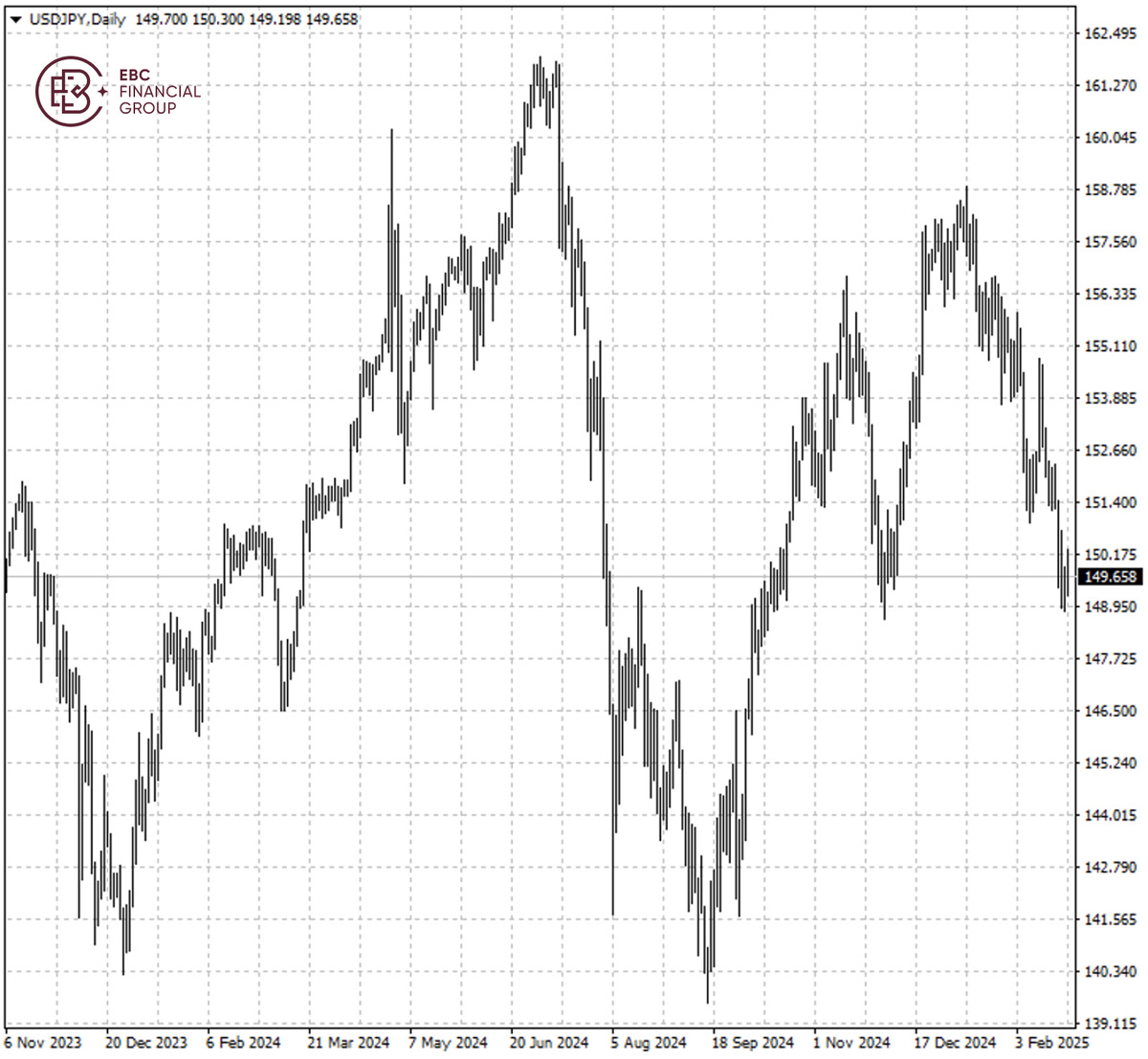

The yen hit its strongest level since December last week amid growing

speculation the BOJ will hike rates sooner rather than later. Hedge funds have

wagered again it will outperform its major peers in coming months.

All dollar-yen notional trades of at least $200 million on the DTCC on 20

February struck at 150 or lower. The BofA said the majority of interest for yen

calls remained tactical and short-dated.

Traders are increasingly using European currencies, rather than the dollar,

to fund bets on the yen as they look to profit from the diverging path for

interest rates across major economies.

Vanguard Asset Management is among those favouring a variety of trades

reflecting this theme, shorting the euro, the Swiss franc and the pound against

to shun uncertainties around Trump's policies.

It is the best start to the year for the yen against those since 2017.Bullish

bets on its strength among institutional investors have risen to their highest

in nearly four years, according to the CFTC data.

Citigroup, Rabobank and Danske Bank all see the euro ending the year below

150 yen, with the latter forecasting a 12% drop to 141 yen. The bearish mood

echoes our view in the recent notes.

So-called risk reversals for the Swiss franc against the yen are near the

most bearish levels in two months, with growing demand to protect against a drop

to 160 yen.

Boomlet

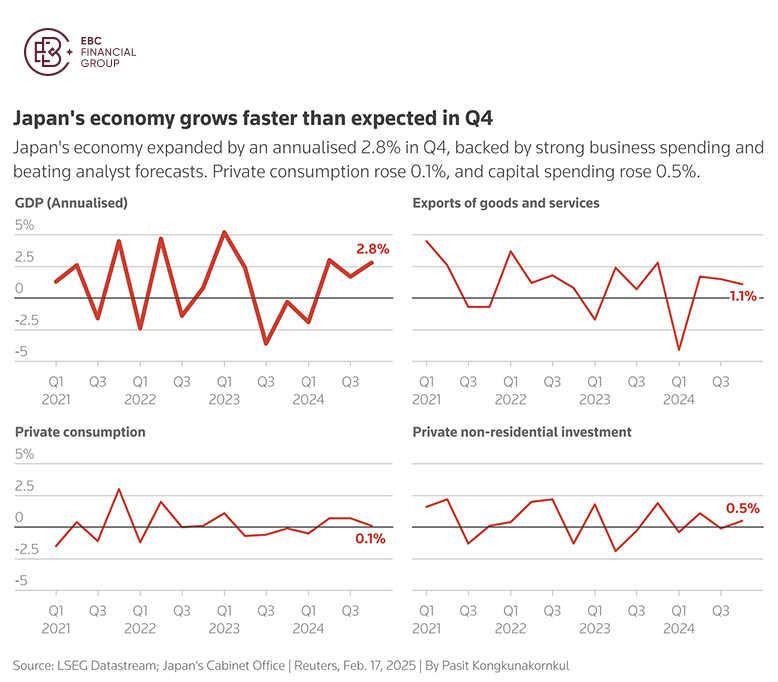

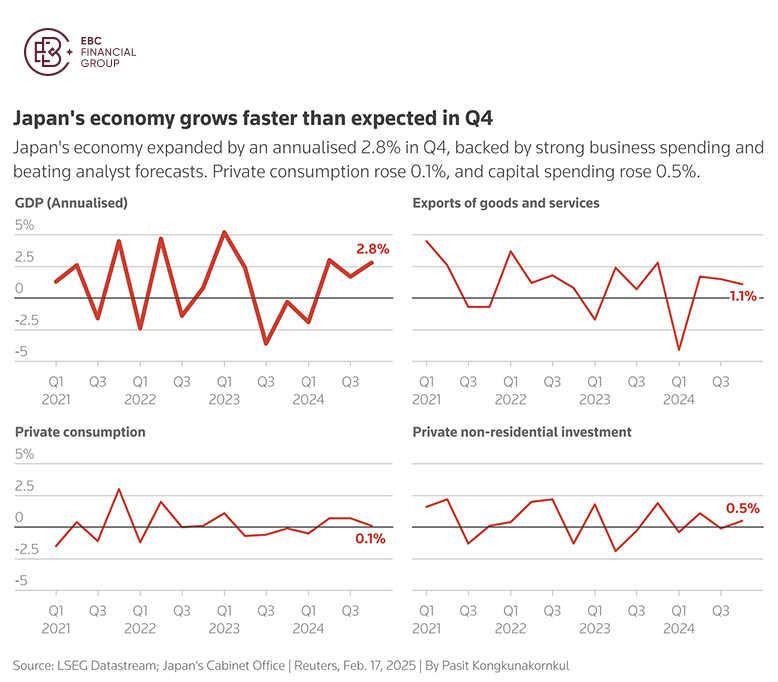

Japan's economy grew faster than expected in the fourth quarter, on improved

business spending and a surprise increase in consumption and shoring up the

central bank's case for more interest rate hikes.

While business spending was a major contribution to the growth, the

manufacturing sector stayed lukewarm. US tariffs on cars and other items may

well make the situation worse.

More than 60% of Japanese companies — a record high percentage — plan to

raise workers' wages next year as they fight to recruit and retain staff,

according to a survey by Teikoku Databank.

Japanese workers and employers are currently in the midst of annual pay

negotiations. Some economists forecast an average wage increase of 4.92% this

year, a slightly below last year's 5.33%.

Factory activity extended declines for an eighth straight month in February

but at a slower pace, au Jibun Bank said, in a sign struggling factories may be

finding their footing.

Japan's Economy Minister Ryosei Akazawa said in a statement that a gradual

recovery in the economy is expected to continue, though continued price rises

for daily items may weigh down consumption.

Household spending rose for the first time in five months in December on an

annual basis, largely driven by one-off or seasonal factors. Shunto's result

will be key to the reversal of its downtrend.

Ceiling

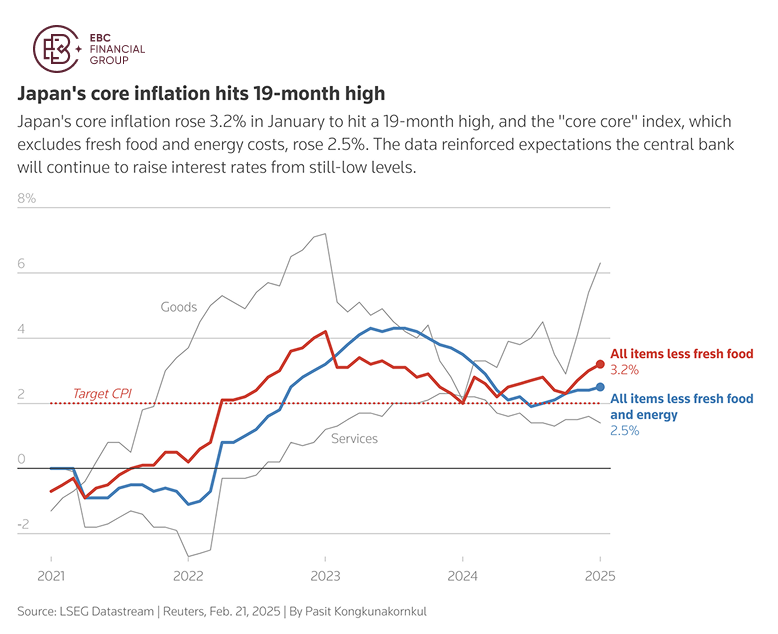

The BOJ will hike interest rates only once more this year, most likely during

Q3, according to a majority of economists in a Reuters poll. The Japanese swap

market is pricing in two 25-bp increases.

A BOJ board member said the central bank must increase borrowing costs more

as keeping them at current low levels could cause excessive risk-taking and

cause an inflation spike.

Japan's 10-year bond yield hit a 15-year high last week, while policymakers

are inclined to weaning the economy off decades of massive monetary support

including by diminishing its huge presence.

If the rise persists, that could affect the pace at which the BOJ will taper

beyond April 2026. It could also affect the board's debate on the pace of

raising its short-term policy rate, analysts say.

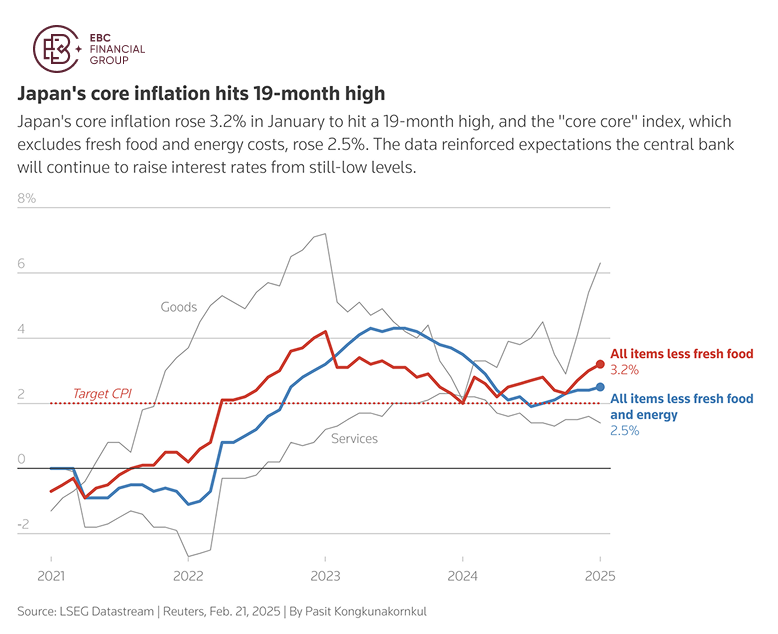

Core inflation rate hit 3.2% in January for its fastest pace in 19 months,

reinforcing expectations of further monetary tightening. For nearly three

months, the reading has exceeded official target of 2%.

Rice prices in the country have hit record highs for the fifth consecutive

month. In a historic change, government is for the first time set to loosen the

rules on accessing strategic rice reserves.

The real rate in Japan is currently -3.5%, the lowest in two years despite a

spate of rate hikes. That means the robust demand of higher returns overseas may

continue to cap the yen's rally.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.