In daily life,the most common financial products that people come into contact with are actually share funds. But many people do not have such a deep understanding of funds,let alone the hot topic in the investment world:private funds. In fact,compared to ordinary funds,it is a kind of investment with a higher threshold. I believe that,having said that,your curiosity about it has grown. Let's take a good look at the business and risks of private funds.

What is the meaning of a private fund?

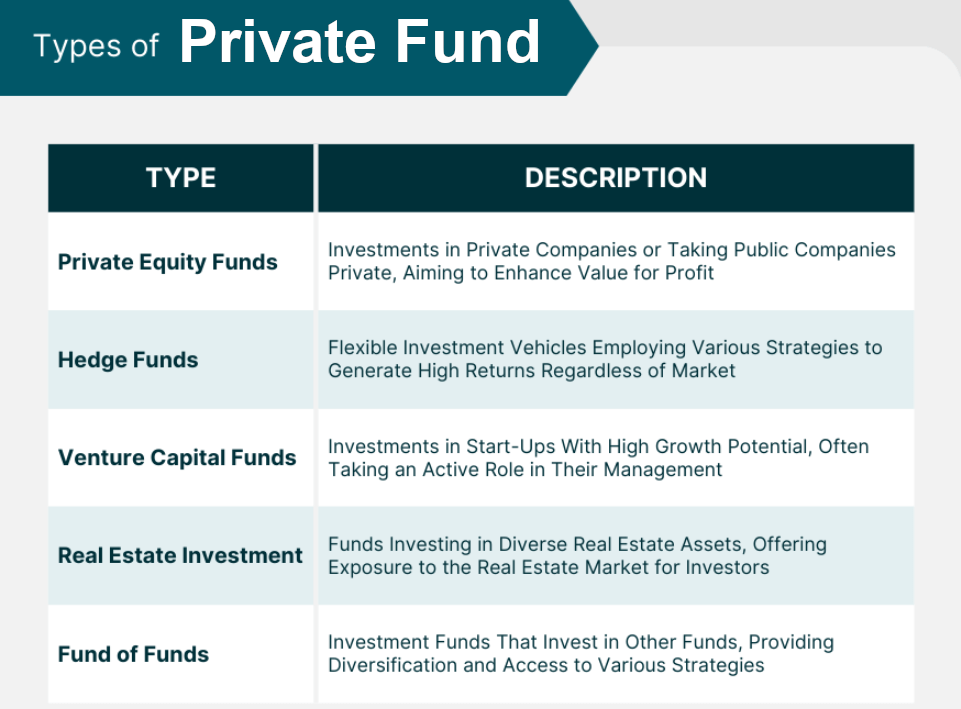

It is a kind of investment fund managed by a professional fund manager,whose main feature is to raise funds from specific investors (such as institutional investors and high-net-worth individuals) through non-public means and conduct investment activities according to established investment strategies. Although a complex industry,it is nevertheless often very profitable and also plays an important role in the economy as a whole.

Unlike public funds,which are traded on the open market,they usually have higher threshold requirements for investors,including the amount of investment,investor qualifications,and investment period. Its investors are usually high-net-worth individuals,family funds,institutional investors,etc., who usually have a higher risk tolerance and a longer investment time horizon.

It manages large sums of money invested in private companies,using a variety of strategies to earn returns for their investors. Simply put,this fund is used to invest in private companies,usually with the aim of growing and improving them before selling them. Of course,this can be risky as it involves investing in companies with undisclosed trading points and limited financial and operational transparency. However,private equity usually has extensive experience and expertise in managing and growing companies,which helps to mitigate the risks.

The private equity market is a large and growing part of the global financial industry,with portfolios typically managed by professional investors or fund managers and often utilizing more flexible investment strategies. It can cover a wide range of asset classes,such as equities,bonds,commodities,real estate,etc., and may employ complex investment strategies such as leverage,arbitrage,hedging,etc.

One of its characteristics is that it strictly limits the scope of investors in terms of who it can raise. Generally speaking,its investor scope is limited to some large institutional investors and some wealthy individuals with certain investment knowledge and investment experience,where wealthy is the focus.

According to the new requirements,qualified investors cannot invest less than 10.000 yuan in a single private fund. The investor's personal net worth can't be less than 10 million yuan,and the individual's financial assets can't be less than 3 million yuan. The average annual income of an individual for the last three years cannot be less than 500.000 yuan.

In terms of the method of fundraising,this type of fund raises funds in a non-public manner. The definition of the non-public method is carried out through the number of investors and the method of issuance.These include private negotiations,an invitation system,and a professional investor registration system. In private negotiation,the fund manager directly communicates and negotiates one-on-one with potential investors to reach an investment agreement.

The invitation system,on the other hand,involves the fund inviting specific investors to participate in the fund's fundraising activities through invitation letters or private events. The professional investor registration system requires investors to fulfill certain conditions in order to participate in private placement solicitations,such as having a certain level of assets or having specific investment experience.

Then,in terms of information disclosure,the requirements for private placements will be lower. This also gives rise to the next aspect,that is,the legal-regulatory aspect. Private investment funds have always belonged to the gray area; there is no special law to regulate and guide their healthy development.

From the point of view of the process of raising funds for private investment,it has experienced three periods. That is,the collection period,the closed period,and the normal subscription and redemption periods. During these three times,investors buying and selling of fund shares will be very different.

First,there is the fundraising period,which is typically one to three months. During this period of time,the private investment shares will be given to specific investors to raise funds. Investors in this stage can only buy and cannot sell the shares; the price of the shares to be bought is the net value of the shares,that is, 1 yuan.

After the end of the collection period,enter the closed period,which is generally 6 months to 1 year. In this time period,the fund contract has come into effect,but in the closed period,the fund does not accept investors to subscribe to or redeem the fund share request. So investors can neither buy nor sell fund shares during this period.

The third stage is when the closed period ends and the fund can accept both subscriptions and redemptions. This enters the normal subscription and redemption period,in which investors can make subscriptions and redemptions of the fund according to the net value of the fund's shares.

At this time,the subscription and redemption times are entirely determined by the private equity firm; the specifics also require consulting the corresponding private equity firm. In addition,the fund can continue to subscribe after the fundraising is completed,so investors can continue to subscribe according to the fund's opening date.

Overall,a private fund is a privately managed investment fund designed to provide diversified investment opportunities to a relatively small group of investors and often utilizes more flexible and sophisticated investment strategies. At the same time,it may also be subject to more regulatory restrictions and risks,as its investment strategies and operations are relatively more flexible and may be subject to a higher degree of risk and uncertainty.

Requirements for the establishment of a private equity fund company

| Establishment conditions |

Description |

| Registered Capital and Funding |

Adequate capital is needed for operations and investments. |

| Legal and regulatory requirements |

Comply with local regulations and meet regulatory demands. |

| Qualified management team. |

Experienced management team with relevant qualifications. |

| Plan and strategy for investment. |

A clear investment plan with goals and risk management. |

| Control and compliance needs. |

Establish internal controls for investor protection. |

| Other Requirements |

Meet regional and regulatory requirements. |

Private fund business

It is mainly engaged in capital raising and investment activities,and its business mainly includes fund raising,investment management,investment decision-making,risk management,and exit mechanisms. Of course,there are different differences among these businesses according to their types and modes of operation.

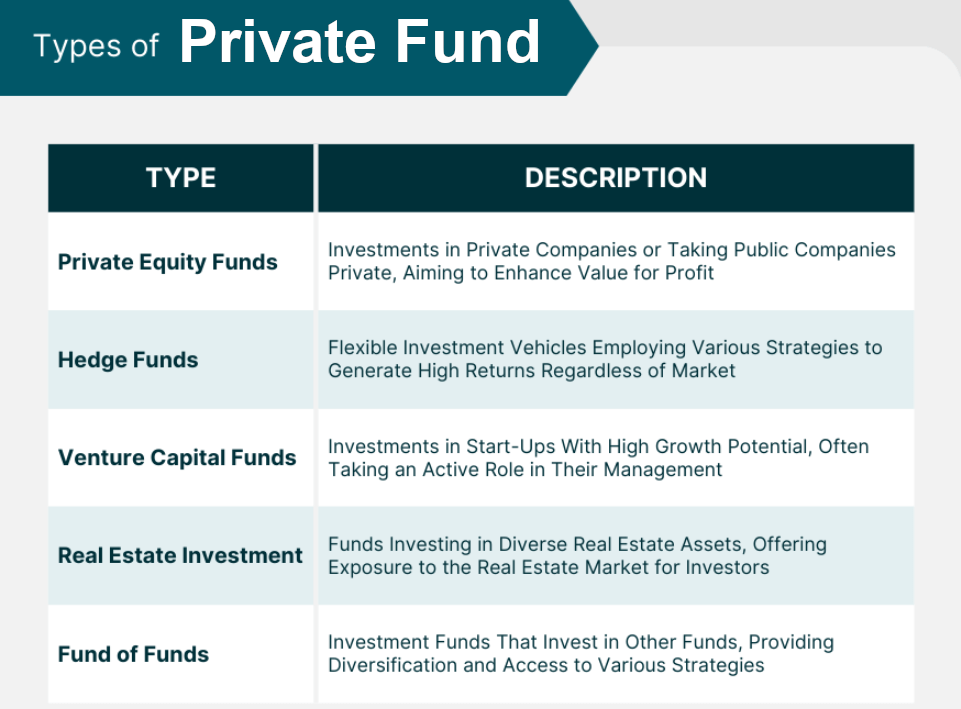

First of all,private funds raise funds from specific investors,which usually include institutional investors and high-net-worth individual investors,in a non-public manner. And according to the established investment strategy,they carry out investment activities,including equity investment,fixed income investment,hedge fund,real estate investment,angel investment,and so on,in order to maximize investment returns.

Among them,private funds mainly invest in the stock market,which is to obtain income by purchasing shares of listed companies,participating in equity investments in private enterprises,or making equity investment acquisitions.

Fixed-income investment funds,on the other hand,mainly invest in the bond market,including Treasury bonds,corporate bonds,convertible bonds,etc., in order to obtain fixed interest returns. Hedge funds,on the other hand,adopt diversified investment strategies,including market-neutral strategies,event-driven strategies,arbitrage strategies,etc., in order to realize returns in different market environments. And they usually adopt diversified investment strategies,including interest rates,exchange rates,commodities,stocks,and other markets,to achieve the objectives of hedging risks and stabilizing returns.

Real estate investment funds mainly invest in the real estate market,including commercial real estate,residential real estate,industrial real estate,etc., in order to obtain rental income,asset appreciation income,etc. Angel Investment Fund mainly invests in start-ups or innovative projects and supports the growth of enterprises through equity investment and venture capital investment in order to obtain high investment returns.

The fund manager and investment team are responsible for making investment decisions,selecting suitable investment targets and strategies,and conducting portfolio construction and adjustment. It is also required to carry out risk management,including assessing and controlling the risk of the investment portfolio and taking appropriate risk management measures to protect the safety of investorsfunds.

It also needs to report to investors on a regular basis on the fund's performance,portfolio situation,and operation to ensure that investors are informed of the fund's operation in a timely manner. Moreover,an exit mechanism is usually set up to allow investors to exit the fund under specific conditions to ensure the smooth exit of investment projects and the realization of investment returns. For example,fixed-term expiration,achievement of investment objectives,or other agreed-upon conditions.

Private funds also provide investor services,including asset management consulting,portfolio customization,risk management advice,etc., to meet investorsindividual needs. It is also required to comply with local laws,regulations,and regulatory requirements to ensure that the company's operations are legally compliant and subject to supervision and inspection by regulatory bodies.

Overall,private funds are professional investment institutions that raise funds and manage investments in order to realize investment returns,and the specifics of their business and the way they operate may vary depending on the size of the company,its investment strategy,and its business model. Moreover,their investment strategies and objectives are diversified,and they usually have certain investment thresholds and investment periods,as well as certain risks and liabilities.

How risky is a private fund?

This risk depends on a number of factors,including the fund's investment strategy,asset allocation,market environment,and the ability of the management team. Generally speaking,it carries a higher level of risk than traditional public-market investment vehicles.

Firstly,because the types of assets and underlying investments of a private investment fund may be more diversified and complex,including stocks,bonds,derivatives,etc., it is exposed to greater market risks. At the same time,it usually has a longer investment period and lower liquidity,so investors may not be able to redeem their funds at any time and need to bear certain liquidity risks.

Moreover,private investment fund management involves complex investment strategies and trading operations,and the decision-making and execution abilities of the management team directly affect the performance of the fund,which involves operational risk. And because it may invest in assets with higher credit risk or trade with riskier counterparties,it is subject to credit risk.

Some private funds may use financial instruments such as leverage or borrowing to increase investment returns,but they also increase portfolio risk exposure. At the same time,such funds have relatively few regulatory and disclosure requirements and may be subject to regulatory risks,including non-compliance and inadequate disclosure of information.

In fact,for investors in private funds,the risks that they should be most wary of can be categorized into six major categories. The first is the risk of opaque information. Since there is no strict information disclosure requirement for this type of fund,information opacity is one of its major risks. Inadequate information disclosure exists at all stages of investment operation and management,such as investment programs,fund transfers,and project tracking and management,which may pose greater risks to investors.

Secondly,investors have lower risk resistance. The reason why many investors participate in private investment funds is mostly because of their high returns.But don't forget that high returns also correspond to high risks. Many investors may lack the appropriate risk-tolerance ability,so special attention must be paid to the risks of such funds.

There are also risks caused by fund managers.Due to the lack of strict regulations on industry entry standards,there are obvious differences in the management level,industry status,and market recognition of fund managers. Even in the same market environment,only a portion of fund managers are able to bring profits to investors by virtue of their accurate investment decisions,while others may cause investors to suffer huge losses.

The fourth is a higher moral hazard. As fund projects are usually set up in the form of partnerships,investors are unable to effectively monitor and manage the projects due to professional,geographical,and time constraints. Therefore,moral hazard is also one of the risks that investors often face.

Then there is also a lack of professionalism in project financing. Project financing usually requires extensive practical experience and professional competence; however,some private investment fund managers or management teams may lack sufficient competence to effectively supervise and manage the project financing process.

The last one is the risk of illegal absorption of public deposits. Some of the funds from private placements will attract investors by means of deliberately exaggerating returns and concealing projects,and there is a great possibility that these private placements are illegally attracting public deposits.

It is not difficult to see that private funds with very high returns are also accompanied by high risks.Therefore,when you have the opportunity to invest in this type of fund,you must not make an impulsive decision. Do your homework and understand what you are investing in. What are the risks involved? Whether it is in line with the personal investment situation,and then carefully make investment decisions.

More famous private equity firms

| Private equity firms |

Assets under management |

| BlackRock |

7.5 trillion dollars |

| Blackstone |

US$951 billion |

| Apollo Global Management |

US$523 billion |

| Goldman Sachs Carlyle (KKR) |

US$471 billion |

| The Carlyle Group |

US$369 billion |

| CVC Capital Partners |

146 billion dollars |

| TPG (Texas Pacific Group) |

$135 billion |

| Thoma Bravo |

114 billion dollars |

| Einto (EQT) |

100 billion dollars |

| Insight Partners |

98 billion dollars |

Disclaimer:This material is for general information purposes only and is not intended as (and should not be considered to be) financial,investment,or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment,security,transaction,or investment strategy is suitable for any specific person.