Understanding forex sentiment is a powerful way to enhance your trading strategy. While technical and fundamental analysis are essential, sentiment analysis reveals the collective mood of the market-helping you anticipate trends, spot reversals, and avoid being caught on the wrong side of a trade.

This guide explains what forex sentiment is, how to measure it, and how to use it effectively in your trading approach.

What Is Forex Sentiment?

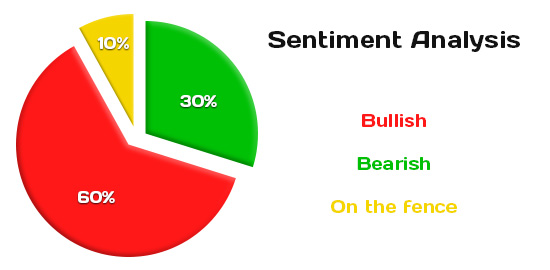

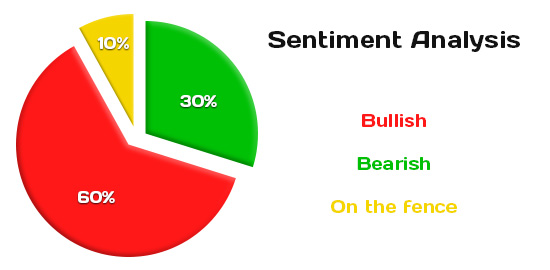

Forex sentiment is the overall attitude or feeling of traders towards a particular currency pair or the forex market as a whole. It reflects whether traders are optimistic (bullish) or pessimistic (bearish) about a currency's prospects, and whether the market is in a “risk-on” or “risk-off” mood.

This collective psychology drives price movements and can create trends or trigger volatility, even when economic data suggests otherwise.

Why Is Sentiment Important in Forex Trading?

Sentiment analysis helps you understand market psychology and identify potential turning points. If a large majority of traders are positioned in one direction, it can signal an overcrowded trade and a possible reversal.

For example, if 80% of traders are bullish on EUR/USD, the market may be overbought, and a correction could be imminent. Ignoring sentiment is like sailing without checking the weather-you might get lucky, but you're taking unnecessary risks.

Key Forex Sentiment Indicators

There are several tools and reports that provide insight into forex sentiment:

Sentiment Indexes: Tools like the SWFX Sentiment Index and Myfxbook's sentiment tracker show the ratio of long to short positions among traders.

Commitment of Traders (COT) Report: Published weekly by the CFTC, this report details the positions of commercial and non-commercial traders in the futures market, offering clues about broader sentiment.

Forex Forecast Polls: Expert surveys, such as FXStreet's weekly forecast, aggregate professional opinions to map near-term sentiment.

Volume and Order Flow Data: Some brokers provide real-time data on buy/sell orders, helping you gauge shifts in trader attitudes.

How to Interpret Forex Sentiment

Identify Extremes: When sentiment indicators show an overwhelming majority on one side (e.g., 80% long or short), it often signals a market that is ripe for reversal. Extreme sentiment rarely lasts and can precede sharp corrections.

Spot Divergence: If price moves higher but sentiment turns bearish (or vice versa), this divergence can signal a weakening trend or a coming reversal.

Monitor Shifts: Watch for changes in sentiment, such as a sudden increase in long positions. These can indicate emerging trends or shifts in market mood.

Strategies for Using Forex Sentiment

1. Contrarian Trading

Contrarian traders go against the prevailing sentiment, betting that extreme optimism or pessimism will soon reverse. For example, if 85% of traders are short GBP/USD, a contrarian might look for a buying opportunity, anticipating a short squeeze.

How to apply:

Use sentiment indicators to identify overcrowded trades.

Confirm with technical analysis before entering a position.

Set stop-loss orders to manage risk in case the trend persists longer than expected.

2. Trend Following

Trend followers align their trades with the prevailing sentiment, riding the wave until signs of exhaustion or reversal appear. If sentiment is strongly bullish and price action supports it, trend traders may buy and hold until sentiment shifts.

How to apply:

Enter trades in the direction of both sentiment and technical trends.

Use sentiment as confirmation for your technical signals.

Watch for signs of sentiment extremes as early warnings to tighten stops or take profits.

3. Sentiment as a Filter

Sentiment can serve as an additional filter for your trade setups. For example, if your technical strategy signals a buy but sentiment is extremely bullish, you might skip the trade to avoid entering at the top.

How to apply:

Practical Example

Suppose the SWFX Sentiment Index shows that 83% of traders are short EUR/USD, but the pair starts to rally after a news release. This extreme bearish sentiment, combined with a bullish price move, could signal a short squeeze.

A contrarian trader might enter a long position, using a stop-loss below recent support to manage risk.

Risks and Challenges of Trading with Sentiment

Emotional Bias: Following sentiment can lead to herd behaviour and emotional trading.

False Signals: Sentiment indicators may be skewed by a small sample size or broker-specific data.

Timing Issues: Sentiment extremes can persist longer than expected, leading to premature trades.

Market Manipulation: Rumours or social media hype can distort sentiment and trigger volatility.

Liquidity Risks: Highly sentiment-driven markets may experience sharp moves and slippage.

Tips for Using Forex Sentiment Effectively

Cross-Check Data: Compare sentiment readings from multiple sources to avoid bias.

Integrate with Other Analysis: Use sentiment alongside technical and fundamental analysis for a well-rounded view.

Stay Updated: Monitor news, economic releases, and central bank actions as they can quickly shift sentiment.

Risk Management: Always use stop-losses and appropriate position sizing to protect your capital.

Continuous Learning: Sentiment analysis is nuanced-keep refining your approach as you gain experience.

Conclusion

Incorporating forex sentiment into your trading strategy can give you a significant edge, helping you understand market psychology and anticipate shifts before they happen.

Whether you use sentiment as a contrarian signal, a trend confirmation, or a filter for your trades, it's most effective when combined with solid technical and fundamental analysis. By staying disciplined and aware of the risks, you can harness the power of sentiment to make smarter, more informed trading decisions.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.