Goldman Sachs suggests the euro could drop below parity with the dollar if Donald Trump wins the presidential election and implements extensive tariffs and tax cuts. They estimate that a 10% tariff on all imports and a 20% tariff on Chinese goods could lead to an 8% to 10% decline in the euro as the dollar strengthens.

Currently, Trump is in a tight race with Vice President Kamala Harris, but his aggressive economic policies could significantly impact Europe, a major U.S. trading partner.

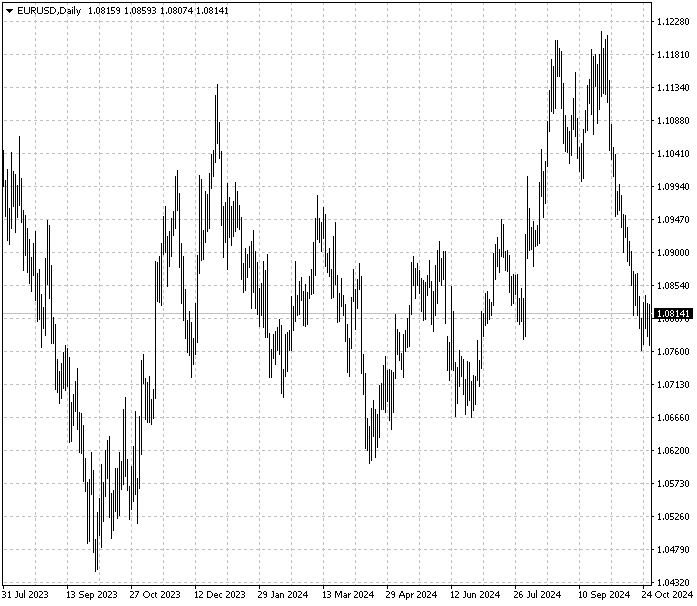

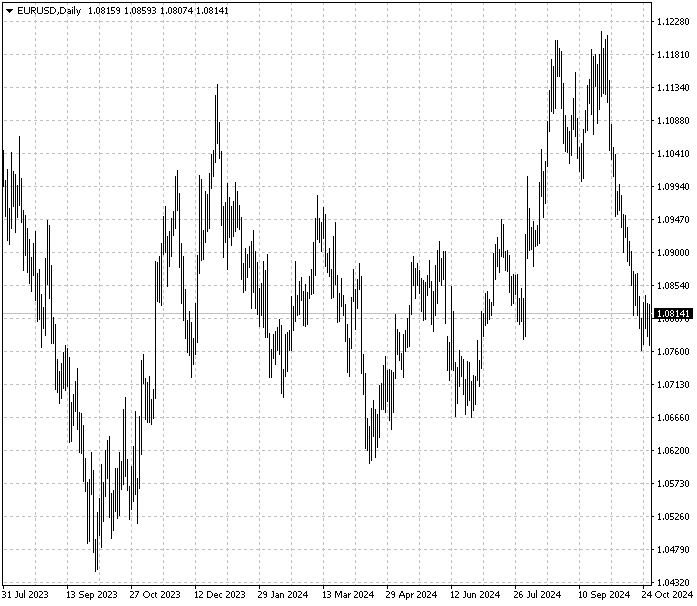

If Trump were to pursue a more limited trade war, imposing additional tariffs only on China, Goldman predicts the euro might decrease by about 3%. So far in 2024, the single currency has already shown signs of weakness.

The euro reached parity with the dollar for the first time in 20 years in 2022, largely due to the European Central Bank (ECB) raising interest rates more slowly than the Federal Reserve and the outflow of capital sparked by Russia's invasion of Ukraine.

A rally in the euro began in the last quarter of the previous year, but the momentum is fading. U.S. core inflation has consistently outpaced that of the eurozone, resulting in significantly higher benchmark interest rates in the U.S.

Additionally, China's recovery has been sluggish since the end of its zero-COVID policy, creating uncertainty for Europe’s growth outlook, particularly concerning exports, until new stimulus measures take effect in the world’s second-largest economy.

Warning of Retaliation

German Finance Minister Christian Lindner cautioned that a U.S. trade war with the EU could provoke retaliation, reflecting a hawkish stance reminiscent of the EU's response in 2018.

Brussels was taken aback by the tariffs on steel and aluminum and retaliated only partially, surprised by Trump's willingness to sever ties with key allies.

In the first half of 2024, Germany exported more goods to the U.S. than to China, especially as the EU has accused Beijing of supporting Putin's war effort, leading to a strategic shift away from its former top trading partner.

According to a recent study by the German economic institute IW, if the U.S. were to impose a 20% tariff, the EU's GDP could decline by as much as 1.3% in 2027 and 2028. Even a 10% tariff would negatively impact the German economy due to the uncertainty it would create around investment and consumption, noted Juergen Matthes, head of international economic policy at IW.

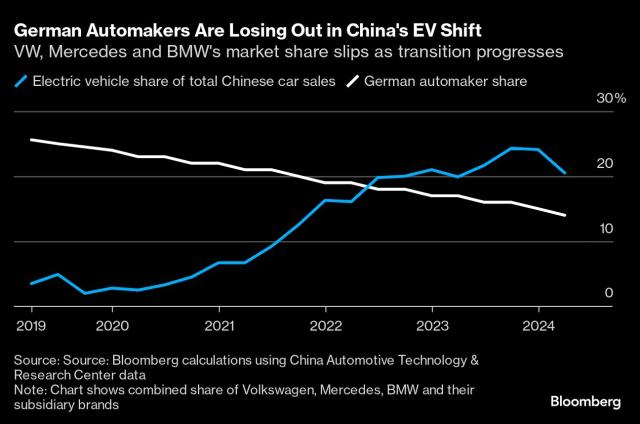

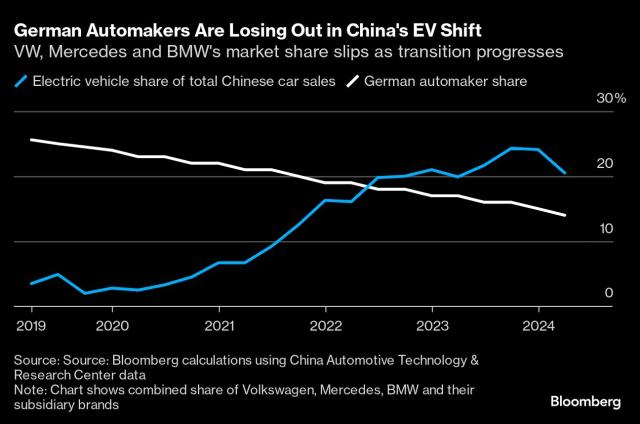

German car exports would be particularly hard hit, down 32%, said ifo. The

industry is already struggling as Chinese EVs have been increasingly popular

among local customers over time.

Germany will this year be the only G7 country failing to grow for two

consecutive years, according to the latest forecast by the IMF. Basically

further deglobalisation will be the last thing the industrial nation seeks.

Debate among ECB

ECB policymakers are starting to discuss whether interest rates should be lowered sufficiently to stimulate the economy, as the so-called neutral interest rate remains elusive. The IMF estimates this level at 2.5%, while ECB analysts suggest it's around 2.25%. ECB staff believe it's close to or just above 2%, while market pricing indicates it might now be below 2%.

Recent months have seen inflation fall short of earlier predictions, raising concerns that price growth could dip below the 2% target, reminiscent of trends seen in the decade before the pandemic. This situation is leading a growing number of policymakers to argue that the central bank has fallen behind and will need to implement deeper cuts than previously anticipated to prevent inflation from dropping too low.

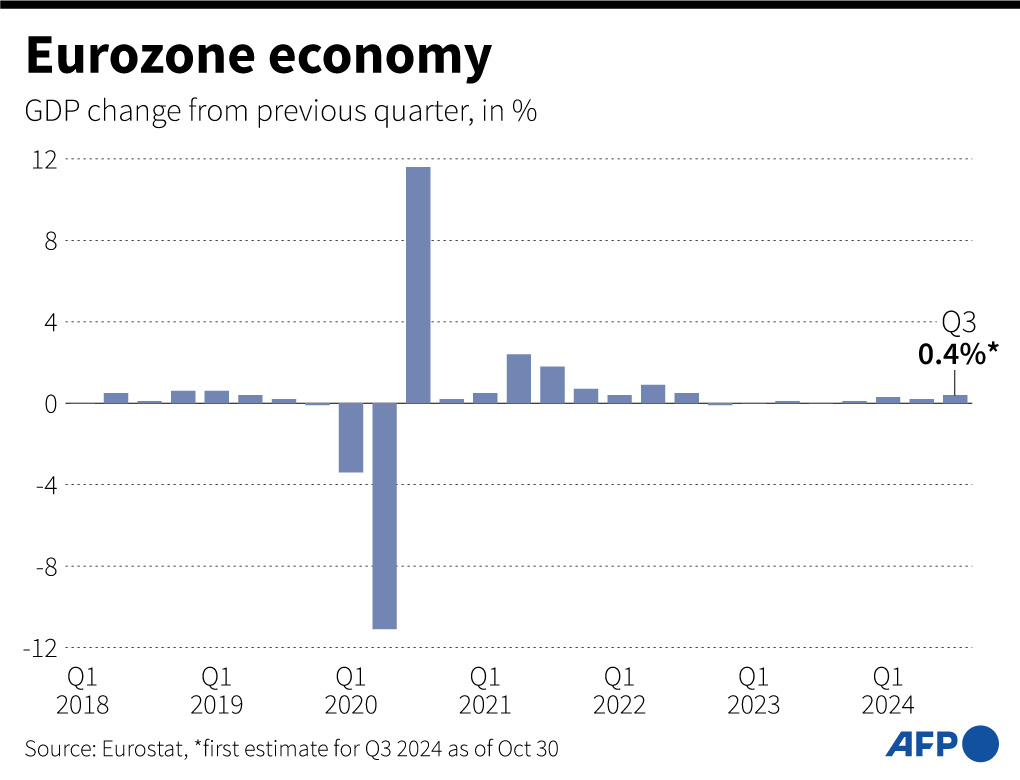

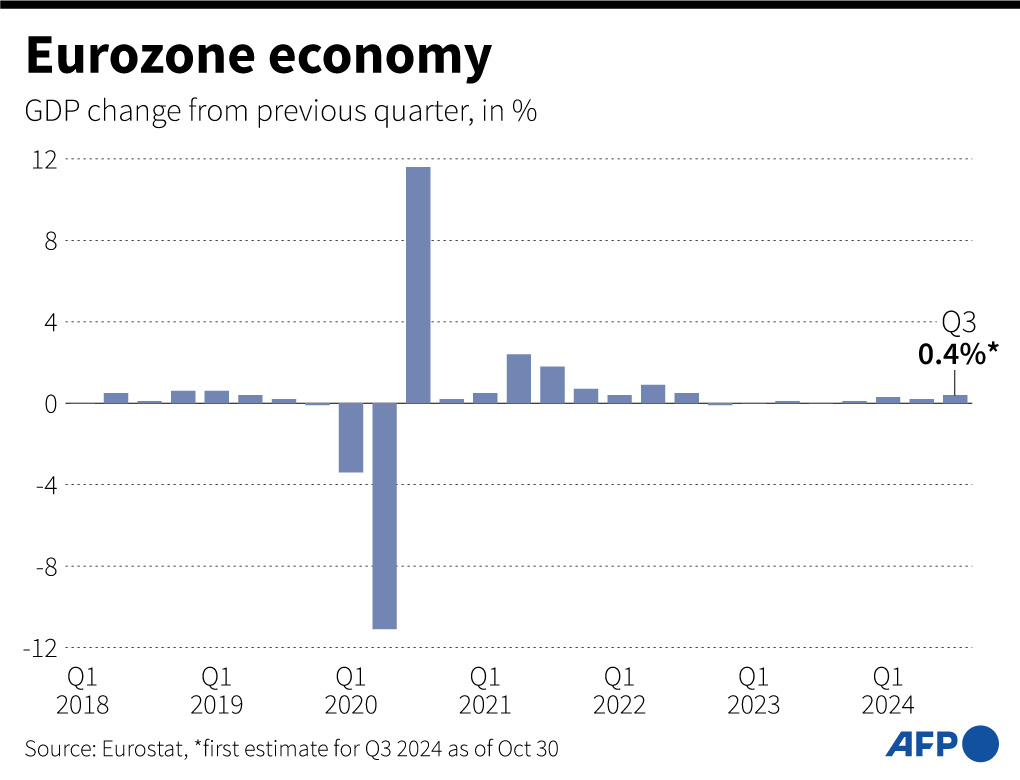

While the eurozone economy grew faster than expected last quarter, it still exhibits fragility, with industry in recession and household consumption barely increasing, according to Eurostat data released on Wednesday.

Without a clear indication of a turnaround, the labor market could quickly soften, adding downward pressure on prices. The ECB may need to intensify its easing measures if more tariffs are implemented.

It's uncertain whether a victory for Harris would actually benefit the currency. While her proposed tax hikes could undermine confidence in a soft landing, we cannot dismiss the risk of the eurozone underperforming.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.