The dollar edged broadly higher on Monday

2024-01-08

Summary:

Summary:

The dollar rose Monday with a subdued risk appetite. A key inflation report later in the week may clarify the Fed's interest rate path.

EBC Forex Snapshot

8 Jan 2024

The dollar edged broadly higher on Monday as risk appetite remained subdued

ahead of a key inflation report later in the week that is likely to provide

further clarity on the Fed’ interest rate path.

Market pricing now shows a roughly 64% chance that the Fed could begin easing

rates as early as March, compared to a nearly 90% chance a week ago, according

to the CME FedWatch Tool. The US labour market did not cool further as expected

in Dec.

The yen shed 2.6% last week, the worst performance since June 2022. The

powerful earthquake that hit Japan on New Year’s Day makes it harder to abolish

negative interest rates soon.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 2 Jan) |

HSBC (as of 8 Jan) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0833 |

1.1150 |

1.0831 |

1.1095 |

| GBP/USD |

1.2527 |

1.2848 |

1.2606 |

1.2826 |

| USD/CHF |

0.8333 |

0.8667 |

0.8336 |

0.8655 |

| AUD/USD |

0.6691 |

0.6900 |

0.6611 |

0.6843 |

| USD/CAD |

1.3114 |

1.3387 |

1.3225 |

1.3449 |

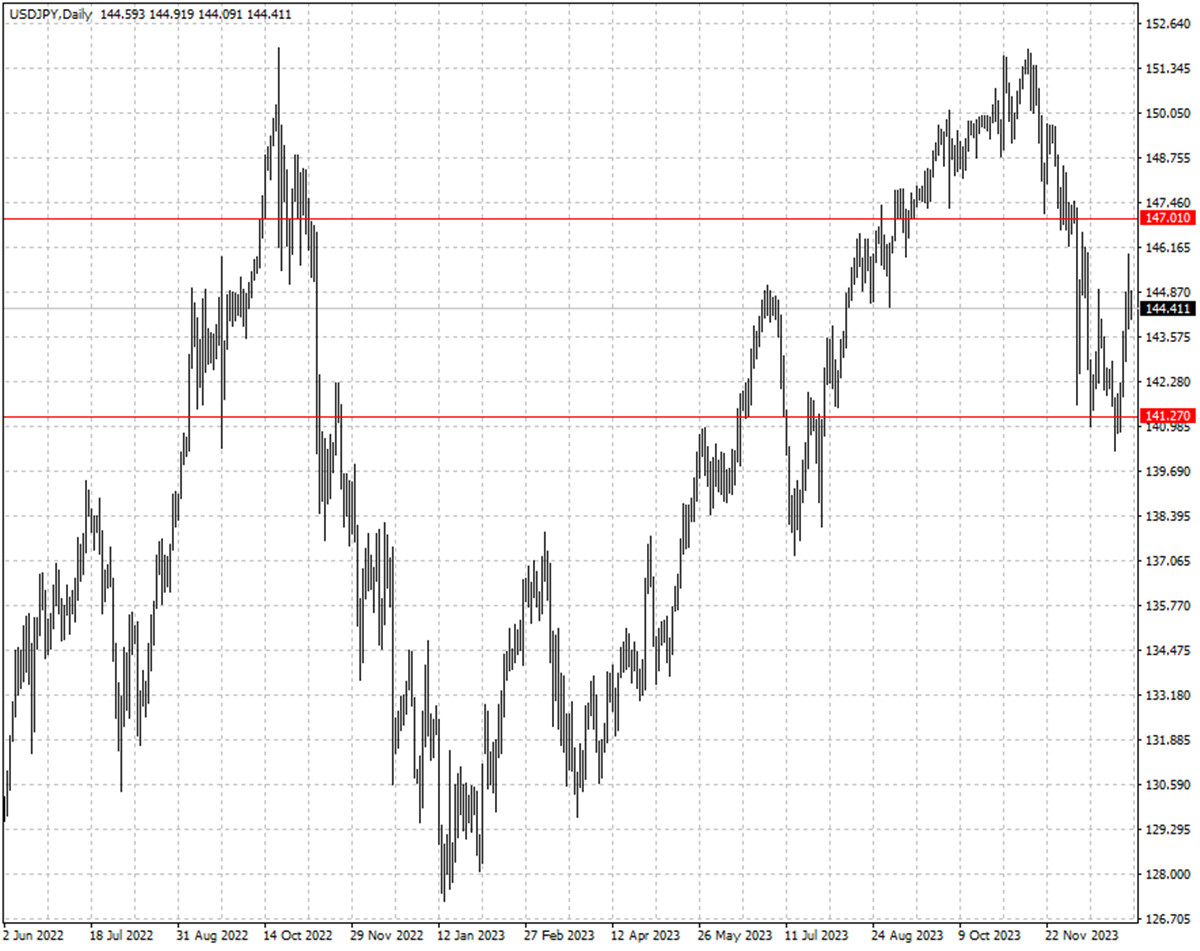

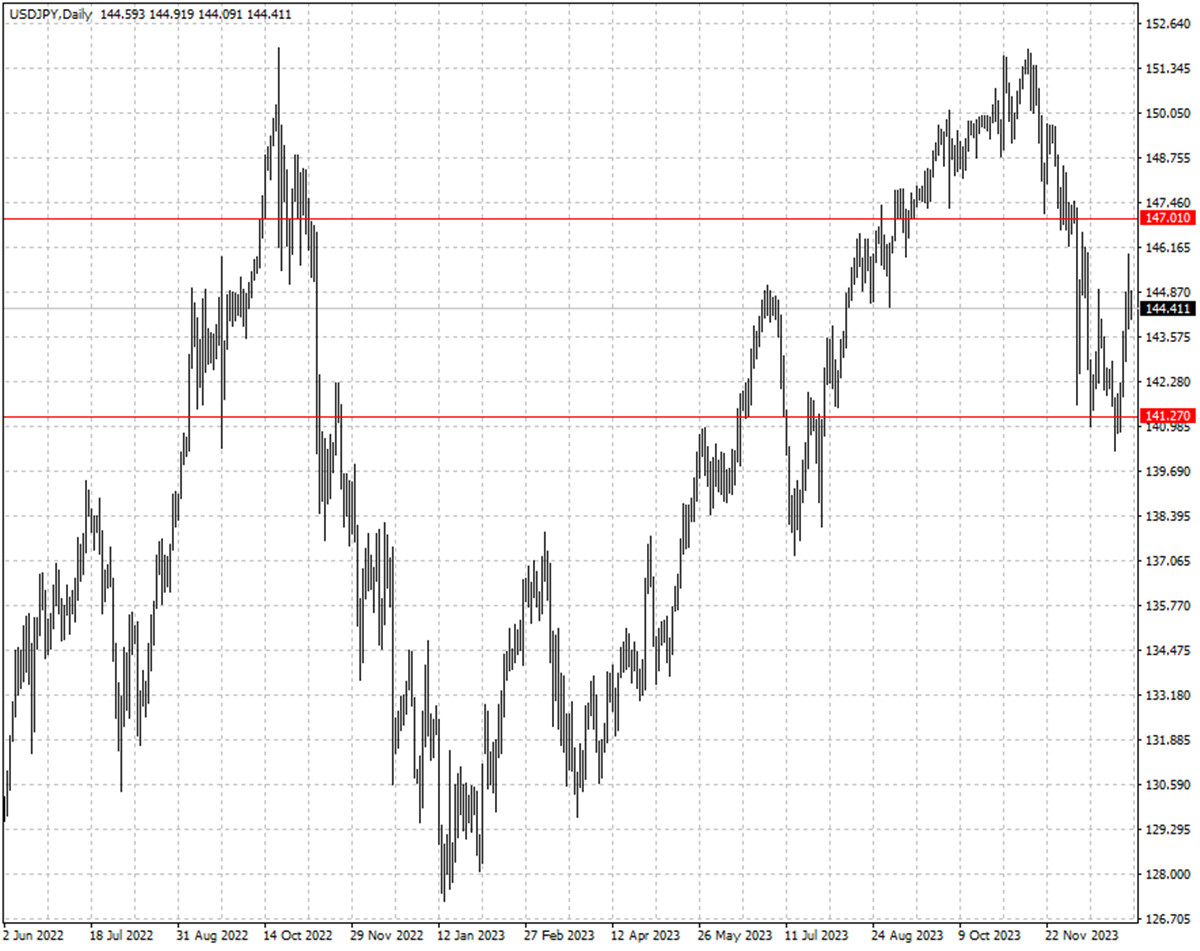

| USD/JPY |

139.48 |

144.94 |

141.27 |

147.01 |

The green numbers in the table indicate an increase in data, the red numbers indicate a decrease in data, and the black numbers indicate that the data remains unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.