Intel Corporation (NASDAQ: INTC) has long been a cornerstone of the semiconductor industry. However, as of April 2025, its stock is trading at approximately $20.05, reflecting a significant decline over the past year.

This downturn has prompted investors to question the underlying reasons for the stock's current valuation. This article delves into the multifaceted reasons behind Intel's current valuation, examining internal challenges, market dynamics, and external pressures.

Intel's Financial Overview

Intel's recent financial results have been underwhelming. The company reported a net loss of $821 million in Q1 2025 despite revenues slightly exceeding forecasts at $12.7 billion.

Moreover, Intel's stock is currently trading at approximately $20.05, reflecting a substantial decline over the past year. Analyst price targets for the next 12 months vary, with estimates ranging from $14.00 to $34.00 and an average target of $22.23.

The outlook for Q2 remains cautious, as analysts anticipate revenues between $11.2 billion and $12.4 billion.

For additional context, listed are Intel's Q3 2024 Performance

Revenue: $13.3 billion, a 6% decrease year-over-year.

Net Loss: $16.6 billion due to restructuring and impairment charges.

Operating Margin: Negative 68.2%, reflecting substantial operational challenges.

Gross Margin: 15%, significantly impacted by manufacturing impairment charges.

Fiscal Year 2024 Summary

Total Revenue: $53.1 billion.

Net Income: Loss $18.76 billion, underscoring the company's financial challenges.

Why Is Intel Stock So Cheap? Explaining The 4 Factors

1) Competitive Pressures and Market Share Erosion

Intel was once the undisputed leader in CPUs and semiconductor technology. However, in recent years, companies like AMD, NVIDIA, and TSMC have aggressively captured market share. AMD's Ryzen and EPYC processors, built on advanced 5nm and 4nm nodes from TSMC, offer superior performance and energy efficiency compared to Intel's chips, which have lagged due to manufacturing delays.

Meanwhile, NVIDIA has dominated the explosive AI and GPU markets, leaving Intel struggling to catch up with initiatives like AI accelerator chips. Besides, Intel's technical leadership change has shaken investor confidence, making the stock less attractive and contributing heavily to its depressed valuation.

Furthermore, Intel's once-strong moat in server CPUs, through its Xeon product line, has been significantly eroded by AMD's EPYC processors and ARM-based alternatives from companies like Ampere. In a high-growth sector like data centres, losing ground has magnified Intel's challenges.

2) Financial Performance and Investor Sentiment

Intel's financial results have underscored deep structural problems. For fiscal year 2024, the company posted a loss of $18.76 billion — one of the largest in its history — driven by massive impairment charges, declining margins, and weaker-than-expected revenues. In Q1 2025, while revenues slightly beat analyst expectations at $12.7 billion, Intel still posted a significant net loss, suggesting that the turnaround will take time.

Investors prefer companies that show either strong growth or stable profitability. Intel currently offers neither. For example, its margins are squeezed by lower sales and high capital expenditure for its foundry ambitions. The deteriorating bottom line has triggered multiple analyst downgrades, weakening market sentiment and lowering the stock price.

3) Organisational Restructuring and Cost-Cutting Measures

In response to mounting challenges, Intel's leadership under CEO Lip-Bu Tan initiated aggressive restructuring. This included a plan to cut 22,000 jobs, sell off non-core businesses, and slash capital spending. While these moves are seen as necessary to refocus the company on its core competencies — semiconductor design and manufacturing — they are painful in the short term.

Restructuring often signals internal turmoil to investors. Although it can improve long-term profitability, it brings upfront costs, operational disruption, and management distraction. Intel's massive layoffs and strategic divestitures have investor worries about instability, further depressing the stock price in 2024 and early 2025.

4) Geopolitical Factors and Trade Tensions

Like many tech companies, Intel is deeply entangled in geopolitical risks, especially U.S.-China trade relations. Restrictions on semiconductor exports to China, Intel's major end-market, have hit revenues. Chinese companies, once heavy buyers of Intel server and PC chips are increasingly turning to domestic alternatives like Huawei's new processors.

The ongoing uncertainty around the U.S. CHIPS Act funding rollout has further complicated Intel's efforts to expand manufacturing domestically. Intel's ambitious plans to build new fabs in Ohio and Arizona depend heavily on subsidies and tax incentives. Delays or changes in political priorities could derail these projects, making future revenue streams less definite.

These geopolitical headwinds create a riskier investment profile for Intel than peers less reliant on China or U.S. government funding.

Potential for Turnaround and Long-Term Outlook

Despite all these headwinds, Intel is not without potential upside. Its $100 billion investment into expanding manufacturing capabilities through Intel Foundry Services (IFS) could bear fruit over the next decade. Intel aims to become the second-largest foundry player globally, challenging TSMC and Samsung by offering manufacturing services to third-party chip designers.

Additionally, Intel is ramping up its AI investments. Products like the Gaudi 3 AI accelerator, designed to compete with NVIDIA's dominance in AI chips, could open new revenue streams if adopted. Intel is also betting heavily on leadership in advanced packaging technologies, an area expected to become critical as Moore's Law slows.

Moreover, from a traditional valuation standpoint, Intel looks cheap — trading at a price-to-book (P/B) ratio below 1.0, a rare situation for a blue-chip tech stock. However, valuation reflects expectations about future earnings, not just current assets. A low P/B ratio often indicates that the market believes the company's prospects are deteriorating faster than its book value would suggest.

Moreover, price-to-earnings (P/E) ratios, when calculated forward, reveal uncertainty. Analysts project only modest EPS growth in the next few years, and if Intel misses those already conservative targets, it could justify an even lower stock price. In essence, Wall Street is signalling that Intel could be a "value trap" — a stock that appears cheap but continues to underperform.

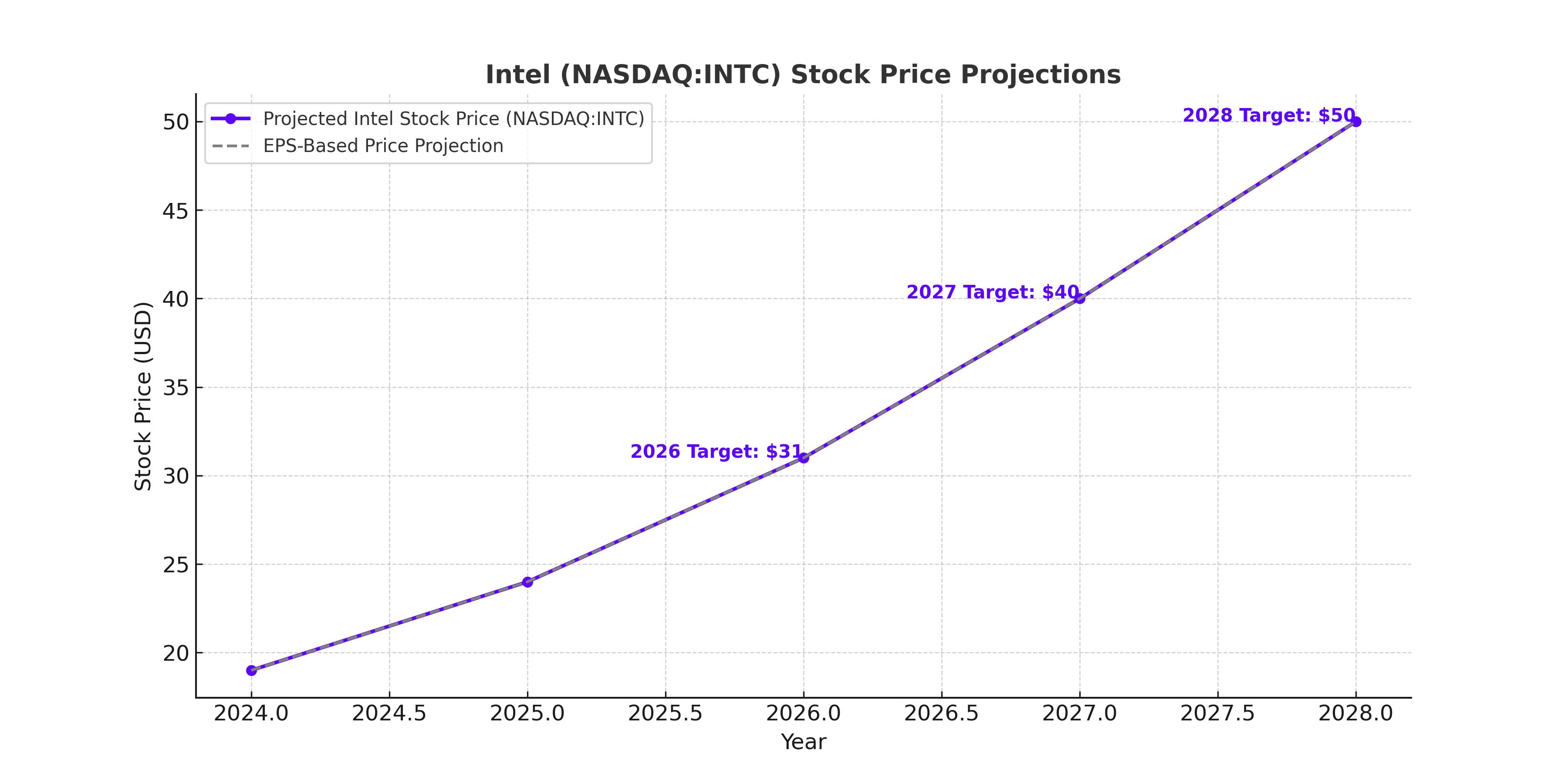

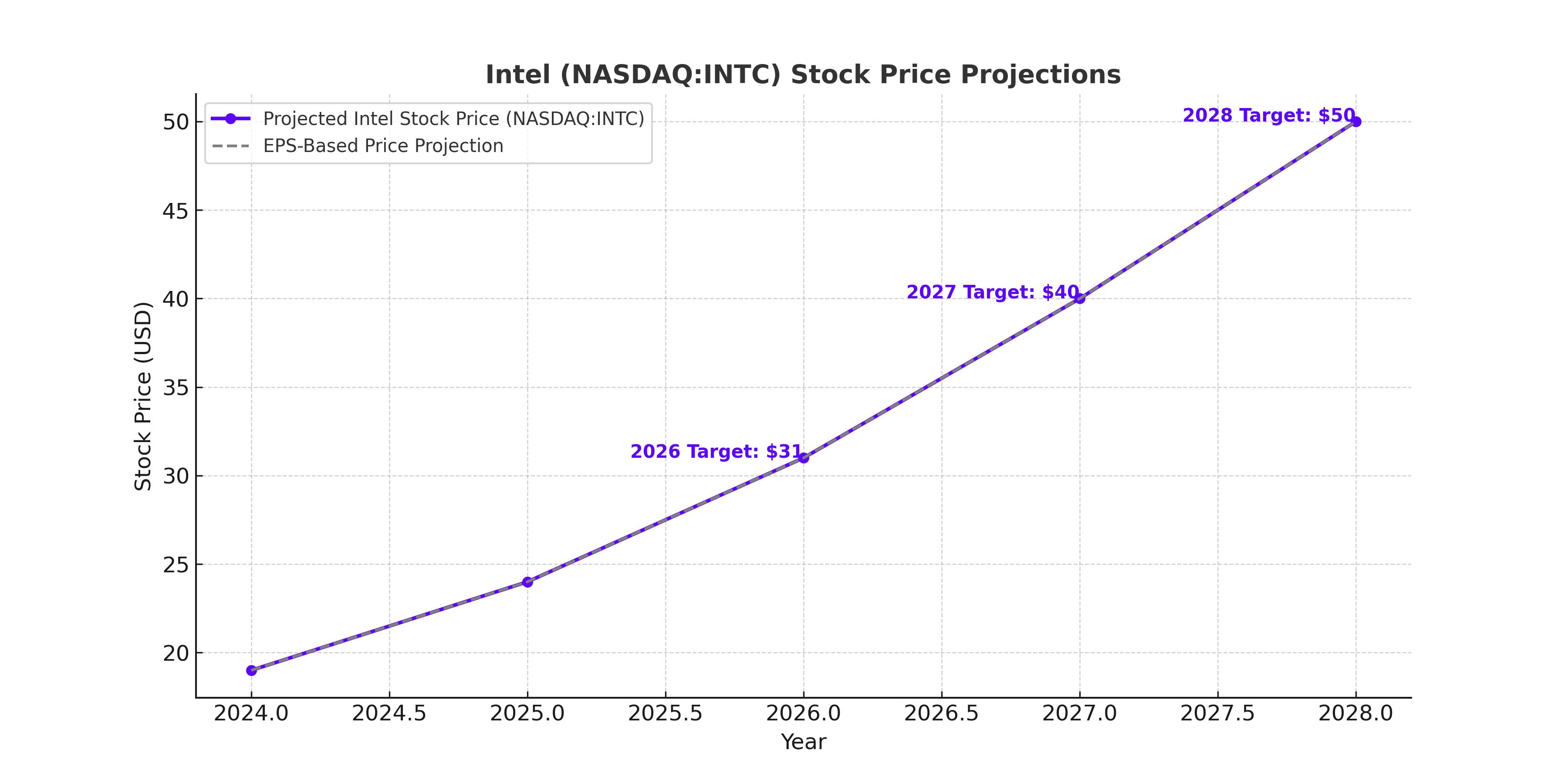

Intel Stock Forecast 2025 and Beyond

2025 Projections

Earnings Per Share (EPS): Analysts project an EPS of $0.98 by December 2025, indicating a potential recovery from the previous year's losses.

Revenue Growth: Expected to grow by 6% to $55.84 billion.

2026 and Beyond

Stock Price Predictions:

CoinPriceForecast: Projects an increase, with the stock reaching $29.45 mid-2026 and $34.75 by year-end.

WalletInvestor: Offers a bearish outlook, with the stock potentially declining to $4.78 by the end of 2026.

Gov Capital: Provides an optimistic scenario, forecasting the stock to reach $128.35 by the end of 2026.

Conclusion

In conclusion, Intel's current stock valuation reflects internal and external challenges, including competitive pressures, financial performance concerns, organisational restructuring, and geopolitical factors.

While the company is taking steps to address these issues, the path to recovery will require sustained effort and strategic execution. Investors should closely monitor Intel's progress in implementing its turnaround plans and adapting to the evolving semiconductor landscape.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.