Stock options have become increasingly popular among investors looking to buy or sell a stock at a predetermined price within a specified timeframe, flexibility, leverage, and strategic opportunities in the financial markets.

While stock options can seem complex at first glance, they are powerful tools that, when understood correctly, can be used to manage risk, generate income, or speculate on price movements.

Understanding How Do Stock Options Work

The first step in applying the concept is understanding it. To summarise, a stock option is a financial contract that gives the buyer the right, but not the obligation, to buy or sell a stock at a predetermined price within a specific time frame. Options are derivatives, meaning their value comes from the price of an underlying asset — in this case, a stock.

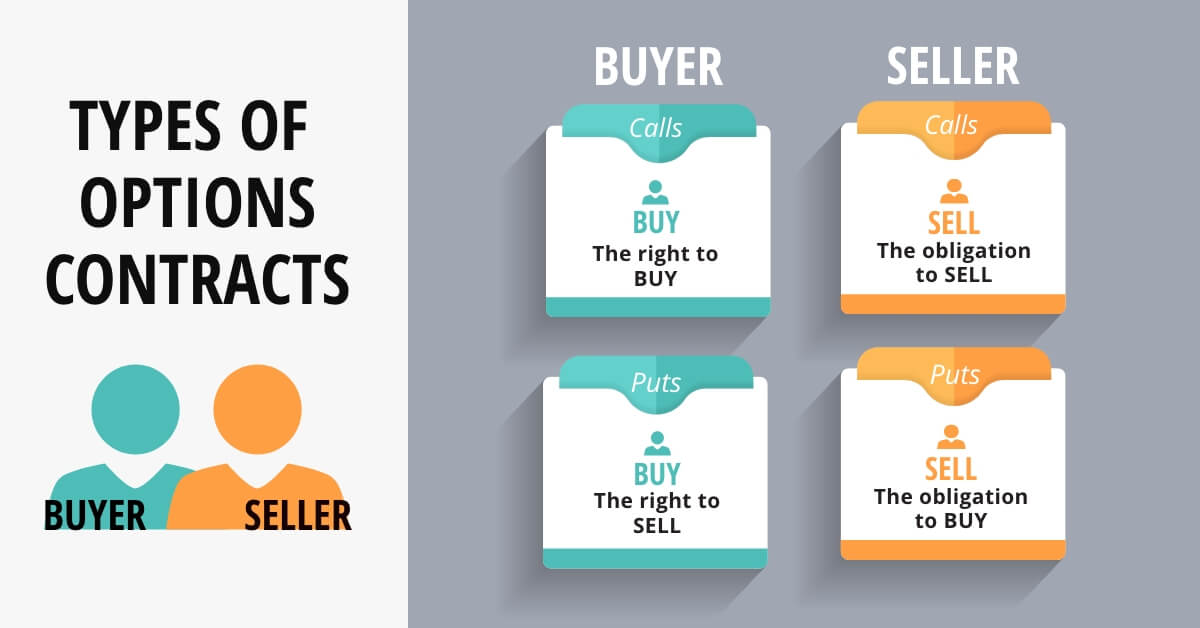

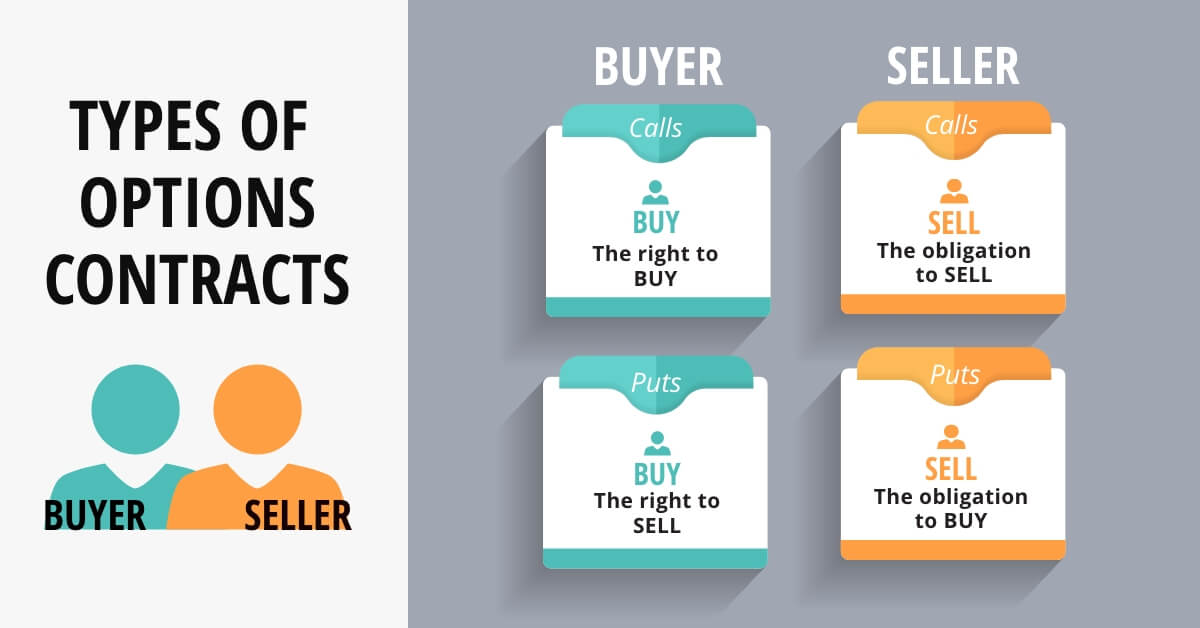

There are two primary types of stock options: call options and put options. A call option gives the holder the right to buy the stock, while a put option gives the holder the right to sell the stock. Each option contract typically represents 100 shares of the underlying stock, and the buyer pays a premium for the right to exercise the option.

Options are traded on various exchanges, including the Chicago Board Options Exchange (CBOE), and are available for a wide range of publicly traded stocks. Traders can buy or sell options depending on their market outlook and risk appetite.

The Components of an Option Contract

To understand how stock options work in practice, it's crucial to break down the key components of an option contract. These include the strike price, the expiration date, the premium, and the underlying stock.

The strike price is the predetermined price at which the option can be exercised. For call options, it is the price at which the buyer can purchase the stock. For put options, it is the price at which the buyer can sell the stock.

The expiration date is the last date the option must be exercised. After this date, the option becomes invalid. Options typically have different expiration dates, ranging from days to months or even years, in the case of long-term equity anticipation securities (LEAPS).

The premium is the price paid by the buyer to the seller of the option for acquiring the right to exercise the contract. This amount is influenced by various factors, including the stock's current price, the strike price, the time until expiration, and the volatility of the underlying stock.

The underlying stock is the security on which the option is based. The price movement of this stock directly impacts the value of the option contract.

Call Options: The Right to Buy

A call option is a contract that gives the buyer the right to purchase a stock at a specific price, known as the strike price, before the expiration date. Investors typically buy call options when they expect the price of a stock to rise.

For example, suppose you buy a call option for Stock A with a strike price of $50 and an expiration date one month from now. If the stock's market price rises to $60 before the expiration date, you can exercise your option to buy at $50, even though it is now worth $60. You would then have an immediate profit opportunity because you could resell the stock at market value.

However, if the stock price does not rise above the strike price before the option expires, the option becomes worthless, and the only loss you incur is the premium you paid to buy the option. This limited downside is one of the features that attract investors to call options, particularly those who want to speculate with controlled risk.

Put Options: The Right to Sell

On the other spectrum, a put option gives the buyer the right to sell a stock at the strike price before the option's expiration. Put options are generally purchased when investors believe the stock price will decline.

For instance, you buy a put option for Stock B with a strike price of $40, and the stock drops to $30 before expiration. You can then exercise the put option and sell the stock at $40, even though it's trading at a lower price in the market. This strategy allows you to profit from falling stock prices.

Put options are often used as a form of insurance. For instance, if you own a stock and are concerned about a possible short-term decline in its price, you can buy a put option to hedge against that loss. If the stock price falls, the gain on your put option can offset the loss in your stock holdings, helping you manage downside risk.

How Stock Options Generate Profit

Options can generate profits in numerous ways, depending on the type of option and how the trader chooses to use it. With call options, profit is generated when the price of the underlying stock rises above the strike price by more than the cost of the premium. It allows the trader to exercise the option and buy the stock at a discount or sell the option contract for a profit in the open market.

Put options generate profit when the stock price falls below the strike price by more than the premium paid. The trader can exercise the put to sell the stock at the higher strike price or sell the put option for a profit.

Another common way to profit from options is by selling options contracts, a strategy typically used by more advanced traders. The seller, or the option writer, receives the premium upfront. If the option expires worthless, the seller keeps the premium as profit. However, this strategy comes with higher risk, especially if the stock moves significantly in the opposite direction of the position.

Advanced Options Trading Strategies

While basic calls and puts are straightforward, traders use a number of more advanced strategies to optimise their positions. Some popular ones include covered calls, protective puts, spreads, and straddles.

1) Covered Call: It includes owning a stock and selling a call option on that stock. A covered call can generate additional income through the premium received from selling the call, but it also limits the upside potential if the stock rises above the strike price.

2) Protective Put: It is a strategy when an investor buys a put option for a stock they already own. This strategy provides downside protection in case the stock price falls, much like insurance.

3) Spread: These strategies involve buying and selling options with different strike prices or expiration dates to limit risk and potential losses. It can be more complex but allows for controlled risk and tailored profit goals.

4) Straddle: This strategy involves buying a call and a put option with the same strike price and expiration date. Straddle profits from significant price movement in either direction and is often used ahead of earnings reports or other major news events.

Conclusion

In conclusion, stock options are dynamic and flexible financial instruments that can be used for many purposes, from speculation to income generation to risk management. Understanding how options work — especially the roles of calls, puts, strike prices, expiration dates, and premiums — is key to using them effectively.

While the potential for profit is significant, so is the potential for loss. Therefore, education, strategy, and discipline are essential when trading options.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.