Pound steady on more trade deal progress

2025-07-01

Summary:

Summary:

Sterling hovers near a 4-year high amid trade hopes and fiscal concerns, though economic signals suggest a possible pullback.

Sterling hovered around its 4-year high on Tuesday, as Trump's spending bill stoked fiscal worries and uncertainty around trade deals continued to weigh on sentiment.

The UK-US trade deal comes into play on Monday, giving a preferential tariff rate to British cars imported to America, while questions linger over final levies on metal exports.

Cars are the UK's largest export to the US - the top buyer of the brands globally. Unlike EU's large trade surplus with the States, the UK is running a deficit and hence a quicker deal.

RBC suggested that in the coming months, the outlook for the British pound is not overly compelling — but noted that geopolitical developments could catalyse further upward movements in the longer term.

The UK's economy expanded 0.7% in Q1,marking the highest GDP growth rate in a year. The OECD has lowered its forecasts for its growth in 2025 to 1.3% from 1.4% and downgraded 2026 forecasts to 1.0% from 1.2%.

The governor of the BOE has warned there are growing signs that jobs markets is slowing as employers respond to higher national insurance contributions by cutting hiring and offering weaker pay rises.

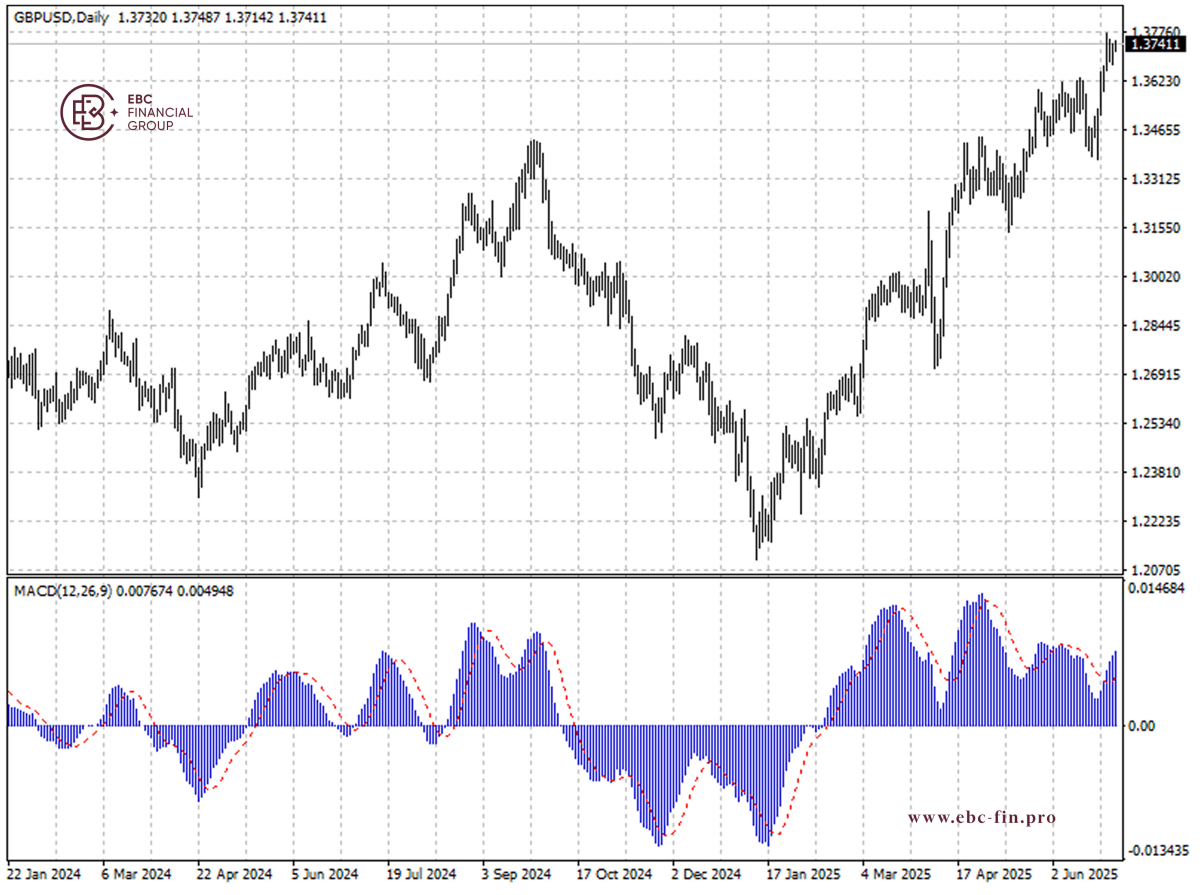

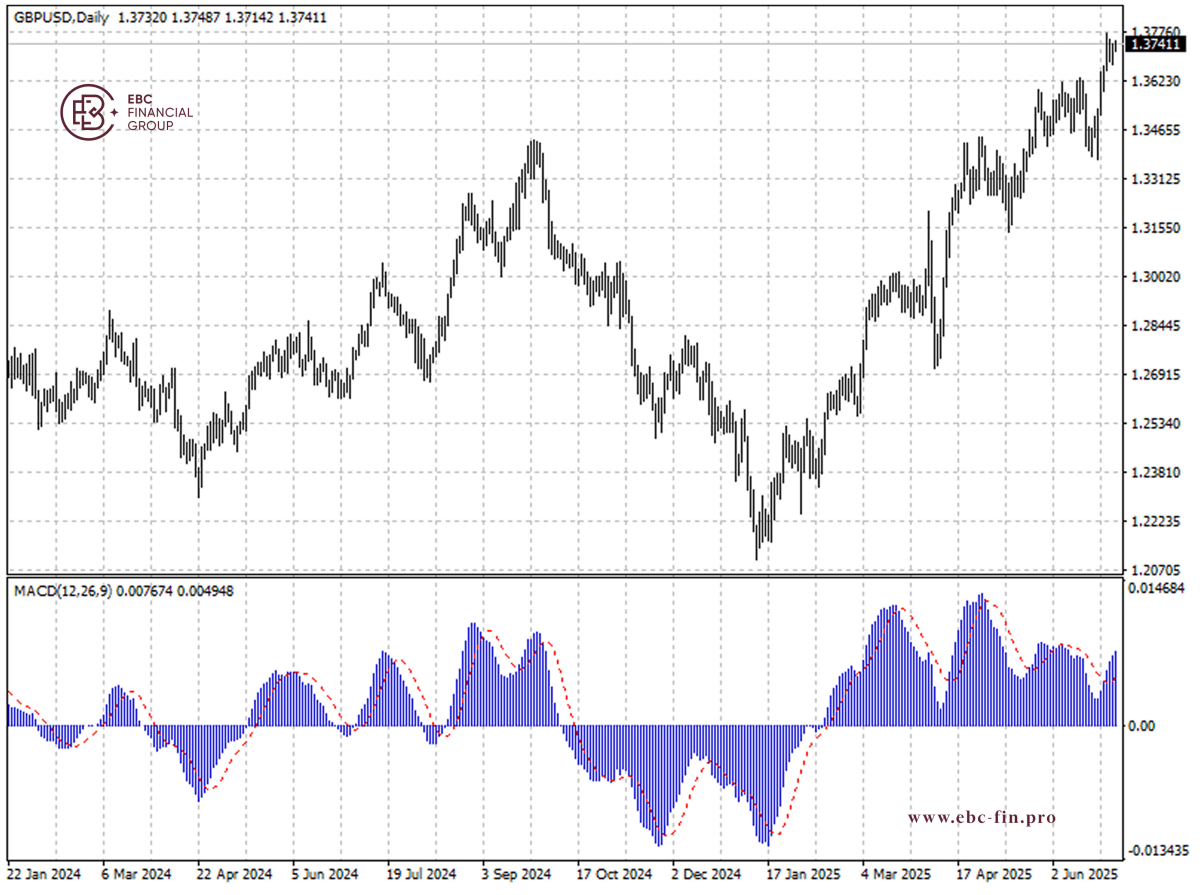

The pound has been in a spiral upwards since mid-January, but bearish MACD divergence signals potential retreat from the current level. The support is seen around 1.3700.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.