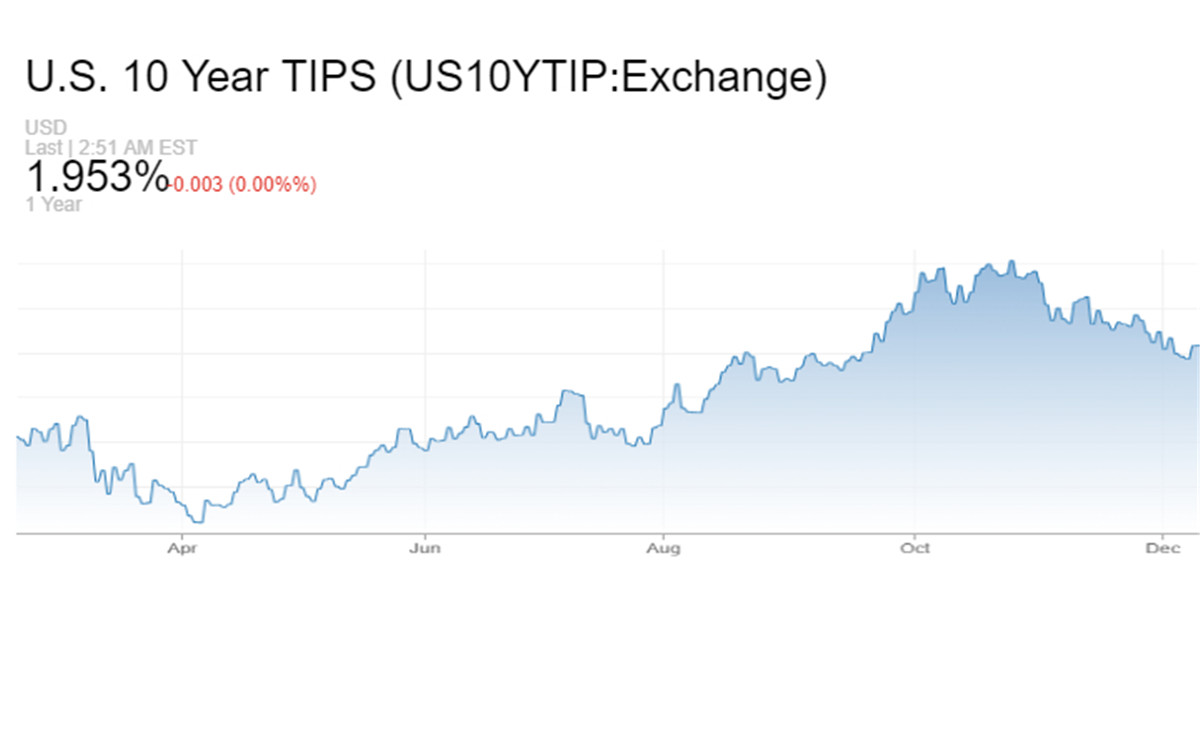

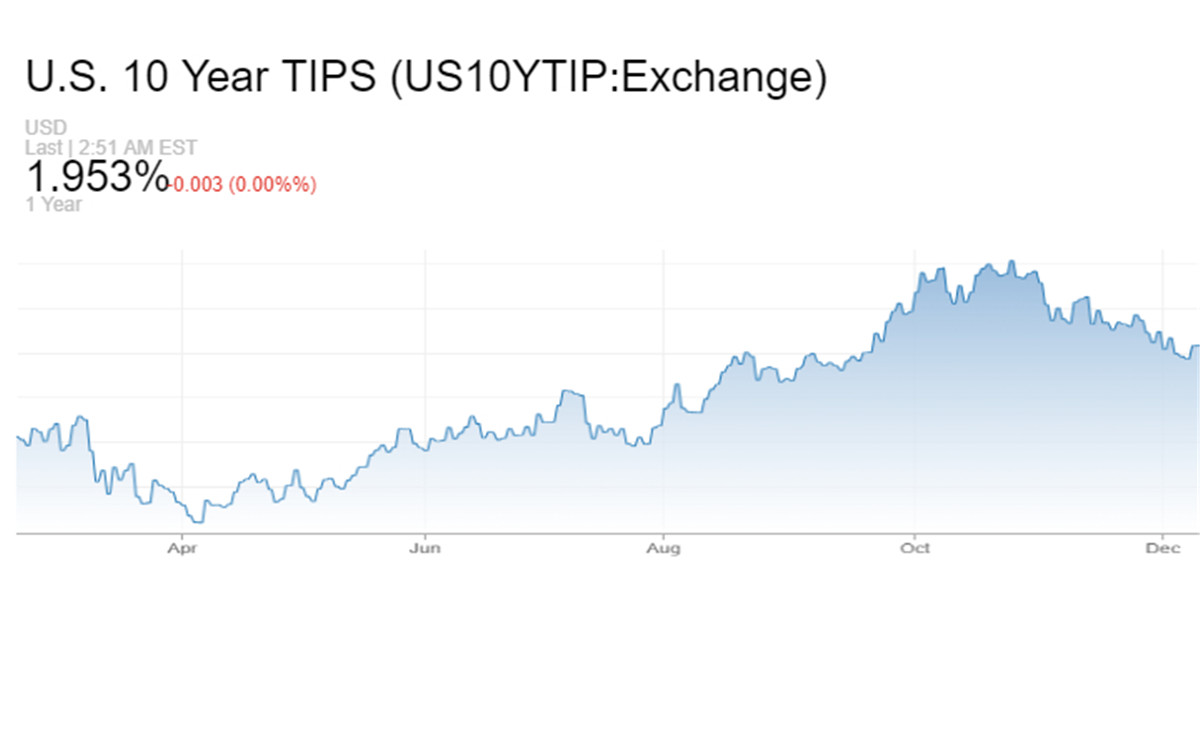

Their calculation shows that the real Treasury 10-year yield, would have to

reach 2.5% or 3% to end the investor craze for AI and megacap tech. It’s

currently about 2%, well below that area.

With a PE ratio of 45, the Magnificent Seven is categorically expensive, but

not less so than for Japanese stocks in 1989 at multiples of 67 and the Nasdaq

Composite in 2000 at 65.

The group has jumped about 140% from its low in Dec 2022, eclipsed by the

190% surge seen during the Internet bubble for the Nasdaq Composite or the 230%

rally of FAANG stocks from Covid lows.

That being said, Hartnett warned there are “no two bubbles alike.” After all

those data are staggering enough to be taken as warning signs for investors

hoping to keep riding the rally.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.