Similar to regular health checkups for maintaining physical well-being, investors must assess a company's financial health before making investment decisions. This process inevitably involves a thorough examination of the company's financial reports, particularly the balance sheet which provides a detailed breakdown of assets and liabilities. Mastering the skills to interpret a balance sheet is crucial for investors seeking to make informed investment choices. In this article, we will discuss key techniques and insights into effectively analyzing balance sheets.

What is a Balanced Sheet?

Generally speaking, beginner investors prefer to read the income statement because of its intuitive simplicity and clear presentation of a company's revenues, costs, and profits. The balance sheet, on the other hand, is more complex, with details that hide a lot of important information and require investors to have a deeper understanding of financial knowledge.

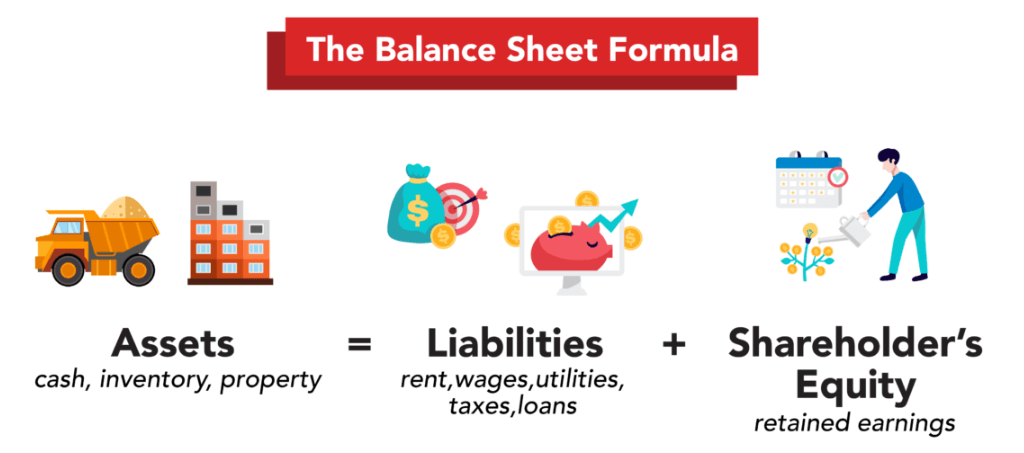

It can be compared to a photograph that reflects the assets, liabilities, and shareholders' equity of a business at a specific point in time. Its components are mainly divided into an assets component and a liabilities component, as well as a shareholders' equity component. Assets are the resources owned by the company, while liabilities are the debts that the company owes to others. Shareholders' equity represents the net worth of the company's assets and is the shareholders' ownership of the company.

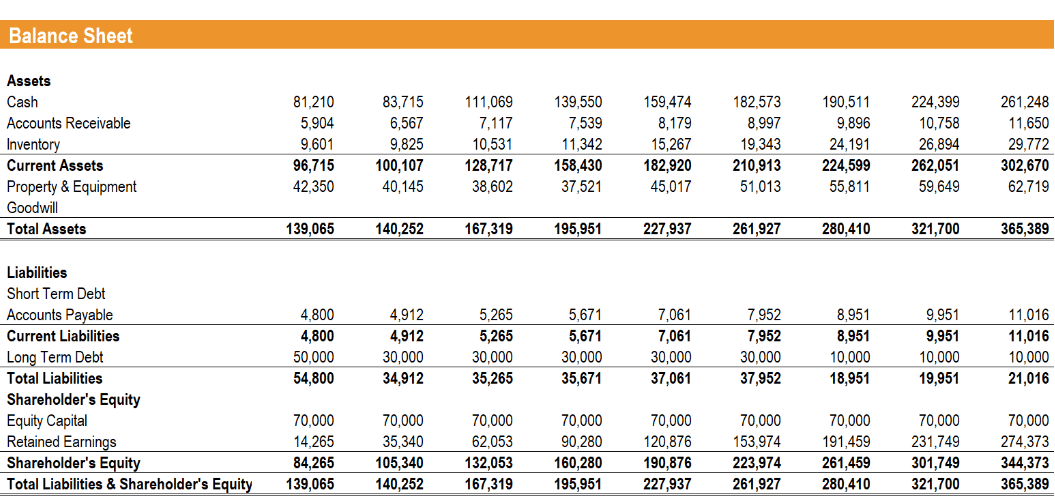

Its core principle follows a simple equation: assets equal liabilities plus owners' equity. This equation reflects the basic structural principles of the balance sheet. This equation provides a clear picture of the sources of a company's assets.

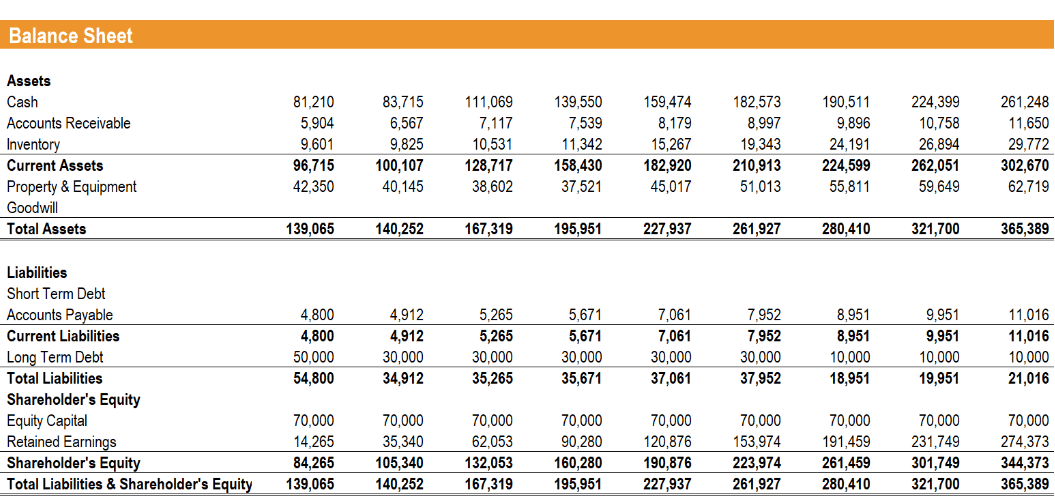

The assets section of the equation consists mainly of current and non-current assets. Current assets are assets that can be realized within one year, such as cash, accounts receivable, and inventory, while non-current assets are assets with an expected useful life of more than one year, such as fixed assets and intangible assets, such as equipment and real estate.

Similarly, liabilities are categorized into current and non-current liabilities. Current liabilities are debts that need to be repaid within one year, such as accounts payable and short-term borrowings; non-current liabilities are long-term liabilities with a maturity of more than one year, such as long-term loans and bonds.

The shareholders' equity section is composed of share capital, capital surplus, and retained earnings, reflecting the shareholders' investment in the enterprise and the retention of profits. Shareholders' equity consists of the capital invested by shareholders and the retained earnings of the company. The capital invested by the shareholders is the principal invested by the shareholders in the company, while the retained earnings are the profits earned by the company after operation.

As an example of how it works, let's say that a company selling coffee machines opens today and initially invests $100.000 in start-up capital, $50.000 of which is used to purchase the coffee machines. The $50.000 would then be included in the capital portion of shareholders' equity, while the $50.000 in cash and the purchase of the coffee maker would be categorized as cash and coffee maker liquid assets.

In order to expand its business, the company takes out another bank loan of $200.000 to purchase a warehouse. This $200.000 loan would then be included in the noncurrent debt in the liabilities section and also add $200.000 to the warehouse in noncurrent assets. In addition, another $20.000 was spent on insurance to protect the inventory, and this cost would then be included in liquid liabilities. As a result, cash in liquid assets is reduced by $20.000. but the value of the insurance contract is again included in liquid assets.

With the operation of the company's business, the company successfully sold $20.000 worth of coffee machines and made a $40.000 profit. The $40.000 profit is added to shareholders' equity, and the amount of the coffee maker sold is subtracted from liquid assets, while the $60.000 in cash from the sale is added back to liquid assets.

From this example, I see that during a company's operation, the total assets of the company are always equal to the sum of its liabilities and shareholders' equity. This relationship is interdependent and ensures the balance and integrity of the balance sheet.

When a company begins operations, it may raise funds to purchase assets and conduct business through shareholder investment, borrowing, etc. These funds are used to purchase various assets, such as cash, equipment, warehouses, etc., and are stored in the form of liabilities.

As the company's business grows, it will utilize these assets to conduct business and generate revenue and profits. These profits will be reflected in shareholders' equity, increasing the net worth of the company. At the same time, the company may continue to borrow money or issue stock to expand its business, thereby increasing its liabilities.

The balance of the balance sheet was maintained throughout the process. A company's total assets are always equal to the sum of its liabilities and shareholders' equity, which is the basis for financial stability and sustainability. This principle is crucial for investors, managers, and other stakeholders because it ensures the accuracy and reliability of financial reporting and provides them with the right basis for decision-making.

The balance sheet plays an important role in investment decisions and should be carefully studied and analyzed by investors before making any investment to ensure that the right one is chosen. Of course, reading it requires investors to have certain financial knowledge and skills, and by understanding and analyzing its contents in depth, it can help investors assess the financial status and operating ability of an enterprise more comprehensively.

The Role of the Balance Sheet

It is a financial statement that reflects the financial position of an enterprise at a specific point in time and the relationship between assets, liabilities, and owners' equity. It also reflects the business performance of the enterprise, as changes in assets and liabilities usually reflect the business activities and capital operations of the enterprise. Therefore, it plays a vital role in enterprise financial management.

First of all, it clearly lists the various assets owned by the enterprise, including cash, accounts receivable, inventory, fixed assets, and so on, which represent the resources owned by the enterprise and the potential to bring in revenue in the future. It also lists the various liabilities of the business, including accounts payable, short-term borrowings, long-term borrowings, and so on.

These liabilities represent the debts or obligations that the business needs to pay off and also show the owner's equity, which is the remainder of the assets minus the liabilities and represents the owner's investment in the business and the accumulated earnings. These not only show the composition of the company's assets, the structure of its liabilities, and its owner's equity, but also provide investors, managers, and other stakeholders with an important basis for understanding the company's financial health.

Secondly, it also helps investors and managers understand the current status of the company's asset allocation. Analyzing it can help investors understand the company's current configuration in terms of current assets, long-term investments, fixed assets, intangible assets, etc., which in turn helps them assess the company's asset structure and risk distribution.

It also provides financial information about the company, which helps the operator make decisions. Operators can base their decisions on the information in this statement, and managers can identify problems and develop improvement measures. While formulating reasonable financial strategies and business plans, it optimizes asset allocation and improves the efficiency of asset utilization so as to achieve the long-term development goals of the enterprise.

In addition, it also has the function of supervision and control and is one of the important tools for monitoring the operation of the enterprise. It provides a basis for managers and regulators to oversee the financial situation of the enterprise, helping them to monitor the enterprise's debt level, asset-liability ratio, and other important indicators. It ensures that potential financial risks can be detected and resolved in a timely manner and safeguards the sound operation of the enterprise.

And the regular publication of balance sheets helps to enhance the transparency and trust of the enterprise. Investors, creditors, and other stakeholders can review the statement to understand the enterprise's financial condition and operation, increasing trust and recognition of the enterprise.

People can get a clear picture of the financial position and assets and liabilities of the enterprise, which helps investors and creditors assess the solvency of the enterprise. It simply means that by comparing the amount of assets and liabilities, it determines whether the enterprise has enough assets to cover its liabilities, thus judging whether the enterprise can repay its debts in time.

Finally, balance sheet comparison and analysis are also important roles. Investors and managers can compare this statement at different points in time, or with the financial data of the same industry or competitors, in order to assess the company's operating performance, financial stability, and competitiveness.

How to Understand the Balance Sheet

How to Understand the Balance Sheet

Many people regard it as one of the most important tools for analyzing the future ups and downs of a stock because, although financial reports are after-the-fact information, they are not as helpful as insider information in predicting the subsequent ups and downs of the stock market. But it can tell investors the current status of a company's asset allocation, which helps investors get a fundamental grasp of a company's profitability and operations.

Of course, although it has this role, how one can discern the desired message from it is also something that investors need to learn. When analyzing this statement, investors should focus on the assets section, including tangible and intangible assets, and the method of asset allocation will be different for different types of industries. For example, the manufacturing industry focuses most of its assets on real estate or other production equipment, while the financial industry focuses most of its assets on discounting or lending.

Whereas in the case of a service company, there may be more reliance on intangible assets such as brand value, patents, and customer relationships. For example, a software development company may highlight intangible assets such as intellectual property, software licenses, and R&D results, as these assets are critical to the competitiveness and long-term value of the company.

Also, current assets and long-term investments are metrics to focus on to understand the liquidity of the company's funds and long-term investments. As an example, current assets include cash, accounts receivable, short-term investments, and inventory. Investors can assess a company's liquidity position by analyzing its current assets. For example, if a company has a high percentage of cash and accounts receivable in its current assets, it may indicate that the company has good capital reserves and collection ability, which is conducive to coping with unexpected situations and investment opportunities.

Long-term investments, on the other hand, are funds that a company invests in long-term assets or other ventures that are expected to earn a return over a longer period of time. For example, a company may realize strategic cooperation or expand its market share by holding stakes in other companies. Investors can understand the impact of such strategic moves on the company's future earnings through long-term investments.

For the liabilities section, investors need to pay attention to current and long-term liabilities. Current liabilities are debts that a company needs to repay within a year or business cycle and usually include accounts payable, short-term borrowings, interest payable, dividends payable, and so on. Investors should focus on the amount and composition of current liabilities to assess the short-term solvency of a company.

For example, if a company's current liabilities are high and consist mainly of short-term borrowings and accounts payable, it may indicate that the company is under pressure to repay its debts and needs more liquidity to do so.

Long-term liabilities are debts that need to be repaid by a company in more than one year or business cycle and usually include long-term borrowings, bonds payable, and lease liabilities. Investors should pay attention to the amount, interest rate, and maturity period of long-term liabilities to assess a company's long-term solvency and debt management.

For example, if a company has a relatively high percentage of long-term liabilities but a low interest rate and reasonable maturity period, it may indicate that the company has a stable source of financing and good debt management capability.

In the shareholders' equity section, it is important to pay attention to its structure and to derive various financial indicators, such as the return on shareholders' equity and the ratio of liabilities to assets, by applying the relevant indicators, which can help to assess the company's operating conditions and financial security.

At the same time, it is important to pay attention to the order of the data on the balance sheet, such as the sequence of current assets and current liabilities, and the trend of each indicator, such as the current ratio (the ratio of current assets to current liabilities). If the current ratio shows a stable or growing trend, it may indicate that the enterprise has good liquidity and solvency; on the contrary, if the current ratio is declining, it may indicate that the enterprise is facing the risk of debt servicing.

For example, suppose a company's current ratio gradually declines over several consecutive quarters, primarily due to an increase in accounts payable and short-term borrowings and a decrease in cash and cash equivalents. This could mean that the company's short-term solvency is declining and may require additional financing or improved management of accounts receivable to ensure solvency.

Finally, it is important to understand that, in contrast to the income statement as well as the cash flow statement, the balance sheet describes the state of a company's assets at a point in time, while the other two statements describe the changes over a period of time. So investors can identify possible signals by comparing the statements of different companies or the same company at different points in time; for example, an increase or decrease in liabilities can be considered a signal.

Suppose a company's short-term borrowings increase significantly over a period of time. This may indicate that the company is experiencing a financial crunch, possibly due to poor operations or the investment of funds in a major project. In this case, investors and managers would need to be concerned about the financial stability of the company, as the increased debt could increase the risk of debt servicing and lead to financial distress in the future.

Conversely, if a company's long-term debt continues to decrease, this may indicate that the company is making progress in its financial management or has successfully repaid some of its debt. This situation increases the confidence of investors and managers in the financial health of the company, as the reduced debt reduces the company's financial risk and frees up more funds for investment or operational activities.

Therefore, the increase or decrease in liabilities can be viewed as a signal that can help investors and managers assess the company's financial position and risk level so that they can make decisions accordingly.

Overall, the balance sheet is one of the most important tools for investors to understand the financial position of a company. By comparing the previous and subsequent financial reports, you can quickly understand the business approach, risks, and development trends of the company. These analyses can help investors make more accurate investment decisions.

Tips for interpreting the balance sheet

|

Interpretation Tips

|

DESCRIPTION

|

|

Basic structural principles

|

Assets = liabilities + owners' equity |

|

Categorization Focus

|

Understand assets, liabilities, and equity for a clear view of capital. |

|

Asset Allocation

|

Track asset allocation trends: cash, inventory, and fixed assets. |

|

Solvency Assessment

|

Assess liabilities for timely debt repayment. |

|

Comparative Analysis

|

Benchmark data for trend insights and competitive positioning. |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

How to Understand the Balance Sheet

How to Understand the Balance Sheet