Oil prices are in a tug of war between geopolitical turmoil in the Middle

East and global economic slowdown. Israel killed two more Hamas leaders this

week, raising more concerns about a wider rift.

Islamist hardliners in Iran and militant groups across the Arab world will

see it as further proof of their belief that the state of Israel is a menace

that must be destroyed at all costs.

"We are prepared for any scenario and will stand united and determined

against any threat," PM Netanyahu said. That came after Iran sworn revenge on

the nation – a repeat of the stories over the past 10 months.

No major oil producer has been directly involved so far, so any news update

was largely seen as a one-off fillip to the market. But saudi arabia is fretting

over the Houthis' animosity.

Houthi leader Abdul Malik Al-Houthi claimed Saudi Arabia is colluding with

Israel and the US to curb the group's attacks on Red Sea shipping. He even

threatened to make Riyadh to pay a heavy price.

A scholar at the Middle East Institute think tank, cite the "significant

leap" in Houthi capabilities since 2015 — as evidenced by sending a drone almost

2,000 km from Yemen into the heart of Tel Aviv.

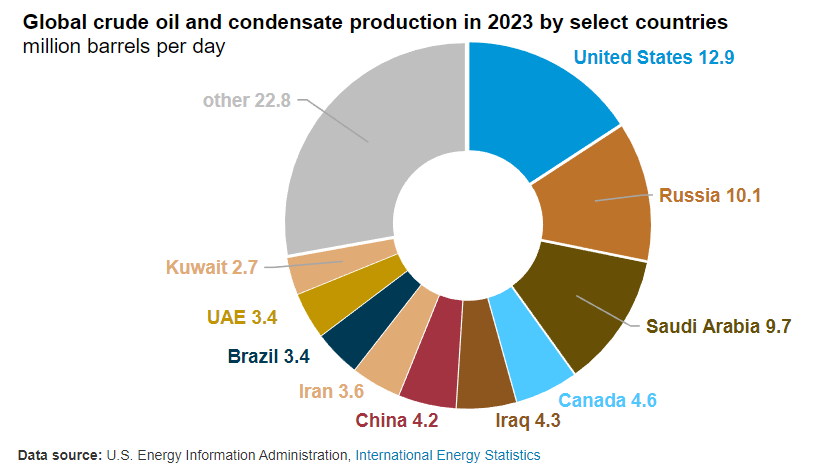

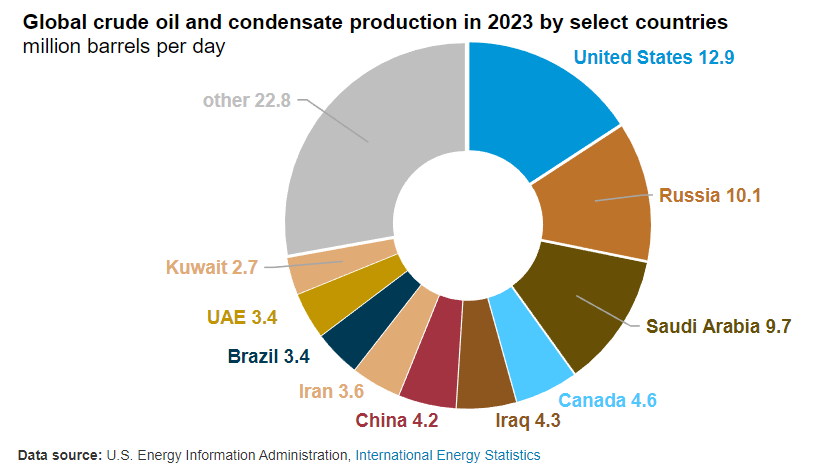

Together, the US, Russia, and Saudi Arabia accounted for 40% of global oil

production in 2023, according to the EIA. Panics will flare if two of the three

are forced to tackle attacks on their energy infrastructure.

Crumbling pillar

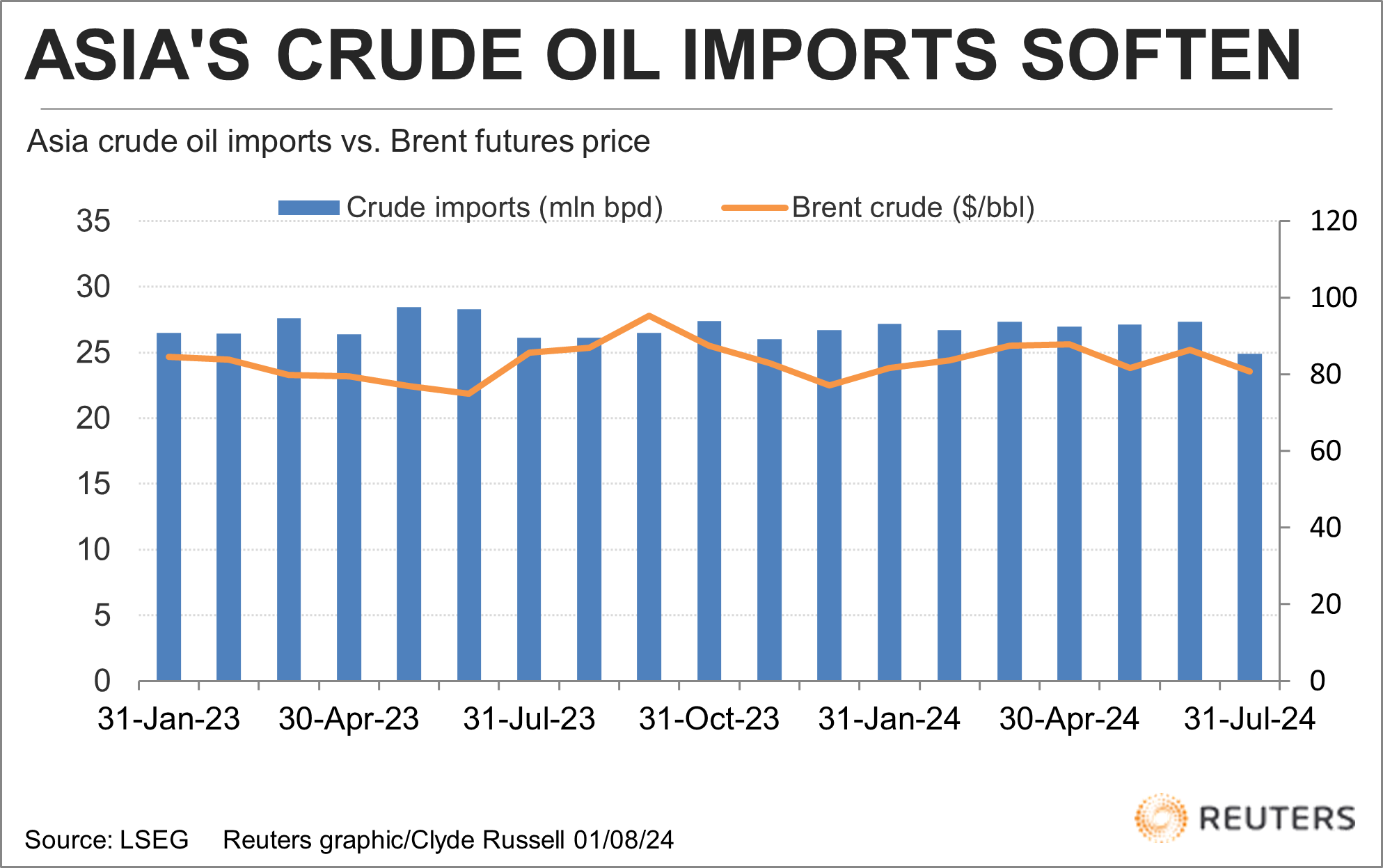

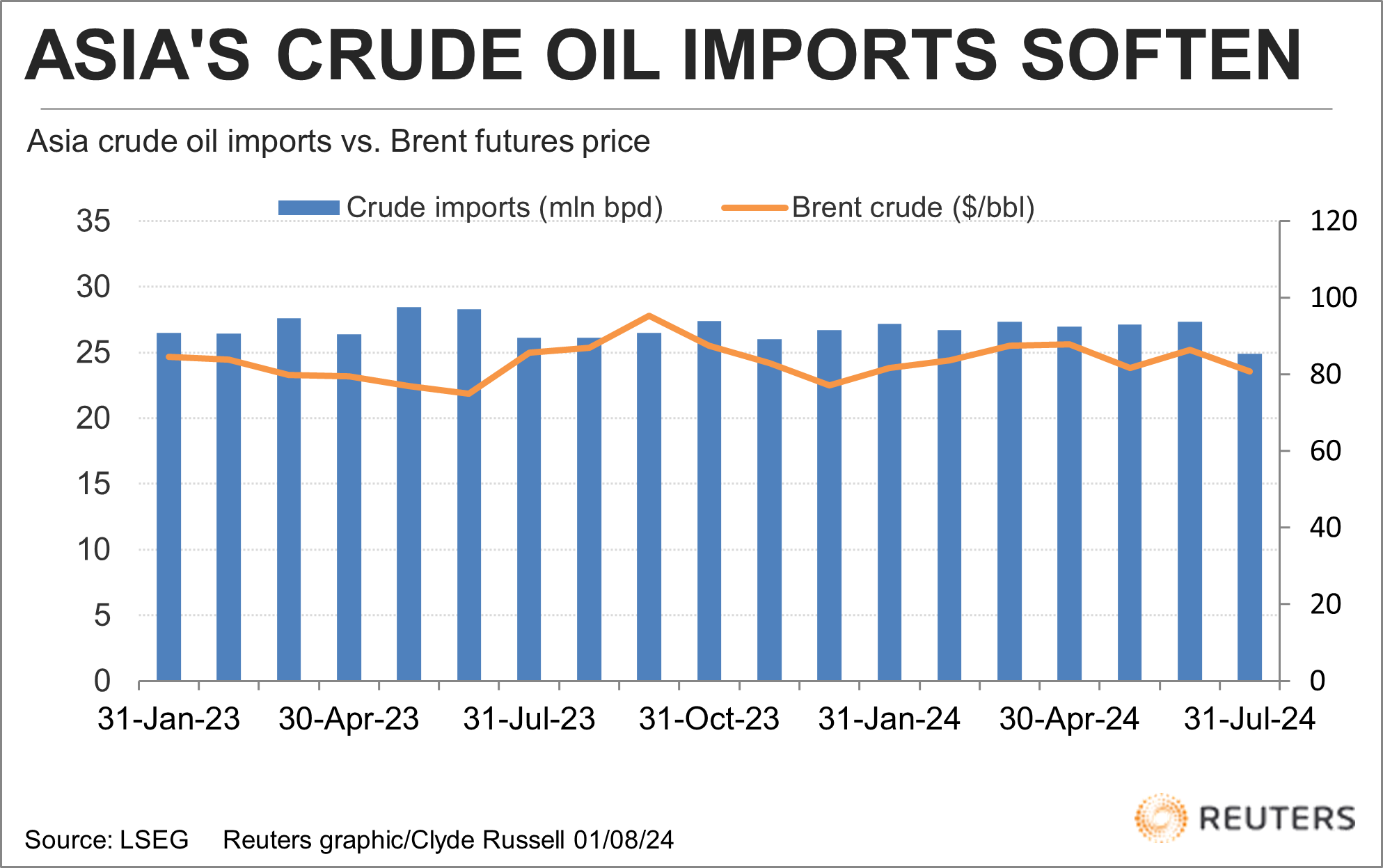

Oil bulls hoping for a second-half demand spurt from China are likely heading

for disappointment as economic weakness persists and the adoption of new energy

vehicles continues apace.

The world's second largest economy is seen to import marginally higher at

best in the second half of the year – not enough to soak up OPEC+ additional

supply, according to a Bloomberg survey.

Crude imports fell 2.3% in the first six months, the biggest half-year drop

outside of Covid years. Some independent refiners have reduced operations as

higher costs squeeze refining margins, trimming their appetite for oil.

Without a dramatic turnaround, the imports over the remainder of this year

will be an ocean away from OPEC's forecast for a rise of 2.25 million bpd in the

world demand in 2024.

Even if policies to encourage consumers to swap old for new appliances and

vehicles are enacted, it is likely that a high percentage of any new vehicle

sales will be electric.

Meanwhile, crude oil pipelines connecting the busiest Texas oil fields to a

critical export hub across the state are nearly out of space, threatening to cap

US oil exports at a time.

The Permian region accounts for nearly half of all US oil production. While

output is set to keep growing, it will be difficult for that incremental output

to reach international buyers without ample pipeline space.

Following Years

The market is currently tight but next year will likely be in surplus after

both OPEC and non-OPEC supply return to growth, with Brent prices declining into

the mid-to-high $70s range, Morgan Stanley said.

Goldman Sachs said that whoever wins the US presidential election in November

will have limited tools to significantly boost domestic oil supply next year

when strategic petroleum reserve stocks are low.

The bank expects Brent prices to range from $75 to $90 in 2025, assuming

trend-like growth in GDP and steady oil demand as well as market balancing by

the OPEC+.

Both Morgan Stanley and Goldman Sachs left their forecast for Brent Crude

prices for the third quarter of 2024 unchanged at $86 per barrel. Further ahead,

the outlook looks even bleaker.

The IEA said in June that a US-led surge in global oil production is expected

to push spare capacity to unprecedented levels and potentially upend OPEC+

market management.

The watchdog expected demand to reach its peak of near 106 million bpd and

total oil production capacity to surge to nearly 114 million bpd by 2030 – a gap

equivalent to around 8 million bpd.

The share of fossil fuels in the global energy supply has stayed at around

80% for decades, the IEA noted, although it expects this to drop to around 73%

by 2030.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.