The dollar came under pressure on Wednesday

2024-02-07

Summary:

Summary:

USD pressured by falling US Treasury yields, deepening market concerns. CAD rebounds, and the central bank seeks more time to address inflation. Oil rises, US crude inventories grow less than expected, and production records are tough to break.

EBC Forex Snapshot

7 Feb 2024

The dollar came under pressure on Wednesday. Treasury yields turned down from highs overnight on solid demand at a sale of new three-year notes.

Traders are currently pricing in a 21.5% chance of a cut in March, the CME Group's FedWatch Tool shows, compared with a 68.1% chance at the start of the year.

Loonie extended its rally from the weakest intraday level since mid-December. BOC governor Tiff Macklem said more time was needed for monetary policy to ease price pressures.

Oil prices rose for a third day after industry data showed US crude inventories grew less than expected and the EIA forecast US production would not exceed the December 2023 record until February 2025.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 29 Jan) |

HSBC (as of 7 Feb) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0822 |

1.1139 |

1.0673 |

1.0884 |

| GBP/USD |

1.2487 |

1.2827 |

1.2483 |

1.2742 |

| USD/CHF |

0.8333 |

0.8728 |

0.8582 |

0.8774 |

| AUD/USD |

0.6526 |

0.69 |

0.6452 |

0.6609 |

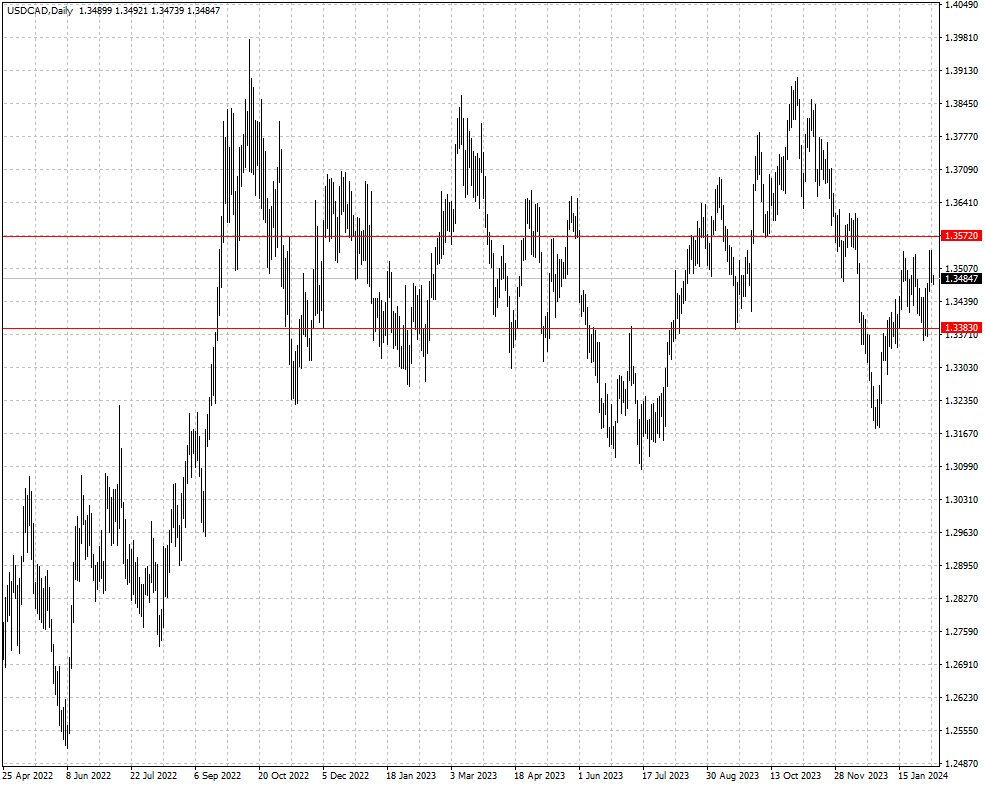

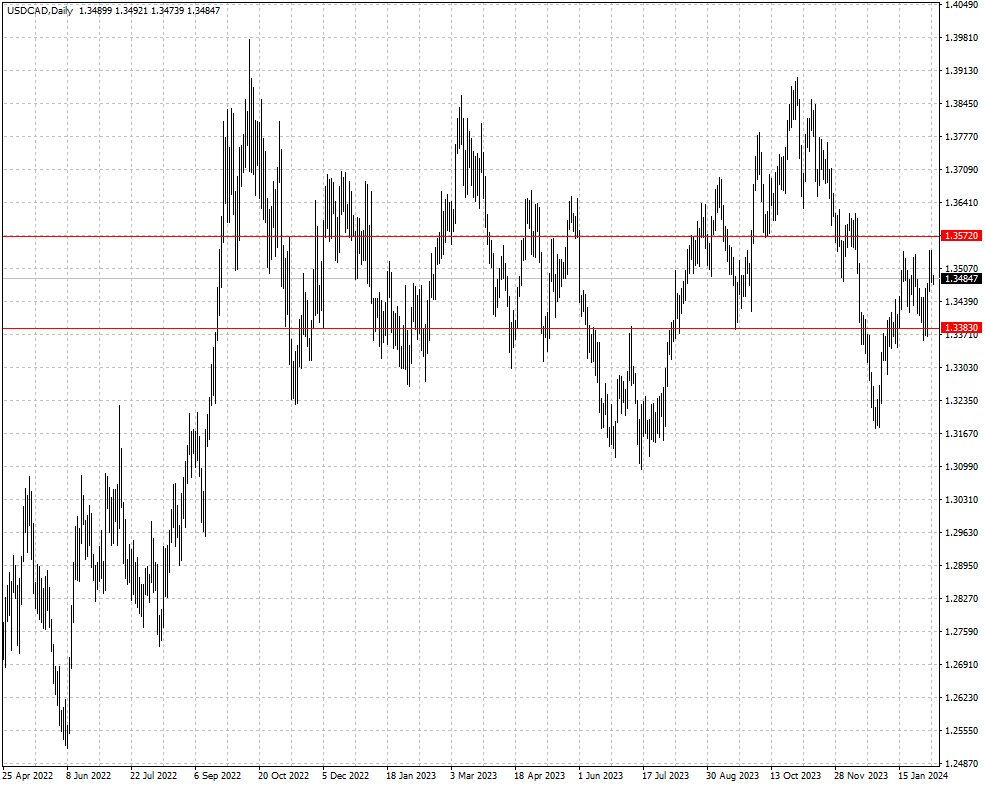

| USD/CAD |

1.3379 |

1.3619 |

1.3383 |

1.3572 |

| USD/JPY |

145.09 |

148.8 |

146.25 |

149.26 |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.