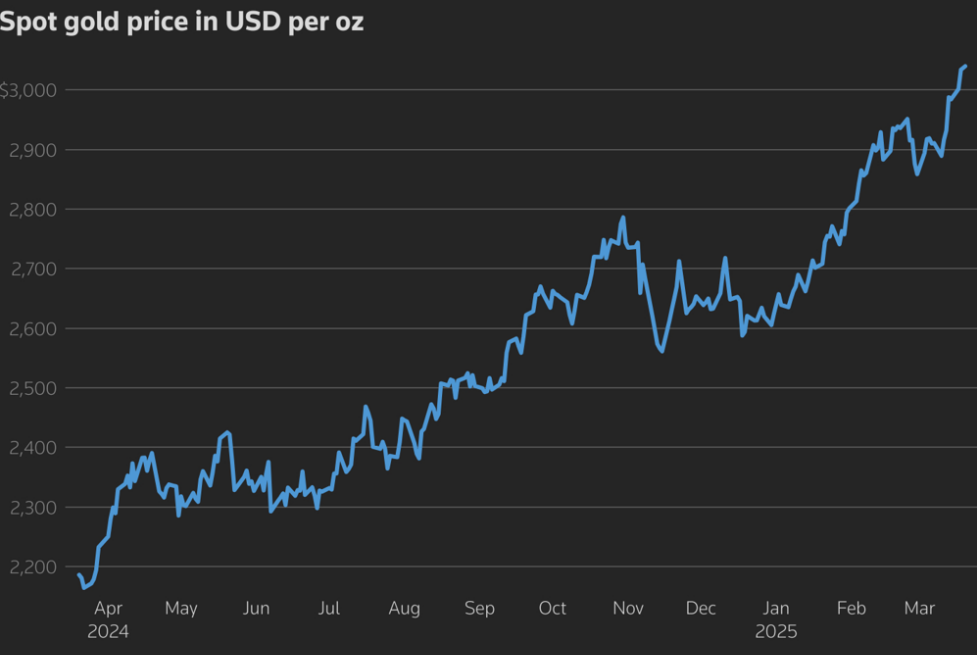

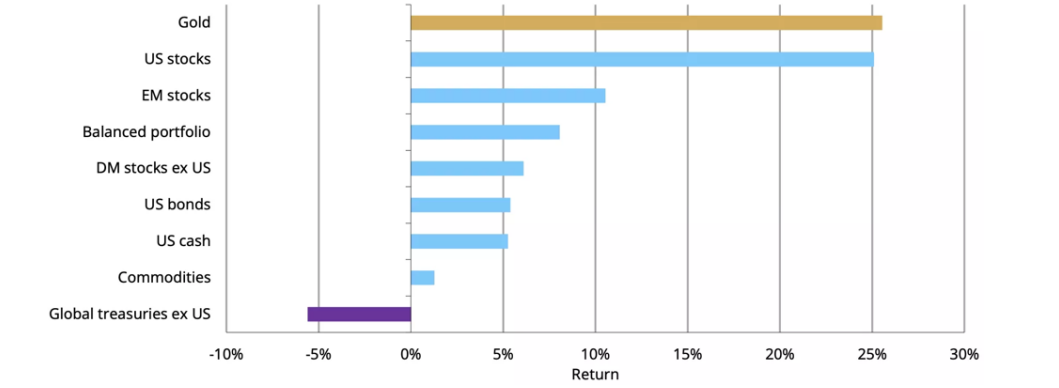

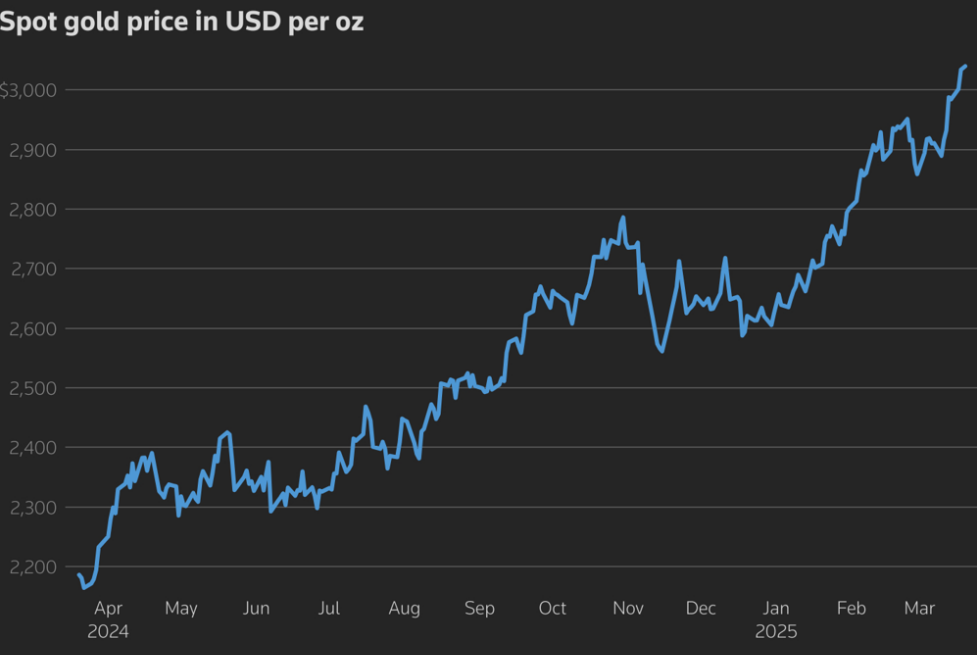

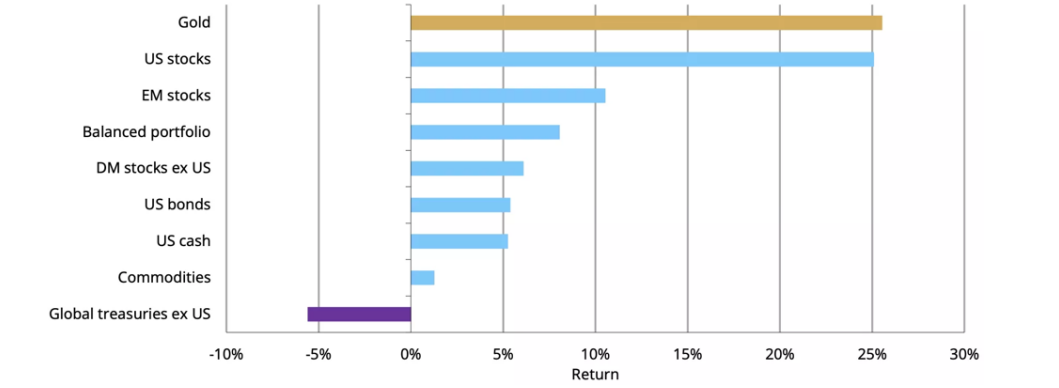

Gold prices have been on a remarkable rise from 2024 into 2025. grabbing the attention of traders and analysts worldwide. In 2024 alone, the yellow metal climbed about 25%, outperforming major asset classes. The London Bullion Market Association (LBMA) gold price set 40 new all-time highs in 2024. peaking at roughly US$2.778 per ounce in late October. By March 2025. gold had broken above US$3.000/oz for the first time on record. Such a swift ascent naturally has traders asking "why is gold going up" so fast and whether this momentum can continue.

In this article, we explore the key factors behind gold's surge – from macroeconomic drivers like inflation and central bank policies to geopolitical jitters, currency fluctuations, and shifting investor sentiment – all of which have converged to drive gold's 2024–2025 rally.

Inflation Pressures and Shifting Monetary Policies

One of the fundamental drivers of gold's rise has been the global macroeconomic backdrop – notably stubborn inflation and the response of central banks like the Federal Reserve (Fed) and Bank of England (BoE). In the aftermath of the pandemic, inflation spiked to multi-decade highs. By 2024. inflation had cooled but remained above target, keeping investors wary. Gold is traditionally seen as a hedge against inflation, and inflation expectations have pushed investors into gold.

By late 2024. there was a notable shift in monetary policy expectations. The BoE and ECB cut rates amid slowing inflation, and the Fed signalled upcoming rate cuts. Lower interest rate expectations reduce the opportunity cost of holding gold, making it more attractive and supporting the rally.

Central Banks' Appetite for Gold

Another powerful factor supporting gold prices has been surging demand from central banks. Around the world, central banks have been diversifying their reserves by accumulating gold at a historic pace. A 2024 survey found 81% of central bankers expected gold reserves to increase, citing its role as a store of value and hedge against crises. 2024 marked the third consecutive year of over 1.000 tonnes in purchases. Notably, Poland, Turkey, India, and China were among the largest buyers. These actions send a strong bullish signal to the market and reinforce confidence in gold's long-term value.

Geopolitical Uncertainty Fuels Safe-Haven Demand

Beyond economics, geopolitical turbulence has been a key reason why gold is going up. Gold is the classic safe-haven asset that investors flock to in times of uncertainty or crisis. Over 2024–2025. the world has seen no shortage of uncertainty – and gold's price has reflected that. From the ongoing Russia–Ukraine war to tensions in the Middle East and U.S.–China relations, 2024 was full of geopolitical flashpoints. Such uncertainty boosts gold's appeal. Investors use gold as portfolio insurance, and it tends to perform well during economic or political stress.

Currency Trends and the US Dollar Factor

The US dollar plays a key role in gold's price, with an inverse relationship between the dollar's value and gold's USD price. A weaker dollar typically drives up gold demand, while a stronger dollar can limit gold's gains. In 2024. the dollar weakened as US inflation eased and the Fed slowed rate hikes, supporting gold's rise. However, in some cases, like late 2024. gold still climbed despite a stronger dollar, driven by safe-haven demand during periods of uncertainty.

As the Fed signalled potential rate cuts, expectations of a softer dollar in 2025 further supported gold. This trend also sparked increased gold buying by central banks. Gold's rise wasn't limited to USD; it reached record highs in other currencies like GBP and euros, offering protection against currency volatility. In emerging markets with weak currencies, demand for gold as a store of value surged. Overall, gold benefited from waning faith in fiat currencies during 2024–25. positioning it as a stable asset amidst global uncertainty.

Investor Sentiment and Market Dynamics

Investor sentiment and market momentum have played a major role in pushing gold higher. As gold outperformed other assets in 2024. it attracted more interest from institutional and retail investors. Investment demand, including from ETFs and physical bar and coin buyers, surged. Momentum and fear of missing out (FOMO) further propelled prices. Gold has re-established itself as a key asset in diversified portfolios amid uncertainty.

Conclusion

The 2024–2025 period has seen a confluence of factors driving gold's surge. Persistent inflation, central bank policy shifts, and geopolitical tensions have heightened gold's appeal as both an inflation hedge and a safe haven. Central banks have become major buyers, reinforcing gold's long-term value. A weaker dollar and widespread scepticism about fiat currencies have further boosted gold's demand globally. Rising investment inflows and strong market performance show increasing confidence in the metal. Gold's dual role in portfolios, as a hedge and growth asset, has made it attractive across the board. Moving forward, traders must monitor inflation, central bank decisions, geopolitical risks, and market sentiment, as these factors will determine gold's future trajectory. The current rise reflects a blend of economic and political drivers reaffirming gold's status as a trusted store of value in uncertain times.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.