Major investors, including BlackRock and Allianz, are anticipating a significant shift in the UK stock market. They are optimistic that an improving economy, lower interest rates, and increased political stability will drive positive change.

According to flow data from Bank of America, its institutional customers have since May

switched from being net sellers of UK equities, which has underperformed their

European peers for ages, to net buyers.

The FTSE 100 index has only returned 8.4% over the past five years, compared

with 47.3% for the DAX 40 and 32.4% for the CAC 40. A steady delisting from

London has fuelled angst about the city.

The exodus is underlined by take-privates of DWF, secondary listings in New

York by Flutter and, of course, the particularly painful miss that was Arm's choice to list in New York.

Fund managers argue that the negativity that has surrounded the UK market

leaves it primed for a period of catch-up with overseas markets, even if there

is no full-blown renaissance.

However, retail investors continue to sell out of UK equity funds,

withdrawing a record monthly amount in May. Since 2016 they have been pulled out

about £54bn, according to the Investment Association.

Sterling is the strongest G10 currency this year, which acts as a drag on the

profits of the multinational companies that dominate the FTSE 100. The BOE

remains behind the curve due to still-hot service inflation.

Labour policy

Starmer's first cabinet is one of the best-prepared of new governments in

recent decades. Three of the new secretaries of state have previous experience

leading departments.

Also with 200 Labour MPs new to the job, the PM will probably seek to

capitalise on their relative inexperience and the government's natural honeymoon

period to push through much legislation as early as possible.

European Commission president Ursula von der Leyen and Starmer are to

organise a meeting within weeks to accelerate a "reset" of relations after the

UK chose to left the EU.

That represents a part of his drive for better trade terms with the common

market though he has ruled out a Breturn. An EU official said there is goodwill

on both sides at present.

Rebecca Maclean, investment director at abrdn, pointed to falling inflation

and optimism that Labour's landslide victory in this month's general election

would lead to a period of stable government.

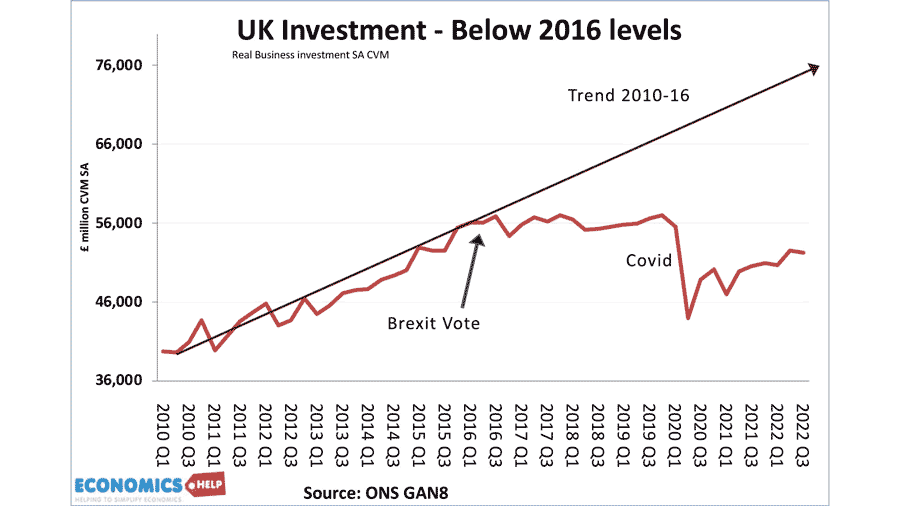

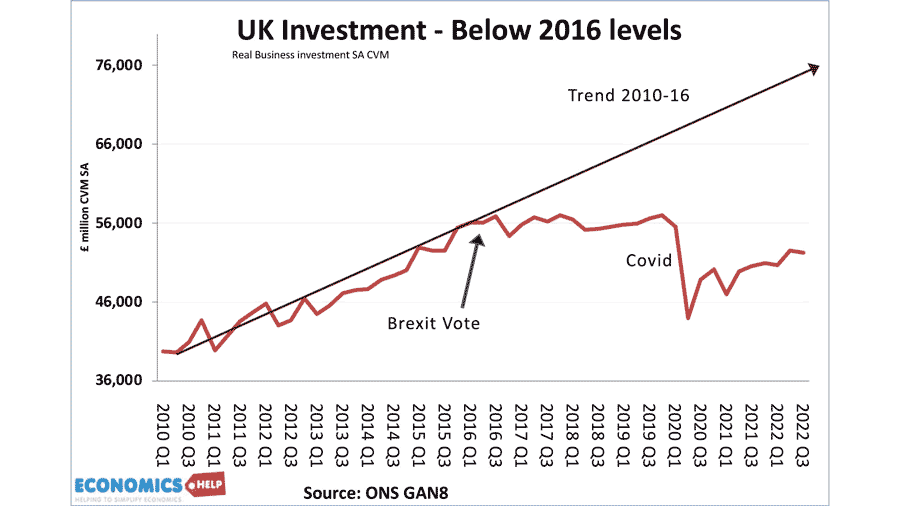

The new government is eyeing the so-called defined contribution schemes,

which is expected to manage £800 billion in assets by the end of the decade, to

unlock more investments in the economy.

1% of the assets into productive investments could equals to £8 billion inflow

into the nation that has been suffering from chronic levels of underinvestment,

the government claimed in its statement.

Great Rotation

Popular tech stocks have undergone significant selloff this month as AI

frenzy is cooling. That likely portend a great rotation into value stocks in

boost for the FTSE 100.

None of the large-cap European tech firms primarily floats in London such as

SAP and ASML, so the stale market will likely benefit the most from the emerging

trend among the continent.

A top analyst at Goldman Sachs warned the hundreds of billions of dollars

that companies are ploughing into AI won't set off the next economic revolution

— or even rival the benefits of the smartphone and the Internet.

"Most technology transitions in history … replace very expensive solutions

with very cheap solutions," Jim Covello said. "Potentially replacing jobs with

tremendously costly technology is basically the polar opposite."

Microsoft, Alphabet, Amazon, and Meta have collectively pumped more than $150

billion into capex in the last four quarters, with a chunk of that for computing

capacity to train their own large-language models.

According to a survey conducted by Lucidworks, fewer than half of companies

investing in AI have yet to see a significant return. A recorking will be

inevitable if the technology turns out to be overblown.

That is evident in Salesforce shares tumbling after the company projected the

slowest quarterly sales growth in its history despite long touting the potential

for AI to boost sales.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.