The dollar rose to an eight-week high on Monday

2024-02-05

Summary:

Summary:

The dollar surged to an 8-week high as traders reduced bets on aggressive Fed rate cuts. Simultaneously, the Canadian dollar hit a one-week low.

EBC Forex Snapshot

5 Feb 2024

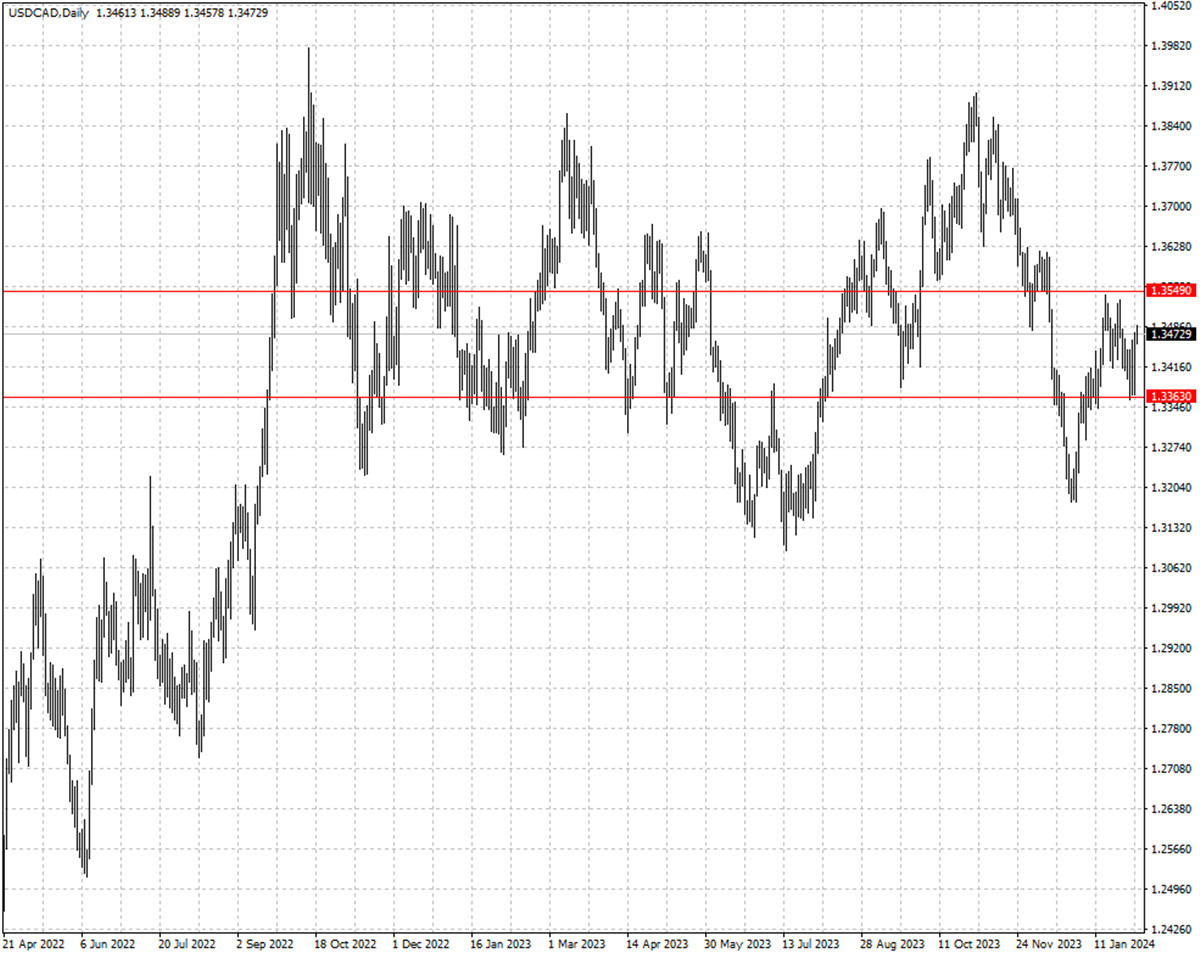

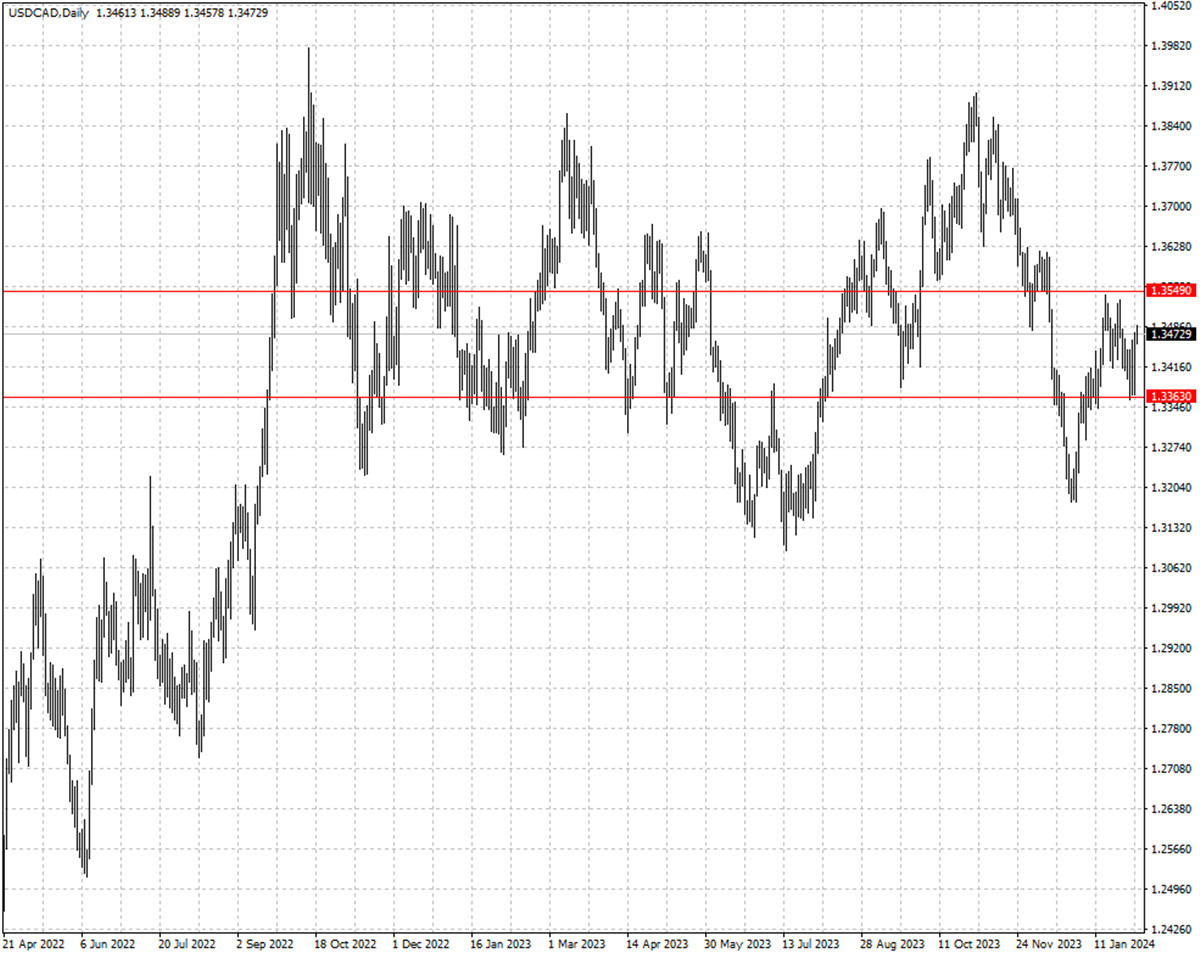

The dollar rose to an eight-week high on Monday as traders trimmed bets for

aggressive rate cuts by the Fed this year. Meanwhile the Canadian dollar

weakened to a one-week low.

Preliminary data showed Canada's economy likely expanding at an annualised

rate of 1.2% in Q4. That means the economy probably avoided a technical

recession.

money markets pared bets for an April rate cut to a 42% chance by the BOC.

Oil prices just posted weekly loss due to faltering growth in China and rising

non-OPEC supply.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 29 Jan) |

HSBC (as of 5 Feb) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0822 |

1.1139 |

1.0716 |

1.0902 |

| GBP/USD |

1.2487 |

1.2827 |

1.2557 |

1.2738 |

| USD/CHF |

0.8333 |

0.8728 |

0.8566 |

0.8745 |

| AUD/USD |

0.6526 |

0.6900 |

0.6442 |

0.6623 |

| USD/CAD |

1.3379 |

1.3619 |

1.3363 |

1.3549 |

| USD/JPY |

145.09 |

148.80 |

146.35 |

149.60 |

The green numbers in the table indicate an increase in data, the red numbers indicate a decrease in data, and the black numbers indicate that the data remains unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.