As of April 2025, Shein, the Singapore-headquartered fast-fashion giant, is on the cusp of a landmark initial public offering (IPO) in London. Once valued at $100 billion, Shein IPO is preparing to go public amid shifting market dynamics, regulatory scrutiny, and geopolitical headwinds.

With a global customer base and a disruptive digital-first model, Shein's public debut will reshape the fashion and retail investment landscape.

This article provides a comprehensive overview of Shein's IPO journey, its current valuation, regulatory hurdles, and what investors should consider before the company hits the public markets.

Shein's IPO Timeline: Where Things Stand

As of April 2025, Shein has secured approval from the UK's Financial Conduct Authority (FCA) to list on the London Stock Exchange. However, the company still awaits clearance from China's Securities Regulatory Commission, a crucial step given Shein's substantial operations in China.

Initially, Shein aimed for a first-quarter 2025 listing. However, delays, influenced by regulatory complexities and shifting market conditions, have pushed the anticipated Shein IPO to the second half of the year. The company has prepared for this move since confidentially filing with the FCA in June 2024.

The decision to pursue a London listing rather than a U.S. one stems from regulatory challenges in the U.S., including increased scrutiny over Shein's supply chain practices and compliance with labour laws. Despite this move, Shein still faces regulatory scrutiny in the UK, particularly regarding its supply chain practices and labour standards.

Shein IPO Valuation and Financial Performance

Shein's valuation has seen a significant decline over the past few years.

2022: Valued at $100 billion.

2023: Dropped to $66 billion.

January 2024: Further reduced to $45 billion.

February 2025: Reports suggest a potential valuation cut to $30 billion before the IPO.

This downward trend reflects investor concerns over Shein's business model, regulatory risks, and the impact of new trade policies, particularly in the U.S.

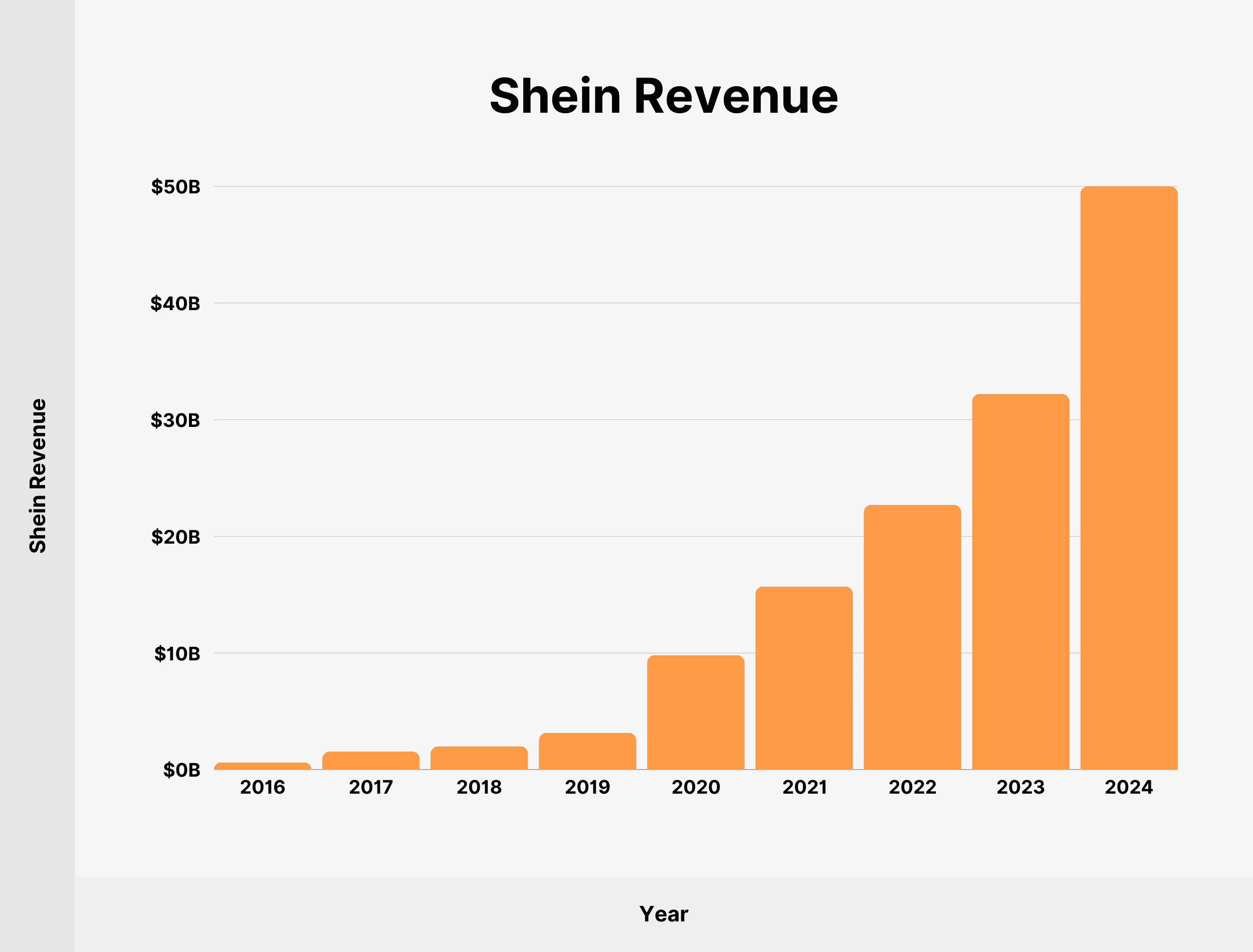

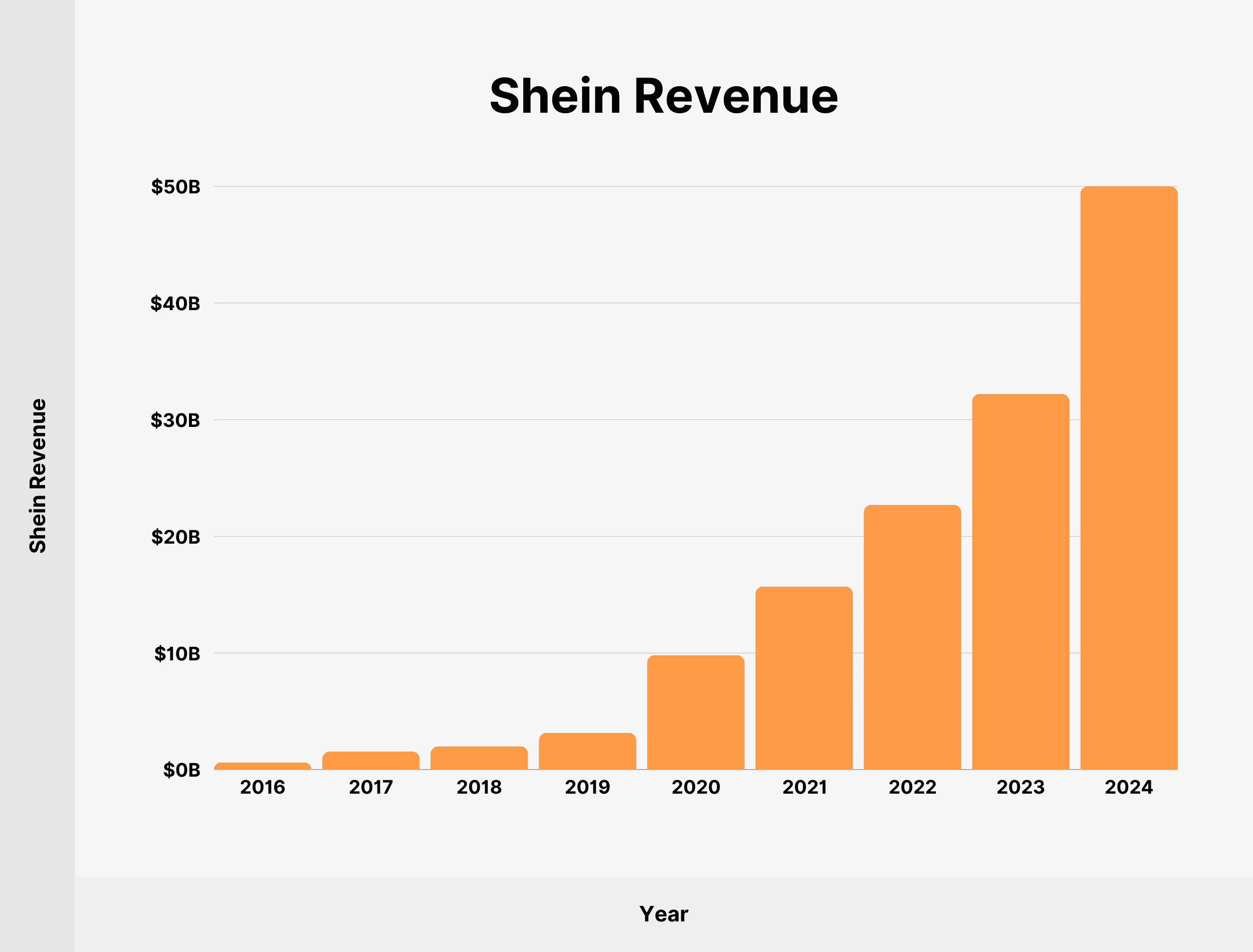

Despite these challenges, Shein continues to demonstrate strong sales growth:

Sales Growth: As of April 2025, Shein's sales grew 35.7% year-over-year, outperforming the broader Apparel & Accessories category, which grew by 7.9%.

Profitability: Shein reported profits of $2 billion in 2023, more than double the previous year.

These figures indicate that, despite external pressures, Shein's business model remains resilient and continues to attract a significant customer base.

Challenges

1) Tariffs and Trade Policies

Shein's logistics-heavy model — shipping directly from China to consumers without maintaining massive inventories — had given it an edge for years. This model is now under threat:

The end of the U.S. "de minimis" exemption means imports valued under $800 from China are now taxed, heavily impacting its margins and price advantage.

Additional postal fees and customs processing slow down deliveries and introduce friction that didn't exist before, degrading the customer experience.

To protect margins, Shein has had no choice but to raise prices, with some items seeing a shocking 377% increase.

Higher prices erode Shein's key value proposition — affordability — making it vulnerable to domestic and other international brands. Furthermore, shipping delays and customs hassles could push buyers towards faster, more predictable shopping experiences like Amazon or Walmart.

This trade policy shift is not just a speed bump; it fundamentally questions the scalability of its existing model, particularly in its most profitable market, the United States.

2) Ethical and Regulatory Scrutiny

Perhaps the most serious threat to Shein's IPO — and its long-term viability — is not economic but ethical:

Investigations and accusations about forced labour in Shein's supply chain, particularly concerning Xinjiang cotton, have drawn fire from lawmakers, activists, and consumers.

New U.S. legislation like the Uyghur Forced Labor Prevention Act (UFLPA) raises the compliance burden.

Investor groups in the UK have warned that Shein's listing without addressing these human rights concerns could spark backlash and lead to reputational damage for the London Stock Exchange itself.

A tarnished ESG profile is not a trivial matter today. With trillions of dollars flowing into funds that adhere to ESG criteria, Shein risks alienating a huge source of institutional investment unless it improves its transparency and labour practices.

Moreover, ethical risks could evolve into legal risks if regulatory bodies impose fines, bans, or operational restrictions based on ongoing investigations.

Strategic Shifts: Diversification and Localisation

Recognising the existential threats posed by over-reliance on China-based operations, Shein has initiated several strategic shifts:

Supply Chain Diversification: Shein is urging its manufacturing partners to relocate operations to Vietnam, India, and other Southeast Asian countries to mitigate the impact of U.S. tariffs. This mirror moves by giants like Apple, signalling a broader decoupling trend from China.

Distribution Centers Expansion: Opening fulfilment centres in the U.S., Canada, Mexico, and Brazil allows Shein to lower shipping times, increase customer satisfaction, and better comply with local regulations.

Product Safety Investments: Shein has pledged to invest $15 million into improving supply chain transparency and product safety standards, aiming to counter criticism over substandard goods and labour abuses.

If successful, these initiatives could reduce Shein's geopolitical risk and position it as a more resilient global retailer capable of withstanding future shocks.

Key Takeaways for Investors

The Shein IPO is one of the most anticipated — and most controversial — listings of 2025. Investors considering participation should weigh the following carefully:

Shein remains a strong growth story, especially among young consumers.

The company's valuation has dropped significantly, potentially offering a better entry point.

Regulatory and ethical risks are significant and could materially impact the stock post-listing.

Tariffs and supply chain restructuring are major overhangs for near-term profitability.

Long-term success will depend heavily on its ability to diversify operations, rebuild its ESG credibility, and evolve its business model beyond ultra-cheap fast fashion.

Conclusion

In conclusion, Shein's impending IPO represents a significant moment in the fast-fashion industry and the broader retail market.

The company's ability to navigate regulatory challenges, address ESG concerns, and adapt to changing trade policies will be critical to its success as a publicly traded entity.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.