The US dollar firmed near a three-month peak

2024-02-06

Summary:

Summary:

USD steadies near a 3-month high; the Fed is unlikely to cut rates in March. AUD rises on RBA, hinting at further tightening possibilities.

EBC Forex Snapshot

6 Feb 2024

The US dollar firmed near a three-month peak as the Fed is not expected to

cut interest rates in March. The Australian dollar rose after the RBA said

further tightening could not be ruled out.

The central bank held interest rates steady as expected and its surprisingly

hawkish tone indicates that monetary easing will unlikely come anytime soon.

Futures markets now see the first cut announced on September.

The Australian economy has slowed to a crawl, labour market has softened and

consumer spending has floundered amid higher living costs. But China’s pledge to

prop up economy and India’s growth momentum may act as a buffer.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 29 Jan) |

HSBC (as of 6 Feb) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0822 |

1.1139 |

1.0664 |

1.0875 |

| GBP/USD |

1.2487 |

1.2827 |

1.2440 |

1.2699 |

| USD/CHF |

0.8333 |

0.8728 |

0.8593 |

0.8772 |

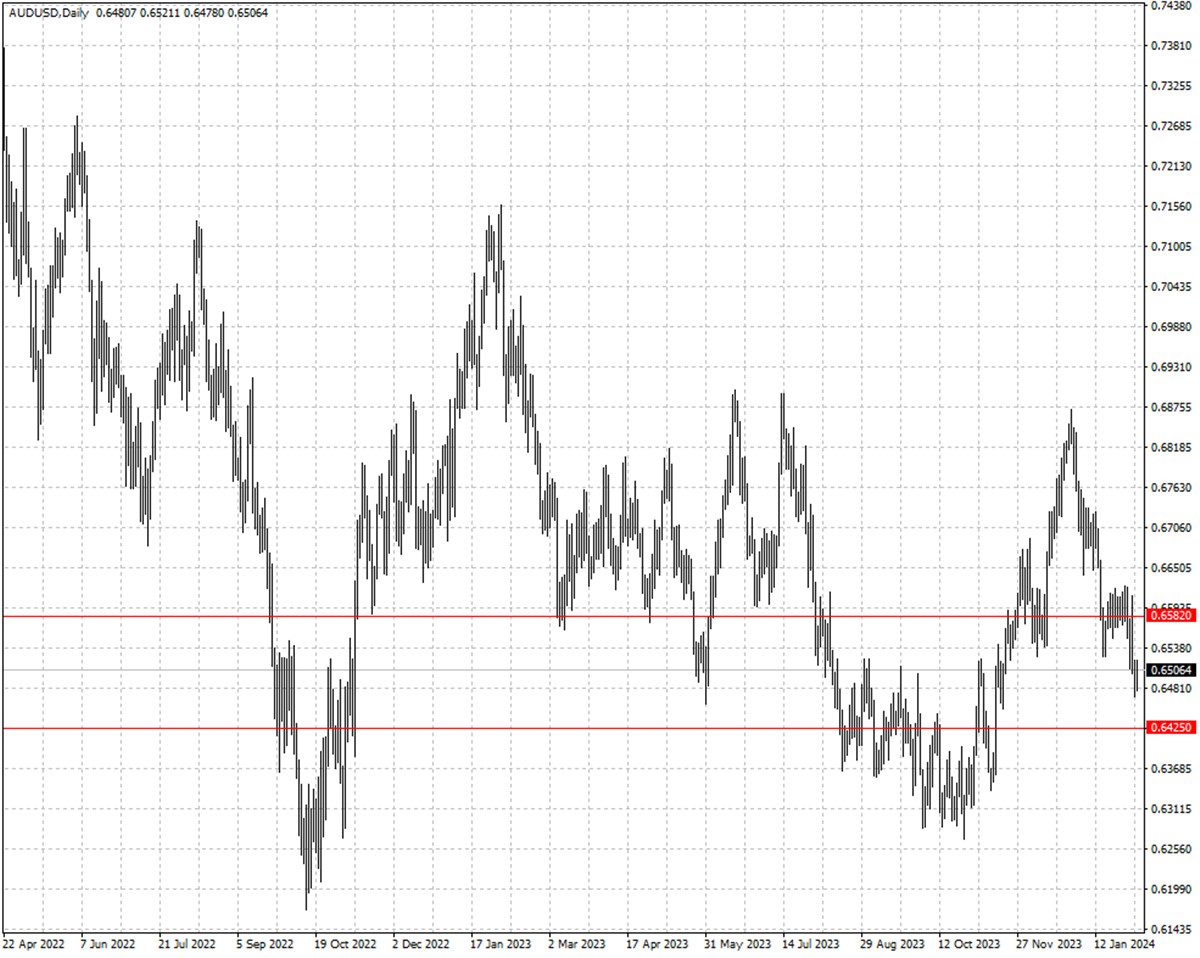

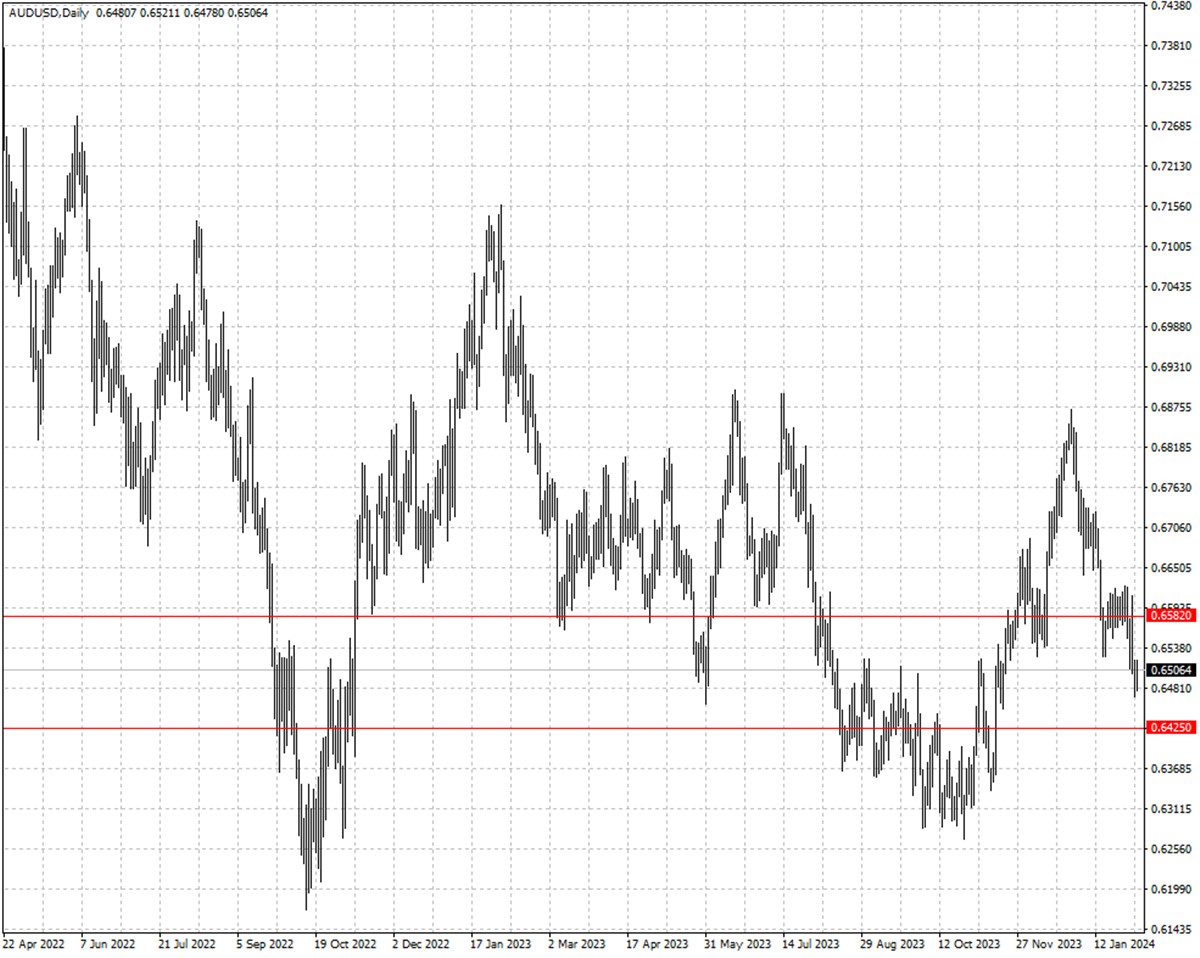

| AUD/USD |

0.6526 |

0.6900 |

0.6425 |

0.6582 |

| USD/CAD |

1.3379 |

1.3619 |

1.3414 |

1.3603 |

| USD/JPY |

145.09 |

148.80 |

146.74 |

149.75 |

The green numbers in the table indicate an increase in data, the red numbers indicate a decrease in data, and the black numbers indicate that the data remains unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.